Asalam -e aulikum dear member main umeed krta hn ap sub log khariyat say hn gay. Ap log forex trading main achi earing hasil kr rhy hn gay . Aj ka mara sawal Bahut he experience provide kry ga. Forex trading main jab ap kaam krty hain to ap ap traing strategy ya candlestick kay pattern ko follow kr kay trading karty hn gay. Longe white candlestick kiya hy aur ap is ko kasy used kr sakhty hain.

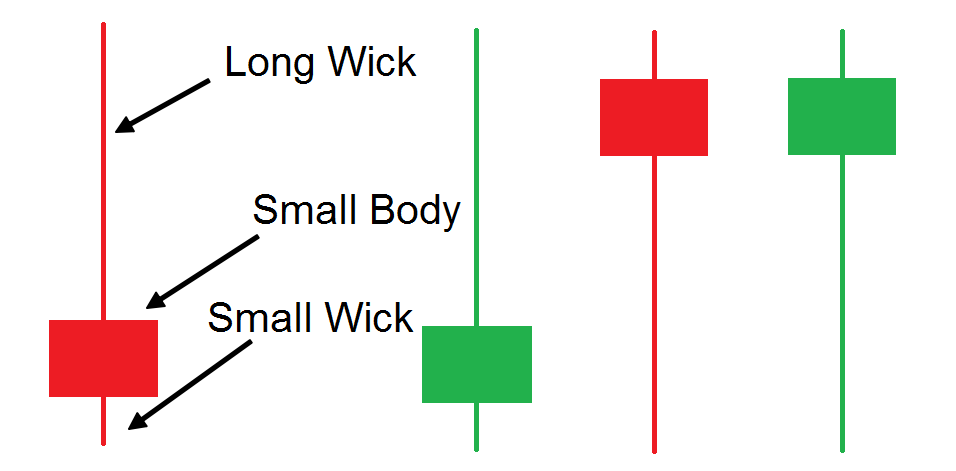

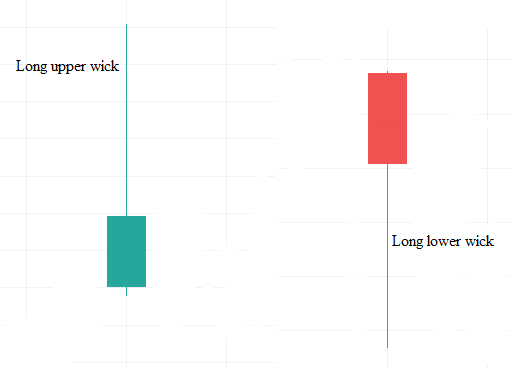

What is longe white candlestick

safaid mom batian mushahida shuda muddat ke douran security ki qeemat mein misbet izafay ki numaindagi karti hain. candle stuck ka body aam tor par candle stuck series ke chart par safaid rang mein dekhaya jaye ga taakay yeh zahir kya ja sakay ke muddat ki qeemat ki karwai ka khalis nateeja oopar tha. taham, kuch takneeki charting systems mein, tajir ko qeemat mein izafay ki numaindagi karne ke liye aik makhsoos rang, jaisay neela ya sabz, muntakhib karne ka ikhtiyar ho sakta hai .

Significance longe white candlesticks

safaid candle stick aik aisay daur ki akkaasi karti hai jahan security ki qeemat jahan khuli thi is se onche satah par band hui hai. aik candle stick Sarif ki makhsoos muddat ke liye security ke khulay, ounchay, kam aur band ko dukhaay gi. candle stuck charts takneeki taajiron ke liye aasaan hain kyunkay woh poooray din ki qeemat ki naqal o harkat ko aasani se zahir kar satke hain. kayi baar baar anay wali safaid mom batii aam tor par oopri rujhan ka ishara deti hain. is par munhasir hai ke kon sa programme istemaal kya jata hai, candle stick ho sakti hai .

Working long white candlesticks

He hai jo taizi ke daur ki numaindagi karta hai. kuch charts par, aik oopar candle stick ko sabz ya siyah ke tor par dekhaya ja sakta hai. un ka muqaabla surkh mom batii ke sath kya ja sakta hai, jo pichlle arsay ke muqablay mein kam ikhtitami qeemat ko zahir karta hai .

Asalam -e aulikum dear member main umeed krta hn ap sub log khariyat say hn gay. Ap log forex trading main achi earing hasil kr rhy hn gay . Aj ka mara sawal Bahut he experience provide kry ga. Forex trading main jab ap kaam krty hain to ap ap traing strategy ya candlestick kay pattern ko follow kr kay trading karty hn gay. Longe white candlestick kiya hy aur ap is ko kasy used kr sakhty hain.

What is longe white candlestick

safaid mom batian mushahida shuda muddat ke douran security ki qeemat mein misbet izafay ki numaindagi karti hain. candle stuck ka body aam tor par candle stuck series ke chart par safaid rang mein dekhaya jaye ga taakay yeh zahir kya ja sakay ke muddat ki qeemat ki karwai ka khalis nateeja oopar tha. taham, kuch takneeki charting systems mein, tajir ko qeemat mein izafay ki numaindagi karne ke liye aik makhsoos rang, jaisay neela ya sabz, muntakhib karne ka ikhtiyar ho sakta hai .

Significance longe white candlesticks

safaid candle stick aik aisay daur ki akkaasi karti hai jahan security ki qeemat jahan khuli thi is se onche satah par band hui hai. aik candle stick Sarif ki makhsoos muddat ke liye security ke khulay, ounchay, kam aur band ko dukhaay gi. candle stuck charts takneeki taajiron ke liye aasaan hain kyunkay woh poooray din ki qeemat ki naqal o harkat ko aasani se zahir kar satke hain. kayi baar baar anay wali safaid mom batii aam tor par oopri rujhan ka ishara deti hain. is par munhasir hai ke kon sa programme istemaal kya jata hai, candle stick ho sakti hai .

Working long white candlesticks

He hai jo taizi ke daur ki numaindagi karta hai. kuch charts par, aik oopar candle stick ko sabz ya siyah ke tor par dekhaya ja sakta hai. un ka muqaabla surkh mom batii ke sath kya ja sakta hai, jo pichlle arsay ke muqablay mein kam ikhtitami qeemat ko zahir karta hai .

What is longe white candlestick

safaid mom batian mushahida shuda muddat ke douran security ki qeemat mein misbet izafay ki numaindagi karti hain. candle stuck ka body aam tor par candle stuck series ke chart par safaid rang mein dekhaya jaye ga taakay yeh zahir kya ja sakay ke muddat ki qeemat ki karwai ka khalis nateeja oopar tha. taham, kuch takneeki charting systems mein, tajir ko qeemat mein izafay ki numaindagi karne ke liye aik makhsoos rang, jaisay neela ya sabz, muntakhib karne ka ikhtiyar ho sakta hai .

Significance longe white candlesticks

safaid candle stick aik aisay daur ki akkaasi karti hai jahan security ki qeemat jahan khuli thi is se onche satah par band hui hai. aik candle stick Sarif ki makhsoos muddat ke liye security ke khulay, ounchay, kam aur band ko dukhaay gi. candle stuck charts takneeki taajiron ke liye aasaan hain kyunkay woh poooray din ki qeemat ki naqal o harkat ko aasani se zahir kar satke hain. kayi baar baar anay wali safaid mom batii aam tor par oopri rujhan ka ishara deti hain. is par munhasir hai ke kon sa programme istemaal kya jata hai, candle stick ho sakti hai .

Working long white candlesticks

He hai jo taizi ke daur ki numaindagi karta hai. kuch charts par, aik oopar candle stick ko sabz ya siyah ke tor par dekhaya ja sakta hai. un ka muqaabla surkh mom batii ke sath kya ja sakta hai, jo pichlle arsay ke muqablay mein kam ikhtitami qeemat ko zahir karta hai .

Asalam -e aulikum dear member main umeed krta hn ap sub log khariyat say hn gay. Ap log forex trading main achi earing hasil kr rhy hn gay . Aj ka mara sawal Bahut he experience provide kry ga. Forex trading main jab ap kaam krty hain to ap ap traing strategy ya candlestick kay pattern ko follow kr kay trading karty hn gay. Longe white candlestick kiya hy aur ap is ko kasy used kr sakhty hain.

What is longe white candlestick

safaid mom batian mushahida shuda muddat ke douran security ki qeemat mein misbet izafay ki numaindagi karti hain. candle stuck ka body aam tor par candle stuck series ke chart par safaid rang mein dekhaya jaye ga taakay yeh zahir kya ja sakay ke muddat ki qeemat ki karwai ka khalis nateeja oopar tha. taham, kuch takneeki charting systems mein, tajir ko qeemat mein izafay ki numaindagi karne ke liye aik makhsoos rang, jaisay neela ya sabz, muntakhib karne ka ikhtiyar ho sakta hai .

Significance longe white candlesticks

safaid candle stick aik aisay daur ki akkaasi karti hai jahan security ki qeemat jahan khuli thi is se onche satah par band hui hai. aik candle stick Sarif ki makhsoos muddat ke liye security ke khulay, ounchay, kam aur band ko dukhaay gi. candle stuck charts takneeki taajiron ke liye aasaan hain kyunkay woh poooray din ki qeemat ki naqal o harkat ko aasani se zahir kar satke hain. kayi baar baar anay wali safaid mom batii aam tor par oopri rujhan ka ishara deti hain. is par munhasir hai ke kon sa programme istemaal kya jata hai, candle stick ho sakti hai .

Working long white candlesticks

He hai jo taizi ke daur ki numaindagi karta hai. kuch charts par, aik oopar candle stick ko sabz ya siyah ke tor par dekhaya ja sakta hai. un ka muqaabla surkh mom batii ke sath kya ja sakta hai, jo pichlle arsay ke muqablay mein kam ikhtitami qeemat ko zahir karta hai .

تبصرہ

Расширенный режим Обычный режим