Assalamu Alaikum:

dear friend I hop aap sab khairiyat se Honge aur Apna best work kar rahe Honge Jab aap ismein work karte hain to aapko bahut hi acchi planning ke sath aur Soch Samajh Kar karna hota hai agar aap ismein jaldbaji karte hain to aapke liye bahut bada nuksan bhi ho sakta hai isliye aapko Koshish Karna Hogi ki aap ismein Jyada Se Jyada acche experience aur acchi learning ke sath kam Karen Taki aapko is market mein kamyabi mile main aaj aapse bahut hi acchi information share karungi jo aapki trading ko Kafi table banaa sakti hai to Mera topic hai bearish neckline candles take pattern kya Hai iski detail aapke sath discuss karunga.

What is Bearish Neck Line Pattern:

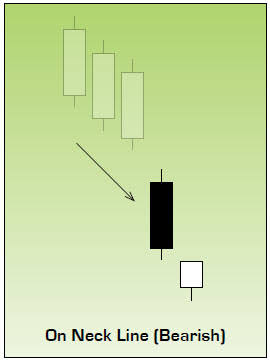

Dear bearish in neckline candlestick pattern price chart per Jab Bhi hota hai to market ka trend Sameer mom and Karna Jari Rakhta Hai yah 2 days ka ek bearing stand continuation hai jo price ke bottom per ya bear stand Mein paya jata hai yah pattern market Mein bear iska control jahir karta hai jo Ba restand Ke dauran vah Bole Ki Koshish ko nakam banaa Deta Hai price chart per Hamesha se ek Khas Trend ke mutabik move kar rahi hoti hai but high price ko train reversal ki jagah trend continuation Jari rahata Hai Jaise price ko line candlesticks pattern ka Samna karna Jata Hai To Uske bad price Teji ke sath girna start karti hai jo ki ek bearish trend continuation ki alamat hai.

Identification of Bearish Neck Line Pattern:

Dear friend bear is neckline pattern first Din Ki candles ek baar candle hoti hai lekin dusre Din Ki candles candles ke close price per hone ki bajay top gap mein open hokar Usi ke same close price per close Hoti Hai pattern Mein Shamil candle ki details aapke sath Hai bear is neckline candles pics pattern ki fast candle ek bearish scandal hoti hai.

Bearish neckline candle Jo price ke bottom per ya beer stand ki continuation ka work Karti Hai Kyunki Ek real body wali candle Hoti Hai yah candle black ya red color ki candle Hoti Hai bear is neckline candles take pattern ki second candle Ek real body wali bullish candle Hoti Hai yah candle open fast candle ke bottom per gap Mein Hoti Hai jabki close first candles ke sem close point per hoti hai but candle Lal me real body Mein honi chahie.

Trading With Bearish Neck Line Pattern:

Dear friend bear is neckline candles take pattern market ke price ko same beer stand Mein continue karta hai jo ki do candles par bullish aur bear Se Milkar banta hai pattern ki fast candle Ek bearing scandal hoti hai jo ki price Karti Hai yah candle ek normal real body Mein Shadow Himmat ya Shadow ke bagair ho sakti hai pattern ki second candle fast candle ke opposite direction yani Bole scandals hoti hai jo ki open first candle ke bottom per gap Mein hoti hai but close first candles ke sem close price ke ine line per hoti hai.

Bearish neckline candles takes pattern price ke bottom per traders ke liye Sel ka signal generate Karti Hai Jaise confirmation candles ke bad entry ki Ja sakti hai pattern ke bad confirmation candles ka real body Mein bear Shona bhi jaruri hai jabki second candles ki bottom per close Hona bhi important hai pattern ke bad Bulleh standard banne se pattern per Sel ki entry Nahin Karni chahie jabki trand conformation indicator Jaise CCI RSI MacD or stochastic oscillator Se Bhi ki Ja sakti hai Jis per value 50% se below honi chahie.

dear friend I hop aap sab khairiyat se Honge aur Apna best work kar rahe Honge Jab aap ismein work karte hain to aapko bahut hi acchi planning ke sath aur Soch Samajh Kar karna hota hai agar aap ismein jaldbaji karte hain to aapke liye bahut bada nuksan bhi ho sakta hai isliye aapko Koshish Karna Hogi ki aap ismein Jyada Se Jyada acche experience aur acchi learning ke sath kam Karen Taki aapko is market mein kamyabi mile main aaj aapse bahut hi acchi information share karungi jo aapki trading ko Kafi table banaa sakti hai to Mera topic hai bearish neckline candles take pattern kya Hai iski detail aapke sath discuss karunga.

What is Bearish Neck Line Pattern:

Dear bearish in neckline candlestick pattern price chart per Jab Bhi hota hai to market ka trend Sameer mom and Karna Jari Rakhta Hai yah 2 days ka ek bearing stand continuation hai jo price ke bottom per ya bear stand Mein paya jata hai yah pattern market Mein bear iska control jahir karta hai jo Ba restand Ke dauran vah Bole Ki Koshish ko nakam banaa Deta Hai price chart per Hamesha se ek Khas Trend ke mutabik move kar rahi hoti hai but high price ko train reversal ki jagah trend continuation Jari rahata Hai Jaise price ko line candlesticks pattern ka Samna karna Jata Hai To Uske bad price Teji ke sath girna start karti hai jo ki ek bearish trend continuation ki alamat hai.

Identification of Bearish Neck Line Pattern:

Dear friend bear is neckline pattern first Din Ki candles ek baar candle hoti hai lekin dusre Din Ki candles candles ke close price per hone ki bajay top gap mein open hokar Usi ke same close price per close Hoti Hai pattern Mein Shamil candle ki details aapke sath Hai bear is neckline candles pics pattern ki fast candle ek bearish scandal hoti hai.

Bearish neckline candle Jo price ke bottom per ya beer stand ki continuation ka work Karti Hai Kyunki Ek real body wali candle Hoti Hai yah candle black ya red color ki candle Hoti Hai bear is neckline candles take pattern ki second candle Ek real body wali bullish candle Hoti Hai yah candle open fast candle ke bottom per gap Mein Hoti Hai jabki close first candles ke sem close point per hoti hai but candle Lal me real body Mein honi chahie.

Trading With Bearish Neck Line Pattern:

Dear friend bear is neckline candles take pattern market ke price ko same beer stand Mein continue karta hai jo ki do candles par bullish aur bear Se Milkar banta hai pattern ki fast candle Ek bearing scandal hoti hai jo ki price Karti Hai yah candle ek normal real body Mein Shadow Himmat ya Shadow ke bagair ho sakti hai pattern ki second candle fast candle ke opposite direction yani Bole scandals hoti hai jo ki open first candle ke bottom per gap Mein hoti hai but close first candles ke sem close price ke ine line per hoti hai.

Bearish neckline candles takes pattern price ke bottom per traders ke liye Sel ka signal generate Karti Hai Jaise confirmation candles ke bad entry ki Ja sakti hai pattern ke bad confirmation candles ka real body Mein bear Shona bhi jaruri hai jabki second candles ki bottom per close Hona bhi important hai pattern ke bad Bulleh standard banne se pattern per Sel ki entry Nahin Karni chahie jabki trand conformation indicator Jaise CCI RSI MacD or stochastic oscillator Se Bhi ki Ja sakti hai Jis per value 50% se below honi chahie.

تبصرہ

Расширенный режим Обычный режим