what is inside bar candle stick pattern

inside bar candle stick pattern aik kesam ke makbol candle stick pattern hote hey jo keh forex market ke candle stick ke tashkeel karte hey yeh candle stick pattern short period mein market kay jazbaat kay ley live game hote hey jo keh frex market mein honay wale bare chalon say pehlay inter honay kay ley inside bar prices ke hechkachahat ko zahair karte hey pechle candle stick par ya nechay ke taraf increase honay kay ley forex market ke bay aitnay ko identify karte hey

identify inside bar candle stick pattern

price action or technical indicator ka estamal kartay hovay aik sabqa trend ko identify karen gay

or inside bar candle stick pattern kay andar ka pata lagain gay jes kay tahat inside bar pore tarah andar hote hey or higher or lower candle stick say pore tarah lapte hove hote hey

trade with inside bar candle stick pattern

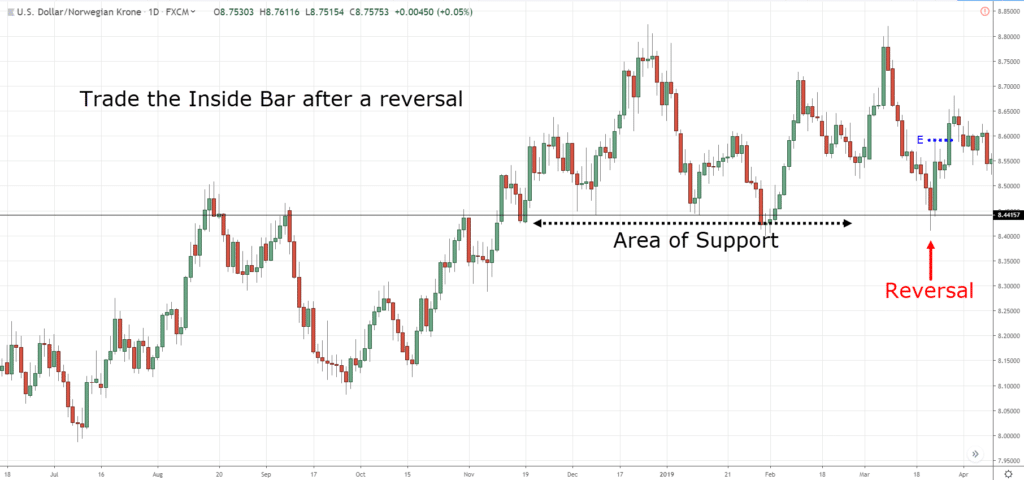

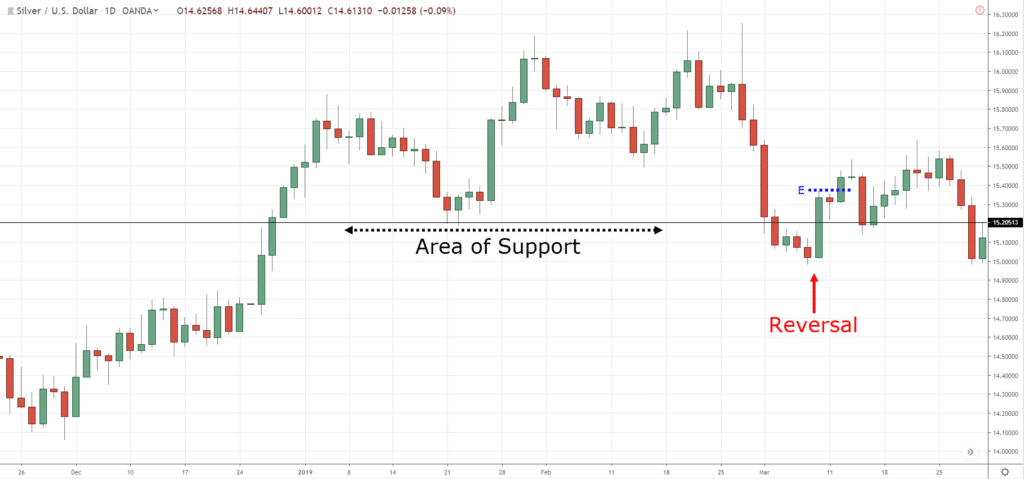

kuch trader es ko continuation candle stick pattern samjhty hn halankeh opposite direction mein breakout bhe possible hota hey aik long period keprice opar kay trend kay bad price ke movement mein gap reversal janay say pehlay wakay ho jata hey lahza inside bar trend kay gap ko stop karnay ke wajah ban jata hey or insdad direction mein trend ko stop karnay ke wajah ban jata hey or forex market mein aik shrt period trade ko stop kea ja sakta hey

inside bar breakout trading strategy

jaisa keh pehlay zekar kea ja choka hey keh trend saz market kam otar charhao kay sath short period mein stable ko nomaindge karte hey es kay bad trader aik new high low kay bananay kay bad breakout ke taraf daikhtay hein

EUR/GBP kay chart par sabka trend new lower level kay bananay or kam highs mein daikha ja sakta hey or breakout pechle bar kay lows say nechay ho jata hey ese tarah market mein aik short entry start ho jate hey ager yeh breakout pechle bar ke highs say opar hova ho t yeh long period entry ke taraf eshara kar sakta hey jes ke wajah say trader zyada carefully ho kar kam karta hey

stop levels pechle swing hig say lea ja sakta hey jaisa keh key price action levels kay motabaq ho stop ko bench mark kay tor par estamal kea ja sakta hey trader es stop kay distance ko 2 factr tak increase karnay kay ley take profit level ka ehsas ho sakay ga yeh forex market mein zama dar risk management kay tor par estamal kea ja sakay ga Fibonacci extension ko limit ke paishan gi kay tor par bhe estamal kea ja sakta hey

inside bar candle stick pattern aik kesam ke makbol candle stick pattern hote hey jo keh forex market ke candle stick ke tashkeel karte hey yeh candle stick pattern short period mein market kay jazbaat kay ley live game hote hey jo keh frex market mein honay wale bare chalon say pehlay inter honay kay ley inside bar prices ke hechkachahat ko zahair karte hey pechle candle stick par ya nechay ke taraf increase honay kay ley forex market ke bay aitnay ko identify karte hey

identify inside bar candle stick pattern

price action or technical indicator ka estamal kartay hovay aik sabqa trend ko identify karen gay

or inside bar candle stick pattern kay andar ka pata lagain gay jes kay tahat inside bar pore tarah andar hote hey or higher or lower candle stick say pore tarah lapte hove hote hey

trade with inside bar candle stick pattern

kuch trader es ko continuation candle stick pattern samjhty hn halankeh opposite direction mein breakout bhe possible hota hey aik long period keprice opar kay trend kay bad price ke movement mein gap reversal janay say pehlay wakay ho jata hey lahza inside bar trend kay gap ko stop karnay ke wajah ban jata hey or insdad direction mein trend ko stop karnay ke wajah ban jata hey or forex market mein aik shrt period trade ko stop kea ja sakta hey

inside bar breakout trading strategy

jaisa keh pehlay zekar kea ja choka hey keh trend saz market kam otar charhao kay sath short period mein stable ko nomaindge karte hey es kay bad trader aik new high low kay bananay kay bad breakout ke taraf daikhtay hein

EUR/GBP kay chart par sabka trend new lower level kay bananay or kam highs mein daikha ja sakta hey or breakout pechle bar kay lows say nechay ho jata hey ese tarah market mein aik short entry start ho jate hey ager yeh breakout pechle bar ke highs say opar hova ho t yeh long period entry ke taraf eshara kar sakta hey jes ke wajah say trader zyada carefully ho kar kam karta hey

stop levels pechle swing hig say lea ja sakta hey jaisa keh key price action levels kay motabaq ho stop ko bench mark kay tor par estamal kea ja sakta hey trader es stop kay distance ko 2 factr tak increase karnay kay ley take profit level ka ehsas ho sakay ga yeh forex market mein zama dar risk management kay tor par estamal kea ja sakay ga Fibonacci extension ko limit ke paishan gi kay tor par bhe estamal kea ja sakta hey

تبصرہ

Расширенный режим Обычный режим