Friends Average Directional Index indicator aik bahot he mufeed aur strategic trading Indicator hea jis per trading kar kay trader ko kafi help milti hea trading ko analysis karny main perfect indicator hai jis mein aap ko market se related different important analysis karny mein help mil rahi hoti hai aur aapko forex trading Mein kuch decision making kerny mein perfect results mil sakty hain.

Introduction to Average Directional Index indicator

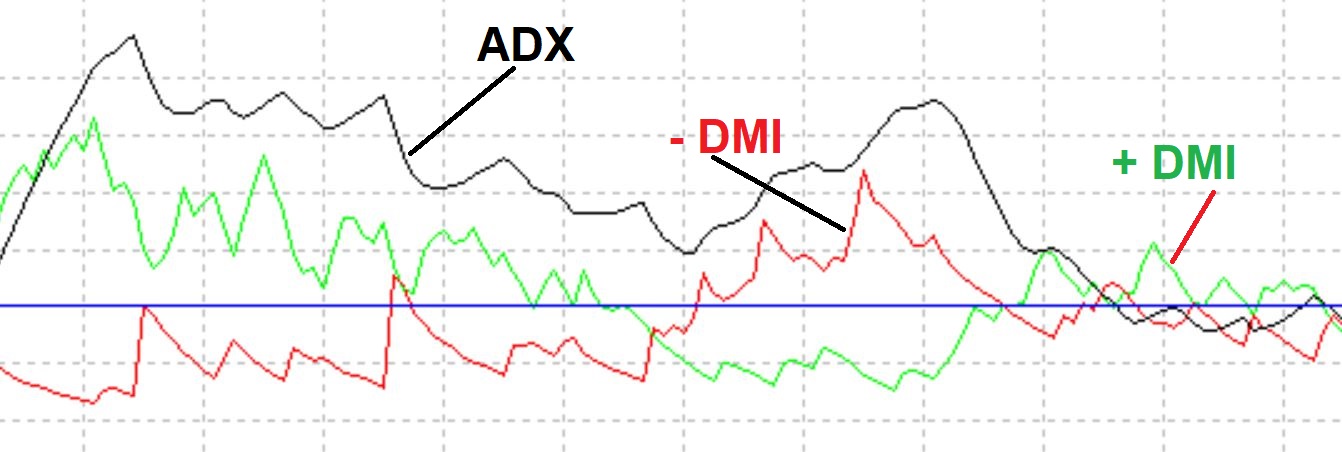

Friends abhi hum is indicator kay technical analysis main use hony kay bary main aur is ki shape kay Hawley say discuss karty hean friends average directional index indicator consecutive fourteen candlestick kobserve karny k bad signal provide karta hai jis ka matlab hai k ye trader ko market ko clear picture farham karta hai or false break out sy trader ki bachny ma help karta hai friends indicator trader ko market ke related information provide karte hain aur average directional index indicator trader Ko is chij ke bare mein bhi batata hai ki market apna Trend kitne time tak continue Rakhegi aur yea indicator market ke Trend ke related trader ko complete Idea deta hai.

Trading at Average Directional Index indicator.

Friends Average Detectional Index indicator technical indicator hai aur is per trading karnay ke liye trader ko technical analysis mein bahut hi Kabil hone ki jarurat hoti hai aur friends Average Directional Index kisi doosray indicator kay sath use kar sakty hain aur is ko bhot easily ham other indicator k sath b compare kar sakty hain.

Introduction to Average Directional Index indicator

Friends abhi hum is indicator kay technical analysis main use hony kay bary main aur is ki shape kay Hawley say discuss karty hean friends average directional index indicator consecutive fourteen candlestick kobserve karny k bad signal provide karta hai jis ka matlab hai k ye trader ko market ko clear picture farham karta hai or false break out sy trader ki bachny ma help karta hai friends indicator trader ko market ke related information provide karte hain aur average directional index indicator trader Ko is chij ke bare mein bhi batata hai ki market apna Trend kitne time tak continue Rakhegi aur yea indicator market ke Trend ke related trader ko complete Idea deta hai.

Trading at Average Directional Index indicator.

Friends Average Detectional Index indicator technical indicator hai aur is per trading karnay ke liye trader ko technical analysis mein bahut hi Kabil hone ki jarurat hoti hai aur friends Average Directional Index kisi doosray indicator kay sath use kar sakty hain aur is ko bhot easily ham other indicator k sath b compare kar sakty hain.

تبصرہ

Расширенный режим Обычный режим