Assalamu Alaikum! dear member Main ummid Karti hun, aap sab khairiyat se Honge aur Apna Achcha kam kar rahe Honge. Jab aap ismein kam karte hain to aapko daily ka target complete karna hota hai aur hard work ke sath kam karna hota hai. agar aap ismein hard work Nahin Karenge to aap kabhi bhi successful trading nahin kar sakte, isliye aapko market Mein different important analysis per completely study Karni chahie aur Market ko acchi tarike se focus karna chahie jitne acchi analysis ke sath aap is market Mein trading Karenge aapko itna hi Achcha result milega. main aaj aapse bahut hi important information share karungi, jo aapki trading ko profit table banaa sakti hai to Mera topic hai Rickshaw Man candlestick pattern Kya Hai Is per Ham Kaise kam Karke profitable trading kar sakte hain iski Kuchh important information aapke sath share karungi.

Rickshaw Man Candlesticks Pattren:

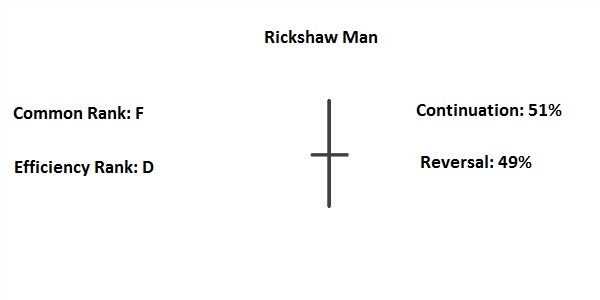

Japanese scandals take bar chart ki nisbat is wajah se jyada Pasand ki Jaati Hai Kyunki yah candle Unki nisbat bahut jyada information rakhti Hai bar chart ek time frame ka open close low high bullish bearish or natural values bhi dekhte hain candlestick Chahe single ho ya tadad mein jyada ho Inki information Jyada reliable Hoti Hai Jisko analyst Jyada Pasand Karte Hain Rickshaw Man candles B Ek single candle hoti hai jo ki amuman ek natural candle tasawar ki Jaati Hai yah candle bagair real body Mein Hoti Hai Jiska upper aur lower side per long equal length ke Shadow Hota Hai.

Candles Formation:

Rickshaw Man candles amuman price mein jyadatar Dikhai deti Hain Kyunki yah Ek natural candles Shumar Hoti Hai yah candle ek hi time mein market Mein buyers aur sailor ki equal takat ki aakashi Karti Hai Jo price ko ek Khas position per mustahikam rakhti hai candles ki formation darja Sel aapko mil rahi hoti hain.

Rickshaw Man candlestick price Ke Darmiyan Mein jyadatar natural Hoti Hai Jab Ke bottom aur top price per trend reversal Ki salahiyat rakhti Hai yah candle Ek bagair real body Mein Hoti Hai Jab Kijiye candle single hone ki vajah Se bullish aur bearish donon Tarah ka kam karti hai candles ke upper aur lower side per Shadow hota hai jo ki donon side per size mein takriban equal Hota Hai.

Explanation Of Rickshaw Man Candlesticks Pattren:

Rickshaw Man candlestick Ek bagair real body Mein upper aur lower side per long Shadow ki Hoti Hai yah candle Bullish aur bearish donon Tarah Se ho sakti hai Jab Ke candles ki open aur close price ke upper aur lower side per equally long Shadow Hote Hain Jab Bhi stock ki price per selected time frame ke mutabik pahle ek side Se Jyada pressure parh jata hai aur bad Mein dusri taraf se same pressure padta hai to use time mein yah candle banti hai lekin buyers aur sailors ki market Mein equal pressure ki vajah se candles ki donon taraf Shadow same Ban Jaati Hain rickshaw man candles Dekhne Mein same small doji star candles Jaisi hoti hain lekin Uske Apar aur lower side ka Shadow length mein jyada hota hai jisse donon candles Ke Darmiyan bahut clear difference a jata hai.

Trading With Rickshaw Man Candlesticks Pattren:

Rickshaw Man candles take a single candle pattern hone ki wajah se traders ke liye clear signal Nahin deta hai aur khas kar sideway Market Mein To yah invalid ya natural candles Hoti Hai yah candle price ke top ya bottom mein thodi bahut MuyaSir ho sakti hai lekin uske liye bhi confirmation Ka Hona jaruri hai candles ki trading se pahle market Mein long term ke time frame select karne ke bad price ke top ya bottom position dekh le Uske bad Kuchh indicator Jaise CCI indicator aur Oscilater per value dekh le jo ki overbought ya over sold zone Mein Hona jaruri hai candles per trading Jyada risky Hai Is vajah Se stop loss candles ke bottom ya top price Se Two pipes below above set Karen.

Rickshaw Man Candlesticks Pattren:

Japanese scandals take bar chart ki nisbat is wajah se jyada Pasand ki Jaati Hai Kyunki yah candle Unki nisbat bahut jyada information rakhti Hai bar chart ek time frame ka open close low high bullish bearish or natural values bhi dekhte hain candlestick Chahe single ho ya tadad mein jyada ho Inki information Jyada reliable Hoti Hai Jisko analyst Jyada Pasand Karte Hain Rickshaw Man candles B Ek single candle hoti hai jo ki amuman ek natural candle tasawar ki Jaati Hai yah candle bagair real body Mein Hoti Hai Jiska upper aur lower side per long equal length ke Shadow Hota Hai.

Candles Formation:

Rickshaw Man candles amuman price mein jyadatar Dikhai deti Hain Kyunki yah Ek natural candles Shumar Hoti Hai yah candle ek hi time mein market Mein buyers aur sailor ki equal takat ki aakashi Karti Hai Jo price ko ek Khas position per mustahikam rakhti hai candles ki formation darja Sel aapko mil rahi hoti hain.

Rickshaw Man candlestick price Ke Darmiyan Mein jyadatar natural Hoti Hai Jab Ke bottom aur top price per trend reversal Ki salahiyat rakhti Hai yah candle Ek bagair real body Mein Hoti Hai Jab Kijiye candle single hone ki vajah Se bullish aur bearish donon Tarah ka kam karti hai candles ke upper aur lower side per Shadow hota hai jo ki donon side per size mein takriban equal Hota Hai.

Explanation Of Rickshaw Man Candlesticks Pattren:

Rickshaw Man candlestick Ek bagair real body Mein upper aur lower side per long Shadow ki Hoti Hai yah candle Bullish aur bearish donon Tarah Se ho sakti hai Jab Ke candles ki open aur close price ke upper aur lower side per equally long Shadow Hote Hain Jab Bhi stock ki price per selected time frame ke mutabik pahle ek side Se Jyada pressure parh jata hai aur bad Mein dusri taraf se same pressure padta hai to use time mein yah candle banti hai lekin buyers aur sailors ki market Mein equal pressure ki vajah se candles ki donon taraf Shadow same Ban Jaati Hain rickshaw man candles Dekhne Mein same small doji star candles Jaisi hoti hain lekin Uske Apar aur lower side ka Shadow length mein jyada hota hai jisse donon candles Ke Darmiyan bahut clear difference a jata hai.

Trading With Rickshaw Man Candlesticks Pattren:

Rickshaw Man candles take a single candle pattern hone ki wajah se traders ke liye clear signal Nahin deta hai aur khas kar sideway Market Mein To yah invalid ya natural candles Hoti Hai yah candle price ke top ya bottom mein thodi bahut MuyaSir ho sakti hai lekin uske liye bhi confirmation Ka Hona jaruri hai candles ki trading se pahle market Mein long term ke time frame select karne ke bad price ke top ya bottom position dekh le Uske bad Kuchh indicator Jaise CCI indicator aur Oscilater per value dekh le jo ki overbought ya over sold zone Mein Hona jaruri hai candles per trading Jyada risky Hai Is vajah Se stop loss candles ke bottom ya top price Se Two pipes below above set Karen.

:max_bytes(150000):strip_icc():format(webp)/dotdash_INV-final-Rickshaw-Man-May-2021-01-64a19d3f61874c29b46e8b3def66db1f.jpg)

تبصرہ

Расширенный режим Обычный режим