Assalam o Alikum Friends Umeed Hai ap sab loog khriyat sy hungy or enjoy kar rahy hungy apni trading life ko.dosto forex market mai analysis bhoot zaruri hai aiaye analysis ki types ko lern krty hain

Forex Chart Pattern

Wedge Pattern

Bollinger Band Indicator

Forex Candlestick Pattern

Reverse Charting

Forex Chart Pattern

Forex markets ke tajir deegar marketon ki terhan maghribi takneeki tajzia ki bohat si techniques ka istemaal kar satke hain, Bashmole wages, masalas, channels, double tops aur bottoms aur head and sholr jaisay patteren. miqdari aur imtezaaj ki tknikin jaisay k Bollinger bands, moving average, fabonacci retracement bhi maqbool hain, sath hi oscillators aur MACD, RSI aur stochastic jaisay momentum indicators ke tajzia ke sath. Wage patteren aur Bollinger band technical analysis ke do maqbool tareen tareeqon ki misalein hain.

Wedge Pattern

Wedge patteren aam tor par is baat ka ishara dete hain ke trend ka reversal qareeb aa sakta hai, lehaza agar qeemat wedge ke andar neechay ka rujhan dikha rahi hai, to koi yeh samajh sakta hai ke jab qeemat patteren ke oopri hissay se toot jati hai to rujhan oopri rujhan mein badal sakta hai. Wedge patteren taizi ya mandi ke ho satke hain, wedge ke andar dukhaay gaye mojooda rujhan par munhasir hai, aur yeh aam tor par taweel mudti patteren hotay hain.

Bollinger Band Indicator

Bollinger band aik chart overlay hain jo aik line ko do standard deviations aik saada moving average se oopar khinchtaa hai aur aik line do mayaari inhiraf ko saada moving average se neechay khinchtaa hai. Yeh takneeki tajzia ke sab se mashhoor tools mein se aik hai kyunkay yeh utaar charhao ka aik acha pemana hai. chart par qeemat oopri baind ke jitni qareeb hoti hai, market ko itna hi' ziyada khareeda sun-hwa' samjha ja sakta hai. nichale baind tak qeemat jitni qareeb hogi, market mein ziyada farokht honay ka imkaan itna hi ziyada hoga Forex traders tik ya minute charts se le kar hafta waar ya mahana chart tak kisi bhi waqt ke charts par un techniques ka istemaal kar satke hain. Trends ki nishandahi karne ke ilawa, takneeki tajir qeemat ke maqasid, stap loss ki satah aur tijarat ke andar intikhab ki shanakht ke liye un techniques ka istemaal karte hain, aksar kam az kam 2:1 ke khatray ke tanasub ki wapsi ki talaash mein rehtay hain.

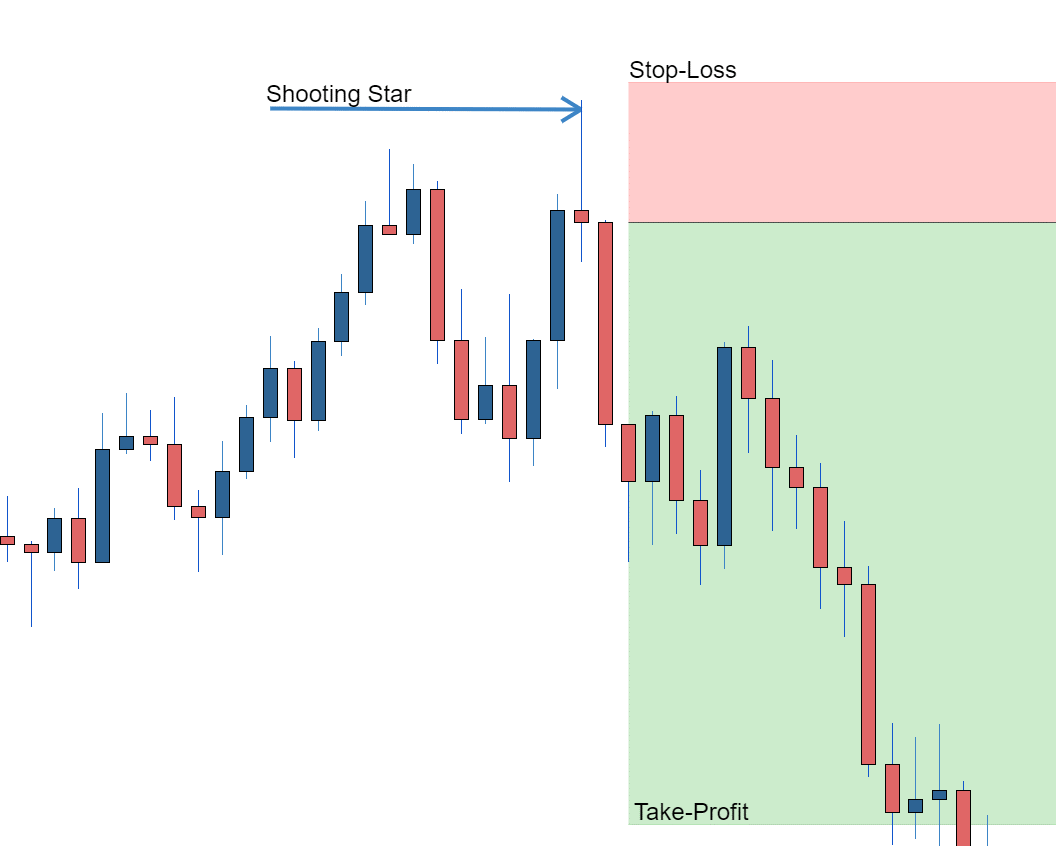

Forex Candlestick Pattern

Forex traders Japanese technical analysis ki techniques ko istemaal karne ke qabil bhi hain jaisay candle stuck patteren, khaas tor par qaleel mudti tijarat aur ahem mourr ki nishandahi karne ke liye. ghair mulki currency ke tajzia mein istemaal honay walay mom batii ke kuch mashhoor patterns mein doji, hammer, hanging man, morning aur evening star candlestick pattern shaamil hain.Bohat se forex traders tajzia ki techniques ke imtezaaj ko istemaal karte hue khaas tor par mufeed paate hain, kyunkay jitne ziyada indicators mumkina tijarat ki tajweez ke liye seedh mein hon ge, aetmaad ki satah itni hi ziyada hogi.

Reverse Charting

Aik khaas tor par mufeed technical analysis ka tool hai jo ke dosray asasa tabqo ke taajiron ke liye aasani se mushkil hai. Technical analysis ki purani kahawaton mein se aik hai 'jab shak ho to apne chart ko ulta kar den'. kaghazi charts ke dinon mein yeh aasaan tha lekin computer ke daur mein taqreeban namumkin ho gaya, halaank yeh mobile phone ya tablet par chart bananay walay traderske liye qadray aasaan ho gaya hai.

Though trading on financial markets involves high risk, it

can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence.

Though trading on financial markets involves high risk, it

can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence.

تبصرہ

Расширенный режим Обычный режим