Dear all members, Forex trading main profit Hasil krny k liy market knowledge aur emotional discipline zarori hai. Is me ap knowledge aur experience k sath hi kamyab ho sakty hain. Forex trading main kamyabi k liy ap ko candlestick aur chart patterns ko understand krna chaiy. Candlesticks aur chart patterns market analysis krny main madad krty hain. Candlesticks, technical analysis krny me madad krti hain. Technical aur fundamental analysis k sath ap profit wali trade kr sakty hain. Aj main ap say falling window kehty ka knowledge aur is ki importance k bary main information share krna chata hoon.

What is Falling window:

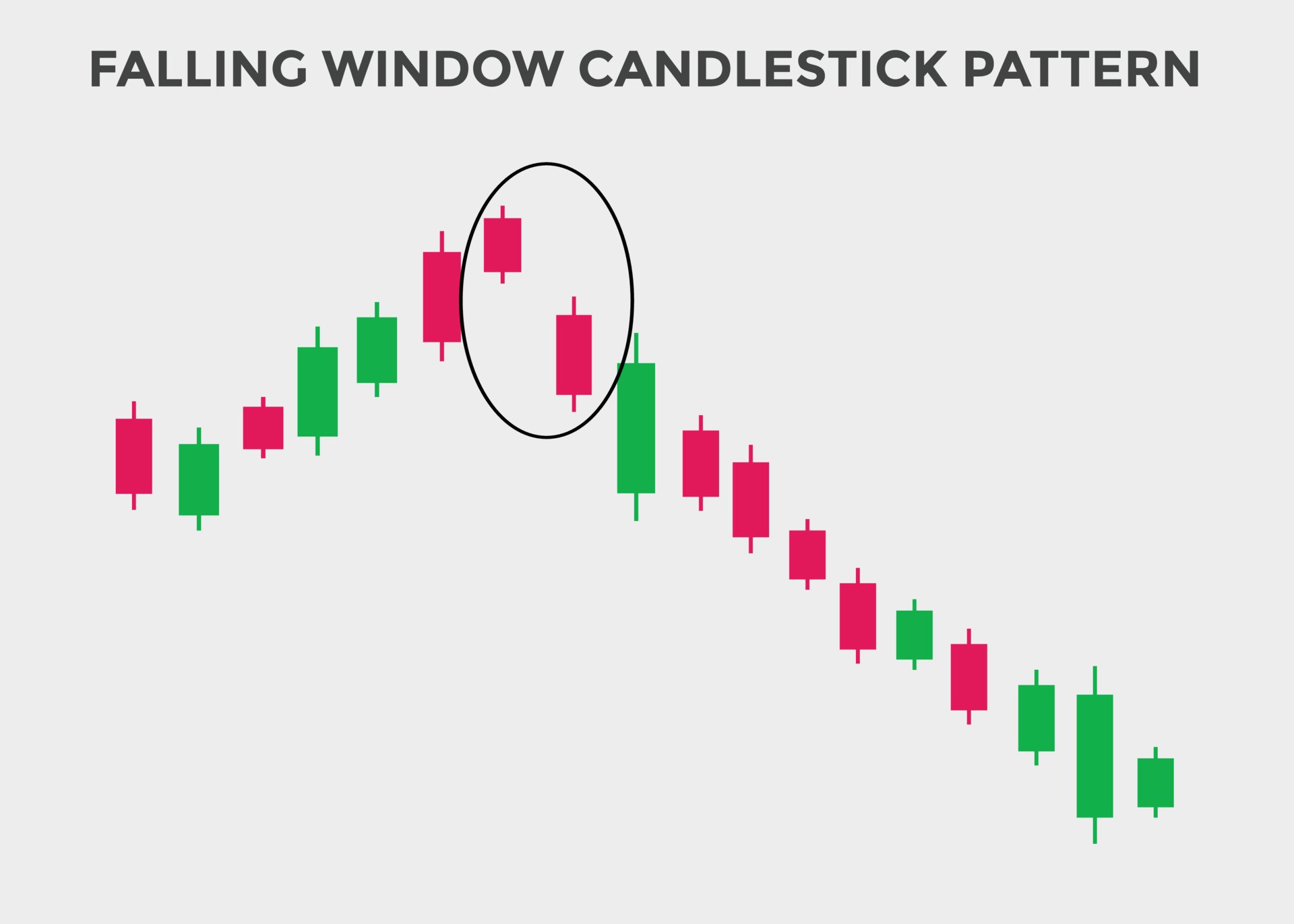

Dear forum friends, Falling windows ko pehchan ny k liy ap ko do candlestick ko focus krna hota hai. Is pattern main do candlestick ki body is trah hoti hai.

*Is pattern ki pehli candle, aik selling candle hoti hai. Jo sellers pressure k bary main btati hai.

*is pattern ki dosri candle bi selling hoti hai lakin is ki pehchan ya hai k yah second candle say down open hoti hai.

is pattern formation falling window pattern kehty hain. Jab market main yah pattern Ban jata hai to ap ki liya aik buht acha signal hota hai.

How to trade:

Dear forum friends, yah pattern market k down trend ko show krta hai. Is pattern k bnanay k bad ap ko sell ki entry lani chaiy. Ager ap ko yah pattern Kisi bary time frame main mil jata hai to yah aur bi acha hota hai.

Explanation through Chart:

Dear forum friends, is pattern ki proper understanding k liy ap ko chart pay focus krna ho ga. Ager ap is pattern ko H4 ya daily time frame main daikhty hain to ap ko yaj opportunity kabi bi zaya ni krni chaiy.

What is Falling window:

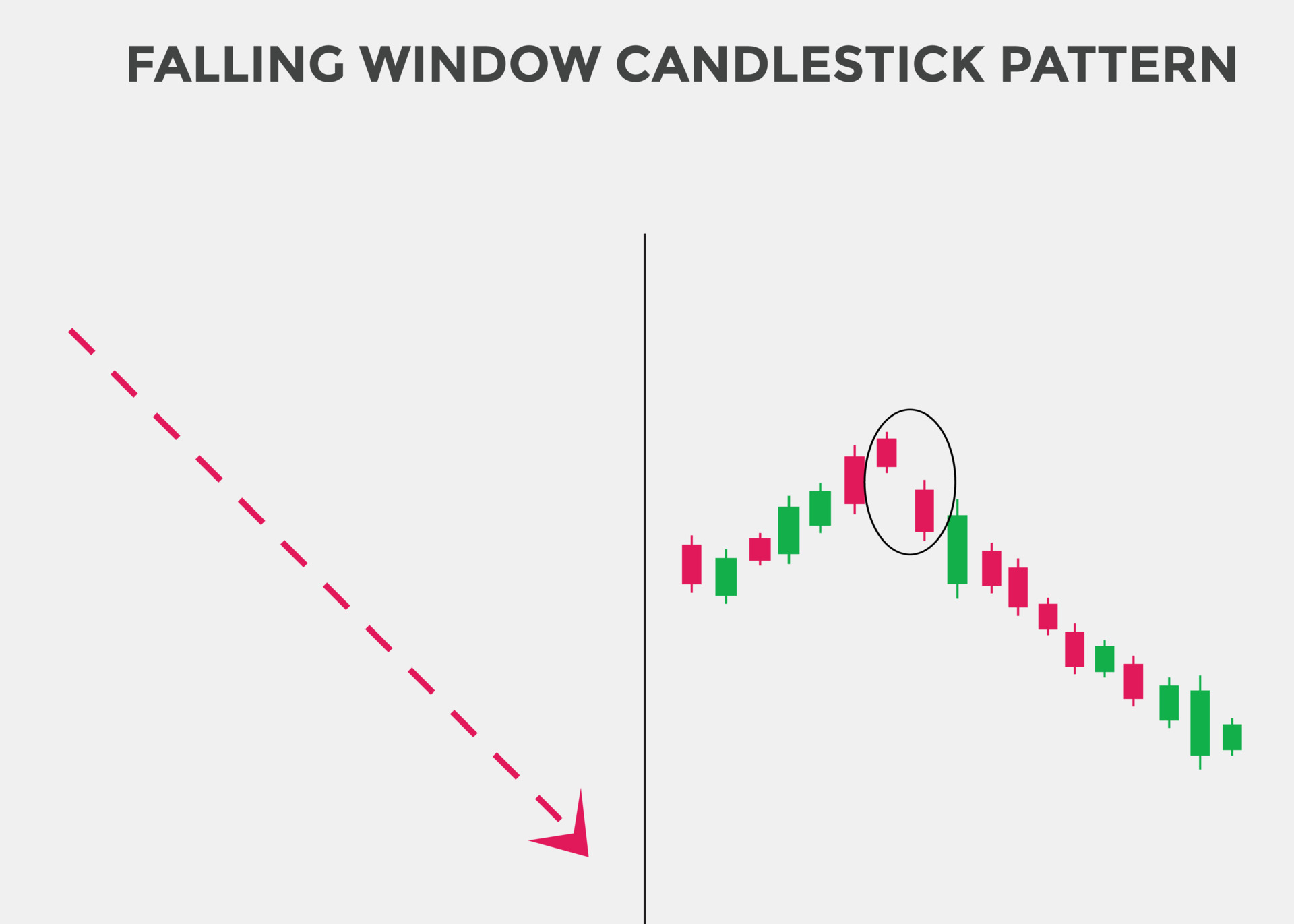

Dear forum friends, Falling windows ko pehchan ny k liy ap ko do candlestick ko focus krna hota hai. Is pattern main do candlestick ki body is trah hoti hai.

*Is pattern ki pehli candle, aik selling candle hoti hai. Jo sellers pressure k bary main btati hai.

*is pattern ki dosri candle bi selling hoti hai lakin is ki pehchan ya hai k yah second candle say down open hoti hai.

is pattern formation falling window pattern kehty hain. Jab market main yah pattern Ban jata hai to ap ki liya aik buht acha signal hota hai.

How to trade:

Dear forum friends, yah pattern market k down trend ko show krta hai. Is pattern k bnanay k bad ap ko sell ki entry lani chaiy. Ager ap ko yah pattern Kisi bary time frame main mil jata hai to yah aur bi acha hota hai.

Explanation through Chart:

Dear forum friends, is pattern ki proper understanding k liy ap ko chart pay focus krna ho ga. Ager ap is pattern ko H4 ya daily time frame main daikhty hain to ap ko yaj opportunity kabi bi zaya ni krni chaiy.

تبصرہ

Расширенный режим Обычный режим