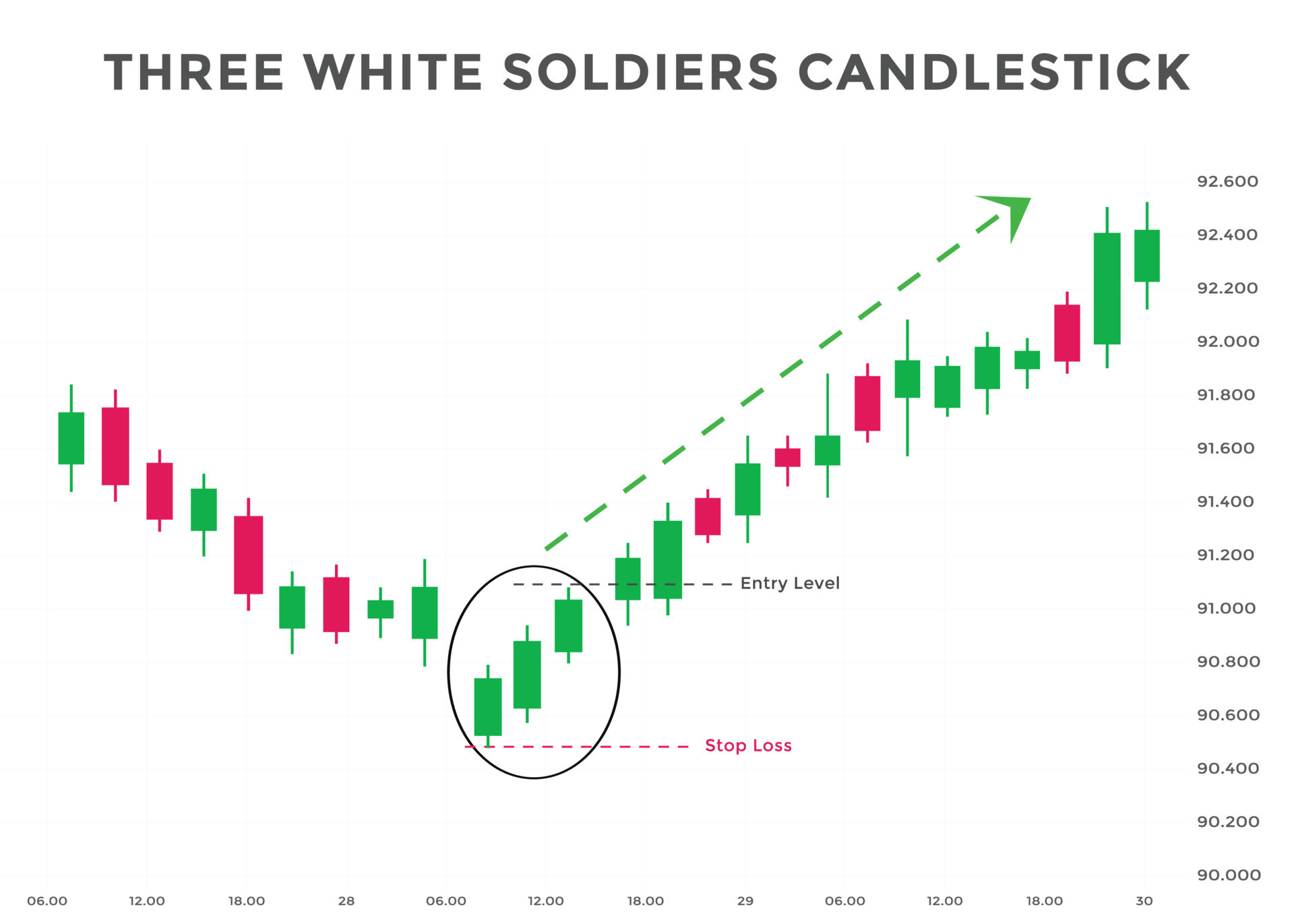

teen safaid sipahi candle stuck patteren aksar qeemat mein kami ke baad dekha jata hai aur usay aam tor par ulat indicater ke tor par istemaal kya jata hai. jab baat stock, commodity, ya forex pear ki ho jo chart par qeemat ke amal ka mauzo hai, yeh patteren market ke jazbaat mein aik ahem tabdeeli ki nishandahi karta hai .

ho sakta hai ke bail session ke liye range ke oopri hissay mein qeemat ko barqarar rakhnay mein kamyaab ho gaye hon agar koi blush candle baghair kisi saaye ke band ho jaye. johar mein, belon ne poooray session ke liye really ko control kya aur din ki oonchai ke qareeb teen seedhay session band kar diye. mazeed bar-aan, deegar mom batii ke patteren jaisay hathora ya doji jo ulat jane ki taraf ishara karte hain patteren se pehlay ho saktay hain .

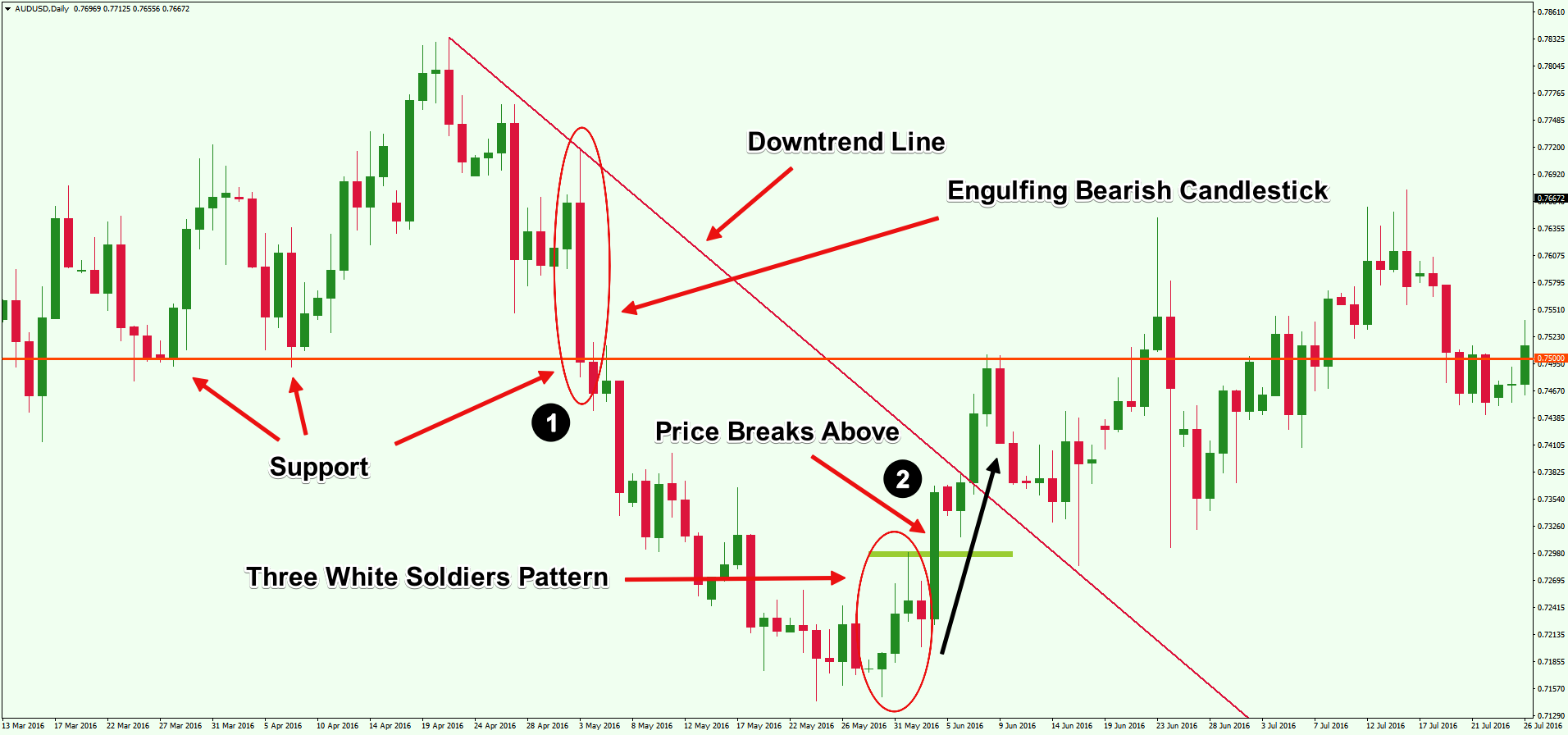

teen safaid sipahiyon ki aik misaal vaneck vectors fallen angel high yeld bond exchange-traded fund ( etf ) praysng chart mein dekhi ja sakti hai .

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_ThreeWhite_Soldiers_Definition_2020-01-cedf748e8c644b90b96e588aa4364291.jpg)

teen safaid sipahiyon ke patteren se pehlay kayi hafton tak jo taizi se taizi ke ulat jane ki nishandahi karta hai, etf mazboot mandi ke rujhan mein tha. agarchay patteren is baat ki nishandahi karsaktha hai ke really jari rahay gi, taajiron ko amal karne se pehlay deegar mutaliqa maloomat par ghhor karna chahiye. misaal ke tor par, ho sakta hai izafah kam hajam par sun-hwa ho, jo ke taaqat ki alamat nahi hai, ya patteren ki tashkeel ke ekhtataam par stock ko muzahmat ka saamna karna para hai .

Example of How to Trade Three White Soldiers

teen safaid sipahiyon ko tijarat ke liye mumkina dakhlay ya kharji nuqta ke tor par istemaal kya jata hai kyunkay woh aik taiz basri namona hain. teen safaid faam fouji taizi se position lainay ke muntazir taajiron ke liye dakhlay ka aik mauqa paish karte hain, jab ke security se kam tajir zamanat ke liye nazar atay hain .

is baat ko zehen mein rakhna zaroori hai ke teen safaid sipahiyon ke patteren ki tijarat ke nateejay mein mazboot chalon ki wajah se earzi had se ziyada kharidari ki sorat e haal peda ho sakti hai. misaal ke tor par, yeh mumkin hai ke rishta daar taaqat index ( rsi ) 70. 0 ki had se tajawaz kar gaya ho. teen safaid sipahiyon ka namona baaz halaat mein aik mukhtasir muddat ke istehkaam ka baais ban sakta hai, lekin mukhtasir aur darmiyani muddat ka taasub ab bhi taiz hai. ahem muzahmati sthin kaafi oopar ki taraf bherne se haasil ki ja sakti hain, aur is ke baad stock ka saamna ho sakta hai .

The Difference Between Three White Soldiers and Three Black Crows

teen siyah kvon candle stuck patteren teen safaid sipahiyon ke bar aks hai. teen lagataar lambay jism wali shammen jo pichli mom batii ke asal body ke andar khulti hain aur pichli mom batii se neechay band hoti hain teen kalay kaway banati hain. teen kalay kaway rechon ko belon se dobarah control haasil karte hue dikhata hain, jabkay teen safaid sipahi reechh se belon ki raftaar mein tabdeeli ko pakarte hain. dono patteren hajam aur izafi tasdeeq ke hawalay se yaksaa ahthyat ke tabay hain. taham, taizi ke andaaz mein, hajam ki tasdeeq ziyada ahem hai .

ho sakta hai ke bail session ke liye range ke oopri hissay mein qeemat ko barqarar rakhnay mein kamyaab ho gaye hon agar koi blush candle baghair kisi saaye ke band ho jaye. johar mein, belon ne poooray session ke liye really ko control kya aur din ki oonchai ke qareeb teen seedhay session band kar diye. mazeed bar-aan, deegar mom batii ke patteren jaisay hathora ya doji jo ulat jane ki taraf ishara karte hain patteren se pehlay ho saktay hain .

teen safaid sipahiyon ki aik misaal vaneck vectors fallen angel high yeld bond exchange-traded fund ( etf ) praysng chart mein dekhi ja sakti hai .

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_ThreeWhite_Soldiers_Definition_2020-01-cedf748e8c644b90b96e588aa4364291.jpg)

teen safaid sipahiyon ke patteren se pehlay kayi hafton tak jo taizi se taizi ke ulat jane ki nishandahi karta hai, etf mazboot mandi ke rujhan mein tha. agarchay patteren is baat ki nishandahi karsaktha hai ke really jari rahay gi, taajiron ko amal karne se pehlay deegar mutaliqa maloomat par ghhor karna chahiye. misaal ke tor par, ho sakta hai izafah kam hajam par sun-hwa ho, jo ke taaqat ki alamat nahi hai, ya patteren ki tashkeel ke ekhtataam par stock ko muzahmat ka saamna karna para hai .

Example of How to Trade Three White Soldiers

teen safaid sipahiyon ko tijarat ke liye mumkina dakhlay ya kharji nuqta ke tor par istemaal kya jata hai kyunkay woh aik taiz basri namona hain. teen safaid faam fouji taizi se position lainay ke muntazir taajiron ke liye dakhlay ka aik mauqa paish karte hain, jab ke security se kam tajir zamanat ke liye nazar atay hain .

is baat ko zehen mein rakhna zaroori hai ke teen safaid sipahiyon ke patteren ki tijarat ke nateejay mein mazboot chalon ki wajah se earzi had se ziyada kharidari ki sorat e haal peda ho sakti hai. misaal ke tor par, yeh mumkin hai ke rishta daar taaqat index ( rsi ) 70. 0 ki had se tajawaz kar gaya ho. teen safaid sipahiyon ka namona baaz halaat mein aik mukhtasir muddat ke istehkaam ka baais ban sakta hai, lekin mukhtasir aur darmiyani muddat ka taasub ab bhi taiz hai. ahem muzahmati sthin kaafi oopar ki taraf bherne se haasil ki ja sakti hain, aur is ke baad stock ka saamna ho sakta hai .

The Difference Between Three White Soldiers and Three Black Crows

teen siyah kvon candle stuck patteren teen safaid sipahiyon ke bar aks hai. teen lagataar lambay jism wali shammen jo pichli mom batii ke asal body ke andar khulti hain aur pichli mom batii se neechay band hoti hain teen kalay kaway banati hain. teen kalay kaway rechon ko belon se dobarah control haasil karte hue dikhata hain, jabkay teen safaid sipahi reechh se belon ki raftaar mein tabdeeli ko pakarte hain. dono patteren hajam aur izafi tasdeeq ke hawalay se yaksaa ahthyat ke tabay hain. taham, taizi ke andaaz mein, hajam ki tasdeeq ziyada ahem hai .

تبصرہ

Расширенный режим Обычный режим