Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members forex trading ma different types k pattern hoty hain or ye trader k lae helpful hoty hain. Agr trader enki information sy trade ko open kar ley to wo achy andaz sy predict kar sakta hai. Es topic ma ham asy he ik pattern ko discuss karny ja rahy hain.

J hook pattern.

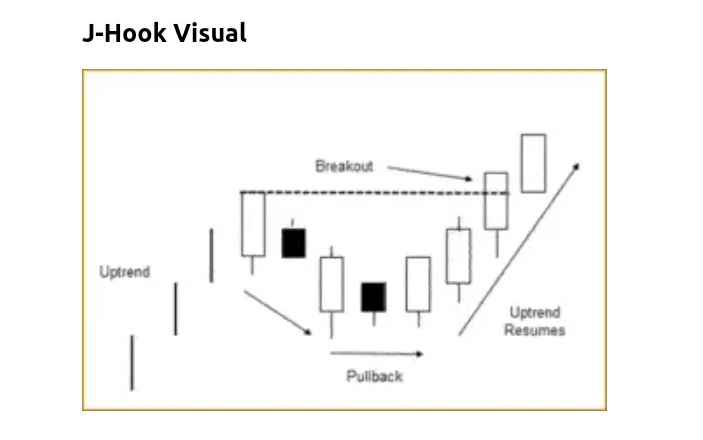

Forex chart ma j hook pattern ko spot karna bhot easy hoya hai kiu k ye english Alphbet J ki tarha chart ma appear hota hai. Ye pattern up trending ka part hai or tora dip face karta or phr apna trend resume kar leta hai. Es pattern ki key ye hai k trader ko 4th or 3rd candlesticks ko nazar ma rakhna hota hai jo market ma lower high form karti hain or ye j hook pattern ki beginning ho sakti hai. Now price down move karna stop kar deti hai or side way move karna start kar deti hai. Es k bad market ki price higher move karna start kar deti hai. Or ye trader ko oppertunity farham karti hai k wo buy ki trade ko open kar sakta hai.

Uses of j hook pattern.

Es pattern ma market price pehle up trend ma move kar rahi hoti hai. Phr ye kuch time k lae down trend ma move karti hai or higher low form karti hai or phr ye apna trend resume kar leti hai. Es pattern ka main use ye hai k ye trader ko achy trade karny k mokay farham karta hai. Trader es ko agr start ma predict kar leyn to wo long trade ma acha profit hasil kar sakty hain. Unko chahe k pehle wo market ka wait karyn or confirmation k bad market ma in or small lot k sath buy ki trade ko open karyn.

Inverted j hook pattern and its uses.

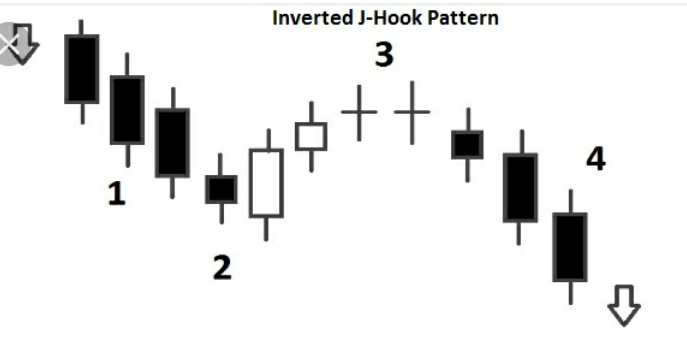

Inverted j hook pattern j hook pattern k ulat form hota hai es ma pehle market ma down trend hota hai or phr market kuch time k lae up trend ma wapas jati hai or kuch lower high form karti hai. Es k bad market wapas apny down trend ma chali jati hai or trader es time par jb market kuch dair side movement ma hoti hai apni trades ko open karyn to wo acha advantage hasil kar sakty hain or es pattern ma trader sell ki trade sy acha profit hasil kar sakty hain.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members forex trading ma different types k pattern hoty hain or ye trader k lae helpful hoty hain. Agr trader enki information sy trade ko open kar ley to wo achy andaz sy predict kar sakta hai. Es topic ma ham asy he ik pattern ko discuss karny ja rahy hain.

J hook pattern.

Forex chart ma j hook pattern ko spot karna bhot easy hoya hai kiu k ye english Alphbet J ki tarha chart ma appear hota hai. Ye pattern up trending ka part hai or tora dip face karta or phr apna trend resume kar leta hai. Es pattern ki key ye hai k trader ko 4th or 3rd candlesticks ko nazar ma rakhna hota hai jo market ma lower high form karti hain or ye j hook pattern ki beginning ho sakti hai. Now price down move karna stop kar deti hai or side way move karna start kar deti hai. Es k bad market ki price higher move karna start kar deti hai. Or ye trader ko oppertunity farham karti hai k wo buy ki trade ko open kar sakta hai.

Uses of j hook pattern.

Es pattern ma market price pehle up trend ma move kar rahi hoti hai. Phr ye kuch time k lae down trend ma move karti hai or higher low form karti hai or phr ye apna trend resume kar leti hai. Es pattern ka main use ye hai k ye trader ko achy trade karny k mokay farham karta hai. Trader es ko agr start ma predict kar leyn to wo long trade ma acha profit hasil kar sakty hain. Unko chahe k pehle wo market ka wait karyn or confirmation k bad market ma in or small lot k sath buy ki trade ko open karyn.

Inverted j hook pattern and its uses.

Inverted j hook pattern j hook pattern k ulat form hota hai es ma pehle market ma down trend hota hai or phr market kuch time k lae up trend ma wapas jati hai or kuch lower high form karti hai. Es k bad market wapas apny down trend ma chali jati hai or trader es time par jb market kuch dair side movement ma hoti hai apni trades ko open karyn to wo acha advantage hasil kar sakty hain or es pattern ma trader sell ki trade sy acha profit hasil kar sakty hain.

تبصرہ

Расширенный режим Обычный режим