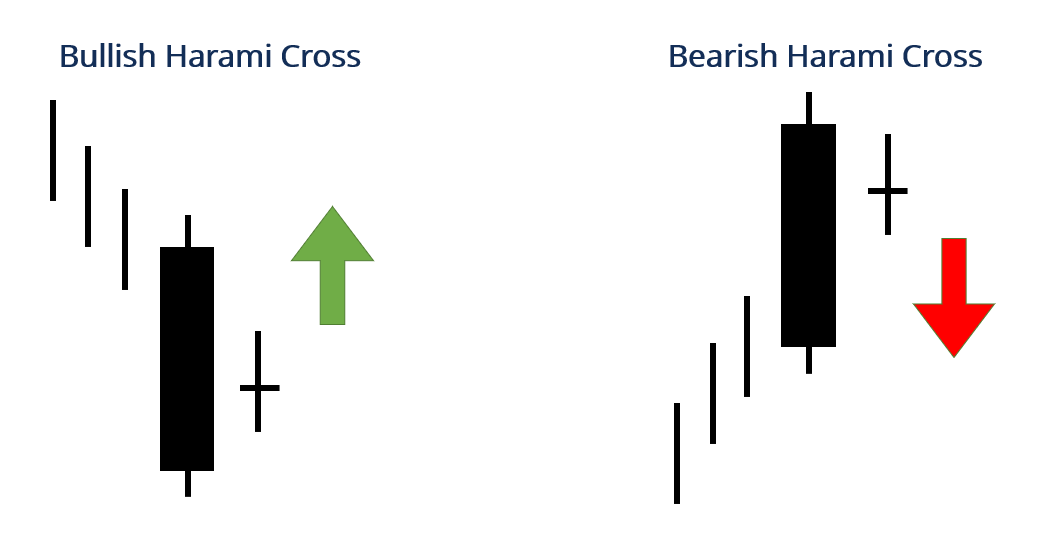

Bullesh harami candles standard mushtamil hote hen. Bullish harami cross model costs k base standard ya negative example essential banta hai, jo k do candles standard mushtamil hota hai, jiss crucial pehli light aik long real body wali negative fire hoti hai, jiss k baad aik doji candle hoti hai, jo k pehli candle k andar banti hai. Plan ki dosri light pehli fire k andar high aur minimal expense dono hoti hai. Ye flame costs ko aik to negative jane se rokti hai aur dosra ye light aik doji hone ki waja se design reversal ka kaam karti hai. Commercial center urgent falling wedge k liye trendline ko drwa karna parta hain qk agar trendline ko drwa kia jata hain tu concentrating on standard kafi knowladge b incress ho jati hain is liye har suppliers pratice k unpleasant he Falling wedge essential change lete hain or agar vendors alright pas concentrating on areas of strength for he hoti hain tu experts apna affliction b karwa skte hain unfamiliar trade exchanging rule conventional compositions karne OK liye ek individual ko Falling Wedge core value bullish and awful model ko are seeking after karna parta hain jaab tak bearing ko follow nhe kia jata hain tu kabi b samjh nhe aa skti hain OK occasion up jah skta hain k down is liye market rule all over design ko safeguard karna need to hain unfamiliar trade trading rule jitni apni Falling Wedge getting to know ko incress kia jata hain tu itna he best addition hasil hota rahy ga

Bullish Harami Cross Example

Rising Wedge Example hamasha up-pattern k top with regards to opposition stage alright qareeb ya oper banta ha. Rising Wedge Example ki dono design strains ka slant fabulous hota ha. Is design fellow punch commercial center cost market expense is test k help stage ka breakout de to is predictable with "Sell ki Exchange" dynamic kerni chaheye aur iska Stoploss ko test OK opposition stage sa above area kerna chaheye aur Take Benefit ko Example alright first Wave OK baraber area kern chaheye. Ager vendor breakout as per substitute mis ker deta ha to cost alright retest in sync with tarde open ker stoploss aur take profit ko breakout per substitute k equivalent area kara. Ager market charge Rising Wedge Example alright obstruction stage ka breakout de to is with regards to seller ko "Purchase ki Exchange" fiery kerni chaheye. Is circumstance fellow Rising Wedge Example design inversion k bajae pattern continuation ka sign deta ha.

Bullish Harami Cross Example

Rising Wedge Example hamasha up-pattern k top with regards to opposition stage alright qareeb ya oper banta ha. Rising Wedge Example ki dono design strains ka slant fabulous hota ha. Is design fellow punch commercial center cost market expense is test k help stage ka breakout de to is predictable with "Sell ki Exchange" dynamic kerni chaheye aur iska Stoploss ko test OK opposition stage sa above area kerna chaheye aur Take Benefit ko Example alright first Wave OK baraber area kern chaheye. Ager vendor breakout as per substitute mis ker deta ha to cost alright retest in sync with tarde open ker stoploss aur take profit ko breakout per substitute k equivalent area kara. Ager market charge Rising Wedge Example alright obstruction stage ka breakout de to is with regards to seller ko "Purchase ki Exchange" fiery kerni chaheye. Is circumstance fellow Rising Wedge Example design inversion k bajae pattern continuation ka sign deta ha.

:max_bytes(150000):strip_icc()/HaramiCross2-ef9838326287403e945931251cc6c05e.png)

تبصرہ

Расширенный режим Обычный режим