What is Margin and Free Margin in Forex

*Asalam o alaikum* members, umid hai k aap sab khairiyat se honge. Jab Ham Forex trading business mein kam Karty Hain to kuch points jinke bare mein hame knowledge aur experience ka hona bahut zaruri hota hai wo hamen seekhani chahie isiliye aaj Ham baat karenge margin aur free margin ke difference ke bare mein aur main ummid Karti hun ye information aapko in donon topics ko samajhne mein bahut jyada madad degi.

Definition of Margin

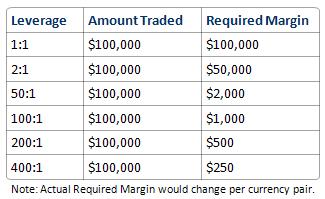

Market mein margin aapka woh balance hota hai jo aap trade open karte waqt istemal Karty Hain Jo aapke pass margin hota hai trade open karne ke liye uska istemal aapki leverage per depend kar raha hota hai apni leverage ko jyada select karte Hain to aap ka margin kam istemal hota hai trade open karte waqt agar aapki leverage kam hoti hai to Is Tarah aap margin jyada istemal Karke trade open kar sakte hain. Missal ke taur per agar aapke pass account mein $50 hai to aap apne trade open Nahin ki aur aapke liye bridge 1:00 hai to Aapka margin $50 Hoga aur free emergen bhi $50 Hoga aur aapki equity bhi $50 Hogi Is Tarah margin aapko aap ke account ke current status ke bare mein tamam information deta hai.

Definition of Free Margin

Jb ap apna koi bhi order open Nahin karte to use waqt aapka free margin aur margin aur equity Ek jitni Hoti hai jabki order open karte Hain to kuchh margin use waqt use hota hai trade open karne mein aur jo aapke pass margin Bach jata hai vah free margin hota hai aur aapki train agar loss ya profit ki nahin aati hai to usi ke lihaj se vah increase ya decrease hota hai aapki jyada use waqt Hoti hai jab aap kya lagaya jaane wala order profit mein hota hai aur agar vah loss mein chalna start kar de to equity kam hona start ho jaati hai Is Tarah free margin bhi Ek uthi kesath sath increase ya decrease ho raha hota hai.

Details of margin and free margin

Used margin is the total amount of all the required margin from all your open positions. Free margin is the difference between equity and used margin — the available margin not taken up by current positions. You can use free margin to open new positions in the forex market.

Dear friends margin wo hota hai jo aap ke account mein maujud capital amount hoti hai aur free margin agar aap ek trade open Karti hai to uske bad bach jaane wala amount hota hai. free margin mein jawab Koi trade open kar sakte hain karte Hain to kitni amount ka lot size ke sath open karte hain usko free marjan kaha jata hai aapko yah maloom honi chahie ki Pakistan mein trading market mein trading karne ke liye Jo points discuss ki jaati hai ya unki selection ko jitna focus rakha jata hai traders ko chahie ki vah in points ke bare mein jarur knowledge hasil karen kyunki yah points usko trading ke dauran bahut zyada madad dety hain.

*Asalam o alaikum* members, umid hai k aap sab khairiyat se honge. Jab Ham Forex trading business mein kam Karty Hain to kuch points jinke bare mein hame knowledge aur experience ka hona bahut zaruri hota hai wo hamen seekhani chahie isiliye aaj Ham baat karenge margin aur free margin ke difference ke bare mein aur main ummid Karti hun ye information aapko in donon topics ko samajhne mein bahut jyada madad degi.

Definition of Margin

Market mein margin aapka woh balance hota hai jo aap trade open karte waqt istemal Karty Hain Jo aapke pass margin hota hai trade open karne ke liye uska istemal aapki leverage per depend kar raha hota hai apni leverage ko jyada select karte Hain to aap ka margin kam istemal hota hai trade open karte waqt agar aapki leverage kam hoti hai to Is Tarah aap margin jyada istemal Karke trade open kar sakte hain. Missal ke taur per agar aapke pass account mein $50 hai to aap apne trade open Nahin ki aur aapke liye bridge 1:00 hai to Aapka margin $50 Hoga aur free emergen bhi $50 Hoga aur aapki equity bhi $50 Hogi Is Tarah margin aapko aap ke account ke current status ke bare mein tamam information deta hai.

Definition of Free Margin

Jb ap apna koi bhi order open Nahin karte to use waqt aapka free margin aur margin aur equity Ek jitni Hoti hai jabki order open karte Hain to kuchh margin use waqt use hota hai trade open karne mein aur jo aapke pass margin Bach jata hai vah free margin hota hai aur aapki train agar loss ya profit ki nahin aati hai to usi ke lihaj se vah increase ya decrease hota hai aapki jyada use waqt Hoti hai jab aap kya lagaya jaane wala order profit mein hota hai aur agar vah loss mein chalna start kar de to equity kam hona start ho jaati hai Is Tarah free margin bhi Ek uthi kesath sath increase ya decrease ho raha hota hai.

Details of margin and free margin

Used margin is the total amount of all the required margin from all your open positions. Free margin is the difference between equity and used margin — the available margin not taken up by current positions. You can use free margin to open new positions in the forex market.

Dear friends margin wo hota hai jo aap ke account mein maujud capital amount hoti hai aur free margin agar aap ek trade open Karti hai to uske bad bach jaane wala amount hota hai. free margin mein jawab Koi trade open kar sakte hain karte Hain to kitni amount ka lot size ke sath open karte hain usko free marjan kaha jata hai aapko yah maloom honi chahie ki Pakistan mein trading market mein trading karne ke liye Jo points discuss ki jaati hai ya unki selection ko jitna focus rakha jata hai traders ko chahie ki vah in points ke bare mein jarur knowledge hasil karen kyunki yah points usko trading ke dauran bahut zyada madad dety hain.

Margin trading mein, trader apne deposited amount ke aage aur bhi amount ko use kar ke trading karta hai. Agar trade profit mein chalta hai, to profit trader ke account mein add ho jata hai, jabki agar trade loss mein chalta hai, to loss trader ke account se deducted ho jata hai. Agar trader ki account balance negative ho jati hai, to usko Margin Call kiya jata hai, aur usko apne account mein balance maintain karne ke liye additional funds deposit karne ke liye kaha jata hai. Free Margin, account balance aur open positions ke margin requirements ko subtract karne se hasil hota hai. Free Margin, trader ke available funds ko represent karta hai, jo trader istemal kar sakta hai, naye trades ke liye. Agar trader ki Free Margin balance zero ho jati hai, to usko Margin Call kiya jata hai. Example ke taur par, agar trader ke account mein $10,000 balance hai, aur usne 2 standard lot ka trade kiya hai, jiski margin requirement $2,000 hai, to uske account mein $8,000 Free Margin bachta hai. Agar trader ek aur trade open karta hai, jiski margin requirement $3,000 hai, to uske account mein $5,000 Free Margin bachta hai. Agar trader apni account balance ko kam karne ke liye kisi existing trade ko close karta hai, to uske account mein Free Margin badhta hai.

Margin trading mein, trader apne deposited amount ke aage aur bhi amount ko use kar ke trading karta hai. Agar trade profit mein chalta hai, to profit trader ke account mein add ho jata hai, jabki agar trade loss mein chalta hai, to loss trader ke account se deducted ho jata hai. Agar trader ki account balance negative ho jati hai, to usko Margin Call kiya jata hai, aur usko apne account mein balance maintain karne ke liye additional funds deposit karne ke liye kaha jata hai. Free Margin, account balance aur open positions ke margin requirements ko subtract karne se hasil hota hai. Free Margin, trader ke available funds ko represent karta hai, jo trader istemal kar sakta hai, naye trades ke liye. Agar trader ki Free Margin balance zero ho jati hai, to usko Margin Call kiya jata hai. Example ke taur par, agar trader ke account mein $10,000 balance hai, aur usne 2 standard lot ka trade kiya hai, jiski margin requirement $2,000 hai, to uske account mein $8,000 Free Margin bachta hai. Agar trader ek aur trade open karta hai, jiski margin requirement $3,000 hai, to uske account mein $5,000 Free Margin bachta hai. Agar trader apni account balance ko kam karne ke liye kisi existing trade ko close karta hai, to uske account mein Free Margin badhta hai.  Agar trader Margin Call se bachna chahta hai, to usko apne account mein additional funds deposit karne ki zaroorat hoti hai. Agar trader Margin Call ke baad bhi funds deposit nahi karta hai, to broker uske open trades ko automatically close kar sakta hai, take trader ki account balance zero na ho jaye. Margin requirements ka level alag alag brokers ke liye alag alag ho sakta hai. Kuch brokers high leverage offer karte hain, jis se traders zyada amount ki position open kar sakte hain, jaisay ke 100:1, 200:1 ya 500:1. Lekin, high leverage ke saath, high risk bhi hota hai. High leverage se traders zyada paisay ki position open kar sakte hain, jis se unki profits bhi zyada ho sakti hain, lekin agar trade against them chalay tou losses bhi zyada ho sakti hain. Margin call ek notification hota hai jo broker trader ko deti hai jab unke account mein kam se kam required margin level ki rakam nahi hoti. Is ka matlab hai ke trader ko additional funds deposit karna hoga, ya unhein apni open positions ko close karne ki zaroorat hogi, taake wo negative balance ke saath aagey nahi jayein. Margin trading ke liye zaroori hai ke traders apne account ki margin requirements aur free margin ko monitor karte rahen, taake unhein apni trading activity aur open positions ki size control karna asan ho. Achi trading strategy aur risk management techniques ka istemal bhi traders ke liye helpful ho sakta hai, taake wo apni trades ko manage karne mein successful ho sakein.

Agar trader Margin Call se bachna chahta hai, to usko apne account mein additional funds deposit karne ki zaroorat hoti hai. Agar trader Margin Call ke baad bhi funds deposit nahi karta hai, to broker uske open trades ko automatically close kar sakta hai, take trader ki account balance zero na ho jaye. Margin requirements ka level alag alag brokers ke liye alag alag ho sakta hai. Kuch brokers high leverage offer karte hain, jis se traders zyada amount ki position open kar sakte hain, jaisay ke 100:1, 200:1 ya 500:1. Lekin, high leverage ke saath, high risk bhi hota hai. High leverage se traders zyada paisay ki position open kar sakte hain, jis se unki profits bhi zyada ho sakti hain, lekin agar trade against them chalay tou losses bhi zyada ho sakti hain. Margin call ek notification hota hai jo broker trader ko deti hai jab unke account mein kam se kam required margin level ki rakam nahi hoti. Is ka matlab hai ke trader ko additional funds deposit karna hoga, ya unhein apni open positions ko close karne ki zaroorat hogi, taake wo negative balance ke saath aagey nahi jayein. Margin trading ke liye zaroori hai ke traders apne account ki margin requirements aur free margin ko monitor karte rahen, taake unhein apni trading activity aur open positions ki size control karna asan ho. Achi trading strategy aur risk management techniques ka istemal bhi traders ke liye helpful ho sakta hai, taake wo apni trades ko manage karne mein successful ho sakein.

تبصرہ

Расширенный режим Обычный режим