Assalamu Alaikum dear friend Umeed hai kya aap sab khairiyat se Honge aur Forex trading Mein Apna Achcha profit bana rahe Honge dear jab aap ismein kam karte hain to aapko bahut hi careful hokar kam karna hota hai aur Market ko acche tarike se Samajh Kar trading karna hoti hai agar aap ismein hard work karte hain aur Market ko acchi tarike se samajhkar kam karte hain to aapko Ek Achcha result Milta hai aapko Hamesha koshish Karni chahie kya aap acche analysis ke sath trading Karen Taki aapko is market Mein acchi entry Mile Jitna Jyada aap market ko time Denge aur Market ko Samajh Kar trading Karenge aapko Itni hi acchi kamyabi Milegi isliye aapko market Mein Chhoti Si Chhoti mistakes Ka Khyal Rakhna chahie aur Roj regulation ko follow karke trading karna chahie aaj main aapse bahut hi important information discuss karungi jo aapki trading ko profitable banaa sakti hai to Mera topic hai Range Trading Strategy kia hai.

Introduction Of Range Trading Strategy:

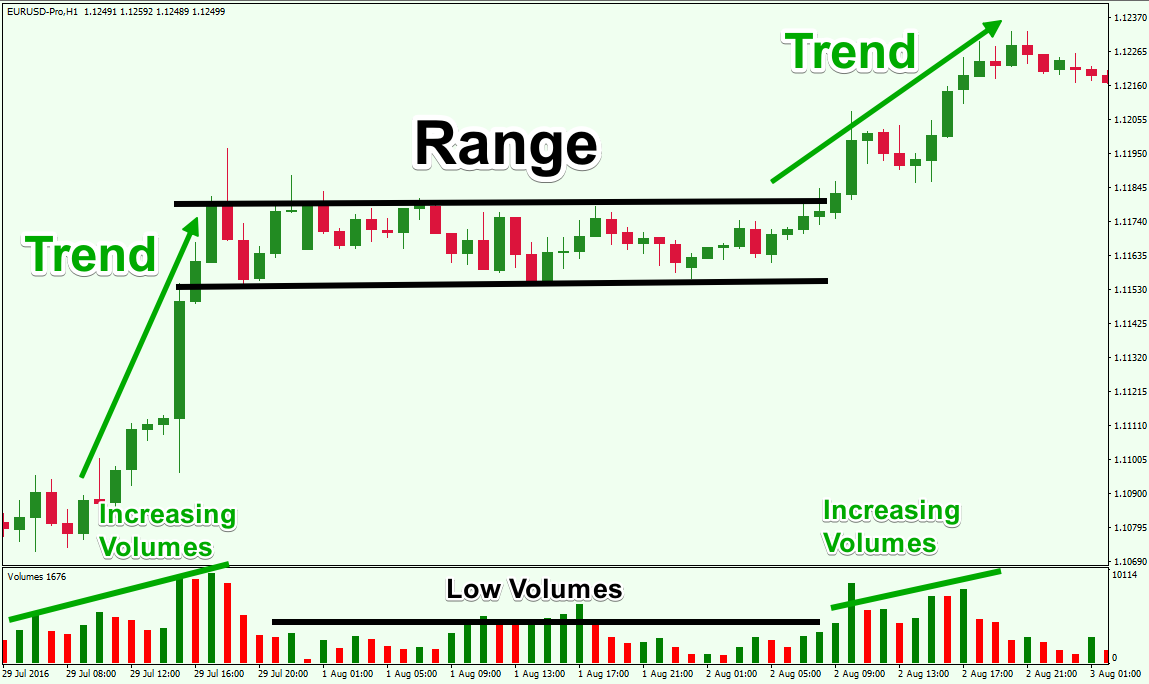

Dear friend Jab Ham is market Mein kam karte hain to usmein different time friends main market ki support Se Lekar register Tak move karti hai aur uske bad FIR Usi resistance se Usi support Tak Aati Hai To usko range Kaha jata hai range trading mein aap support se bye karte hain aur registence se Sel karte hain ismein aap Kisi bhi indicator ka use kar sakte hain.

How To Trade With Range Trading Strategy:

Dear friend forex market main range trading strategies mein ap Jab trade open Karty Hain To ap usmain oscillator indicators ka use bi kar sakty hain Is ky support resistance Ko Dekh kar trade kar sakty hain or ap ismain acchi entry Le kar Acha profit bi banaa sakty hain is liye ap ko trading Main acchi strategies ke sath kam karna chahie.

Consiladtion Area:

Dear friend forex market Mein range trading karne ky liye ap ko sab se pahly range ko find karna Hota Hai Jahan bi market Kisi bi time frame Main range bana Rahi hoti hai is main ap trade kar saktye hain dear is main ap market ko support or resistance Ke Darmiyan Hony Wali movement Ko Dekh kar trade Karty Hain.

Time Your Entry Forex Market:

Dear member is main apko intricate time ko dekhna hota hai jaise ki aap trade Karte Hain To ismein aap different osilators ka use kar sakte hain sab se best or Statistics hai ismain ap ko Kisi bi indicator sy or Market ki hidden divergence se trade Laga sakty hain apni trade key time ko acche se dekhna hota hai or manage karna Hota Hai.

Overbought And Oversold With CCI Indicator:

Dear member ye wo technical indicator hai jo ki bahut hi Acha Oscilater Hai Iske oversold par aap Buy Ki entry trade Laga saktye hain or Is ke over bought par ap Sel kar trade Laga sakty hain Jab market support par ati hai or indicators ap ko oversold Dete Hain To ap buy kar sakty hain Is Tarah Jab market resistance par Jati Hai To yeh oscillator ap ko agar overbought deta hai to aap Sell kar sakty hain.

Place Order:

Dear friend jab aap range trading strategies Mein kam kar rahe hote hain to aap ismein pending order ka bhi use kar sakte hain iska aapko yah fayda hota hai ki Jab market use point per Jaati Hai To aapki trade automatically open Ho Jaati Hai Aap market ke resistance per Sel limit ka use kar sakte hain aur support se aap bile meter Laga sakte hain Is Tarah Jab market range break karti hai to aap bye stop aur Stop loss ka use Karen to aapko fayda hota hai ise aap maximum advantages Hasil kar sakte hain aur apni trading Mein best result Hasil Karke best earning kar sakte hain..

Introduction Of Range Trading Strategy:

Dear friend Jab Ham is market Mein kam karte hain to usmein different time friends main market ki support Se Lekar register Tak move karti hai aur uske bad FIR Usi resistance se Usi support Tak Aati Hai To usko range Kaha jata hai range trading mein aap support se bye karte hain aur registence se Sel karte hain ismein aap Kisi bhi indicator ka use kar sakte hain.

How To Trade With Range Trading Strategy:

Dear friend forex market main range trading strategies mein ap Jab trade open Karty Hain To ap usmain oscillator indicators ka use bi kar sakty hain Is ky support resistance Ko Dekh kar trade kar sakty hain or ap ismain acchi entry Le kar Acha profit bi banaa sakty hain is liye ap ko trading Main acchi strategies ke sath kam karna chahie.

Consiladtion Area:

Dear friend forex market Mein range trading karne ky liye ap ko sab se pahly range ko find karna Hota Hai Jahan bi market Kisi bi time frame Main range bana Rahi hoti hai is main ap trade kar saktye hain dear is main ap market ko support or resistance Ke Darmiyan Hony Wali movement Ko Dekh kar trade Karty Hain.

Time Your Entry Forex Market:

Dear member is main apko intricate time ko dekhna hota hai jaise ki aap trade Karte Hain To ismein aap different osilators ka use kar sakte hain sab se best or Statistics hai ismain ap ko Kisi bi indicator sy or Market ki hidden divergence se trade Laga sakty hain apni trade key time ko acche se dekhna hota hai or manage karna Hota Hai.

Overbought And Oversold With CCI Indicator:

Dear member ye wo technical indicator hai jo ki bahut hi Acha Oscilater Hai Iske oversold par aap Buy Ki entry trade Laga saktye hain or Is ke over bought par ap Sel kar trade Laga sakty hain Jab market support par ati hai or indicators ap ko oversold Dete Hain To ap buy kar sakty hain Is Tarah Jab market resistance par Jati Hai To yeh oscillator ap ko agar overbought deta hai to aap Sell kar sakty hain.

Place Order:

Dear friend jab aap range trading strategies Mein kam kar rahe hote hain to aap ismein pending order ka bhi use kar sakte hain iska aapko yah fayda hota hai ki Jab market use point per Jaati Hai To aapki trade automatically open Ho Jaati Hai Aap market ke resistance per Sel limit ka use kar sakte hain aur support se aap bile meter Laga sakte hain Is Tarah Jab market range break karti hai to aap bye stop aur Stop loss ka use Karen to aapko fayda hota hai ise aap maximum advantages Hasil kar sakte hain aur apni trading Mein best result Hasil Karke best earning kar sakte hain..

Identifying Support and Resistance Levels Range trading strategy forex mein support aur resistance levels ko pehchanne per mabni hoti hai. Support level wo price level hota hai jahan currency pair ki girawat rukti hai aur wapis uchalne lagti hai, jabkay resistance level wo price level hota hai jahan currency pair ki uthne wali movement rok jati hai aur uska rukh badal jata hai. Ye levels chart per horizontal lines ya price bands ke roop mein identify kiye jaate hain. Trading Within the Range Ek baar support aur resistance levels identify karne ke baad, range trading strategy mein traders is defined range ke andar trade karte hain. Ye matlab hota hai ke jab price support level tak pohnchti hai, to traders buy order place kar sakte hain, aur jab price resistance level tak pohnchti hai, to traders sell order place kar sakte hain. Range ke andar trade karne se maksad hota hai ke jab price range ke andar fluctuate karti hai, to traders multiple trades lete hain aur small profits banaate hain. Using Stop Loss and Take Profit Orders Range trading strategy mein stop loss aur take profit orders ka istemal kafi ahem hota hai. Stop loss order, traders ko protect karne mein madad karta hai, agar price range ke bahar move kar jaye to, aur take profit order, traders ko profits realize karne mein madad karta hai, jab price range ke opposite direction mein move karte hain. Traders ko tight stop loss aur take profit levels set karne chahiye, taki risk management maintain kiya ja sake. Monitoring Price Action and Indicators Range trading mein price action aur technical indicators ko closely monitor karna zaroori hota hai. Price action, yani price movement ko dekh kar traders ko entry aur exit points identify karne mein madad milti hai. Technical indicators jaise ki moving averages, RSI, MACD, etc. bhi range trading strategy mein istemal kiye jaate hain, taki traders ko confirmations aur signals mil sake, khas kar support aur resistance levels ko validate karne mein.

Identifying Support and Resistance Levels Range trading strategy forex mein support aur resistance levels ko pehchanne per mabni hoti hai. Support level wo price level hota hai jahan currency pair ki girawat rukti hai aur wapis uchalne lagti hai, jabkay resistance level wo price level hota hai jahan currency pair ki uthne wali movement rok jati hai aur uska rukh badal jata hai. Ye levels chart per horizontal lines ya price bands ke roop mein identify kiye jaate hain. Trading Within the Range Ek baar support aur resistance levels identify karne ke baad, range trading strategy mein traders is defined range ke andar trade karte hain. Ye matlab hota hai ke jab price support level tak pohnchti hai, to traders buy order place kar sakte hain, aur jab price resistance level tak pohnchti hai, to traders sell order place kar sakte hain. Range ke andar trade karne se maksad hota hai ke jab price range ke andar fluctuate karti hai, to traders multiple trades lete hain aur small profits banaate hain. Using Stop Loss and Take Profit Orders Range trading strategy mein stop loss aur take profit orders ka istemal kafi ahem hota hai. Stop loss order, traders ko protect karne mein madad karta hai, agar price range ke bahar move kar jaye to, aur take profit order, traders ko profits realize karne mein madad karta hai, jab price range ke opposite direction mein move karte hain. Traders ko tight stop loss aur take profit levels set karne chahiye, taki risk management maintain kiya ja sake. Monitoring Price Action and Indicators Range trading mein price action aur technical indicators ko closely monitor karna zaroori hota hai. Price action, yani price movement ko dekh kar traders ko entry aur exit points identify karne mein madad milti hai. Technical indicators jaise ki moving averages, RSI, MACD, etc. bhi range trading strategy mein istemal kiye jaate hain, taki traders ko confirmations aur signals mil sake, khas kar support aur resistance levels ko validate karne mein.

تبصرہ

Расширенный режим Обычный режим