What is a One-Cancels-the-Other (OCO) Order

Introduction

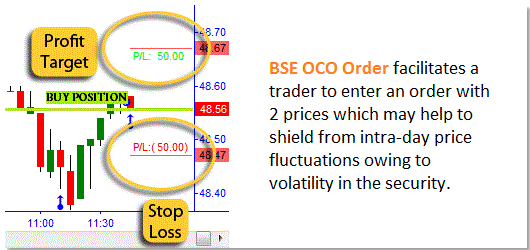

One cancel the other (oco) order mashroot orders ka aik jora hai jis mein kaha gaya hai ke agar aik order par amal hota hai, to dosra order khud bakhud mansookh ho jata hai. oco order aksar khudkaar business board form par stap order ke sath aik had ke order ko jorta hai. jab ya to stap ya had qeemat so pahonch jati hai aur order par amal daraamad ho jata hai, dosra order khud bakhud mansookh ho jata hai. tajurbah car tajir khatray ko kam karne aur market mein daakhil honay ke liye oco orders ka istemaal karte hain. oco order order bhejnay walay order ( oso ) ki sharait se mutazaad ho satke hain jo aik dosray order ko mansookh karne ke bajaye mutharrak karti hain. agar koi tajir muzahmat ke oopar ya neechay ki himayat ke waqfay par tijarat karna chahta hai, to woh oco order day sakta hai jo market mein daakhil honay ke liye khareed stap aur sale stop ka istemaal karta hai. misaal ke tor par, agar koi stock $20 aur $22 ke darmiyan trade kar raha hai, to tajir $22 se bilkul oopar ke khareed stap ke sath oco order day sakta hai aur sirf $20 se neechay sell stop day sakta hai. jab qeemat muzahmat se oopar ya himayat se neechay toot jati hai, to tijarat ki jati hai aur mutaliqa stap order mansookh kar diya jata hai. je ke bar aks, agar koi tajir retracement ki hikmat e amli istemaal karna chahta hai jo support par kharidata hai aur muzahmat par farokht karta hai, to woh $20 par khareed ki had to order ke sath oco order day sakta hai aur $22 par farokht ki should ka order the day of sakta hai. agar oco orders market mein daakhil honay ke liye istemaal kiye jatay hain., jab tijarat ki jati hai to tajir ko dasti tor par stap las order dena chahiye. oco orders ke liye nafiz al amal waqt yaksaa hona chahiye, is ka matlab yeh hai ke stap aur lmit orders dono par amal daraamad ke liye muqarrar kardah time frame yaksaa hona chahiye

Key points

one-cancels-the-other ( oco ) jore ke order ke liye mashroot order ki aik qisam hai jis mein aik ka amal khud bakhud dosray ko mansookh kar deta hai. tajir aam tor par ghair saqe stock ke liye oco orders par amal daraamad karte hain jo qeemat ki wasee range mein tijarat karte hain. bohat se tijarti platformforms par, aik se ziyada mashroot orders dosray orders ke sath diye jasaktay hain jab aik par amal kya jata hai .

Example of an oco order

farz karen ke aik sarmaya car ghair sakht stock ke 1000 shiyrz ka maalik hai yes $10 par trade kar raha hai. sarmaya car ko tawaqqa hai ke yeh stock qareebi muddat mein wasee range par tijarat kere ga aur is ka hadaf $13 hai. khatray mein takhfeef ke liye, woh fi share $2 with ziyada khona nahi chahtay. is liye sarmaya car oco order day sakta hai, jis mein 1, 000 hasas $ 8 par farokht karne ke liye stap las order, aur 1, 000 hasas $ 1 farokht karne ke liye back waqt had ka hota, jo hai pehlay . yeh orders ya to din ke orders him satke hain ya achay se mansookh shuda orders him satke hain. agar stak $13 tak tijarat karta hai to farokht karne ki had to order par amal daraamad hota hai, aur saarmaya car ke 1000 hasas ki hold $13 mein farokht hoti hai. back waqt, business form ke zariye $8 ka stap las ka order khud bakhud mansookh ho jata hai. agar sarmaya car yeh orders azadana tor par deta hai, to is baat ka khatrah hai ke woh stap las order ko mansookh karna bhool sakta hai, jis ke nateejay mein 1,000 hasas ki napasandeedah mukhtasir position hokhtasir a megar baad sakti hai tak gir jata hey

Introduction

One cancel the other (oco) order mashroot orders ka aik jora hai jis mein kaha gaya hai ke agar aik order par amal hota hai, to dosra order khud bakhud mansookh ho jata hai. oco order aksar khudkaar business board form par stap order ke sath aik had ke order ko jorta hai. jab ya to stap ya had qeemat so pahonch jati hai aur order par amal daraamad ho jata hai, dosra order khud bakhud mansookh ho jata hai. tajurbah car tajir khatray ko kam karne aur market mein daakhil honay ke liye oco orders ka istemaal karte hain. oco order order bhejnay walay order ( oso ) ki sharait se mutazaad ho satke hain jo aik dosray order ko mansookh karne ke bajaye mutharrak karti hain. agar koi tajir muzahmat ke oopar ya neechay ki himayat ke waqfay par tijarat karna chahta hai, to woh oco order day sakta hai jo market mein daakhil honay ke liye khareed stap aur sale stop ka istemaal karta hai. misaal ke tor par, agar koi stock $20 aur $22 ke darmiyan trade kar raha hai, to tajir $22 se bilkul oopar ke khareed stap ke sath oco order day sakta hai aur sirf $20 se neechay sell stop day sakta hai. jab qeemat muzahmat se oopar ya himayat se neechay toot jati hai, to tijarat ki jati hai aur mutaliqa stap order mansookh kar diya jata hai. je ke bar aks, agar koi tajir retracement ki hikmat e amli istemaal karna chahta hai jo support par kharidata hai aur muzahmat par farokht karta hai, to woh $20 par khareed ki had to order ke sath oco order day sakta hai aur $22 par farokht ki should ka order the day of sakta hai. agar oco orders market mein daakhil honay ke liye istemaal kiye jatay hain., jab tijarat ki jati hai to tajir ko dasti tor par stap las order dena chahiye. oco orders ke liye nafiz al amal waqt yaksaa hona chahiye, is ka matlab yeh hai ke stap aur lmit orders dono par amal daraamad ke liye muqarrar kardah time frame yaksaa hona chahiye

Key points

one-cancels-the-other ( oco ) jore ke order ke liye mashroot order ki aik qisam hai jis mein aik ka amal khud bakhud dosray ko mansookh kar deta hai. tajir aam tor par ghair saqe stock ke liye oco orders par amal daraamad karte hain jo qeemat ki wasee range mein tijarat karte hain. bohat se tijarti platformforms par, aik se ziyada mashroot orders dosray orders ke sath diye jasaktay hain jab aik par amal kya jata hai .

Example of an oco order

farz karen ke aik sarmaya car ghair sakht stock ke 1000 shiyrz ka maalik hai yes $10 par trade kar raha hai. sarmaya car ko tawaqqa hai ke yeh stock qareebi muddat mein wasee range par tijarat kere ga aur is ka hadaf $13 hai. khatray mein takhfeef ke liye, woh fi share $2 with ziyada khona nahi chahtay. is liye sarmaya car oco order day sakta hai, jis mein 1, 000 hasas $ 8 par farokht karne ke liye stap las order, aur 1, 000 hasas $ 1 farokht karne ke liye back waqt had ka hota, jo hai pehlay . yeh orders ya to din ke orders him satke hain ya achay se mansookh shuda orders him satke hain. agar stak $13 tak tijarat karta hai to farokht karne ki had to order par amal daraamad hota hai, aur saarmaya car ke 1000 hasas ki hold $13 mein farokht hoti hai. back waqt, business form ke zariye $8 ka stap las ka order khud bakhud mansookh ho jata hai. agar sarmaya car yeh orders azadana tor par deta hai, to is baat ka khatrah hai ke woh stap las order ko mansookh karna bhool sakta hai, jis ke nateejay mein 1,000 hasas ki napasandeedah mukhtasir position hokhtasir a megar baad sakti hai tak gir jata hey

تبصرہ

Расширенный режим Обычный режим