Assalamu Alaikum!

dear member Main ummid Karta hun, aap sab khairiyat se Honge aur Apna Achcha kam kar rahe Honge. Jab aap ismein kam karte hain to aapko daily ka target complete karna hota hai aur hard work ke sath kam karna hota hai. agar aap ismein hard work Nahin Karenge to aap kabhi bhi successful trading nahin kar sakte, isliye aapko market Mein different important analysis per completely study Karni chahie aur Market ko acchi tarike se focus karna chahie jitne acchi analysis ke sath aap is market Mein trading Karenge aapko itna hi Achcha result milega. main aaj aapse bahut hi important information share karungi, jo aapki trading ko profit table banaa sakti hai to Mera topic hai relative Strength Index Indicators Ko kesy use kar k trading main kamyaabi hasil kar sakhty hain.

Relative Strength Index Indicators:

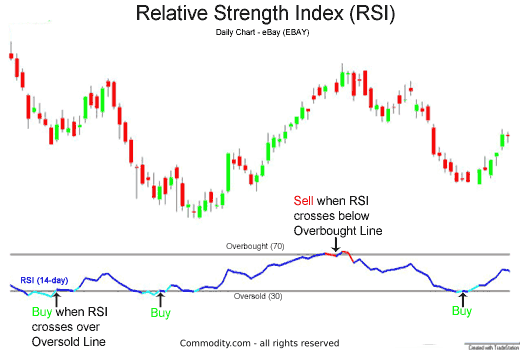

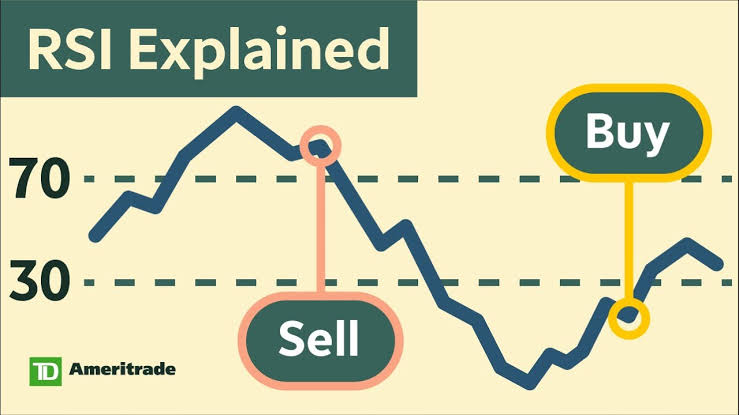

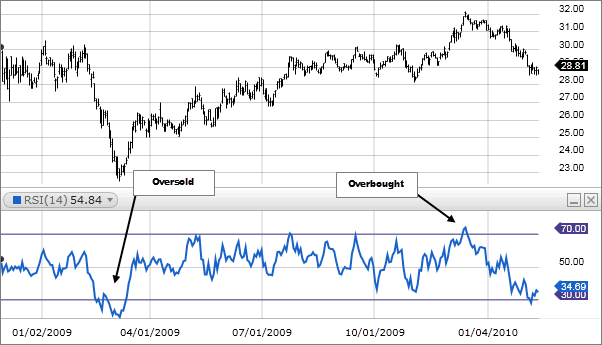

Forex trading market Mein RSI Jenny relative strength index indicator Ek Mary indicator hai aur Si indicator ka use sabse Aasan aur sabse Jyada Kiya Jata Hai Forex trading market Mein RSI indicator ki reliabilities Jyada hone ki vajah se takriban Sare platform isko support Bhi Karte Hain aur is ko is default use Bhi Kiya Jata Hai RSI indicator per paimaish ke liye zero Se Lekar hundred tak ki points Hote Hain Jisko normali 0,30,50,70 or 100 ke digit se show Kiya jata hai aur Si indicator Mein value Ek line graph ki Shakal paimaish ke hisab se movement Karti rahti hai jisse Hamen use currency jode ke Trend ke police ya bearish Harkat Ka Pata Chalta Hai RSI indicator Mein Do position bahut important Hai Ek Ko overbought aur dusre ko oversold Kaha jata hai.

RSI = 100 - [100/ (1 + Average of upward Price Change / Average of Downward Price Change ) ]

RSI Indicator Over-Sold:

RSI indicator ki value 30 aur 70 Ke Darmiyan normal tasawar ki Jaati Hai but Agar market ki value 30 se down Jaati Hai To isko over sold Kaha Jata Hai Kuchh platform per yah value 20 aur 80 Ke Darmiyan Di Jaati Hai Jab Ke 50 ka area jyadatar natural hi tasawar kiya jata hai bear is trendz down trend Mein RSI indicator 10 or 60 Ke Darmiyan Rehta Hai Jab Ke 50 aur 60 ka zone resistance ke Taur per kam karta hai traders ko chahie ki Jab Bhi RSI indicator Mein value 37 Lo yani over sold Jon Mein a Jaaye to trade ko bye Karen Kyunki is position per Jyada chances Hote Hain Ki market Jahan Se Wapas Jayegi.

RSI Indicator Over-Bought:

Agar RSI indicator Mein value 70 se upar Chali Jaaye to yah Over-Bought Kehlata Hai. Kuchh platform Mein yah level 80 Ka Hota Hai bullish trend ya up trend Mein RSI indicator Photo se 90 Kedar Mein Aana rahata Hai Jab Ke 40 se 50 ka zone support ke Taur per kam Karta Hai RSI indicator ke Over-Bought position pay trading ke liye jaruri hai ke indicator Mein value 70 se upar Ho Kyunki is position per Trend ke reversal ke chances jyada hai aur traders ko Sel ke trades Lagane chahie.

dear member Main ummid Karta hun, aap sab khairiyat se Honge aur Apna Achcha kam kar rahe Honge. Jab aap ismein kam karte hain to aapko daily ka target complete karna hota hai aur hard work ke sath kam karna hota hai. agar aap ismein hard work Nahin Karenge to aap kabhi bhi successful trading nahin kar sakte, isliye aapko market Mein different important analysis per completely study Karni chahie aur Market ko acchi tarike se focus karna chahie jitne acchi analysis ke sath aap is market Mein trading Karenge aapko itna hi Achcha result milega. main aaj aapse bahut hi important information share karungi, jo aapki trading ko profit table banaa sakti hai to Mera topic hai relative Strength Index Indicators Ko kesy use kar k trading main kamyaabi hasil kar sakhty hain.

Relative Strength Index Indicators:

Forex trading market Mein RSI Jenny relative strength index indicator Ek Mary indicator hai aur Si indicator ka use sabse Aasan aur sabse Jyada Kiya Jata Hai Forex trading market Mein RSI indicator ki reliabilities Jyada hone ki vajah se takriban Sare platform isko support Bhi Karte Hain aur is ko is default use Bhi Kiya Jata Hai RSI indicator per paimaish ke liye zero Se Lekar hundred tak ki points Hote Hain Jisko normali 0,30,50,70 or 100 ke digit se show Kiya jata hai aur Si indicator Mein value Ek line graph ki Shakal paimaish ke hisab se movement Karti rahti hai jisse Hamen use currency jode ke Trend ke police ya bearish Harkat Ka Pata Chalta Hai RSI indicator Mein Do position bahut important Hai Ek Ko overbought aur dusre ko oversold Kaha jata hai.

RSI = 100 - [100/ (1 + Average of upward Price Change / Average of Downward Price Change ) ]

RSI Indicator Over-Sold:

RSI indicator ki value 30 aur 70 Ke Darmiyan normal tasawar ki Jaati Hai but Agar market ki value 30 se down Jaati Hai To isko over sold Kaha Jata Hai Kuchh platform per yah value 20 aur 80 Ke Darmiyan Di Jaati Hai Jab Ke 50 ka area jyadatar natural hi tasawar kiya jata hai bear is trendz down trend Mein RSI indicator 10 or 60 Ke Darmiyan Rehta Hai Jab Ke 50 aur 60 ka zone resistance ke Taur per kam karta hai traders ko chahie ki Jab Bhi RSI indicator Mein value 37 Lo yani over sold Jon Mein a Jaaye to trade ko bye Karen Kyunki is position per Jyada chances Hote Hain Ki market Jahan Se Wapas Jayegi.

RSI Indicator Over-Bought:

Agar RSI indicator Mein value 70 se upar Chali Jaaye to yah Over-Bought Kehlata Hai. Kuchh platform Mein yah level 80 Ka Hota Hai bullish trend ya up trend Mein RSI indicator Photo se 90 Kedar Mein Aana rahata Hai Jab Ke 40 se 50 ka zone support ke Taur per kam Karta Hai RSI indicator ke Over-Bought position pay trading ke liye jaruri hai ke indicator Mein value 70 se upar Ho Kyunki is position per Trend ke reversal ke chances jyada hai aur traders ko Sel ke trades Lagane chahie.

تبصرہ

Расширенный режим Обычный режим