Hanging candlestick man aik one candle par mushtamil pattern hai, sure ok charge okay pinnacle fashion par banta hai, aur ye candles expenses ka bear fashion reversal ka kaam karta hai. Ye candle taqreeban shap primary hammer jaisa hi hai, lekin faraq ye hai k hanging man candle fees okay pinnacle fashion ya bull fashion main bantti hai. Hanging candlestick guy ki aik small real frame hotti hai, jis ka aspect down par aik lengthy tail ya wick hotti hai. Jab k ziadda tar candle k top side par koi wick ya shadow nahi banati hai. Aggar upside aspect par aik small wick ban bhi jayye to bhi suitable hai, lekin ziata lengthy ya real frame se size main bara na ho. Ye candle pinnacle trend par honne ki waja se capturing celebrity candle ki contrary hotti hai, qk wo bhi top fashion par bantti hai, lekin us ka shadow ya wick upside par hotta hai, Hanging man candlestick sample ok banne k pechay ki psychology ye hai ok top fashion nominal charge bearish fashion reversal ki koshash kartte howe pehle bearish jatti hai, lekin baad predominant mamoli si shopping for stress ki waja se qeematen wappis bullish jatti hai, jiss se candle ki aik small actual body banti hai. Hanging guy candlestick most important charge downwards janne k baad wapis open charge ok pass near ho jatti hai, jis par candle ki bottom side par aik long shadow ya wick hotti hai. Hanging candlestick man ki upside par wese to koi wick ya shadow nahi honna chaheye lekin aggar bann jaye to is se candle to formation par koi assar nahi partta hai. Lekin upside par ziadda nahi honi chaheye jis se ye candle "Spinning pinnacle" candle bann jaye. Candle ok bullish ya bearish coloration se koi assar nahi partta hai

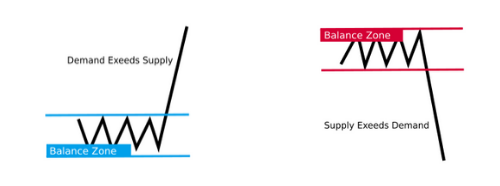

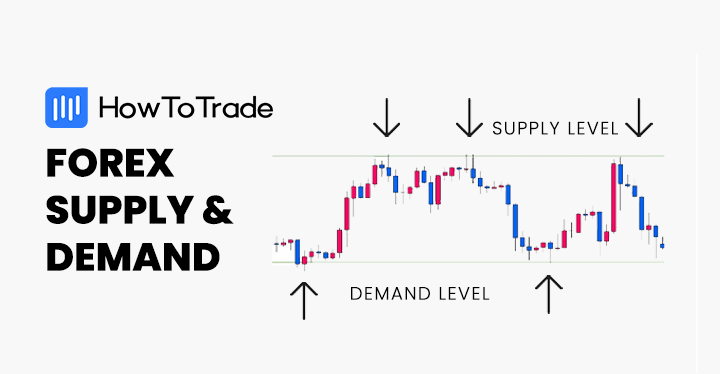

supply and demand

Hanging candlestick man ki aik small real frame hotti hai, jis ka facet down par aik lengthy tail ya wick hotti hai. Jab ok ziadda tar candle okay upper side par koi wick ya shadow nahi banati hai. Aggar upside side par aik small wick ban bhi jayye to bhi proper hai, lekin ziata long ya real body se size important bara na ho. Ye candle top trend par honne ki waja se capturing megastar candle ki opposite hotti hai, qk wo bhi top fashion par bantti hai, lekin us ka shadow ya wick upside par hotta hai, Hanging man candlestick pattern ok banne ok pechay ki psychology ye hai ok top fashion nominal fee bearish fashion reversal ki koshash kartte howe pehle bearish jatti hai, lekin baad important mamoli si shopping for strain ki waja se qeematen wappis bullish jatti hai, jiss se candle ki aik small actual frame banti hai. Hanging guy candlestick predominant rate downwards janne k baad wapis open price k bypass near ho jatti hai, jis par candle ki backside side par aik lengthy shadow ya wick hotti hai. Hanging candlestick man ki upside par wese to koi wick ya shadow nahi honna chaheye lekin aggar bann jaye to is se candle to formation par koi assar nahi partta hai. Lekin upside par ziadda nahi honi chaheye jis se ye candle "Spinning top" candle bann jaye. Candle ok bullish ya bearish coloration se koi assar nahi partta hai.

supply and demand

Hanging candlestick man ki aik small real frame hotti hai, jis ka facet down par aik lengthy tail ya wick hotti hai. Jab ok ziadda tar candle okay upper side par koi wick ya shadow nahi banati hai. Aggar upside side par aik small wick ban bhi jayye to bhi proper hai, lekin ziata long ya real body se size important bara na ho. Ye candle top trend par honne ki waja se capturing megastar candle ki opposite hotti hai, qk wo bhi top fashion par bantti hai, lekin us ka shadow ya wick upside par hotta hai, Hanging man candlestick pattern ok banne ok pechay ki psychology ye hai ok top fashion nominal fee bearish fashion reversal ki koshash kartte howe pehle bearish jatti hai, lekin baad important mamoli si shopping for strain ki waja se qeematen wappis bullish jatti hai, jiss se candle ki aik small actual frame banti hai. Hanging guy candlestick predominant rate downwards janne k baad wapis open price k bypass near ho jatti hai, jis par candle ki backside side par aik lengthy shadow ya wick hotti hai. Hanging candlestick man ki upside par wese to koi wick ya shadow nahi honna chaheye lekin aggar bann jaye to is se candle to formation par koi assar nahi partta hai. Lekin upside par ziadda nahi honi chaheye jis se ye candle "Spinning top" candle bann jaye. Candle ok bullish ya bearish coloration se koi assar nahi partta hai.

تبصرہ

Расширенный режим Обычный режим