Definition of Internal Rate or Return (IRR Return)

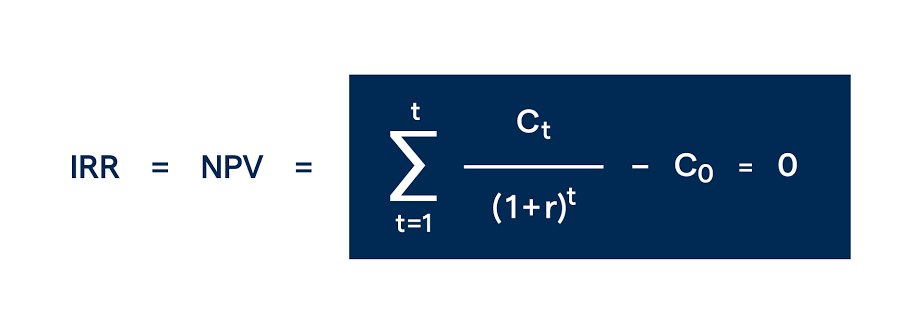

IRR ko ham internal rate or return kehty hain. Es term ko ham investment k uper possible profit k rate ko predict karty hain. Irr ko ham annual growth rate b kehty hain jo hamari investment k uper hasil hota hai. Irr ki value hamy ik formulay k tehat hasil hoti hai or es ka formula npv k same hai. Investment par potential return hasil karny k lae irr ko ideal samja jata hai. So ye other trader ko batata hai k agr wo etni investment karyn gy to es pae unko ketna return hasil ho ga.

IRR Return key Faiday .

Business ko successfully operate karny k lae hamy asi small small terma ko lazmi consider karna chahe. Jo trader en terma ko consider ni karty wo kbi kamyab ni ho paty. So trader ko eska ye beneficial hota hai k wo advance ma market ki value ko calculate karty hain. Agr trader asi terms ko use karny ki knowledge ko hasil ni karty to wo kbi advance ma apni profit ki cost ko ni jan paty. Kuch trader profit k lae bhot concious hoty hain or wo advance ma janana chahty hain k unko ketni ratio hasil hony wali hai.

Stop Limits.

IRR ki madad sy ham loss ko bhi determine karty hain or expected loss ko b well in future predict karny ma kamyab ho sakty hain. Irr ko formulay k zaryae es lae calculate kiya jata hai k analytically find karna bhot mushkil hota hai. Or analytically ham kibi market ki value ko determine ni kar paty.

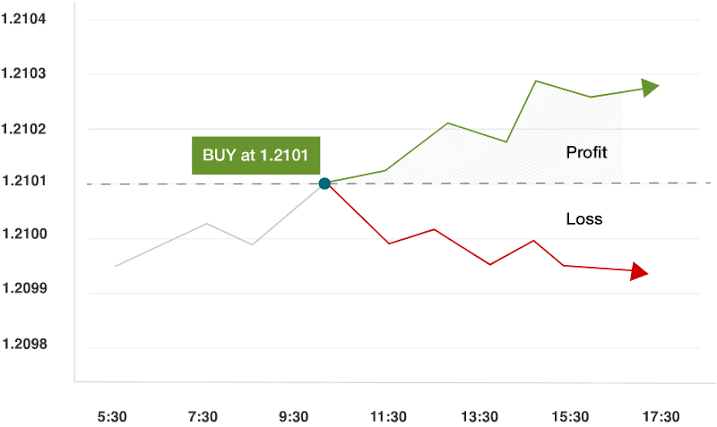

Trading Method IRR Return .

Forex main chahy short term trading ki jaye ya long term trading IRR ka use lazim hota hay kyun keh jab bhi kisi pair main ham trading order place karty hain to iska matlab yehi hota hay keh ham is investment kay zariye return ko bhi judge karain aur jab ham order place karty hain to is main lot size kay through he ham IRR ko control karty hain.

Calculation of IRR Return.

Jab ham investment karty hain to is per har periodically return ko inveatment main say minus karty rehty gain aur is main say tamam expenses ko bhi deduct karty hain is tarah hamain is calculation kay through IRR ka pata chal jata hay jo keh current NPV kay barabar hota hay.

IRR ko ham internal rate or return kehty hain. Es term ko ham investment k uper possible profit k rate ko predict karty hain. Irr ko ham annual growth rate b kehty hain jo hamari investment k uper hasil hota hai. Irr ki value hamy ik formulay k tehat hasil hoti hai or es ka formula npv k same hai. Investment par potential return hasil karny k lae irr ko ideal samja jata hai. So ye other trader ko batata hai k agr wo etni investment karyn gy to es pae unko ketna return hasil ho ga.

IRR Return key Faiday .

Business ko successfully operate karny k lae hamy asi small small terma ko lazmi consider karna chahe. Jo trader en terma ko consider ni karty wo kbi kamyab ni ho paty. So trader ko eska ye beneficial hota hai k wo advance ma market ki value ko calculate karty hain. Agr trader asi terms ko use karny ki knowledge ko hasil ni karty to wo kbi advance ma apni profit ki cost ko ni jan paty. Kuch trader profit k lae bhot concious hoty hain or wo advance ma janana chahty hain k unko ketni ratio hasil hony wali hai.

Stop Limits.

IRR ki madad sy ham loss ko bhi determine karty hain or expected loss ko b well in future predict karny ma kamyab ho sakty hain. Irr ko formulay k zaryae es lae calculate kiya jata hai k analytically find karna bhot mushkil hota hai. Or analytically ham kibi market ki value ko determine ni kar paty.

Trading Method IRR Return .

Forex main chahy short term trading ki jaye ya long term trading IRR ka use lazim hota hay kyun keh jab bhi kisi pair main ham trading order place karty hain to iska matlab yehi hota hay keh ham is investment kay zariye return ko bhi judge karain aur jab ham order place karty hain to is main lot size kay through he ham IRR ko control karty hain.

Calculation of IRR Return.

Jab ham investment karty hain to is per har periodically return ko inveatment main say minus karty rehty gain aur is main say tamam expenses ko bhi deduct karty hain is tarah hamain is calculation kay through IRR ka pata chal jata hay jo keh current NPV kay barabar hota hay.

تبصرہ

Расширенный режим Обычный режим