Asalam -e aulikum dear member main umeed krta hn ap sub log khariyat say hn gay. Ap log forex trading main achi earing hasil kr rhy hn gay . Aj ka mara sawal Bahut he experience provide kry ga. Forex trading main jab ap kaam krty hain to ap ap traing strategy ya candlestick kay pattern ko follow kr kay trading karty hn gay. Hanging man candlestick pattern kiya hy aur ap is ko kasy used kr sakhty hain.

What is hanging man candlestick pattern

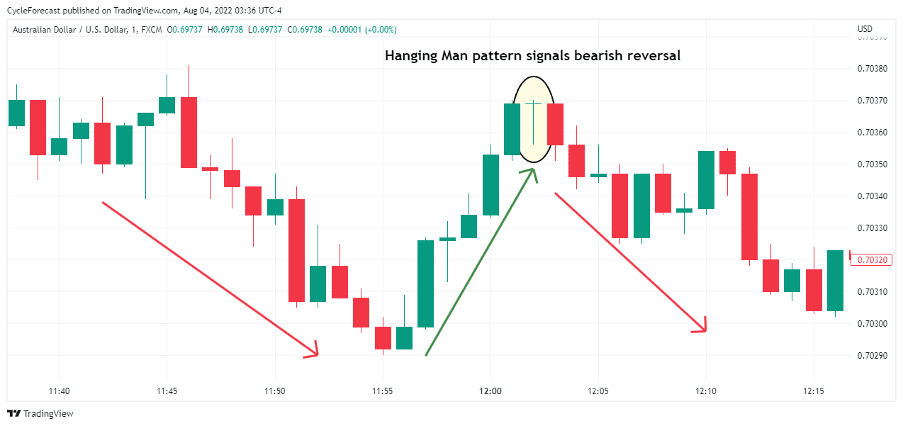

candle stuck patteren ke bohat wazeh, wazahati naam hain. un ke naam yeh samajhney mein hamari madad karne mein kaar amad hain ke woh kis qisam ke namoonay hain aur hamein chart mein un ko kahan talaash karne ka imkaan hai. is muamlay mein phansi wala aadmi itna hi bura hai jitna usay lagta hai. yeh aik bearish reversal patteren hai. tamam infiradi mom btyon ki taamer ke liye chaar data points istemaal kiye jatay hain. woh khulay, qareebi, aala aur adna hain. yeh data points jan-nay walay tajir ko belon aur rojhanke darmiyan jung ki haalat ko wazeh karne mein madad karte hain jo ke market mein hissa lainay walon ki aksariyat hai. candle stuck patteren har waqt ke forum mein zahir ho saktay hain, is misaal mein hum rozana qeemat ke patteren par tawajah markooz karen ge

Apperance of hanging man

phansi wala aadmi aik wahid mom batii ki chhari ka namona hai. chunkay yeh aik ulat patteren hai, is liye patteren ke zahir honay se pehlay is ke liye kuch hona zaroori hai. market ke liye yeh zaroori nahi hai ke woh oopar ke rujhan mein ho, lekin patteren ke zahir honay se pehlay qeematon mein qabil shanakht izafah hona chahiye .

Working of hanging man

candle stuck patteren ke bohat wazeh, wazahati naam hain. un ke naam yeh samajhney mein hamari madad karne mein kaar amad hain ke woh kis qisam ke namoonay hain aur hamein chart mein un ko kahan talaash karne ka imkaan hai. is muamlay mein phansi wala aadmi itna hi bura hai jitna usay lagta hai. yeh aik bearish reversal patteren hai. tamam infiradi mom btyon ki taamer ke liye chaar data points istemaal kiye jatay hain. woh khulay, qareebi, aala aur adna hain. yeh data points jan-nay walay tajir ko belon aur rojhan ke darmiyan jung ki haalat ko wazeh karne mein madad karte hain jo ke market mein hissa lainay walon ki aksariyat hai. candle stuck patteren har waqt ke forum mein zahir ho saktay hain, is misaal mein hum rozana qeemat ke patteren par tawajah markooz karen ge

What is hanging man candlestick pattern

candle stuck patteren ke bohat wazeh, wazahati naam hain. un ke naam yeh samajhney mein hamari madad karne mein kaar amad hain ke woh kis qisam ke namoonay hain aur hamein chart mein un ko kahan talaash karne ka imkaan hai. is muamlay mein phansi wala aadmi itna hi bura hai jitna usay lagta hai. yeh aik bearish reversal patteren hai. tamam infiradi mom btyon ki taamer ke liye chaar data points istemaal kiye jatay hain. woh khulay, qareebi, aala aur adna hain. yeh data points jan-nay walay tajir ko belon aur rojhanke darmiyan jung ki haalat ko wazeh karne mein madad karte hain jo ke market mein hissa lainay walon ki aksariyat hai. candle stuck patteren har waqt ke forum mein zahir ho saktay hain, is misaal mein hum rozana qeemat ke patteren par tawajah markooz karen ge

Apperance of hanging man

phansi wala aadmi aik wahid mom batii ki chhari ka namona hai. chunkay yeh aik ulat patteren hai, is liye patteren ke zahir honay se pehlay is ke liye kuch hona zaroori hai. market ke liye yeh zaroori nahi hai ke woh oopar ke rujhan mein ho, lekin patteren ke zahir honay se pehlay qeematon mein qabil shanakht izafah hona chahiye .

Working of hanging man

candle stuck patteren ke bohat wazeh, wazahati naam hain. un ke naam yeh samajhney mein hamari madad karne mein kaar amad hain ke woh kis qisam ke namoonay hain aur hamein chart mein un ko kahan talaash karne ka imkaan hai. is muamlay mein phansi wala aadmi itna hi bura hai jitna usay lagta hai. yeh aik bearish reversal patteren hai. tamam infiradi mom btyon ki taamer ke liye chaar data points istemaal kiye jatay hain. woh khulay, qareebi, aala aur adna hain. yeh data points jan-nay walay tajir ko belon aur rojhan ke darmiyan jung ki haalat ko wazeh karne mein madad karte hain jo ke market mein hissa lainay walon ki aksariyat hai. candle stuck patteren har waqt ke forum mein zahir ho saktay hain, is misaal mein hum rozana qeemat ke patteren par tawajah markooz karen ge

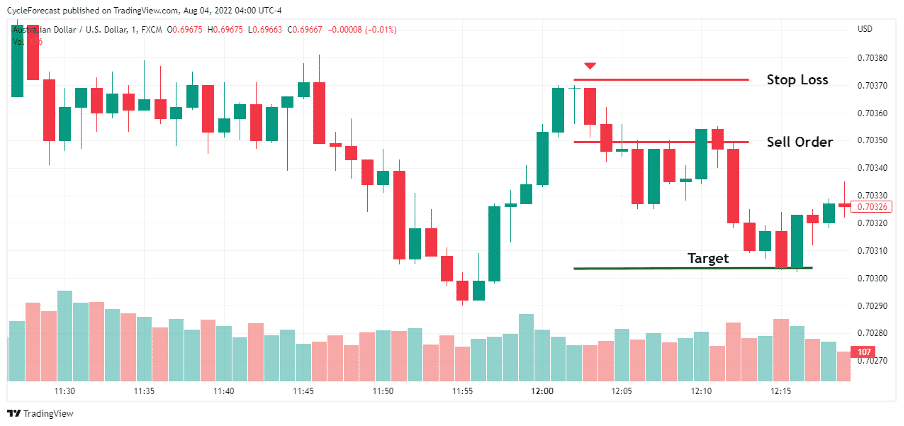

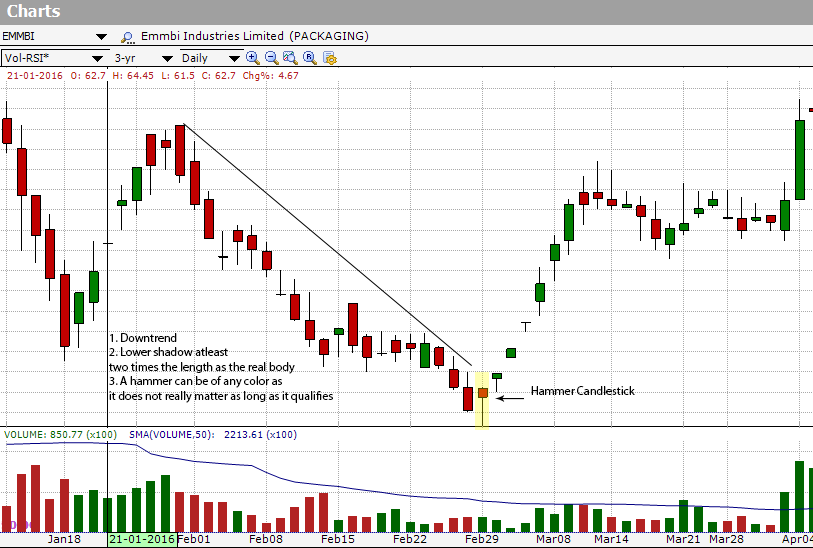

HANGING MAN VS HAMMER CANDLESTICK PATTERN Yah furi trend ke reversal Jaane Ki predicting karne ke bajay existing market ke momentum, ke khatme ke bare mein intebahat Jari karta hai lihaza tajru ko imminent Trend ke direction Mein change ke liye ready start Karni chahie

HANGING MAN VS HAMMER CANDLESTICK PATTERN Yah furi trend ke reversal Jaane Ki predicting karne ke bajay existing market ke momentum, ke khatme ke bare mein intebahat Jari karta hai lihaza tajru ko imminent Trend ke direction Mein change ke liye ready start Karni chahie

تبصرہ

Расширенный режим Обычный режим