Double Top Chart Pattern

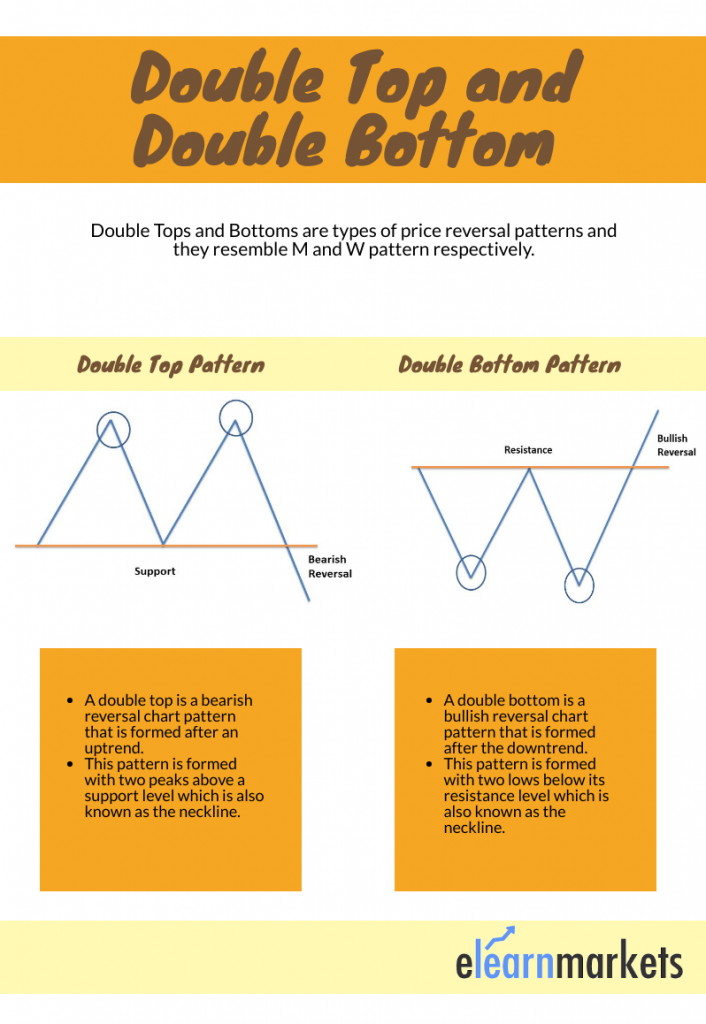

Double top ak chart pattern ha market ma ya pattern market ka trend ko reversal karna ka kam karta ha ya market ke price ko bearish ke traf reversal karta ha. Ya pattern market ma uptrend ka top ma banta ha or market ko top sa downward ke traf reverse kar data ha. Is double top pattern ma market strongly or long term ka liya downward ke traf reversal hote ha. Ya double top pattern jab market ka chart ma banta ha to ya pattern market ka top ma do peaks ko banata ha jo market ka high ma bante ha or in peaks or is pattern ka complete hona ka bad market bearish ke traf reversal kar jate ha

Indication of Double TopPattern

Double top jab banay ga market ma to is ma jo market ho ge wo sab sa phalay market support level par ho ge or is ma market support level sa high ke traf jay ge or market is ma strongly bullish ke traf move kara ge or market high ke traf jate hoi support level ka top ma first peak ko banay ge or is fires peak ko ak high level par banany ka bad market reverse ho kar downward ke traf aay ge or is ma market reverse ho kar support level par a jay ge or is pattern ke ya first complete ho jay ge. Is pattern ma market first peak ko jab support level ma a kar complete kara ge to market is ma ak dafa phir sa up ke traf jay ge is ma market support level sa he high ke traf jay ge or market high ma ja kar same second peak ko banay ge or market is second peak market ka high ma banay ge

Explanation of Double Top

Double top taweel mudti rujhan mein tabdeeli ki nishandahi karta hai. amazon. com inc. ( amzn ) ke stock ne pichlle saal September aur october ke darmiyan aik double taap patteren tayyar kya, jis ki qeemat $ 2, 050 ke lag bhag thi, jaisa ke oopar chart mein dekha ja sakta hai. is sorat e haal mei ahem support level $ 1, 880 par tashkeel paaya. double taap ki tasdeeq is waqt tak nahi ho sakti jab tak ke stock ki qemat $ 1, 880 se neechay nah aa jaye, is ke bawajood ke stock october ki chouti se support ki is satah tak 8 % se ziyada gir gaya. is ke baad hasas mein taqreeban 31 feesad mazeed kami hoti rahi March aur April 2018 mein double taap ki taamer ko netflix inc. ( nflx ) ka istemaal karte hue darj zail misaal mein dekhaya ja sakta hai. lekin jab is misaal mein stock oopar ke rujhaan mein barhta hai to hum dekh satke hain ke support kabhi nahi tooti hai

Trading on Pattern

Double top pattern ma traders ko sell ke trade ko enter karna ka signal mila ga q ka ya pattern market ka top ma banta ha or is ma market bullish sa reversal ho kar bearish ke traf ay ge. Is pattern ma traders dakha ga ka jab ya banay ga to is ma market support level par ho ge or market ma ak strong high bull ka pressure ay ga jo market ko high ma la kar jaey ga or market high ma ja kar ak peak ko banay ge or high ma market ma bull ka control loss ho jay ga or market ma high bear ka pressure ay ga jo market ko lower ke traf reversal kara ga or is ma market bear ka pressure sa bullish ma peak ko banany ka bad downward ke traf reversal ho kar ay ge or market neckline level par ana ka bad is neckline level ko hit karna ka bad market high ke traf reversal ho jay ge

Double top ak chart pattern ha market ma ya pattern market ka trend ko reversal karna ka kam karta ha ya market ke price ko bearish ke traf reversal karta ha. Ya pattern market ma uptrend ka top ma banta ha or market ko top sa downward ke traf reverse kar data ha. Is double top pattern ma market strongly or long term ka liya downward ke traf reversal hote ha. Ya double top pattern jab market ka chart ma banta ha to ya pattern market ka top ma do peaks ko banata ha jo market ka high ma bante ha or in peaks or is pattern ka complete hona ka bad market bearish ke traf reversal kar jate ha

Indication of Double TopPattern

Double top jab banay ga market ma to is ma jo market ho ge wo sab sa phalay market support level par ho ge or is ma market support level sa high ke traf jay ge or market is ma strongly bullish ke traf move kara ge or market high ke traf jate hoi support level ka top ma first peak ko banay ge or is fires peak ko ak high level par banany ka bad market reverse ho kar downward ke traf aay ge or is ma market reverse ho kar support level par a jay ge or is pattern ke ya first complete ho jay ge. Is pattern ma market first peak ko jab support level ma a kar complete kara ge to market is ma ak dafa phir sa up ke traf jay ge is ma market support level sa he high ke traf jay ge or market high ma ja kar same second peak ko banay ge or market is second peak market ka high ma banay ge

Explanation of Double Top

Double top taweel mudti rujhan mein tabdeeli ki nishandahi karta hai. amazon. com inc. ( amzn ) ke stock ne pichlle saal September aur october ke darmiyan aik double taap patteren tayyar kya, jis ki qeemat $ 2, 050 ke lag bhag thi, jaisa ke oopar chart mein dekha ja sakta hai. is sorat e haal mei ahem support level $ 1, 880 par tashkeel paaya. double taap ki tasdeeq is waqt tak nahi ho sakti jab tak ke stock ki qemat $ 1, 880 se neechay nah aa jaye, is ke bawajood ke stock october ki chouti se support ki is satah tak 8 % se ziyada gir gaya. is ke baad hasas mein taqreeban 31 feesad mazeed kami hoti rahi March aur April 2018 mein double taap ki taamer ko netflix inc. ( nflx ) ka istemaal karte hue darj zail misaal mein dekhaya ja sakta hai. lekin jab is misaal mein stock oopar ke rujhaan mein barhta hai to hum dekh satke hain ke support kabhi nahi tooti hai

Trading on Pattern

Double top pattern ma traders ko sell ke trade ko enter karna ka signal mila ga q ka ya pattern market ka top ma banta ha or is ma market bullish sa reversal ho kar bearish ke traf ay ge. Is pattern ma traders dakha ga ka jab ya banay ga to is ma market support level par ho ge or market ma ak strong high bull ka pressure ay ga jo market ko high ma la kar jaey ga or market high ma ja kar ak peak ko banay ge or high ma market ma bull ka control loss ho jay ga or market ma high bear ka pressure ay ga jo market ko lower ke traf reversal kara ga or is ma market bear ka pressure sa bullish ma peak ko banany ka bad downward ke traf reversal ho kar ay ge or market neckline level par ana ka bad is neckline level ko hit karna ka bad market high ke traf reversal ho jay ge

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Double_Top_Definition_Oct_2020-01-b7e6095a764243cc9f79fdaf1214a7b6.jpg)

:max_bytes(150000):strip_icc():format(webp)/doubletop_final-fe90d68ffb714dcbb1db55e87eb40cd3.png)

تبصرہ

Расширенный режим Обычный режим