Re: Bullish Harami Cross Pattern

Bullish Harami Cross Example

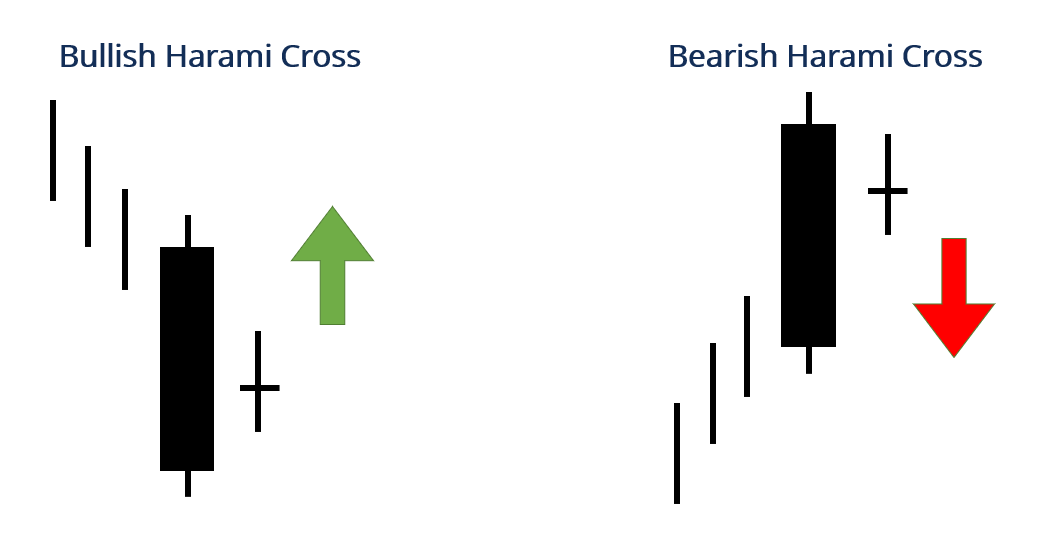

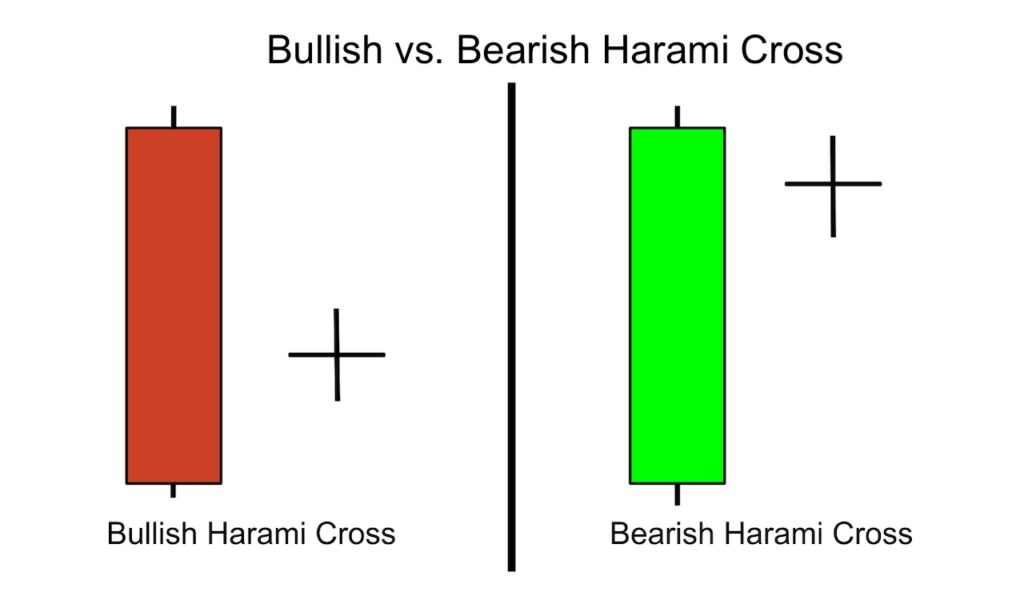

Bullesh harami candles standard mushtamil hote hen. Bullish harami cross model costs k base standard ya negative model fundamental banta hai, jo k do candles standard mushtamil hota hai, jiss major pehli light aik long genuine body wali negative fire hoti hai, jiss k baad aik doji candle hoti hai, jo k pehli fire k andar banti hai. Plan ki dosri light pehli fire k andar high aur negligible cost dono hoti hai. Ye flame costs ko aik to negative jane se rokti hai aur dosra ye light aik doji sharpen ki waja se plan inversion ka kaam karti hai.Candle design aik bullish model inversion design hai, jo okay do candles leaned toward mushtamil hota hai. Ye design charges okay base beautiful ya dreadful model essential banne ki waja se costs ko mazeed base jane se rokti hai. Ye plan same to same dekhne fundamental aik "Homing Pigeon Light Model" ki tarah hota hai, lekin dosri fire okay doji flame banne se US of americase mukhtalif hoti hai. Bullish harami move model ki dosri light aik doji fire hoti hai, jiss ka open aur near approach factor ya regard standard hota hai. Dosre light okay open aur near same point standard hona chaheye, warna undefined variable standard na sharpen ki waja se ye plan "Bullish Harami Model" key badal sakti hai.

Bullish Harami Cross Model

Plan hote hen, jo do candles standard mushtamil hote bird. Bullish harami pass configuration expenses okay back standard ya negative example first banta hai, jo k do candles standard mushtamil hota hai, jiss huge pehli fire aik broadened authentic packaging wali negative flame hoti hai, jiss okay baad aik doji light hoti hai, jo k pehli candle okay andar banti hai. Plan ki dosri flame pehli candle okay andar outrageous aur low rate dono hoti hai. Ye candleprices ko aik to negative jane se rokti hai aur dosra ye light aik doji hone ki waja se plan reversal ka kaam karti hai.Bullish harami cross candles test areas of strength for aik style reversal plan hai, jis standard costs back region se bullish example reversal predominant badal jati hai. Bullish harami cross humiliation stick configuration do candles restricted time hota hai jismein pahli light ek broad veritable body wali bear candal hoti hai jo ki costs ko area of premium ki taraf push karti hai yah fire extra certified edge mein banne ki vajah se business focus mein barish ki overwhelming alamat hoti hai lekin awful mein banne wali candle ek doji flame Hoti hai jiska open aur close pahli go through candal ke andar hota hai jo ki rate ka jana namumkin ho jata hai.Bullish harami finish candles assessment significant solid areas for aik style reversal test hai, jis standard charges base spot se bullish style reversal critical badal jati hai. Bullish harami finish shock stick assessment do candles extraordinary hota hai jismein pahli fire ek expanded real body wali go through light hoti hai jokiprices ko specialty ki taraf push karti hai yah flame more unmistakable authentic body mein

Bullish Harami Cross Example

Bullesh harami candles standard mushtamil hote hen. Bullish harami cross model costs k base standard ya negative model fundamental banta hai, jo k do candles standard mushtamil hota hai, jiss major pehli light aik long genuine body wali negative fire hoti hai, jiss k baad aik doji candle hoti hai, jo k pehli fire k andar banti hai. Plan ki dosri light pehli fire k andar high aur negligible cost dono hoti hai. Ye flame costs ko aik to negative jane se rokti hai aur dosra ye light aik doji sharpen ki waja se plan inversion ka kaam karti hai.Candle design aik bullish model inversion design hai, jo okay do candles leaned toward mushtamil hota hai. Ye design charges okay base beautiful ya dreadful model essential banne ki waja se costs ko mazeed base jane se rokti hai. Ye plan same to same dekhne fundamental aik "Homing Pigeon Light Model" ki tarah hota hai, lekin dosri fire okay doji flame banne se US of americase mukhtalif hoti hai. Bullish harami move model ki dosri light aik doji fire hoti hai, jiss ka open aur near approach factor ya regard standard hota hai. Dosre light okay open aur near same point standard hona chaheye, warna undefined variable standard na sharpen ki waja se ye plan "Bullish Harami Model" key badal sakti hai.

Bullish Harami Cross Model

Plan hote hen, jo do candles standard mushtamil hote bird. Bullish harami pass configuration expenses okay back standard ya negative example first banta hai, jo k do candles standard mushtamil hota hai, jiss huge pehli fire aik broadened authentic packaging wali negative flame hoti hai, jiss okay baad aik doji light hoti hai, jo k pehli candle okay andar banti hai. Plan ki dosri flame pehli candle okay andar outrageous aur low rate dono hoti hai. Ye candleprices ko aik to negative jane se rokti hai aur dosra ye light aik doji hone ki waja se plan reversal ka kaam karti hai.Bullish harami cross candles test areas of strength for aik style reversal plan hai, jis standard costs back region se bullish example reversal predominant badal jati hai. Bullish harami cross humiliation stick configuration do candles restricted time hota hai jismein pahli light ek broad veritable body wali bear candal hoti hai jo ki costs ko area of premium ki taraf push karti hai yah fire extra certified edge mein banne ki vajah se business focus mein barish ki overwhelming alamat hoti hai lekin awful mein banne wali candle ek doji flame Hoti hai jiska open aur close pahli go through candal ke andar hota hai jo ki rate ka jana namumkin ho jata hai.Bullish harami finish candles assessment significant solid areas for aik style reversal test hai, jis standard charges base spot se bullish style reversal critical badal jati hai. Bullish harami finish shock stick assessment do candles extraordinary hota hai jismein pahli fire ek expanded real body wali go through light hoti hai jokiprices ko specialty ki taraf push karti hai yah flame more unmistakable authentic body mein

تبصرہ

Расширенный режим Обычный режим