INTRODUCTION:

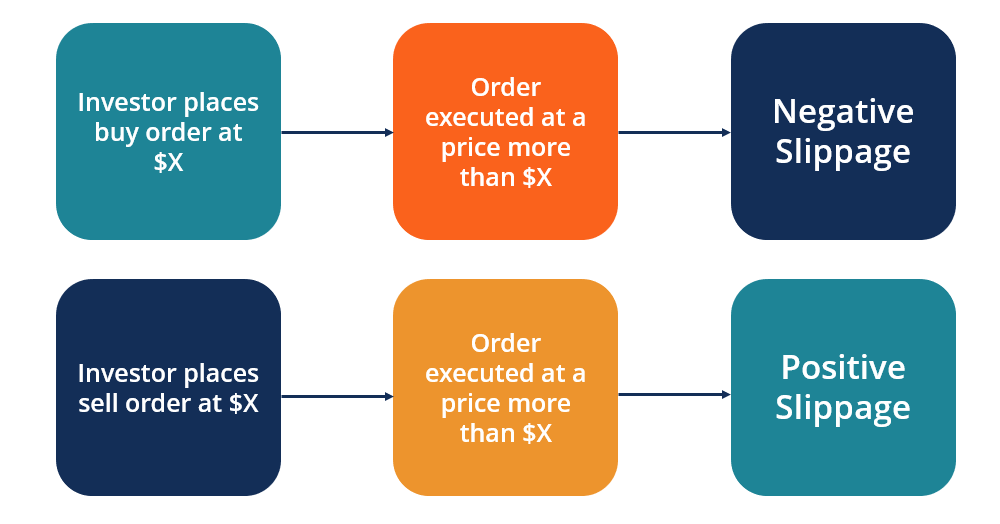

ASLAMUALIKUM DEAR FRIENDS!Dear friends umeed krta hun ap khariat se hun ge Dear Friends, forex ma slippage hm us situation ya condition ko kehtay hain jb koi order open ya close kia jay to usi position ki bjay market ya to uper ya neeche a jay aur hmara order aik new jga par place ho jay, slippage us waqt hoti ha jb market ma buy aur sells k between balance na ho, forex ma do tarah ki slippage hoti ha aik positive aur dusri negative slippage. Positive uper ki trf or negative neeche ki traf move krti he.

" POSITIVE SLIPPAGE "

jb hm market ma koi order place kartay hain to market k back move karnay sa hmara order aik new aur less position par execute ho jata ha jo ziada mufeed sabit ho is ko hm positive slippage kehtay hain, isi tarah koi order close kartay huay b agr market up move kar jay aur new position par trade close ho to ye b positive slippage kehlata ha, jaisay hm trade open karnay k liay kisi pair ko 1800.00 par buy karain aur market further down move kar jay jis sa hmara order 1750.00 par execute ho ya trade close karnay k liay hm 1800.00 select karnay ki koshish karain lakin market up move kar jay aur hmari trade 1850.00 par close ho in situations ko hm positive slippage kehtay hain.

" NEGATIVE SLIPPAGE "

jb hm market ma order place karain aur prices further move kar jaen jin sa hmari trade ghalat situation par open ho jay usay negative slippage kehtay hain, jaisay agr hm kisi pair par 100.00 par trade open karain mgr wo 101.00 par execute ho jay, ya isi tarah agr hm koi trade close karnay k liay 100.00 ki position select karnay ki koshish karain mgr trade 99.00 par close ho jay in conditions ko negative slippage kahain gay.

TRADING MN SLIPPAGE KESE CONTROL KRTE HN?

Forex trading me slippage jb trader ki favour ma ho jae to esko ham positive slippage kehty hain. Jesa k trader ko agr trade close karni hai or wo trade close ni hoe to bad ma trader ka profit zayada ho jata hai to esko ham positive slippage kehty hain. But agr trader apni trade ko slippage ki waja sy close ni kar pata or market profit sy loss ma ponch jati hai to esko ham negative slippage kehty hain. Trader trading tools k help sy market slippage ko counter kae sakty hain. Ik trader ko agr trade close karni hai to esko chahe k stop loss or take profit use kary or trader ko agr trade open karni ho to esko chahe k wo pending orders ko use kary or trade ko open karny k lae wo limit order ya stop order ko use kary. Or apny account ki base par manage kary.

ASLAMUALIKUM DEAR FRIENDS!Dear friends umeed krta hun ap khariat se hun ge Dear Friends, forex ma slippage hm us situation ya condition ko kehtay hain jb koi order open ya close kia jay to usi position ki bjay market ya to uper ya neeche a jay aur hmara order aik new jga par place ho jay, slippage us waqt hoti ha jb market ma buy aur sells k between balance na ho, forex ma do tarah ki slippage hoti ha aik positive aur dusri negative slippage. Positive uper ki trf or negative neeche ki traf move krti he.

" POSITIVE SLIPPAGE "

jb hm market ma koi order place kartay hain to market k back move karnay sa hmara order aik new aur less position par execute ho jata ha jo ziada mufeed sabit ho is ko hm positive slippage kehtay hain, isi tarah koi order close kartay huay b agr market up move kar jay aur new position par trade close ho to ye b positive slippage kehlata ha, jaisay hm trade open karnay k liay kisi pair ko 1800.00 par buy karain aur market further down move kar jay jis sa hmara order 1750.00 par execute ho ya trade close karnay k liay hm 1800.00 select karnay ki koshish karain lakin market up move kar jay aur hmari trade 1850.00 par close ho in situations ko hm positive slippage kehtay hain.

" NEGATIVE SLIPPAGE "

jb hm market ma order place karain aur prices further move kar jaen jin sa hmari trade ghalat situation par open ho jay usay negative slippage kehtay hain, jaisay agr hm kisi pair par 100.00 par trade open karain mgr wo 101.00 par execute ho jay, ya isi tarah agr hm koi trade close karnay k liay 100.00 ki position select karnay ki koshish karain mgr trade 99.00 par close ho jay in conditions ko negative slippage kahain gay.

TRADING MN SLIPPAGE KESE CONTROL KRTE HN?

Forex trading me slippage jb trader ki favour ma ho jae to esko ham positive slippage kehty hain. Jesa k trader ko agr trade close karni hai or wo trade close ni hoe to bad ma trader ka profit zayada ho jata hai to esko ham positive slippage kehty hain. But agr trader apni trade ko slippage ki waja sy close ni kar pata or market profit sy loss ma ponch jati hai to esko ham negative slippage kehty hain. Trader trading tools k help sy market slippage ko counter kae sakty hain. Ik trader ko agr trade close karni hai to esko chahe k stop loss or take profit use kary or trader ko agr trade open karni ho to esko chahe k wo pending orders ko use kary or trade ko open karny k lae wo limit order ya stop order ko use kary. Or apny account ki base par manage kary.

تبصرہ

Расширенный режим Обычный режим