what is RSI divergence?

Divergence aik istalah hey jes ka matlab yeh hey keh forex market mein price action or technical indicator kay darmean deviation hein mesal kay tor par ager price increase ho jate hey to forex market mein indicator ke value bhe increase honay lagte hey laken woh forex market mein es kay opposite kar rahay hein technical trader price or es indicator kay farq ko price kay reersal janay say indicate kartay hein or forex market mein RSI divergence indicator khod he divegence ko talash kar layta hey ap ko es ka koi intazar karna nahe parta hey

trading strategy with RSI divergence

mahar trader kay motabaq aik khordah trader ko automation kay ley programmed par key gay technical indicator par mokamal depend keya ja sakta hey forex market mein aik neam daste programmed banana ho ga jes mein insano or masheno ke zahanat shamel ho

mesal kay tr par ap indicator ka estamal kese moshkel kam kay ley bhe kar saktay hein or forex market mein divergence ko identify karnay kay ley karna chihay phir apnay mind ka estamal kartay hovay seller or buyer ke trading ko open karnay ka decision karna chihay

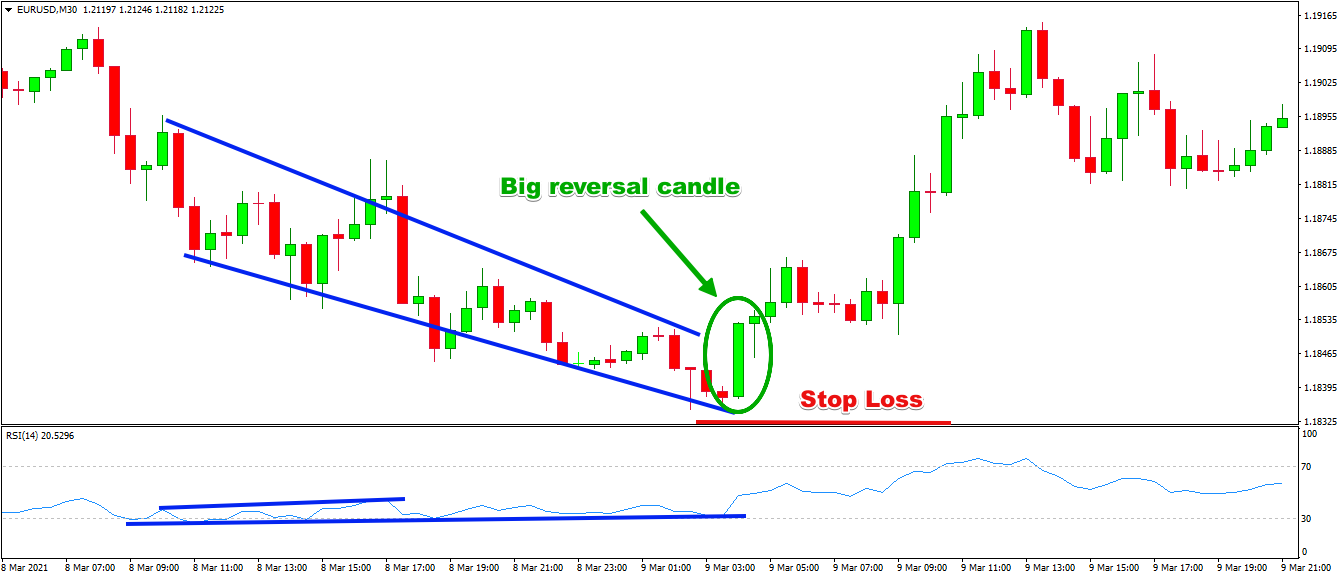

ap ko aik mesal say samjhate hon yahan par main nay candle stick pattern RSI divergence indicator ka estamal kartay hovay aik trading strategy bana rehe hn

Buy signal

jab forex market mein indicator RSI divergence ke planning karta hey to yeh forex market mein buy trading ke taraf openning ke taraf eshara karta hey forex market mein ap ko aik bullish candle stick patern talash karna chihay jo keh bullish divergence kay bad pin bar ya bullish candle stick banta hey to bullish trend kay reversal janay ka imkan increase ho jata hey to es point par buy ke trade open karne chihay

sell signal

jab indicator forex market mein bearish ka signal ready karta hey to ap ko fore tor par sell ke trade open nahe karne chihay balkeh ap ko bearish candle stick kay sungum ka intazar karna chihhay mesal kay tor par ager bearish divergence bearish pin bar ya engulfing candle stick bante hey to ap ko selling ke trade ko open karna chihay or forex market mein stop loss ke level ko set karna chihay

Divergence aik istalah hey jes ka matlab yeh hey keh forex market mein price action or technical indicator kay darmean deviation hein mesal kay tor par ager price increase ho jate hey to forex market mein indicator ke value bhe increase honay lagte hey laken woh forex market mein es kay opposite kar rahay hein technical trader price or es indicator kay farq ko price kay reersal janay say indicate kartay hein or forex market mein RSI divergence indicator khod he divegence ko talash kar layta hey ap ko es ka koi intazar karna nahe parta hey

trading strategy with RSI divergence

mahar trader kay motabaq aik khordah trader ko automation kay ley programmed par key gay technical indicator par mokamal depend keya ja sakta hey forex market mein aik neam daste programmed banana ho ga jes mein insano or masheno ke zahanat shamel ho

mesal kay tr par ap indicator ka estamal kese moshkel kam kay ley bhe kar saktay hein or forex market mein divergence ko identify karnay kay ley karna chihay phir apnay mind ka estamal kartay hovay seller or buyer ke trading ko open karnay ka decision karna chihay

ap ko aik mesal say samjhate hon yahan par main nay candle stick pattern RSI divergence indicator ka estamal kartay hovay aik trading strategy bana rehe hn

Buy signal

jab forex market mein indicator RSI divergence ke planning karta hey to yeh forex market mein buy trading ke taraf openning ke taraf eshara karta hey forex market mein ap ko aik bullish candle stick patern talash karna chihay jo keh bullish divergence kay bad pin bar ya bullish candle stick banta hey to bullish trend kay reversal janay ka imkan increase ho jata hey to es point par buy ke trade open karne chihay

sell signal

jab indicator forex market mein bearish ka signal ready karta hey to ap ko fore tor par sell ke trade open nahe karne chihay balkeh ap ko bearish candle stick kay sungum ka intazar karna chihhay mesal kay tor par ager bearish divergence bearish pin bar ya engulfing candle stick bante hey to ap ko selling ke trade ko open karna chihay or forex market mein stop loss ke level ko set karna chihay

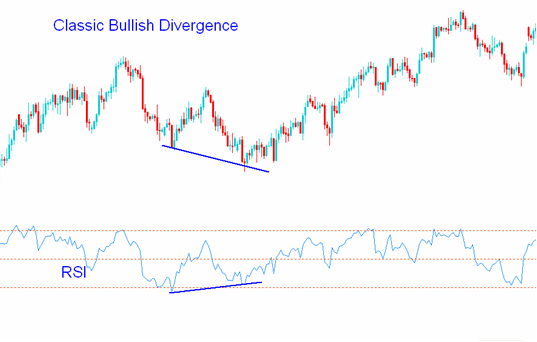

RSI divergence do tarah ki hoti hai: Positive divergence aur Negative divergence. Positive Divergence Positive divergence woh waqt hota hai jab price chart par lower low (neechay ka neya low) banta hai aur RSI indicator par higher low (ooper ka neya low) banta hai. Dusre alfaz mein kaha jaye toh, price kamzoriyat dikha raha hai lower low banakar, lekin RSI indicator taqat dikha raha hai higher low banakar. Iss se price aur indicator ke darmiyan tanazah paida hota hai. Positive divergence aksar bullish signal ke tor par samjha jata hai kyun ke iska matlab hai ke price ki mukhtalifiat ne trend change ya uptrend ki taraf honay ki sambhavna dikha di hai. Yeh ishara karta hai ke bechne walon ki dabawat kam ho rahi hai aur khareedne walay market mein dakhil ho sakte hain, jis se price mein upar ki taraf sair mumkin ho sakti hai. Positive divergence ko dekhne wale traders aksar mazeed tasdeeq ke signals ki talaash karte hain, jaise bullish candlestick pattern ya trendline breakout, pehle trade ko samajhne se pehle. Iss se unki trade ki kamiyabi ke imkanat mein izafa hota hai. Negative Divergence Negative divergence woh waqt hota hai jab price chart par higher high (ooper ka neya high) banata hai aur RSI indicator par lower high (neechay ka neya high) banata hai. Iss halat mein price taqat dikha raha hai higher high banakar, lekin RSI indicator kamzori dikha raha hai lower high banakar. Iss se price aur indicator ke darmiyan tanaza'ah paida hota hai. Negative divergence aksar bearish signal ke tor par samjha jata hai kyun ke iska matlab hai ke price ki mukhtalifiat ne trend change ya downtrend ki taraf honay ki sambhavna dikha di hai. Yeh ishara karta hai ke khareedne walon ki dabawat kam ho rahi hai aur bechne walay market mein dakhil ho sakte hain, jis se price mein neechay ki taraf sair mumkin ho sakti hai. Negative divergence ko pehchanne wale traders aksar mazeed tasdeeq ke signals ki talaash karte hain, jaise bearish candlestick pattern ya trendline breakdown, apni trading decisions ko madad karne ke liye. Iss se unki trade setup ki aitmad mein izafa hota hai.

RSI divergence do tarah ki hoti hai: Positive divergence aur Negative divergence. Positive Divergence Positive divergence woh waqt hota hai jab price chart par lower low (neechay ka neya low) banta hai aur RSI indicator par higher low (ooper ka neya low) banta hai. Dusre alfaz mein kaha jaye toh, price kamzoriyat dikha raha hai lower low banakar, lekin RSI indicator taqat dikha raha hai higher low banakar. Iss se price aur indicator ke darmiyan tanazah paida hota hai. Positive divergence aksar bullish signal ke tor par samjha jata hai kyun ke iska matlab hai ke price ki mukhtalifiat ne trend change ya uptrend ki taraf honay ki sambhavna dikha di hai. Yeh ishara karta hai ke bechne walon ki dabawat kam ho rahi hai aur khareedne walay market mein dakhil ho sakte hain, jis se price mein upar ki taraf sair mumkin ho sakti hai. Positive divergence ko dekhne wale traders aksar mazeed tasdeeq ke signals ki talaash karte hain, jaise bullish candlestick pattern ya trendline breakout, pehle trade ko samajhne se pehle. Iss se unki trade ki kamiyabi ke imkanat mein izafa hota hai. Negative Divergence Negative divergence woh waqt hota hai jab price chart par higher high (ooper ka neya high) banata hai aur RSI indicator par lower high (neechay ka neya high) banata hai. Iss halat mein price taqat dikha raha hai higher high banakar, lekin RSI indicator kamzori dikha raha hai lower high banakar. Iss se price aur indicator ke darmiyan tanaza'ah paida hota hai. Negative divergence aksar bearish signal ke tor par samjha jata hai kyun ke iska matlab hai ke price ki mukhtalifiat ne trend change ya downtrend ki taraf honay ki sambhavna dikha di hai. Yeh ishara karta hai ke khareedne walon ki dabawat kam ho rahi hai aur bechne walay market mein dakhil ho sakte hain, jis se price mein neechay ki taraf sair mumkin ho sakti hai. Negative divergence ko pehchanne wale traders aksar mazeed tasdeeq ke signals ki talaash karte hain, jaise bearish candlestick pattern ya trendline breakdown, apni trading decisions ko madad karne ke liye. Iss se unki trade setup ki aitmad mein izafa hota hai.  Ek cheez trader ko yaad rakhni hogi ke positive aur negative divergence ka istemaal karke trading decisions banate waqt inko akela indicator ke tor par istemaal na karein. Traders aksar divergence signals ko doosre technical analysis tools ke saath mila kar istemaal karte hain, jaise support aur resistance levels, moving averages, ya trendlines, taa ke potential reversal ya trend change ki tasdeeq ki jaye aur trade ki accuracy mein izafa ho. RSI divergence trading strategies ka istemaal karke traders price reversals aur trend changes ke signals ko samajhne ki koshish karte hain. Jab divergence detect hoti hai, traders price action ke saath sath RSI indicator ki bhi tafseelati tafseelat janchte hain, jaise ki overbought ya oversold levels aur kisi confirmation signal ki maujoodgi. Ache forex traders RSI divergence ka sahi tashkeelat ke saath istemaal karte hain, jismein doosre technical indicators aur price patterns ke saath mila kar confirmations aur entry/exit points ko samajhne ki koshish karte hain.

Ek cheez trader ko yaad rakhni hogi ke positive aur negative divergence ka istemaal karke trading decisions banate waqt inko akela indicator ke tor par istemaal na karein. Traders aksar divergence signals ko doosre technical analysis tools ke saath mila kar istemaal karte hain, jaise support aur resistance levels, moving averages, ya trendlines, taa ke potential reversal ya trend change ki tasdeeq ki jaye aur trade ki accuracy mein izafa ho. RSI divergence trading strategies ka istemaal karke traders price reversals aur trend changes ke signals ko samajhne ki koshish karte hain. Jab divergence detect hoti hai, traders price action ke saath sath RSI indicator ki bhi tafseelati tafseelat janchte hain, jaise ki overbought ya oversold levels aur kisi confirmation signal ki maujoodgi. Ache forex traders RSI divergence ka sahi tashkeelat ke saath istemaal karte hain, jismein doosre technical indicators aur price patterns ke saath mila kar confirmations aur entry/exit points ko samajhne ki koshish karte hain.

تبصرہ

Расширенный режим Обычный режим