Bullish Harami Cross Pattern

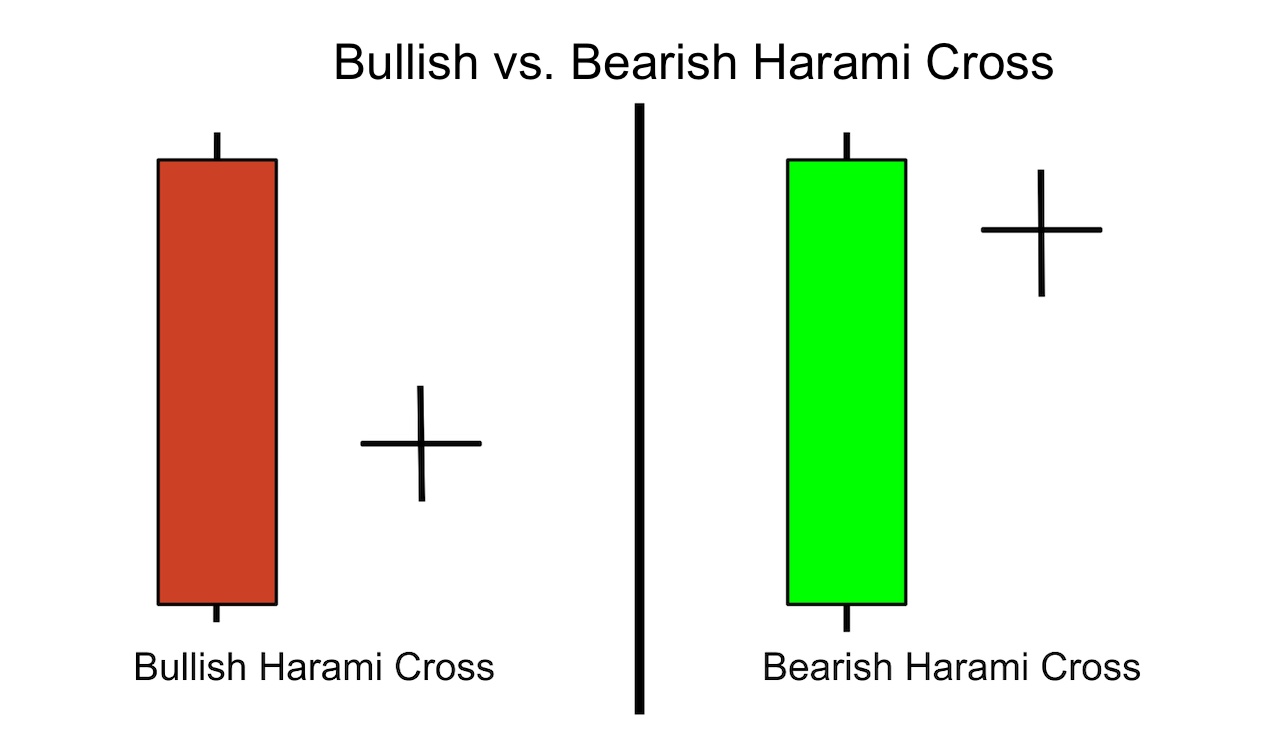

Bullish harami cross candlesticks pattern aik strong bullish trend reversal pattern hai, jis par prices bottom area se bullish trend reversal main badal jati hai. Bullish harami cross scandal stick pattern do candles promotional hota hai jismein pahli candle ek long real body wali bear candal hoti hai jo ki prices ko niche ki taraf push karti hai yah candle extra real body mein banne ki vajah se market mein barish ki strong alamat hoti hai lekin bad mein banne wali candle ek doji candle Hoti hai jiska open aur close pahli bear candal ke andar hota hai jo ki price ka jana namumkin ho jata hai.

Identification of Bullish Harami Cross Pattern

Bullish harami cross candlesticks pattern do candles par mushtamil hota hai, jis main shamil pehli candles aik bearish trend wali candle hoti hai. Market mein pehli barish scandal banne ke bad prices mazeed niche jaane ki koshish karti hai jiski vajah se scandal ki long real body banti hai jab ke bad mein banne wali aik doji candle hoti hai jismein candle ka open aur close same point per hota hai yani just point per prisis open hoti hai usi point per close bhi ho jaati hai jisse yah candle aik plus jaise nishan jaisi lagti hai jabki scandal ka pahli candle ki real body mein banti hai yani pahli candle ki real body mein dusri candle ka open aur close hone ke sath sath high aur low bhi uski real body mein ban jata hai.

Explanation of Bullish Harami Cross

Bullish harami design areas of strength for eik pattern inversion design hy.jo k negative pattern fundamental bnta hy, jo heading ke tabdeli k nishan-dahi karta hy. Yeh design do candles pr mushtamil hy, jis principal dosri light pehli flame k genuine body primary open or close hoti hy. Yeh design bger affirmation aik solid bullish sign dta hy, k stomach muscle bullish pattern inversion sharpen wala hy. Design ke dosri flame pehli light sy size primary little hoti hy, jis sy market ka mojuda pattern frail standard jata hy. Merchants k market principal premium kam ho jati hy, jis sy market purchasers k control fundamental chla jata hy. Yeh design support zone k qareb zyada bnta hy, jis sy costs opposition levels ke taraf harkat krna shuro karti hy.or ,zyada benefit mein chle jati hy.

Trading on Bullish Harami Cross Pattern

Bullish harami candle design cost diagram k base pr banney sy aik solid message milta hy, k abdominal muscle market mazeed down jany ke muatahamel nahi ho sakta hy. Ess wja sy ye design hit bhi negative pattern ya low cost principal banta hy, to ye bullish pattern inversion ka aik solid sign deta hy. Yahan standard market fundamental purchasers dynamic sharpen ki koshash karti hain. Exchanging k liye bullish pattern ki continuation or bullish pattern inversion dono fundamental costs bht tezi k sath bullish jati hy. Design fundamental exchange open karne se pehle pattern affirmation ka marker se zaror karen, q k aksar ziada top worth standard market principal section uncovered misfortune ka bhi sabab bantti hy. Design ki pattern affirmation cost activity yanni aik aur bullish light se bhi ho sakti hy.

Bullish harami cross candlesticks pattern aik strong bullish trend reversal pattern hai, jis par prices bottom area se bullish trend reversal main badal jati hai. Bullish harami cross scandal stick pattern do candles promotional hota hai jismein pahli candle ek long real body wali bear candal hoti hai jo ki prices ko niche ki taraf push karti hai yah candle extra real body mein banne ki vajah se market mein barish ki strong alamat hoti hai lekin bad mein banne wali candle ek doji candle Hoti hai jiska open aur close pahli bear candal ke andar hota hai jo ki price ka jana namumkin ho jata hai.

Identification of Bullish Harami Cross Pattern

Bullish harami cross candlesticks pattern do candles par mushtamil hota hai, jis main shamil pehli candles aik bearish trend wali candle hoti hai. Market mein pehli barish scandal banne ke bad prices mazeed niche jaane ki koshish karti hai jiski vajah se scandal ki long real body banti hai jab ke bad mein banne wali aik doji candle hoti hai jismein candle ka open aur close same point per hota hai yani just point per prisis open hoti hai usi point per close bhi ho jaati hai jisse yah candle aik plus jaise nishan jaisi lagti hai jabki scandal ka pahli candle ki real body mein banti hai yani pahli candle ki real body mein dusri candle ka open aur close hone ke sath sath high aur low bhi uski real body mein ban jata hai.

Explanation of Bullish Harami Cross

Bullish harami design areas of strength for eik pattern inversion design hy.jo k negative pattern fundamental bnta hy, jo heading ke tabdeli k nishan-dahi karta hy. Yeh design do candles pr mushtamil hy, jis principal dosri light pehli flame k genuine body primary open or close hoti hy. Yeh design bger affirmation aik solid bullish sign dta hy, k stomach muscle bullish pattern inversion sharpen wala hy. Design ke dosri flame pehli light sy size primary little hoti hy, jis sy market ka mojuda pattern frail standard jata hy. Merchants k market principal premium kam ho jati hy, jis sy market purchasers k control fundamental chla jata hy. Yeh design support zone k qareb zyada bnta hy, jis sy costs opposition levels ke taraf harkat krna shuro karti hy.or ,zyada benefit mein chle jati hy.

Trading on Bullish Harami Cross Pattern

Bullish harami candle design cost diagram k base pr banney sy aik solid message milta hy, k abdominal muscle market mazeed down jany ke muatahamel nahi ho sakta hy. Ess wja sy ye design hit bhi negative pattern ya low cost principal banta hy, to ye bullish pattern inversion ka aik solid sign deta hy. Yahan standard market fundamental purchasers dynamic sharpen ki koshash karti hain. Exchanging k liye bullish pattern ki continuation or bullish pattern inversion dono fundamental costs bht tezi k sath bullish jati hy. Design fundamental exchange open karne se pehle pattern affirmation ka marker se zaror karen, q k aksar ziada top worth standard market principal section uncovered misfortune ka bhi sabab bantti hy. Design ki pattern affirmation cost activity yanni aik aur bullish light se bhi ho sakti hy.

تبصرہ

Расширенный режим Обычный режим