Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members jab aap Trading karte Hain, ismein aapko hamesha successful trading karne ke liye consistently technical analysis ko apni trading activities main shamil krna hota hai. Technical analysis main Different individual candlesticks aur candlestick pattern ko carefully study karte Hain. Aaj main apni post main familiar candlestick pattern, jisko Tweezer Bottom Candlestick or Tweezer Top candlestick pattern kaha jata hai, unki explanation krna chahata Hun.

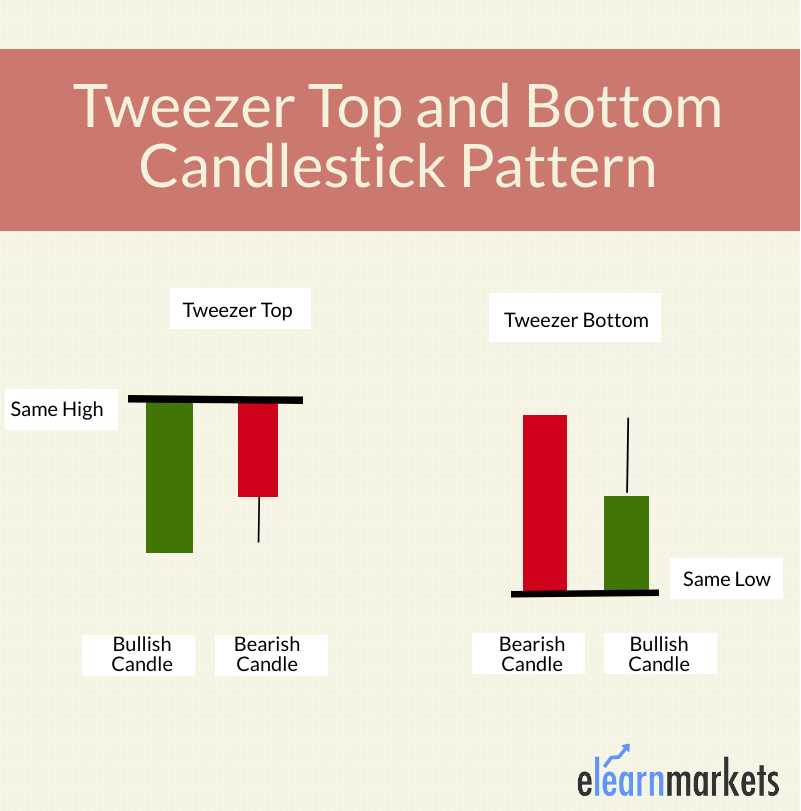

Tweezer Top Candlestick Pattern

Dear members Jab market mein aik strong uptrend banta hai, or market aik strong resistance level apni last bullish candlestick close krti hai, same us high point sa next bearish candlestick banti hai, Jo almost last bullish candlestick ko more than fifty percent cover kr jati hai, isko aapk Tweezers Top Candlestick Pattern khety Hain.

How to recognize Tweezer Top

Is candlestick pattern ko ap easily recognise kar sakhty Hain, kunk is main 2 candlestick include hoti hain, first candlestick bullish or 2nd candlestick bearish hoti hain, bullish candlestick ki closing or bearish candlestick ki opening same point sa honi cheye. Jo almost us trend ka highest point bhi hota hai.

Interpretation in Tweezer Top

Jab aap Forex trading market mein is candlestick pattern ko completely find out kar laty Hain, or iski confirmation aik achy pattern main mil jati hai, tu aap selling ki entry la ker bahut acha profit hasil kar sakte hain.

Tweezer Bottom Candlestick

Jab aap market mein aik strong downtrend dekhty Hain, or jab last bearish candlestick ki closing hoti hai, same us point sa start hony wali next bullish candlestick last candlestick ko more than fifty percent cover kr da, tu isko tweezer Bottom Candlestick pattern kaha jata hai.

Identification of Tweezer Bottom

Is candlestick pattern ko identify karna bahut hi aasan hota hai, ya candlestick pattern hamesha support level per banta hai. Jab first candlestick bearish or 2nd candlestick bullish trend main banti hai or enka respectively closing or origin point same hota hai, tu aapko easily isko identify kar lete hain.

Interpretation in Tweezer Bottom

Jab aap market mein tweezer Bottom Candlestick pattern ko identify kar laty Hain, tu usk bad aap market mein other important aspect ki basis per buying ki trade lga ker acha profit hasil kr sakhty Hain.

Explaination in Trading Charts

Following mentioned diagram aapko iski further information provide kar rahi hai, is Trading chart ko aap dekh Kar easily tweezer Top and tweezer Bottom ki identification kar sakhty Hain.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members jab aap Trading karte Hain, ismein aapko hamesha successful trading karne ke liye consistently technical analysis ko apni trading activities main shamil krna hota hai. Technical analysis main Different individual candlesticks aur candlestick pattern ko carefully study karte Hain. Aaj main apni post main familiar candlestick pattern, jisko Tweezer Bottom Candlestick or Tweezer Top candlestick pattern kaha jata hai, unki explanation krna chahata Hun.

Tweezer Top Candlestick Pattern

Dear members Jab market mein aik strong uptrend banta hai, or market aik strong resistance level apni last bullish candlestick close krti hai, same us high point sa next bearish candlestick banti hai, Jo almost last bullish candlestick ko more than fifty percent cover kr jati hai, isko aapk Tweezers Top Candlestick Pattern khety Hain.

How to recognize Tweezer Top

Is candlestick pattern ko ap easily recognise kar sakhty Hain, kunk is main 2 candlestick include hoti hain, first candlestick bullish or 2nd candlestick bearish hoti hain, bullish candlestick ki closing or bearish candlestick ki opening same point sa honi cheye. Jo almost us trend ka highest point bhi hota hai.

Interpretation in Tweezer Top

Jab aap Forex trading market mein is candlestick pattern ko completely find out kar laty Hain, or iski confirmation aik achy pattern main mil jati hai, tu aap selling ki entry la ker bahut acha profit hasil kar sakte hain.

Tweezer Bottom Candlestick

Jab aap market mein aik strong downtrend dekhty Hain, or jab last bearish candlestick ki closing hoti hai, same us point sa start hony wali next bullish candlestick last candlestick ko more than fifty percent cover kr da, tu isko tweezer Bottom Candlestick pattern kaha jata hai.

Identification of Tweezer Bottom

Is candlestick pattern ko identify karna bahut hi aasan hota hai, ya candlestick pattern hamesha support level per banta hai. Jab first candlestick bearish or 2nd candlestick bullish trend main banti hai or enka respectively closing or origin point same hota hai, tu aapko easily isko identify kar lete hain.

Interpretation in Tweezer Bottom

Jab aap market mein tweezer Bottom Candlestick pattern ko identify kar laty Hain, tu usk bad aap market mein other important aspect ki basis per buying ki trade lga ker acha profit hasil kr sakhty Hain.

Explaination in Trading Charts

Following mentioned diagram aapko iski further information provide kar rahi hai, is Trading chart ko aap dekh Kar easily tweezer Top and tweezer Bottom ki identification kar sakhty Hain.

تبصرہ

Расширенный режим Обычный режим