Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members MACD (Moving Average Convergence Divergence) aik simple oscillating trend aur momentum indicator ha, jisko Gerald Apple na develop kia tha, ye 2 exponential moving averages kay darmian difference calculate kar kay convergance aur divergence ko show karta ha,

Features and working principle:

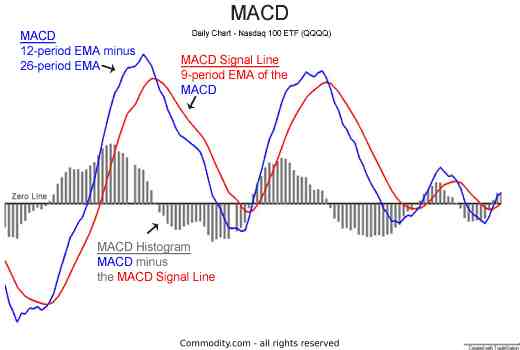

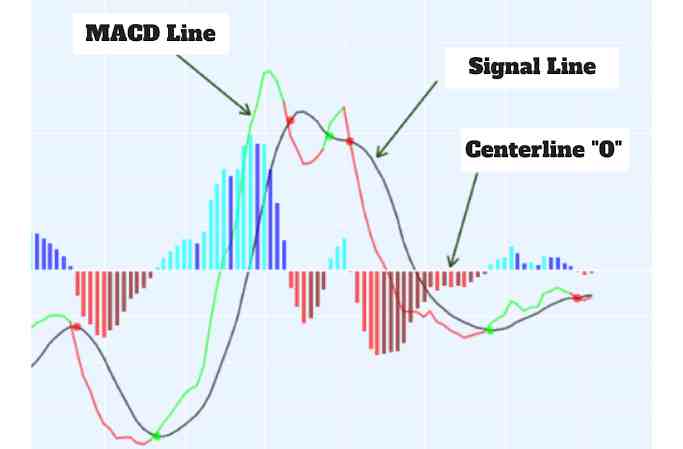

ye trend indicator kay tor par bhi use hota ha jis sa moving average ka trend define karta ha, is kay ilawa isay momentum indicator bhi use kia jata ha, is ma signal line jo MACD ka moving average hota ha uski help sa hum bullish aur bearish conditions ko identify kartay hain, MACD two lines kay sath plot kia jata ha jo zero line kay above aur below fluctuate karti hain, is kay ilawa MACD Histogram signal line aur MACD kay darmian distance ko indicate karti ha, MACD ma upper aur lower limit nhi hoti isi bina par ye overbought aur oversold conditions ko identify nhi karta,

calculation and strategy:

aik standard MACD closing prices kay shorter period kay sath12 days EMA 26 days EMA use karta ha jis ko longer periods ma sa subtract kia jata ha, in kay darmian 9 days EMA kay difference sa jo signal line bnti ha us sa hm bullish aur bearish turning points ka signal identify kartay hain, MACD histogram signal line aur MACD kay darmian difference ko kehtay hain, jab histogram zero sa above hogi to positive aur jab zero sa below hogi to negative,

Technical uses of MACD:

MACD ki positive value ye show karti ha kay faster period, shorter period EMA longer period EMA kay above ha jiski waja sa market ka bullish signal milta ha aur jab ye positive value increase hoti ha to is ki waja sa momentum bhi increase hota rehta ha, jab kay negative MACD ki value ye show jarti ha kay faster moving, shorter period EMA longrr period kay below ha jisa sa market ka bearish signal hasil hota ha aur ye negative value momentum kay loose honay ki indication bhi daiti ha, jab kay signal line MACD ma turning point ko zahir karti ha, jab MACD line signal line kay above crossover karti ha to bullish aur jab below crossover karti ha to bearish crossover hota ha, MACD ki center line crossover sa bhi hmain bullish aur bearish signal miltay hain, is kay ilawa MACD divergence kay liay bhi use hota ha

Dear forex member umeed karta hun aap sab khairiyat se honge dear members MACD (Moving Average Convergence Divergence) aik simple oscillating trend aur momentum indicator ha, jisko Gerald Apple na develop kia tha, ye 2 exponential moving averages kay darmian difference calculate kar kay convergance aur divergence ko show karta ha,

Features and working principle:

ye trend indicator kay tor par bhi use hota ha jis sa moving average ka trend define karta ha, is kay ilawa isay momentum indicator bhi use kia jata ha, is ma signal line jo MACD ka moving average hota ha uski help sa hum bullish aur bearish conditions ko identify kartay hain, MACD two lines kay sath plot kia jata ha jo zero line kay above aur below fluctuate karti hain, is kay ilawa MACD Histogram signal line aur MACD kay darmian distance ko indicate karti ha, MACD ma upper aur lower limit nhi hoti isi bina par ye overbought aur oversold conditions ko identify nhi karta,

calculation and strategy:

aik standard MACD closing prices kay shorter period kay sath12 days EMA 26 days EMA use karta ha jis ko longer periods ma sa subtract kia jata ha, in kay darmian 9 days EMA kay difference sa jo signal line bnti ha us sa hm bullish aur bearish turning points ka signal identify kartay hain, MACD histogram signal line aur MACD kay darmian difference ko kehtay hain, jab histogram zero sa above hogi to positive aur jab zero sa below hogi to negative,

Technical uses of MACD:

MACD ki positive value ye show karti ha kay faster period, shorter period EMA longer period EMA kay above ha jiski waja sa market ka bullish signal milta ha aur jab ye positive value increase hoti ha to is ki waja sa momentum bhi increase hota rehta ha, jab kay negative MACD ki value ye show jarti ha kay faster moving, shorter period EMA longrr period kay below ha jisa sa market ka bearish signal hasil hota ha aur ye negative value momentum kay loose honay ki indication bhi daiti ha, jab kay signal line MACD ma turning point ko zahir karti ha, jab MACD line signal line kay above crossover karti ha to bullish aur jab below crossover karti ha to bearish crossover hota ha, MACD ki center line crossover sa bhi hmain bullish aur bearish signal miltay hain, is kay ilawa MACD divergence kay liay bhi use hota ha

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-04-cfe1f26792bb4e98884cee4f8b816cc7.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-03-b4e70e4507ac4578977e56461af09a01.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-05-89bcc16eb76b4d158e0bcc00be800f2f.jpg)

تبصرہ

Расширенный режим Обычный режим