AOA

Es topic ma ham bhot he unique pattern ko discuss karyn waly hain or jis ko ham bhot simple or easy words ma explain karyn gy.

Introduction on the topic.

Three falling or rising method trader ko profit hasil karny ma bhot helpful sabit ho sakty hain. But esa tb he mumkin hai jb traders ko eski information ho. Ye trader ko asi opportunities farham karty hain jis sy wo missed trends ko phr sy hasil kar sakty hain. Generally market price ik straight line ma move ni karti. Market up or down swing ma move karti hai or ye trade ko second chance dety hain k wo missed trades ma phr sy enter ho sakty hain. Es topic ko ham 2 parts ma divide karty hain ta kay es post ko samajny ma asani ho.

1. What are falling three methods in forex trading.

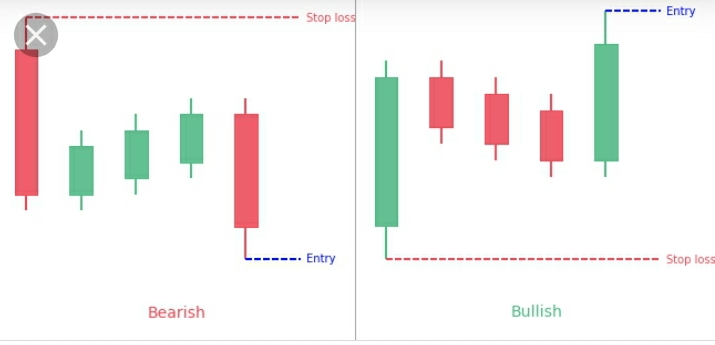

Falling three method bearish trend continuation pattern hota hai or ye bearish trend ma develop hota hai. Ye candlestick pattern different candlesticks par mabni hota hai. Es pattern ma first or last candle bearish hoti hai or ye prevailing trend ma same direction ma show hota hai. Pehle bearish candle kay bad second sy fourth candles tak marker corrective move ma rehti hai. Phr 5th candle again bearish hoti hai or ye continuation pattern ko complete kar deti hai. Jis sy trader ko acha advantage ho sakta hai but es kay laye knowledge key honi chahe.

2. What are rising three methods in forex chart.

Similarly rising three method esa continuation pattern hai jo bullish trend ma form hota hai. Ye pattern bi 5 candlesticks par mabni hota hai or es ma pehle or last candle bullish or long banti hai. Es pattern ki second sy fourth candles bearish hoti hai or ye market ki corrective movement ko show karti hai. Traders kay pass jetna acha knowledge ho gi wo profit hasil karny ma hamesa success gain kar lety hain.

Method of trading falling and rising three methods in forex chart.

Uper ham ye discuss kar chuky hain kay falling or rising three methods ko kesy identify kiya jaye. Trader ko kbi ye method blindly use ni karny chahe hamesa enko technical analysis kay sath use karna chahe. Rising three method ki bat ki jaye ya falling three methods ki trader ko respectively buy or sell ki trade ko tb open karna chahe jb ye pattern complete ho jaye. Yani k trader ko last fifth candle k end point par trade ko open karna chahe. Ye pattern tb he valid ho ga jb last candle close ho jaye gi. Agr esa ni hota to ye pattern valid ni samja jaye ga. Validity ko check karna bhot important hai.

Stop loss for entery exist points based on this topic.

Rising three method ma fifth candle bhot important hoti hai. Es ko deeply analyze karna chahe. Ye define karti hai trend continuation ko after market correction. So price high move karny kay chances barh jaty hain. Agr price first candle k below move kar jaye to phr ye pattern invalid samja jae ga. So trader ko fifth candle kay low point par stop loss ko set karna chahe. Same rule falling three method par bi applicable hota hai. Es ma bi fifth candlestick bhot important hoti hai. Agr ye complete ho to tb he trade ma enter hona chahe.

Es topic ma ham bhot he unique pattern ko discuss karyn waly hain or jis ko ham bhot simple or easy words ma explain karyn gy.

Introduction on the topic.

Three falling or rising method trader ko profit hasil karny ma bhot helpful sabit ho sakty hain. But esa tb he mumkin hai jb traders ko eski information ho. Ye trader ko asi opportunities farham karty hain jis sy wo missed trends ko phr sy hasil kar sakty hain. Generally market price ik straight line ma move ni karti. Market up or down swing ma move karti hai or ye trade ko second chance dety hain k wo missed trades ma phr sy enter ho sakty hain. Es topic ko ham 2 parts ma divide karty hain ta kay es post ko samajny ma asani ho.

1. What are falling three methods in forex trading.

Falling three method bearish trend continuation pattern hota hai or ye bearish trend ma develop hota hai. Ye candlestick pattern different candlesticks par mabni hota hai. Es pattern ma first or last candle bearish hoti hai or ye prevailing trend ma same direction ma show hota hai. Pehle bearish candle kay bad second sy fourth candles tak marker corrective move ma rehti hai. Phr 5th candle again bearish hoti hai or ye continuation pattern ko complete kar deti hai. Jis sy trader ko acha advantage ho sakta hai but es kay laye knowledge key honi chahe.

2. What are rising three methods in forex chart.

Similarly rising three method esa continuation pattern hai jo bullish trend ma form hota hai. Ye pattern bi 5 candlesticks par mabni hota hai or es ma pehle or last candle bullish or long banti hai. Es pattern ki second sy fourth candles bearish hoti hai or ye market ki corrective movement ko show karti hai. Traders kay pass jetna acha knowledge ho gi wo profit hasil karny ma hamesa success gain kar lety hain.

Method of trading falling and rising three methods in forex chart.

Uper ham ye discuss kar chuky hain kay falling or rising three methods ko kesy identify kiya jaye. Trader ko kbi ye method blindly use ni karny chahe hamesa enko technical analysis kay sath use karna chahe. Rising three method ki bat ki jaye ya falling three methods ki trader ko respectively buy or sell ki trade ko tb open karna chahe jb ye pattern complete ho jaye. Yani k trader ko last fifth candle k end point par trade ko open karna chahe. Ye pattern tb he valid ho ga jb last candle close ho jaye gi. Agr esa ni hota to ye pattern valid ni samja jaye ga. Validity ko check karna bhot important hai.

Stop loss for entery exist points based on this topic.

Rising three method ma fifth candle bhot important hoti hai. Es ko deeply analyze karna chahe. Ye define karti hai trend continuation ko after market correction. So price high move karny kay chances barh jaty hain. Agr price first candle k below move kar jaye to phr ye pattern invalid samja jae ga. So trader ko fifth candle kay low point par stop loss ko set karna chahe. Same rule falling three method par bi applicable hota hai. Es ma bi fifth candlestick bhot important hoti hai. Agr ye complete ho to tb he trade ma enter hona chahe.

تبصرہ

Расширенный режим Обычный режим