Introduction

Forex trading ma chart patterns ka istemal hmain market ki ongoing aur upcoming moments sa agah karta hay is liay hmain indicators aur chart patterns ka knowledge hasil karna chaiay forex ma candles kay patterns hmain trades open aur adjust karnay ma kafi support faraham kartay hain in patterns ma sa aik ladder top candlestick pattern ha

What Is Ladder Top Candlestick Pattern

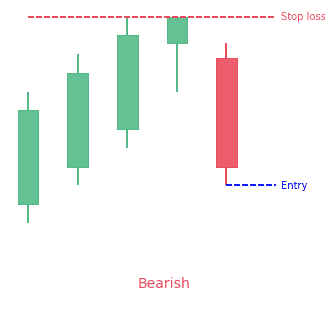

Is pattern aik bearish reversal pattern ha jo bullish trend kay end ma appear hota ha ye aik popular pattern ha jo uptrend kay khatmay kay early signs aur indications daita ha ye pattern five candles sa mil kar bnta ha

Identification Of Pattern

Is pattern boht rarely appear hota ha, jaisa kay ye aik bearish reversal pattern ha is liay is ka prevailing trend bullish hota ha, pattern ma five candles hoti hain jin ma pehli three candles three white soldiers pattern ki formation banati hain, fourth candle bhi bullish hoti ha lakin iski real body pehli three candles sa shorter hoti ha jis ki lower side par long wick hoti ha, pattern ki fifth candle large bearish hoti ha jo pattern kay low par closehoti ha. ladder tops ki candle jitni large hongi utna hi reliable pattern banay ga

Guidance Of Ladder Top Candlestick Pattern

Yah pattern bearish reversal ya upcoming reversal ka signal daita ha, market ka behaviour samajhnay kay liay traders ko candlestick patterns par depend karna parta ha lihaza ye traders ko market ki overall current picture sa guide karta ha aur future moments ko predict karnay ma support daita ha, pattern ma first three candles market ma bullish senttiments kay honay ka signal daiti hain aur momentum jari rakhnay ki information milti ha, jab kay fifth candle bearish honay ka matlab ye hota ha kay ab market new move chalnay lagi ha jo current bullish trend ka reversal hoti hay

Forex trading ma chart patterns ka istemal hmain market ki ongoing aur upcoming moments sa agah karta hay is liay hmain indicators aur chart patterns ka knowledge hasil karna chaiay forex ma candles kay patterns hmain trades open aur adjust karnay ma kafi support faraham kartay hain in patterns ma sa aik ladder top candlestick pattern ha

What Is Ladder Top Candlestick Pattern

Is pattern aik bearish reversal pattern ha jo bullish trend kay end ma appear hota ha ye aik popular pattern ha jo uptrend kay khatmay kay early signs aur indications daita ha ye pattern five candles sa mil kar bnta ha

Identification Of Pattern

Is pattern boht rarely appear hota ha, jaisa kay ye aik bearish reversal pattern ha is liay is ka prevailing trend bullish hota ha, pattern ma five candles hoti hain jin ma pehli three candles three white soldiers pattern ki formation banati hain, fourth candle bhi bullish hoti ha lakin iski real body pehli three candles sa shorter hoti ha jis ki lower side par long wick hoti ha, pattern ki fifth candle large bearish hoti ha jo pattern kay low par closehoti ha. ladder tops ki candle jitni large hongi utna hi reliable pattern banay ga

Guidance Of Ladder Top Candlestick Pattern

Yah pattern bearish reversal ya upcoming reversal ka signal daita ha, market ka behaviour samajhnay kay liay traders ko candlestick patterns par depend karna parta ha lihaza ye traders ko market ki overall current picture sa guide karta ha aur future moments ko predict karnay ma support daita ha, pattern ma first three candles market ma bullish senttiments kay honay ka signal daiti hain aur momentum jari rakhnay ki information milti ha, jab kay fifth candle bearish honay ka matlab ye hota ha kay ab market new move chalnay lagi ha jo current bullish trend ka reversal hoti hay

تبصرہ

Расширенный режим Обычный режим