Assalamu Alaikum Dosto!

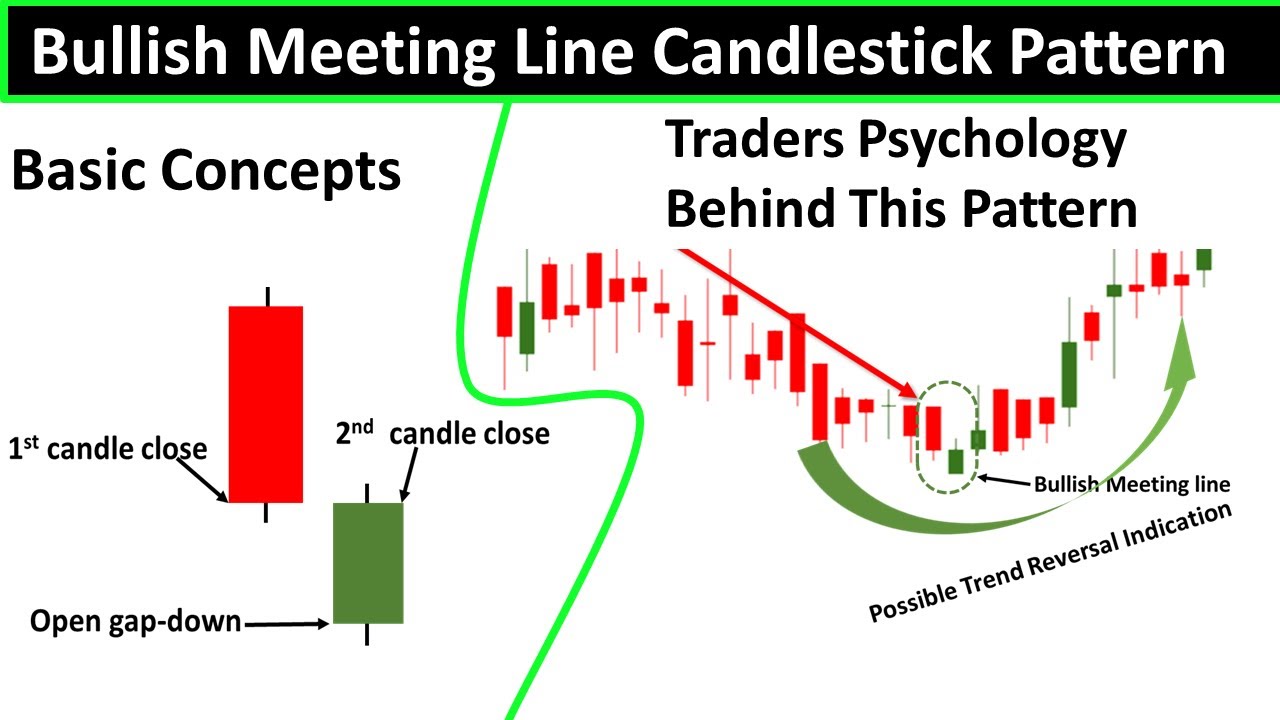

Bullish Meeting Line Pattern

Bullish meeting line pattern main aik bullish candle bearish trend ki akhari candle par lower side se attack karke market main bearish trend ka khatma karti hai. Ye pattern two days candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jo k qeematon ko downward push karti hai. Pattern ki dosri candle aik bullish candle hoti hai, jo k open pehli candle se below gap main hoti hai, lekin close pehli candle k closing point par hoti hai. Yanni pehli aur dosri candles k closing prices same point par melte ya meeting karte hen. Bullish meeting line pattern ka opposite side ya bottom price par bearish meeting line pattern banta hai, jo k bearish trend reversal pattern hai.

Candles Formation

Bullish meeting line pattern main prices bearish trend k khatme par aik strong bullish attack hoti hai. Jiss se bearish trend bullish main badal jata hai. Ye pattern bearish aur bullish candles par mushtamil hota hai, jiss ki formation darjazel tarah se hoti hai;

1. First Candle: Bullish meeting line candlestick pattern main pehli candle aik bearish candle hoti hai, ye candle price k downtrend ko show kar rahi hoti hai, jo k black ya red color ki candle hoti hai. Ye candle aik strong real body main banti hai, yanni candle ki real body shadow se ziada hoti hai.

2. Second Candle: Bullish meeting line pattern ki dosri candle aik bullish candle hoti hai, jo k open to pehli candle k bottom par gap main hoti hai lekin close pehli candle k close price par hoti hai. Ye candle color main white ya green hoti hai, jo k bearish trend ka khatma karti hai.

Explaination

Bullish meeting line pattern two days candles ka aik bullish trend reversal pattern hai, jo k "Separating Line Pattern" se mushabehat rakhta hai. Ye pattern prices k bottom par ban kar same bullish trend reversal pattern ki tarah prices k bearish trend k khatme ka bahis banta hai. Pattern ki pehli candle aik strong bearish candle hoti hai, jiss ko aik bullish candle follow karti hai. Bullish candle bearish candle k bottom par gap main open ho kar ussi k close point par close hoti hai. Second candle ki closing point pehli candle k closing point se upper nahi hona chaheye. Ye pattern piercing line pattern ka bhi hum shakal hai.

Trading

Bullish meeting line pattern two days candles ka aik bullish trend reversal pattern hai, jo k "Separating Line Pattern" se mushabehat rakhta hai. Ye pattern prices k bottom par ban kar same bullish trend reversal pattern ki tarah prices k bearish trend k khatme ka bahis banta hai. Pattern ki pehli candle aik strong bearish candle hoti hai, jiss ko aik bullish candle follow karti hai. Bullish candle bearish candle k bottom par gap main open ho kar ussi k close point par close hoti hai. Second candle ki closing point pehli candle k closing point se upper nahi hona chaheye. Ye pattern piercing line pattern ka bhi hum shakal hai.

Trading

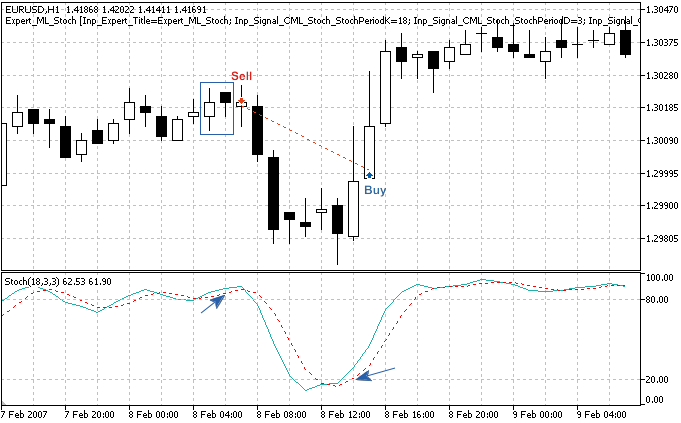

Bullish meeting line pattern buyers ki achanak market main pressure ki waja se banti hai, jiss main market main sellers ki dabao ka khatma karke prices k bottom ko bullish trend main badal deti hai. Bullish meeting line pattern par trading se pehle aik confirmation black candle ka hona zarori hai, jo k dosri candle k baad real body main honi chaheye, jiss par buyers market main buy ki entry kar sakte hen. Aggar pattern k baad black candle banti hai to pattern ki reliability khatam ho jati hai. Stop Loss k leye pattern ka sab se bottom position muntakhib karen, jo k dosri candle ka low banega, se two pips below select karen.

تبصرہ

Расширенный режим Обычный режим