Introduction:

Dear forex forum members, Umeed hai sab dost theak hain, aur mehnat sy apna kam complete kar rhy hain. Jasa k ap sab janty hain k, forex trading main learning, knowledge aur experience ka hona bohat zarori hai. Dear members, forex trading me loss say bachny k liye, aur aik profitable trade krny k liye, candlesticks ka knowledge, aur technical analysis skills ka hona bohat zarori hai. Aj main ap sy aik important candlestick k bary main discuss krna chahta hu. Wo candlestick “White/Bullish Marubozu candlestick”hai. Agar hum achi trading karna chahty hain aur risk sy avoid karna chahty hain to is candlestick ki understanding bohat zarori hai. Isi candlestick ki knowledge gain kr k, hum blind trading sy avoid kar k profit earn kar sakty hain aur risk management kr k loss sy bach sakty hain. Aur perfect trading kar sakty hain. Is tra achy knowledge sy he hum trading expertise gain kar sakty hain.

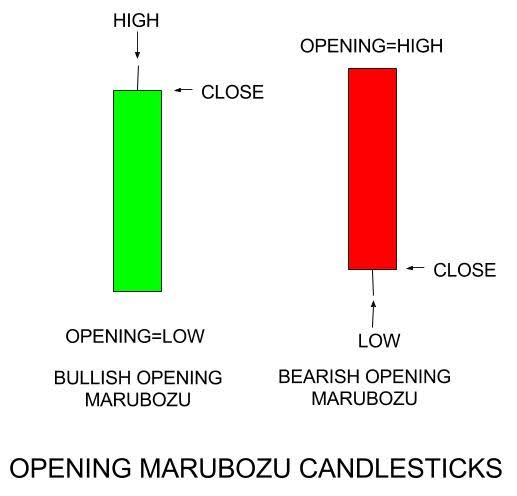

Definition of “Bullish/White Marubozu candlestick”:

Dear forex forum member Bullish Marubozu candlestick is bat ko indicate karta hai k stock main buying ka itna interest hai k, market participants din k doran, her qeemat per stock ko purchase karny p tyar thy, aur itna k stock din k higher point k qareeb band hua.

Recognition criteria of Bullish/White Marubozu candlestick:

1. Is candlestick ki body white aur lambi hoti hai.

2. Is candlestick k koi b upper aur lower shadows nhi hoty.

Trader’s behavior in Bullish/White Marubozu candlestick:

Dear forex forum members, aik Bullish Marubozu ka sedha matlab ye hai k opening price din k nichly hisy k brabar hai, aur ending price din k unchy hisy k brabar hai. Is sy ye pta lagta hai k buyers sy pehli trade sy ly kar, akhri trade tak price action ko control kia hai. Is candlestick main din open hota he, sara din price increase hoti rehti hain, istra aik lamba safeed din banta hai, jis ka koi shadow nhi hota. Is duration main, din bhi high p band hota hai, jis ka koi shadow nhi hota.

it

it

Dear forex forum member Ye candlestick aam tor p bullish hoti hai. Is ki broader technical picture main position ahmiat ki hamil hoti hai. Ye aik mumkina turning point dikha sakta hai aur ye bta sakta hai k prices aik extended rally k bad support level p pohanch gyi hain. Agar is candlestick ko aik long aur important rally k bad dekha jaye to ye ziada bullishness ki signal dy sakta hai , aur is bat ko b indicate kart hai k prices khatarnak had tak buland ho chuki hain. Taham, akeli candlestick direction ka decision karny k lye kafi nhi hai, q k ye sirf aik din ki trading ko reflect karta hai.

Trading in Bullish/White Marubozu candlestick:

Dear forex forum member Bullish ya white Marubozu candlestick main trading karty waqt in chezo ka khas khyal rakhna chaiye.

1. Bullish Marubozu main, upper and lower shadows ki absence is bat ko indicate karti hai k low price, opening price k brabar hai. Jab k high price kam price k brabar hai.

2. Bullish Marubozu, traders k darmyan dye gye assets main buying interest ki traf ishara karta hai, ta k traders is session k doran, is ki price qata nazar, is ko buy karny p willing hon. Is ki wja sy asset ki price, is session k doran apny high point k qareeb band ho jati hai.

3. Bullish Marubozu, aik uptrend main appear hony sy, strongly uptrend ki continuation ki taraf signal deta hai. Taham, jab wo downtrend main appear ho, to is ka matlab trend ki reversal hai. Aisi situation market k sentiments main tabdeli ko indicate karti hai, aur is bat ko indicate karti hai k assets ki buying ab bullish hai.

4. Tezi k sath sentiments k change k sath, traders ko bullish trend ki expectation hoti hai, aur trader ye expect karty hain, k ye any waly session tak jari rhy g. Aisi surat main, traders tazi sy buying opportunity ko talash karty hain.

Agar hum in points ko zehan main rakhain gy aur is candlestick ko achy sy understand kar lain gy to success k chances bhar jaein gy. Aur right time p right decisions ly k, right strategy implement kar sakain gy. Is tra risk management kar k achi selling opportunity gain ki ja sakti hai. Aur acha profit earn kia ja sakta hai.

Dear forex forum members, Umeed hai sab dost theak hain, aur mehnat sy apna kam complete kar rhy hain. Jasa k ap sab janty hain k, forex trading main learning, knowledge aur experience ka hona bohat zarori hai. Dear members, forex trading me loss say bachny k liye, aur aik profitable trade krny k liye, candlesticks ka knowledge, aur technical analysis skills ka hona bohat zarori hai. Aj main ap sy aik important candlestick k bary main discuss krna chahta hu. Wo candlestick “White/Bullish Marubozu candlestick”hai. Agar hum achi trading karna chahty hain aur risk sy avoid karna chahty hain to is candlestick ki understanding bohat zarori hai. Isi candlestick ki knowledge gain kr k, hum blind trading sy avoid kar k profit earn kar sakty hain aur risk management kr k loss sy bach sakty hain. Aur perfect trading kar sakty hain. Is tra achy knowledge sy he hum trading expertise gain kar sakty hain.

Definition of “Bullish/White Marubozu candlestick”:

Dear forex forum member Bullish Marubozu candlestick is bat ko indicate karta hai k stock main buying ka itna interest hai k, market participants din k doran, her qeemat per stock ko purchase karny p tyar thy, aur itna k stock din k higher point k qareeb band hua.

Recognition criteria of Bullish/White Marubozu candlestick:

1. Is candlestick ki body white aur lambi hoti hai.

2. Is candlestick k koi b upper aur lower shadows nhi hoty.

Trader’s behavior in Bullish/White Marubozu candlestick:

Dear forex forum members, aik Bullish Marubozu ka sedha matlab ye hai k opening price din k nichly hisy k brabar hai, aur ending price din k unchy hisy k brabar hai. Is sy ye pta lagta hai k buyers sy pehli trade sy ly kar, akhri trade tak price action ko control kia hai. Is candlestick main din open hota he, sara din price increase hoti rehti hain, istra aik lamba safeed din banta hai, jis ka koi shadow nhi hota. Is duration main, din bhi high p band hota hai, jis ka koi shadow nhi hota.

Dear forex forum member Ye candlestick aam tor p bullish hoti hai. Is ki broader technical picture main position ahmiat ki hamil hoti hai. Ye aik mumkina turning point dikha sakta hai aur ye bta sakta hai k prices aik extended rally k bad support level p pohanch gyi hain. Agar is candlestick ko aik long aur important rally k bad dekha jaye to ye ziada bullishness ki signal dy sakta hai , aur is bat ko b indicate kart hai k prices khatarnak had tak buland ho chuki hain. Taham, akeli candlestick direction ka decision karny k lye kafi nhi hai, q k ye sirf aik din ki trading ko reflect karta hai.

Trading in Bullish/White Marubozu candlestick:

Dear forex forum member Bullish ya white Marubozu candlestick main trading karty waqt in chezo ka khas khyal rakhna chaiye.

1. Bullish Marubozu main, upper and lower shadows ki absence is bat ko indicate karti hai k low price, opening price k brabar hai. Jab k high price kam price k brabar hai.

2. Bullish Marubozu, traders k darmyan dye gye assets main buying interest ki traf ishara karta hai, ta k traders is session k doran, is ki price qata nazar, is ko buy karny p willing hon. Is ki wja sy asset ki price, is session k doran apny high point k qareeb band ho jati hai.

3. Bullish Marubozu, aik uptrend main appear hony sy, strongly uptrend ki continuation ki taraf signal deta hai. Taham, jab wo downtrend main appear ho, to is ka matlab trend ki reversal hai. Aisi situation market k sentiments main tabdeli ko indicate karti hai, aur is bat ko indicate karti hai k assets ki buying ab bullish hai.

4. Tezi k sath sentiments k change k sath, traders ko bullish trend ki expectation hoti hai, aur trader ye expect karty hain, k ye any waly session tak jari rhy g. Aisi surat main, traders tazi sy buying opportunity ko talash karty hain.

Agar hum in points ko zehan main rakhain gy aur is candlestick ko achy sy understand kar lain gy to success k chances bhar jaein gy. Aur right time p right decisions ly k, right strategy implement kar sakain gy. Is tra risk management kar k achi selling opportunity gain ki ja sakti hai. Aur acha profit earn kia ja sakta hai.

تبصرہ

Расширенный режим Обычный режим