Kuchh aise factors hote hain jinki bahut jyada advantages hone ke sath unki kuchh drawbacks bhi hote Hain aaj Main aapko ek bahut hi important topic se related kuchh important information share karne ja raha hun jismein aapko cleverage ke drawbacks share karne ja raha hun kyunki leverage ke definittely bahut jyada advantages aur features hote hain lekin iske sath iski kuchh drawbacks bhi ho sakte hain Jo aapke liye most important roll play kar sakte hain isliye iske dropex ko understand karna ya aapke liye bahut hi important hota hai.

What is Leverage

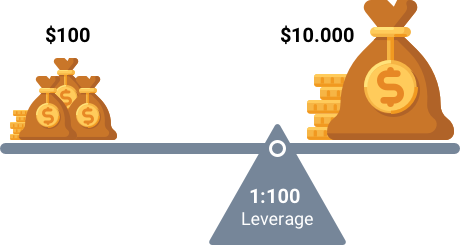

Leverage basically yah Kaisa important tool hai jiski vajah se aapko credit facility mil rahi Hoti hai is credit facility ki vajah se aap minimum account per bhi bahut acchi trading kar sakte hain aur apni credit worth ki vajah se jyada se jyada trades Le sakte hain no doubt yah ek important feature hota hai jo different brokers aapko provide kar rahe hote hain different brokers ki different types ki facilities Hoti hai kuchh aisi broker dete Hain jo aapko extra delivery facility provide nahin kar rahe hote hain aur kuchh broker se aap request facility ko increase karva sakte hain.

Features of Leverage

Jab aap leverage facility ko find out karte hain aur iske features ko study karte hain to ismein aapko definittely bahut jyada features available ho rahe hote hain aapko hamesha market mein kuchh aise factors ko completely focus karna hota hai jinke features aap ke liye helping platform provide kar sakte hain leverage ki vajah se aap minimum account balance per bhi trading kar sakte hain aur isase bhi reasonable aur handsome amount off profit hasil kar sakte hain aaj aapko market mein jyada se jyada profit hasil karne ke liye kuchh aise factors ko acchi Tarah focus karna hota hai jo aapke liye helping platform provide kar sakte hain.

When Leverage Can Be Dangerous

Question yah hota hai ki Jab aap liveri facility ko utilise karte hain aur yah features ke liye aapki base banti hai to yah aapke liye kaise dangerous ho sakti hai to ismein main aapko yah inform karna chahta hun ki basically leverage facility aapke liye use time per dangerous ho sakti hai Jab aap market mein working karte hue apni leverage facility ko negatively use karte hain aur apne account balance ke hisab se management Nahin karte hain aur bahut jyada trades open kar lete hain aisi situation mein aapke liye market mein bahut jyada problems ho sakte hain.

What is Leverage

Leverage basically yah Kaisa important tool hai jiski vajah se aapko credit facility mil rahi Hoti hai is credit facility ki vajah se aap minimum account per bhi bahut acchi trading kar sakte hain aur apni credit worth ki vajah se jyada se jyada trades Le sakte hain no doubt yah ek important feature hota hai jo different brokers aapko provide kar rahe hote hain different brokers ki different types ki facilities Hoti hai kuchh aisi broker dete Hain jo aapko extra delivery facility provide nahin kar rahe hote hain aur kuchh broker se aap request facility ko increase karva sakte hain.

Features of Leverage

Jab aap leverage facility ko find out karte hain aur iske features ko study karte hain to ismein aapko definittely bahut jyada features available ho rahe hote hain aapko hamesha market mein kuchh aise factors ko completely focus karna hota hai jinke features aap ke liye helping platform provide kar sakte hain leverage ki vajah se aap minimum account balance per bhi trading kar sakte hain aur isase bhi reasonable aur handsome amount off profit hasil kar sakte hain aaj aapko market mein jyada se jyada profit hasil karne ke liye kuchh aise factors ko acchi Tarah focus karna hota hai jo aapke liye helping platform provide kar sakte hain.

When Leverage Can Be Dangerous

Question yah hota hai ki Jab aap liveri facility ko utilise karte hain aur yah features ke liye aapki base banti hai to yah aapke liye kaise dangerous ho sakti hai to ismein main aapko yah inform karna chahta hun ki basically leverage facility aapke liye use time per dangerous ho sakti hai Jab aap market mein working karte hue apni leverage facility ko negatively use karte hain aur apne account balance ke hisab se management Nahin karte hain aur bahut jyada trades open kar lete hain aisi situation mein aapke liye market mein bahut jyada problems ho sakte hain.

Yeh zaruri hai ke aap leverage trading mai sirf woh quantity trade karen, jis se aap comfortable feel karen. Aapko apni financial situation aur risk tolerance ko consider kar ke leverage level ko choose karna chahiye. Agar aap zyada leverage ka istemal karenge, to aapko loss uthane ka risk bhi zyada hoga. Ek aur important baat hai ke leverage trading mai aapko apni emotions ko control karna zaruri hai. Forex market mai trading karte waqt, emotions jaise greed aur fear aapki decision-making ability ko influence kar sakti hain. Agar aapko leverage ka istemal karte hue greed ka ehsaas hota hai, to aap bade trades karne ke liye impulsive ho saktay hain, jo ki risky ho sakta hai. Leverage ka istemal karne se pehle, aapko demo account par practice karna chahiye. Demo account mai aap virtual money ke saath trading kar saktay hain, jis se aapko real market conditions mai trading experience milta hai. Aapko demo account par leverage ka istemal kar ke dekhna chahiye ke aapko kaisa result mil raha hai aur aapko kitna risk tolerate karne ki capacity hai. Leverage trading mai aapko apni trading education ko bhi prioritize karna hoga. Aapko forex market aur leverage trading ke bare mai acchi knowledge honi chahiye. Aap forex trading courses, books aur online resources ka istemal kar saktay hain, taaki aapko market aur leverage trading ke bare mai zyada samajh aaye.

Yeh zaruri hai ke aap leverage trading mai sirf woh quantity trade karen, jis se aap comfortable feel karen. Aapko apni financial situation aur risk tolerance ko consider kar ke leverage level ko choose karna chahiye. Agar aap zyada leverage ka istemal karenge, to aapko loss uthane ka risk bhi zyada hoga. Ek aur important baat hai ke leverage trading mai aapko apni emotions ko control karna zaruri hai. Forex market mai trading karte waqt, emotions jaise greed aur fear aapki decision-making ability ko influence kar sakti hain. Agar aapko leverage ka istemal karte hue greed ka ehsaas hota hai, to aap bade trades karne ke liye impulsive ho saktay hain, jo ki risky ho sakta hai. Leverage ka istemal karne se pehle, aapko demo account par practice karna chahiye. Demo account mai aap virtual money ke saath trading kar saktay hain, jis se aapko real market conditions mai trading experience milta hai. Aapko demo account par leverage ka istemal kar ke dekhna chahiye ke aapko kaisa result mil raha hai aur aapko kitna risk tolerate karne ki capacity hai. Leverage trading mai aapko apni trading education ko bhi prioritize karna hoga. Aapko forex market aur leverage trading ke bare mai acchi knowledge honi chahiye. Aap forex trading courses, books aur online resources ka istemal kar saktay hain, taaki aapko market aur leverage trading ke bare mai zyada samajh aaye.

تبصرہ

Расширенный режим Обычный режим