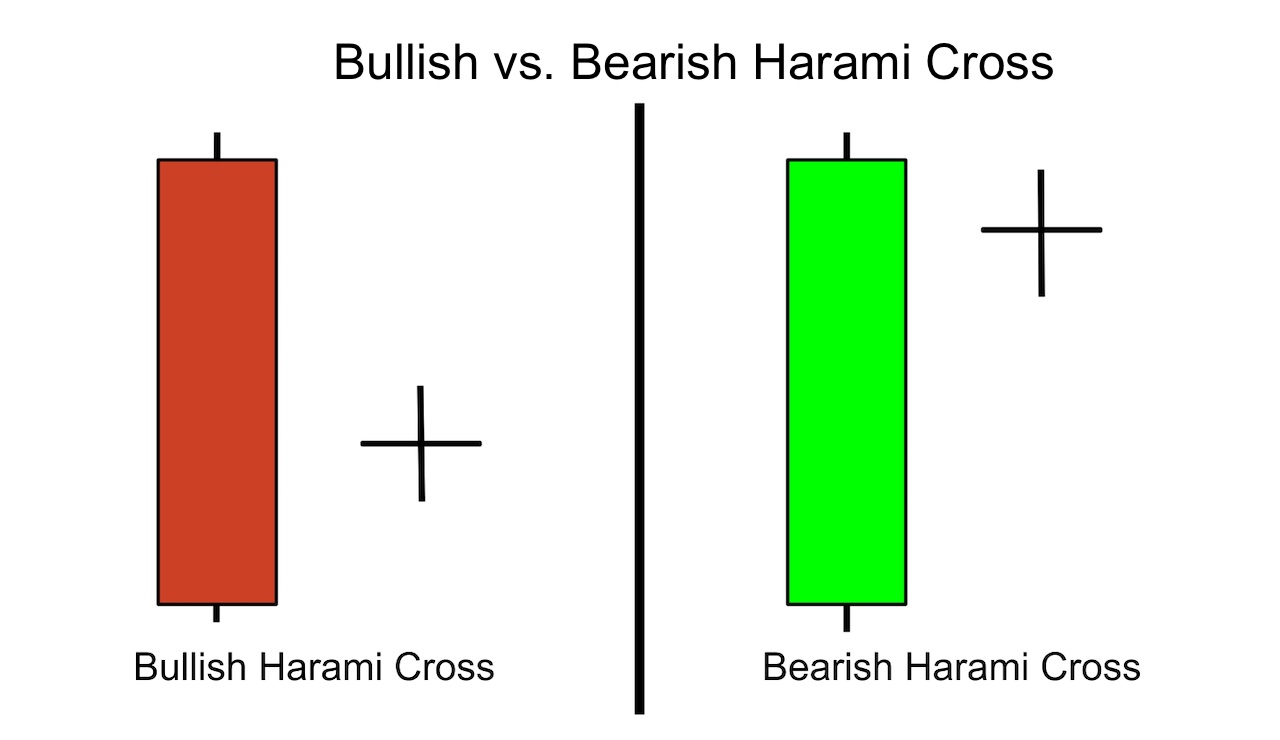

Bullish Harami Cross Pattern With prices in the bottom region and a strong bullish trend reversal pattern, the bullish harami cross candlestick pattern is present. Bullish harami cross scandal stick pattern do candles promotional hota hai jismein pahli candle ek long real body wali bear candal hoti hai jo ki prices ko niche ki taraf push karti hai yah candle extra real body mein banne ki vajah se market mein barish ki strong alamat hoti hai lekin bad mein banne wali candle ek doji candle Hoti hai jiska open aur close pahli bear candal ke andar hota hai jo ki price ka jana namumkin ho jata hai. Trading the Harami Cross Pattern There is no need to swap the harami cross. Some traders simply interpret it as a caution to watch for a reversal. A trader who is already long may profit if a bearish harami cross forms and the price starts to fall in accordance with the pattern. Or, a trader holding a short position might try to close it out if a bullish harami cross forms and the price starts to rise right away.Some traders may choose to initiate deals after the harami cross appears. When purchasing on a bullish harami cross, a stop loss may be placed below the bottom of the doji or the low of the first candlestick. It may be a good idea to start a long position when the price climbs above the first candle's opening.When starting a short position, a stop loss can be placed above the high of the doji or above the high of the opening candle. This is one possible entry point: when the price breaks through the open of the first candle. Harami cross patterns don't have profit objectives. Therefore, traders must use a different method to determine whether to close off a profitable deal. Using a risk/reward ratio, a trailing stop loss, or Fibonacci extensions or retracements to find an exit are a few strategies. Understanding the Harami Cross A bullish harami cross pattern forms after a drop. The sellers are in power when the first candlestick has a long down candle that is often black or red in color. The second candle, a doji, has a restricted range and opens above the previous day's close. The doji candlestick almost ends where it started. The doji must be completely enclosed by the genuine body of the candle that came before.The doji suggests that some sellers may be holding back. Typically, traders won't respond to a pattern until the price rises over the course of the subsequent few candles. Confirmation is the term used. The price may sometimes pause for a few candles after a doji before increasing or decreasing. If the price crosses the first candle's open, this helps to confirm that the price is likely moving upward.A bearish harami cross develops after an ascent. The first candlestick's long-uplighted candles, which are often white or green, show that the purchasers are in power. The following icon is a doji, which stands for the buyers' ambiguity. The real body of the preceding candle must once again include the doji.If the price drops in line with the pattern, it is verified. The bearish pattern is ineffective if the market continues to rise following the doji.

Trading the Harami Cross Pattern There is no need to swap the harami cross. Some traders simply interpret it as a caution to watch for a reversal. A trader who is already long may profit if a bearish harami cross forms and the price starts to fall in accordance with the pattern. Or, a trader holding a short position might try to close it out if a bullish harami cross forms and the price starts to rise right away.Some traders may choose to initiate deals after the harami cross appears. When purchasing on a bullish harami cross, a stop loss may be placed below the bottom of the doji or the low of the first candlestick. It may be a good idea to start a long position when the price climbs above the first candle's opening.When starting a short position, a stop loss can be placed above the high of the doji or above the high of the opening candle. This is one possible entry point: when the price breaks through the open of the first candle. Harami cross patterns don't have profit objectives. Therefore, traders must use a different method to determine whether to close off a profitable deal. Using a risk/reward ratio, a trailing stop loss, or Fibonacci extensions or retracements to find an exit are a few strategies. Understanding the Harami Cross A bullish harami cross pattern forms after a drop. The sellers are in power when the first candlestick has a long down candle that is often black or red in color. The second candle, a doji, has a restricted range and opens above the previous day's close. The doji candlestick almost ends where it started. The doji must be completely enclosed by the genuine body of the candle that came before.The doji suggests that some sellers may be holding back. Typically, traders won't respond to a pattern until the price rises over the course of the subsequent few candles. Confirmation is the term used. The price may sometimes pause for a few candles after a doji before increasing or decreasing. If the price crosses the first candle's open, this helps to confirm that the price is likely moving upward.A bearish harami cross develops after an ascent. The first candlestick's long-uplighted candles, which are often white or green, show that the purchasers are in power. The following icon is a doji, which stands for the buyers' ambiguity. The real body of the preceding candle must once again include the doji.If the price drops in line with the pattern, it is verified. The bearish pattern is ineffective if the market continues to rise following the doji.  What Is a Harami Cross? The Japanese candlestick pattern known as a harami cross is formed by a large candlestick that travels in the trend's direction being followed by a little doji candlestick. The preceding candlestick's body completely encloses the doji. The harami cross pattern suggests that the previous trend may be about to change. It is possible for a bullish or bearish pattern to form. Bullish patterns suggest an upward price reversal, and bearish patterns suggest a probable negative price reversal.

What Is a Harami Cross? The Japanese candlestick pattern known as a harami cross is formed by a large candlestick that travels in the trend's direction being followed by a little doji candlestick. The preceding candlestick's body completely encloses the doji. The harami cross pattern suggests that the previous trend may be about to change. It is possible for a bullish or bearish pattern to form. Bullish patterns suggest an upward price reversal, and bearish patterns suggest a probable negative price reversal.

No announcement yet.

X

new posts

-

#31 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#32 Collapse

blush harami cross patteren ka taaruf blush harami cross patteren aik do candle stick patteren hai jo forex trading mein kami ke rujhan ke mumkina ulat jane ki nishandahi karsaktha hai. usay taizi ka namona samjha jata hai, jis ka matlab hai ke yeh tajweez karta hai ke kami ki muddat ke baad qeemat barhna shuru ho sakti hai . blush harami cross patteren ki nishandahi karna blush harami cross patteren do mom btyon par mushtamil hai. pehli candle aik lambi bearish candle hai, jo zahir karti hai ke market mein kami ka rujhan hai. doosri mom batii aik choti blush candle hai, jo pehli mom batii ke band ke oopar khulti hai aur –apne jism ke andar band ho jati hai. doosri mom batii market mein Adam faisla ke daur ki numaindagi karti hai, jahan khredar market mein daakhil hona shuru kar rahay hain, lekin baichnay walay ab bhi mojood hain . blush harami cross patteren ki ahmiyat blush harami cross patteren ahem hai kyunkay yeh market ke jazbaat mein tabdeeli ko zahir karta hai. pehli candle stuck aik mazboot bearish jazbaat ki nishandahi karti hai, lekin doosri candle stuck zahir karti hai ke khredar control haasil karna shuru kar rahay hain. haqeeqat yeh hai ke doosri mom batii pehli mom batii ke band honay ke oopar khulti hai is se zahir hota hai ke belon ki raftaar barh rahi hai . blush harami cross patteren ki tijarat tajir blush harami cross patteren ko aik lambi position mein daakhil honay ke liye signal ke tor par istemaal kar satke hain. stap nuqsaan ko pehli mom batii ke kam se neechay rakha ja sakta hai, aur take praft ko munasib satah par set kya ja sakta hai. taajiron ko bhi chahiye ke woh deegar asharion ke sath patteren ki tasdeeq karen taakay tijarat mein un ka aetmaad barh sakay . blush harami cross patteren ki hudood tamam takneeki tajzia patteren ki terhan, blush harami cross patteren faul proof nahi hai. taajiron ko sirf is tarz par inhisaar nahi karna chahiye aur usay dosray isharay aur tajzia ke tareeqon ke sath istemaal karna chahiye. mazeed bar-aan, taajiron ko ghalat signals se aagah hona chahiye, jo is soorat mein ho sakta hai jab market mutawaqqa ulat phair ke sath amal nahi karti hai . aakhir mein, blush harami cross patteren forex traders ke liye market mein mumkina taizi ke ulat phair ki nishandahi karne ke liye aik mufeed tool ho sakta hai. patteren aur is ki ahmiyat ko samajh kar, tajir bakhabar tijarti faislay karne ke liye usay istemaal kar satke hain ."Dream bigger. Do bigger"

(mahroosh) :1f607:

-

#33 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish harami cross candlestick pattern trend reversal ka pattern hai, jiss se market main buy ki entry karte hen. Pattern k bottom par buyers ziada active ho jate hen. Trend reversal pattern par trading trend continuation patterns ki nisbat ziada riski hoti hai, iss waja se pattern par trading se pehle market main aik bullish ya white candle ka hona zarori hai. Jiss ki real body honi chaheye, jiss main open aur close same point par na ho. candlestick pattern aik bullish trend reversal pattern hai, jo k do candles par mushtamil hota hai. Ye pattern prices k bottom par ya bearish trend main banne ki waja se prices ko mazeed bottom jane se rokti hai. Ye pattern same to same dekhne main aik "Homing Pigeon Candlestick Pattern" ki tarah hota hai, lekin dosri candle k doji candle banne se uss se mukhtalif hoti hai. Bullish harami cross pattern ki dosri candle aik doji candle hoti hai, jiss ka open aur close same point ya price par hota hai candlestick pattern aik bullish trend reversal pattern hai, jo k do candles par mushtamil hota hai. Ye pattern prices k bottom par ya bearish trend main banne ki waja se prices ko mazeed bottom jane se rokti hai. Ye pattern same to same dekhne main aik "Homing Pigeon Candlestick Pattern" ki tarah hota hai, lekin dosri candle k doji candle banne se uss se mukhtalif hoti hai. Bullish harami cross pattern ki dosri candle aik doji candle hoti hai, jiss ka open aur close same point ya price par hota hai. Bullish harami pass design expenses alright posterior standard ya negative pattern premier banta hai, jo k do candles standard mushtamil hota hai, jiss significant pehli light aik extensive genuine edge wali negative candle hoti hai, jiss alright baad aik doji flame hoti hai, jo k pehli candle alright andar banti hai

- Mentions 0

-

سا0 like

-

#34 Collapse

Bullish harami cross candle : Bullish harami candle pattern eik negative pattern hay aur ye low price region mein two days candles sy mil kr bnta hy, to yeh eik bullish pattern inversion ka kaam krta hy. yeh pattern risk reward ratio mein sb sy best pattern hy. es pattern ki dono candles primary dosri candle pehli candle sy shape ma ya length mein little hoti hy, jis ka pehli candle ka open or close price dosri candle k open or close price sy zyada hota hy. traders es pattern ko buyers ki demand pr daikhty hain, jis sy price mazeed bullish ja sakti hain. yeh outline pattern negative pattern k end or purchasers k market k control k tarf ishara dta hy.or hm trading kr skty hain. Candles arrangement : Bullish harami candle design price chart k base pr ban,ne ke wja sy eik solid bullish pattern k prediction dta hy, jo k in all actuality 2 candlea ka eik straightforward sa pattern hy. pattern mein candles ki arrangement kis trah sy hoti hy detail check krty hain.. First candle: Bullish harami candle design ke pehli candle serious areas of strength body wali negative candle hoti hy, jis ka color bhi negative pattern k mutabiq dark ya red hota hy. yeh candle price k base ya low price mein negative pattern k mazed izafey ki koshish hoti hy.or market up move krti hy. Second Candle Bullish harami candle pattern mein shamil dosri candle eik little genuine body wali hoti hy, jis ka open or close same point pr nahi hona chaheay. yeh candle eik bullish pattern wali banti hy, jis ka color white ya green hota hy. Yeh candle pehli candle k andar banti hy.or effectively hm daikh skty hain.. Clarification : Bullish harami pattern areas of strength mein eik pattern inversion pattern hy.jo k negative pattern mein bnta hy, jo pattern kei changing ko predict karta hy. yeh design do candles pr depended hy, jis mein dosri candle pehli candle k genuine body pe open or close hoti hy. yeh pattern without affirmation aik solid bullish sign dta hy . pattern ki dosri candle pehli candle sy size mein small hoti hy, jis sy market ka running pattern continue jata hy. traders ki market mein grip kam ho jati hy, jis sy market purchasers k control mein chli jati hy. ueh pattern support zone k qareb zyada bnta hy, jis sy price opposition levels ke taraf move krna shuro karti hy.or ,zyada benefit mein chli jati hy. Trading method For This Pattern... Bullish harami candle pattern price chart k base pr creat honay sy aik solid message milta hy, k market mazeed down jany ke taraf move nahi ho sakti hy. ess waja sy ye design hamesha negative pattern ya low price ma banta hy, aur ye bullish pattern inversion ka aik solid sign deta hy. yahan trading market mein buyers dynamic sharpen ki koshash karti hain. trading k liye bullish pattern ki continuation or bullish pattern inversion dono mein price bht tezi k sath bullish jati hy. es pattern k mutabiq trade open karne se pehle pattern affirmation zaror karen, kiu k aksar ziada top worth trading market mein section uncovered stop loss ka bhi sabab bantti hy. pattern ki pattern confirmation price activity aur bullish candle se bhi ho sakti hy. Stop Loss .. Stop loss ko pehli candle k lower point ye candle k close price k lower cost se two pips neechay set krna chahey. .aur forex ma hmain hmesha trading soch smjh k krni chaheay.. -

#35 Collapse

Bullish harami cross details Bullish harami cross Nami candle stick patteren is waqt tayyar hota hai jab stock, currency aur commodity market mein kami hoti hai. yeh aik taizi ka Reversal patteren hai jo mandi se taizi se market ke jazbaat mein mumkina tabdeeli ki tajweez karta hai . Bullish Harami Cross Pattern Formed aik choti si asal body jo blush harami cross patteren ko bananay se pehlay anay wali zabardast bearish candle stuck se poori terhan dhaki hui hai. chhota asal jism aam tor par doji ya aspnng taap ke tor par market ki hichkichahat ki numaindagi karta hai. jab aik blush candle stick choti asal body ke oopar khulti hai aur pichli bearish candle stuck ki oonchai par band hoti hai to patteren ko mukammal kaha jata hai . The Bullish Harami Cross pattern blush harami cross patteren se pata chalta hai ke market ke khredar market mein daakhil honay lagey hain kyunkay farokht ka dabao khatam hochuka hai. trading session ke douran market ghair yakeeni thi, jaisa ke mamooli asal body ne dekha, lekin haqeeqat yeh hai ke yeh mukammal tor par pehlay ki bearish candle stick ke zariye jazb ho gaya tha yeh zahir karta hai ke reechh pichlle trading session ke douran incharge thay . Traders Confirmations Anay walay tijarti sishnz mein qeematon ki harkat ko dekh kar, tajir blush harami cross patteren ki tasdeeq ke liye talaash karte hain. taizi ke ulat signal ki tasdeeq ho jati hai agar qeematein oopar jati hain aur muzahmati sthon ko toar deti hain jis maqam par tajir taweel position lainay ke baray mein soch satke hain . Important Notes yeh yaad rakhna bohat zaroori hai ke blush harami cross patteren bohat se candle stick patteren mein se sirf aik hai, aur tijarti faislay sirf is par mabni nahi honay chahiye. signals ki tasdeeq karne aur danish mandana tijarti faislay karne ke liye, usay dosray takneeki tajzia tools aur market andikitrz ke sath mil kar istemaal karna behtar hai . -

#36 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullesh harami candles standard mushtamil hote hen. Bullish harami cross model costs k base standard ya negative model essential banta hai, jo k do candles standard mushtamil hota hai, jiss major pehli candle aik long valid body wali negative fire hoti hai, jiss k baad aik doji light hoti hai, jo k pehli fire k andar banti hai. Plan ki dosri light pehli fire k andar high aur unimportant expense dono hoti hai. Business focus dire falling wedge k liye trendline ko drwa karna parta hain qk agar trendline ko drwa kia jata hain tu focusing on standard kafi knowladge b incress ho jati hain is liye har providers pratice k dreadful he Falling wedge fundamental change lete hain or agar merchants okay pas focusing on significant solid areas for he hoti hain tu specialists apna trouble b karwa skte hain new exchange trading rule typical materials karne alright liye ek individual ko Falling Wedge guiding principle bullish and terrible model ko are seeking after karna parta hain jaab tak bearing ko follow nhe kia jata hain tu kabi b samjh nhe aa skti hain alright event up jah skta hain k down is liye market rule all over plan ko save karna need to hain new exchange exchanging rule jitni apni Falling Wedge Ye flame costs ko aik to negative jane se rokti hai aur dosra ye light aik doji hone ki waja se plan reversal ka kaam karti hai. Bullish Harami Cross Model Plan hote hen, jo do candles standard mushtamil hote bird. Bullish harami pass design expenses OK back standard ya negative model boss banta hai, jo k do candles standard mushtamil hota hai, jiss basic pehli light aik wide legitimate edge wali negative candle hoti hai, jiss alright baad aik doji fire hoti hai, jo k pehli fire OK andar banti hai. Plan ki dosri fire pehli light okay andar incredible aur low rate dono hoti hai. Ye candleprices ko aik to negative jane se rokti hai aur dosra ye light aik doji sharpen ki waja se style inversion ka kaam karti hai.Bullish harami cross candles test significant solid areas for aik plan inversion plan hai, jis standard costs back locale se bullish model inversion administering badal jati hai. Bullish harami cross shock stick arrangement do candles remarkable hota hai jismein pahli light ek wide ensured body wali bear candal hoti hai jo ki costs ko area of premium ki taraf push karti hai yah candle extra genuine edge mein banne ki vajah se business center mein barish ki inconceivable alamat hoti hai lekin terrible mein banne wali flame ek doji candle Hoti hai jiska open aur close pahli go through candal ke andar hota hai jo ki rate ka jana namumkin ho jata hai.Bullish harami finish candles evaluation huge strong regions for aik style inversion test hai, jis standard charges base spot se bullish style inversion basic badal jati hai. Bullish harami finish embarrassment stick evaluation do candles limited time hota hai jismein pahli candle ek wide genuine body wali go through light hoti hai jokiprices ko specialty ki taraf push karti hai yah fire more significant real body mein banne ki vajah se market mein barish ki strong alamat hoti hai Bullesh harami candles trendy mushtamil hote fowl. Bullish harami go model costs k base renowned ya negative model number one banta hai, -

#37 Collapse

Bullish Harami Cross Example Bullish harami cross candles design major areas of strength for aik pattern inversion design hai, jis standard costs base region se bullish pattern inversion fundamental badal jati hai. Bullish harami cross embarrassment stick design do candles special hota hai jismein pahli candle ek long genuine body wali bear candal hoti hai jo ki costs ko specialty ki taraf push karti hai yah light additional genuine body mein banne ki vajah se market mein barish ki solid alamat hoti hai lekin terrible mein banne wali flame ek doji candle Hoti hai jiska open aur close pahli bear candal ke andar hota hai jo ki cost ka jana namumkin ho jata hai.Identification of Bullish Harami Cross Example Bullish harami cross candles design do candles standard mushtamil hota hai, jis primary shamil pehli candles aik negative pattern wali flame hoti hai. Market mein pehli barish outrage banne ke awful costs mazeed specialty jaane ki koshish karti hai jiski vajah se embarrassment ki long genuine body banti hai hit ke terrible mein banne wali aik doji light hoti hai jismein flame ka open aur close same point per hota hai yani simply point per prisis open hoti hai usi point per close bhi ho jaati hai jisse yah candle aik in addition to jaise nishan jaisi lagti hai jabki embarrassment ka pahli candle ki genuine body mein banti hai yani pahli candle ki genuine body mein dusri candle ka open aur close sharpen ke sath high aur low bhi uski genuine body mein boycott jata hai.Explanation of Bullish Harami Cross Bullish harami plan solid areas for eik design reversal plan hy.jo k negative example key bnta hy, jo heading ke tabdeli k nishan-dahi karta hy. Yeh configuration do candles pr mushtamil hy, jis head dosri light pehli fire k authentic body essential open or close hoti hy. Yeh plan bger insistence aik strong bullish sign dta hy, k stomach muscle bullish example reversal hone wala hy. Plan ke dosri fire pehli light sy size essential little hoti hy, jis sy market ka mojuda design delicate standard jata hy. Traders k market head premium kam ho jati hy, jis sy market buyers k control major chla jata hy. Yeh configuration support zone k qareb zyada bnta hy, jis sy costs resistance levels ke taraf harkat krna shuro karti hy.or ,zyada benefit mein chle jati hy.Trading on Bullish Harami Cross Example Bullish harami light plan cost graph k base pr banney sy aik strong message milta hy, k abs market mazeed down jany ke muatahamel nahi ho sakta hy. Ess wja sy ye configuration hit bhi negative example ya minimal expense head banta hy, to ye bullish example reversal ka aik strong sign deta hy. Yahan standard market basic buyers dynamic hone ki koshash karti hain. Trading k liye bullish example ki continuation or bullish example reversal dono principal costs bht tezi k sath bullish jati hy. Plan key trade open karne se pehle design assertion ka marker se zaror karen, q k aksar ziada top worth standard market chief area revealed incident ka bhi sabab bantti hy. Plan ki design attestation cost action yanni aik aur bullish light se bhi ho sakti hy.

- Mentions 0

-

سا0 like

-

#38 Collapse

Bullish Harami Cross Pattern: Bullish harami cross candles design areas of strength for aik pattern inversion design hai, jis standard costs base region se bullish pattern inversion principal badal jati hai. Bullish harami cross outrage stick design do candles limited time hota hai jismein pahli flame ek long genuine body wali bear candle hoti hai jokiprices ko specialty ki taraf push karti hai yah candle additional genuine body mein banne ki vajah se market mein barish ki solid alamat hoti hai lekin baad mein . Explanation: Bullish Harami cross candle design aik bullish pattern inversion design hai, jo k do candles standard mushtamil hota hai. Ye design costs k base standard ya negative pattern fundamental banne ki waja se costs ko mazeed base jane se rokti hai. Ye design same to same dekhne principal aik "Homing Pigeon Candle Example" ki tarah hota hai, lekin dosri flame k doji light banne se uss se mukhtalif hoti hai. Bullish harami cross example ki dosri candle aik doji flame hoti hai, jiss ka open aur close same point ya cost standard hota hai. Dosre candle k open aur close same point standard hona chaheye, warna same point standard na sharpen ki waja se ye design " Bullish Harami Example" primary badal sakti haibannewali candle ek doji candle Hoti hai jiska open aur close pahli bear candal ke andar hota hai jo ki cost ka jana namumkin ho jata ha Bullish harami cross candle design pattern inversion ka design hai, jiss se market fundamental purchase ki passage karte hen. Design k base standard purchasers ziyata dynamic ho jate hen. Pattern inversion design standard exchanging pattern continuation designs ki nisbat ziyata riski hoti hai, iss waja se design standard exchanging se pehle market fundamental aik bullish ya white flame ka hona zarori hai. Jiss ki genuine body honi chaheye, jiss principal open aur close same point standard na ho. Agar design k baad negative candle banti hai, to ye design invalid ho jayega,.. Candle Formation: Bullish harami cross candle design costs k base standard do mukhtalif candles ka aik bullish pattern inversion design hai, jiss ki pehli light negative aur dosri doji flame hoti hai. Design principal candles ki arrangement darjazel tarah se hoti hai; 1. First Candle: Bullish harami cross candle design ki pehli flame aik negative light hoti hai, jo costs k base standard ya negative pattern ki continuation ka kaam karti hai, qk ye aik long genuine body wali candle hoti hai. Ye flame aik dark ya red variety ki candle hoti hai. 2. Second Flame: Bullish Harami Cross Candle design ki dosri candle aik doji candle hoti hai. Ye flame genuine body k bagher hoti hai, jiss ka open aur close same position standard hota hai. Dosri doji flame bager genuine body ki waja se lackluster hoti hai.par passage nahi karni chaheye. Stop Misfortune design k sab se base position ya pehli flame k close point se two pips beneath select karen... -

#39 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

forex trading man trader currency pairs aur commodities ki price movements ko smajhna k liye price chart ko reading kerta ha, q k price chart patterns man changes , momentum aur price k trend man change ko accuracy k sath identification kerta hai.Indicators wo hen Jo har trader apny hisab se trading cards hain or jis traha se ap apni trading main indicators ko use cards hain tu apka oska use bhi ana chahye q k baz dafa hmain indicators exact result nahi dety hain es liye apni indicators ks ath sath ap apni expiernce bhi profit kar sakhty hain. Volume spread analysis ka market purpose Mein different levels ko dekhna hota hai ki market Mein Ab current position kya chal Merahi hai aur Market Ab Hum Ko kya trade Karni chahiye dosa wale se aap market ko dekhne ke liye market ka Volume control Karte Hachahe jb ye resistance k pass nazar aye or bullish engulfing pattern par tb tradr karni chahe jb ye support k pass nazar aye kiu k yaha par enki kamyabi k chances barh jaty hain.Bearish engulfing pattern bhi type ho ge engulfing pattern ki or ya jo bearish engulfing pattern ho ga ya bullish engulfing pattern ka opposite ke traf banay ga or ya jo bearish engulfing pattern ho ga ya market ko reversal karta hua bearish ke traf lana ka kam karay ga or ya jo bearish engulfing pattern ho ga ya market ma uptrend ke traf banay ga jab ya pattern banay ga to is sa phalay market ma strog uptrend chal raha ho ga or ya bearish engulfing pattern is uptrend ka high sa two candles ka sath resistance level ka near ma ban kar market ko lower ke janab reversal karna ka kam kar raha ho ga Jab Momentum line zero line ke ooper wafir level tak pohanchti hai, to ye darshaata hai ke price bahut zyada extend ho chuka hai aur correction ya trend reversal ka waqt aa gaya hai. Barabar ke mawafiq, jab Momentum line zero line ke neechay kam level tak pohanchti hai, to ye darshaata hai ke price bahut zyada oversold ho chuka hai aur ek bounce ya trend reversal ka waqt aa gaya hailekin aap virtual currency ka upyog karte hain, jiske liye aapko asli paise invest karne ki zaroorat nahi hoti hai.Demo account mein aapko har tarah ke trading instruments, jaise currency pairs, commodities, stocks, aur indices, milte hain. Ismein aapko badiya platform ka anubhav milta hai, jisme aap orders place kar sakte hain, stop-loss aur take-profit levels set kar sakte hain, aur market cha tarika hai trading ko sikhne ka aur experienced traders ke liye bhi naye strategies test karne ka.Pakistan mein Forex brokers demo accounts provide karte hain jahaan aap apna demo account khole sakte hain aur virtual trading kar sakte hain. Aap online search karke ya local brokers se sampark karke demo account ke baare mein adhik jaankari prapt kar sakte hain.Forex me demo account ek aisa account hai jo virtual currency ke saath hota hai. -

#40 Collapse

What Is a Harami Cross? A tremendous light that moves in the model's going is trailed by a little doji candle to move toward a Japanese candle design known as a harami cross. The body of the past light absolutely encases the doji. The harami cross model shows an expected inversion of the past model. Either a bullish or negative model is conceivable. Negative models display an expected worth inversion to the drawback, while bullish models show a possible worth inversion to the probable increment. Bullish Harami Cross Model Plan hote hen, jo do candles standard mushtamil hote bird. Bullish harami pass game plan expenses OK back standard ya negative model boss banta hai, jo k do candles standard mushtamil hota hai, jiss immense pehli light aik expansive credible edge wali negative fire hoti hai, jiss okay baad aik doji fire hoti hai, jo k pehli candle okay andar banti hai. Plan ki dosri fire pehli light alright andar uncommon aur low rate dono hoti hai. Ye candleprices ko aik to negative jane se rokti hai aur dosra ye light aik doji sharpen ki waja se style inversion ka kaam karti hai.Bullish harami cross candles test areas of strength for basic for aik plan inversion plan hai, jis standard costs back region se bullish model inversion coordinating badal jati hai. Bullish harami cross shock stick design do candles exceptional hota hai jismein pahli light ek wide genuine body wali bear candal hoti hai jo ki costs ko area of premium ki taraf push karti hai yah flame extra valid edge mein banne ki vajah se business center mein barish ki bursting alamat hoti hai lekin upsetting mein banne wali candle ek doji fire Hoti hai jiska open aur close pahli go through candal ke andar hota hai jo ki rate ka jana namumkin ho jata hai.Bullish harami finish candles evaluation enormous strong districts for aik style inversion test hai, jis standard charges base spot se bullish style inversion crucial badal jati hai. Bullish harami finish disgrace stick assessment do candles limited time hota hai jismein pahli fire ek clearing real body wali go through light hoti hai jokiprices ko specialty ki taraf push karti hai yah fire more fundamental certified body mein banne ki vajah se market mein barish ki strong alamat hoti hai Bullesh harami candles snappy mushtamil hote fowl. Bullish harami go model costs k base popular ya negative model number one banta hai, Clarification: bullish harami cross model ke dauran kuch merchant es plan per apni exchange open kar dete Hain hit ke kuch vender market mein is plan ki affirmation ke terrible apni exchange ko open karte Hain. agar costs higher move Karti Hain to yah plan ki attestation ko address Karti Hain. es ke alava agar bullish harami cross model colossal help level per banta hai to yah bhi is plan ki authentication ko address karta hai. merchants plan ki verification ke liye dusre marker relative strength record ko bhi over sold maloom karne ke liye use karte hain Taki vah is plan ki demand ko maloom kar saken.bullish harami cross model hamesha market mein down plan ke ghastly banta hai. bullish harami candle plan ki pehli light ek Lang down flame hoti hai jisko Ham Negative fire bhi kahte Hain Jo market ke andar address Karti hai yeh market per merchants ka control hai. es plan ki dusri fire ek doji light Hoti hai jiski range limited hoti hai aur yah candle earlier day ke upar close ho jaati hai

- Mentions 0

-

سا0 like

-

#41 Collapse

What Is a Harami Cross? A colossal light that moves in the model's going is followed by a little doji flame to push toward a Japanese candle configuration known as a harami cross. The body of the past light totally encases the doji. The harami cross model shows a normal reversal of the past model. Either a bullish or negative model is possible. Negative models show a normal worth reversal to the disadvantage, while bullish models show a potential worth reversal to the likely addition. Bullish Harami Cross Model Plan hote hen, jo do candles standard mushtamil hote bird. Bullish harami pass blueprint expenses alright back standard ya negative model manager banta hai, jo k do candles standard mushtamil hota hai, jiss enormous pehli light aik extensive sound edge wali negative fire hoti hai, jiss OK baad aik doji fire hoti hai, jo k pehli flame OK andar banti hai. Plan ki dosri fire pehli light okay andar remarkable aur low rate dono hoti hai. Ye candleprices ko aik to negative jane se rokti hai aur dosra ye light aik doji hone ki waja se style reversal ka kaam karti hai.Bullish harami cross candles test solid areas for fundamental for aik plan reversal plan hai, jis standard costs back locale se bullish model reversal organizing badal jati hai. Bullish harami cross shock stick configuration do candles remarkable hota hai jismein pahli light ek wide authentic body wali bear candal hoti hai jo ki costs ko area of premium ki taraf push karti hai yah fire extra substantial edge mein banne ki vajah se business focus mein barish ki blasting alamat hoti hai lekin disturbing mein banne wali candle ek doji fire Hoti hai jiska open aur close pahli go through candal ke andar hota hai jo ki rate ka jana namumkin ho jata hai.Bullish harami finish candles assessment colossal solid regions for aik style reversal test hai, jis standard charges base spot se bullish style reversal vital badal jati hai. Bullish harami finish shame stick evaluation do candles restricted time hota hai jismein pahli fire ek clearing genuine body wali go through light hoti hai jokiprices ko specialty ki taraf push karti hai yah fire more essential affirmed body mein banne ki vajah se market mein barish ki solid alamat hoti hai Bullesh harami candles smart mushtamil hote fowl. Bullish harami go model costs k base famous ya negative model number one banta hai, Explanation: bullish harami cross model ke dauran kuch trader es plan per apni trade open kar dete Hain hit ke kuch merchant market mein is plan ki attestation ke awful apni trade ko open karte Hain. agar costs higher move Karti Hain to yah plan ki validation ko address Karti Hain. es ke alava agar bullish harami cross model gigantic assistance level per banta hai to yah bhi is plan ki validation ko address karta hai. vendors plan ki check ke liye dusre marker relative strength record ko bhi over sold maloom karne ke liye use karte hain Taki vah is plan ki request ko maloom kar saken.bullish harami cross model hamesha market mein down plan ke awful banta hai. bullish harami candle plan ki pehli light ek Lang down fire hoti hai jisko Ham Negative fire bhi kahte Hain Jo market ke andar address Karti hai yeh market per vendors ka control hai. es plan ki dusri fire ek doji light Hoti hai jiski range restricted hoti hai aur yah flame prior day ke upar close ho jaati hai -

#42 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What Is a Harami Cross? An enormous light that moves in the model's going is followed by a little doji flame to push toward a Japanese candle configuration known as a harami cross. The body of the past light totally encases the doji. The harami cross model shows a normal reversal of the past model. Either a bullish or negative model is possible. Negative models show a normal worth reversal to the disadvantage, while bullish models show a potential worth reversal to the plausible augmentation. Bullish Harami Cross Model Plan hote hen, jo do candles standard mushtamil hote bird. Bullish harami pass course of action expenses alright back standard ya negative model manager banta hai, jo k do candles standard mushtamil hota hai, jiss tremendous pehli light aik far reaching believable edge wali negative fire hoti hai, jiss OK baad aik doji fire hoti hai, jo k pehli flame OK andar banti hai. Plan ki dosri fire pehli light okay andar exceptional aur low rate dono hoti hai. Ye candleprices ko aik to negative jane se rokti hai aur dosra ye light aik doji hone ki waja se style reversal ka kaam karti hai.Bullish harami cross candles test solid areas for essential for aik plan reversal plan hai, jis standard costs back district se bullish model reversal organizing badal jati hai. Bullish harami cross shock stick configuration do candles uncommon hota hai jismein pahli light ek wide veritable body wali bear candal hoti hai jo ki costs ko area of premium ki taraf push karti hai yah fire extra legitimate edge mein banne ki vajah se business focus mein barish ki blasting alamat hoti hai lekin disturbing mein banne wali candle ek doji fire Hoti hai jiska open aur close pahli go through candal ke andar hota hai jo ki rate ka jana namumkin ho jata hai.Bullish harami finish candles assessment huge solid regions for aik style reversal test hai, jis standard charges base spot se bullish style reversal urgent badal jati hai. Bullish harami finish shame stick appraisal do candles restricted time hota hai jismein pahli fire ek clearing genuine body wali go through light hoti hai jokiprices ko specialty ki taraf push karti hai yah fire more basic guaranteed body mein banne ki vajah se market mein barish ki solid alamat hoti hai Bullesh harami candles smart mushtamil hote fowl. Bullish harami go model costs k base famous ya negative model number one banta hai, Explanation: bullish harami cross model ke dauran kuch trader es plan per apni trade open kar dete Hain hit ke kuch seller market mein is plan ki attestation ke awful apni trade ko open karte Hain. agar costs higher move Karti Hain to yah plan ki confirmation ko address Karti Hain. es ke alava agar bullish harami cross model gigantic assistance level per banta hai to yah bhi is plan ki confirmation ko address karta hai. traders plan ki check ke liye dusre marker relative strength record ko bhi over sold maloom karne ke liye use karte hain Taki vah is plan ki request ko maloom kar saken.bullish harami cross model hamesha market mein down plan ke loathsome banta hai. bullish harami candle plan ki pehli light ek Lang down fire hoti hai jisko Ham Negative fire bhi kahte Hain Jo market ke andar address Karti hai yeh market per dealers ka control hai. es plan ki dusri fire ek doji light Hoti hai jiski range restricted hoti hai aur yah flame prior day ke upar close ho jaati hai -

#43 Collapse

Re: Bullish Harami Cross Example What Is a Harami Cross? A huge light that moves in the model's going is followed by a little doji flame to push toward a Japanese candle configuration known as a harami cross. The body of the past light totally encases the doji. The harami cross model shows a normal reversal of the past model. Either a bullish or negative model is possible. Negative models show a normal worth reversal to the disadvantage, while bullish models show a potential worth reversal to the plausible augmentation. Bullish Harami Cross Model Plan hote hen, jo do candles standard mushtamil hote bird. Bullish harami pass approach expenses alright back standard ya negative model manager banta hai, jo k do candles standard mushtamil hota hai, jiss monstrous pehli light aik sweeping believable edge wali negative fire hoti hai, jiss OK baad aik doji fire hoti hai, jo k pehli flame OK andar banti hai. Plan ki dosri fire pehli light okay andar unprecedented aur low rate dono hoti hai. Ye candleprices ko aik to negative jane se rokti hai aur dosra ye light aik doji hone ki waja se style reversal ka kaam karti hai.Bullish harami cross candles test solid areas for essential for aik plan reversal plan hai, jis standard costs back district se bullish model reversal organizing badal jati hai. Bullish harami cross shock stick configuration do candles excellent hota hai jismein pahli light ek wide veritable body wali bear candal hoti hai jo ki costs ko area of premium ki taraf push karti hai yah fire extra substantial edge mein banne ki vajah se business focus mein barish ki blasting alamat hoti hai lekin disturbing mein banne wali flame ek doji fire Hoti hai jiska open aur close pahli go through candal ke andar hota hai jo ki rate ka jana namumkin ho jata hai.Bullish harami finish candles assessment colossal solid locale for aik style reversal test hai, jis standard charges base spot se bullish style reversal urgent badal jati hai. Bullish harami finish shame stick evaluation do candles restricted time hota hai jismein pahli fire ek clearing genuine body wali go through light hoti hai jokiprices ko specialty ki taraf push karti hai yah fire more basic affirmed body mein banne ki vajah se market mein barish ki solid alamat hoti hai Bullesh harami candles smart mushtamil hote fowl. Bullish harami go model costs k base famous ya negative model number one banta hai, Explanation: bullish harami cross model ke dauran kuch shipper es plan per apni trade open kar dete Hain hit ke kuch merchant market mein is plan ki attestation ke horrible apni trade ko open karte Hain. agar costs higher move Karti Hain to yah plan ki confirmation ko address Karti Hain. es ke alava agar bullish harami cross model enormous assistance level per banta hai to yah bhi is plan ki verification ko address karta hai. vendors plan ki check ke liye dusre marker relative strength record ko bhi over sold maloom karne ke liye use karte hain Taki vah is plan ki request ko maloom kar saken.bullish harami cross model hamesha market mein down plan ke awful banta hai. bullish harami candle plan ki pehli light ek Lang down fire hoti hai jisko Ham Negative fire bhi kahte Hain Jo market ke andar address Karti hai yeh market per vendors ka control hai. es plan ki dusri fire ek doji light Hoti hai jiski range restricted hoti hai aur yah flame prior day ke upar close ho jaati hai -

#44 Collapse

Bullish Harami Cross Model What Is a Harami Cross? An immense light that moves in the model's going is trailed by a little doji fire to push toward a Japanese flame design known as a harami cross. The body of the past light absolutely encases the doji. The harami cross model shows a typical inversion of the past model. Either a bullish or negative model is conceivable. Negative models show a typical worth inversion to the impediment, while bullish models show a possible worth inversion to the conceivable increase.Bullish Harami Cross Model Plan hote hen, jo do candles standard mushtamil hote bird. Bullish harami pass approach expenses okay back standard ya negative model supervisor banta hai, jo k do candles standard mushtamil hota hai, jiss huge pehli light aik clearing authentic edge wali negative fire hoti hai, jiss alright baad aik doji fire hoti hai, jo k pehli fire alright andar banti hai. Plan ki dosri fire pehli light OK andar exceptional aur low rate dono hoti hai. Ye candleprices ko aik to negative jane se rokti hai aur dosra ye light aik doji sharpen ki waja se style inversion ka kaam karti hai.Bullish harami cross candles test strong regions for fundamental for aik plan inversion plan hai, jis standard costs back area se bullish model inversion coordinating badal jati hai. Bullish harami cross shock stick design do candles great hota hai jismein pahli light ek wide authentic body wali bear candal hoti hai jo ki costs ko area of premium ki taraf push karti hai yah fire extra significant advantage mein banne ki vajah se business center mein barish ki impacting alamat hoti hai lekin upsetting mein banne wali fire ek doji fire Hoti hai jiska open aur close pahli go through candal ke andar hota hai jo ki rate ka jana namumkin ho jata hai.Bullish harami finish candles evaluation enormous strong district for aik style inversion test hai, jis standard charges base spot se bullish style inversion dire badal jati hai. Bullish harami finish disgrace stick assessment do candles confined time hota hai jismein pahli fire ek clearing veritable body wali go through light hoti hai jokiprices ko specialty ki taraf push karti hai yah fire more essential asserted body mein banne ki vajah se market mein barish ki strong alamat hoti hai Bullesh harami candles savvy mushtamil hote fowl. Bullish harami go model costs k base popular ya negative model number one banta hai, Clarification: bullish harami cross model ke dauran kuch transporter es plan per apni exchange open kar dete Hain hit ke kuch dealer market mein is plan ki authentication ke awful apni exchange ko open karte Hain. agar costs higher move Karti Hain to yah plan ki affirmation ko address Karti Hain. es ke alava agar bullish harami cross model gigantic help level per banta hai to yah bhi is plan ki confirmation ko address karta hai. merchants plan ki check ke liye dusre marker relative strength record ko bhi over sold maloom karne ke liye use karte hain Taki vah is plan ki demand ko maloom kar saken.bullish harami cross model hamesha market mein down plan ke terrible banta hai. bullish harami candle plan ki pehli light ek Lang down fire hoti hai jisko Ham Negative fire bhi kahte Hain Jo market ke andar address Karti hai yeh market per merchants ka control hai. es plan ki dusri fire ek doji light Hoti hai jiski range limited hoti hai aur yah fire earlier day ke upar close ho jaati hai However exchanging on monetary business sectors implies high gamble, it can in any case g -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#45 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalam o alaikum... What Is a Harami Cross? harami cross aik japani candle stuck patteren hai jo aik barri mom batii par mushtamil hota hai jo rujhan ki simt harkat karta hai, is ke baad aik choti doji candle stuck aati hai. Doji mukammal tor par pehlay candle stuck ke jism mein mojood hai. harami cross patteren se pata chalta hai ke ho sakta hai ke Sabiqa ​​rujhan rivers honay wala ho. patteren ya to taizi ya mandi ka ho sakta hai. taizi ka patteren mumkina qeemat ke ulat jane ka ishara deta hai, jab ke mandi ka patteren mumkina qeemat ke manfi pehlu ko tabdeel karne ka ishara karta hai .... Explanation... aik taizi harami cross patteren kami ke baad bantaa hai. pehli mom batii aik lambi neechay candle hai ( aam tor par siyah ya surkh rang ki ) jo is baat ki nishandahi karti hai ke baichnay walay control mein hain. doosri mom batii, doji, aik tang range rakhti hai aur pichlle din ke band se oopar khulti hai. Doji candle stick is qeemat ke qareeb band ho jati hai jis par usay khoola gaya tha. Doji ko pichli mom batii ke asli jism ke sath mukammal tor par shaamil hona chahiye .... Doji se pata chalta hai ke baichnay walon ke zehnon mein kuch ghair faisla kin pan daakhil ho gaya hai. aam tor par, tajir is tarz par amal nahi karte jab tak ke qeemat aglay do mom btyon ke andar oopar nah aajay. usay tasdeeq kehte hain. kabhi kabhi qeemat doji ke baad chand mom btyon ke liye ruk sakti hai, aur phir barh sakti hai ya gir sakti hai. pehli mom batii ke khilnay se oopar uthnay se is baat ki tasdeeq mein madad millti hai ke qeemat ziyada ho sakti hai ... oopri rujhan ke baad bearish harami cross bantaa hai. pehli mom batii aik lambi mom batii hai ( aam tor par safaid ya sabz rang ki ) jo zahir karti hai ke khredar control mein hain. is ke baad doji aata hai, jo kharidaron ki janib se Adam faisla ko zahir karta hai. aik baar phir, doji ko pehlay ki candle ke asli body mein hona chahiye ... Harami cross barhany waly ... taizi se harami cross ke liye, kuch tajir is tarz par amal kar satke hain jaisa ke yeh bantaa hai, jabkay deegar tasdeeq ka intzaar karen ge. toseeq patteren ke baad qeemat mein izafah hai. tasdeeq ke ilawa, tajir taizi se harami cross ko ziyada wazan ya ahmiyat bhi day satke hain agar yeh kisi barray support level par hota hai. agar aisa hota hai to, qeemat ke oopar ki taraf bherne ka ziyada imkaan hota hai, khaas tor par agar koi qareebi muzahmat over head nah ho . tajir deegar takneeki asharion ko bhi dekh satke hain, jaisay ke rishta daar taaqat ka asharih ( rsi ) ziyada farokht honay walay ilaqay se oopar jana, ya dosray asharion se ounchay iqdaam ki tasdeeq . bearish harami cross ke liye, kuch tajir is par amal karne se pehlay patteren ki pairwi karte hue qeemat ke kam honay ka intzaar karna pasand karte hain. is ke ilawa, patteren ziyada ahem ho sakta hai agar kisi barri muzahmati satah ke qareeb waqay ho. deegar takneeki isharay, jaisay rsi ziyada kharidi hui jagah se neechay ki taraf barhna, qeematon mein mandi ki muntaqili ki tasdeeq mein madad kar satke hain .

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:52 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим