INTRODUCTION :-

Aslam u alaikum,

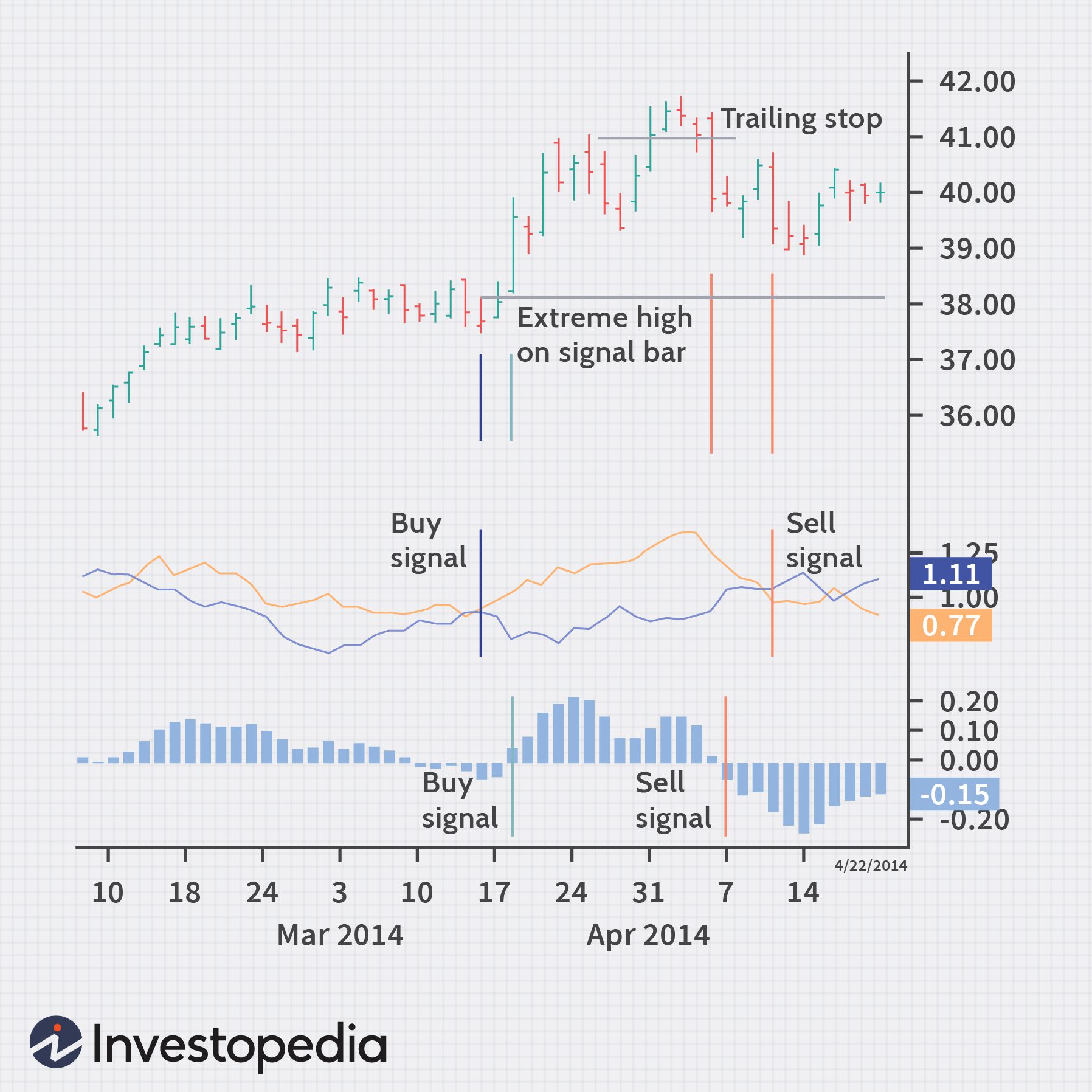

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Forex main trend ko behter samjhna aur isky mutabiq trade karna he acha profit day sakta hay. Different candlesticks patterns ka istemal aur indicators ka use isi maqsad kay liye kia jata hay keh trade aur account ko hata-al-wasah safe rakha jaye aur minimum loss bardasht karna pary.

PURPOSE OF RANGE BOND STRATEGY

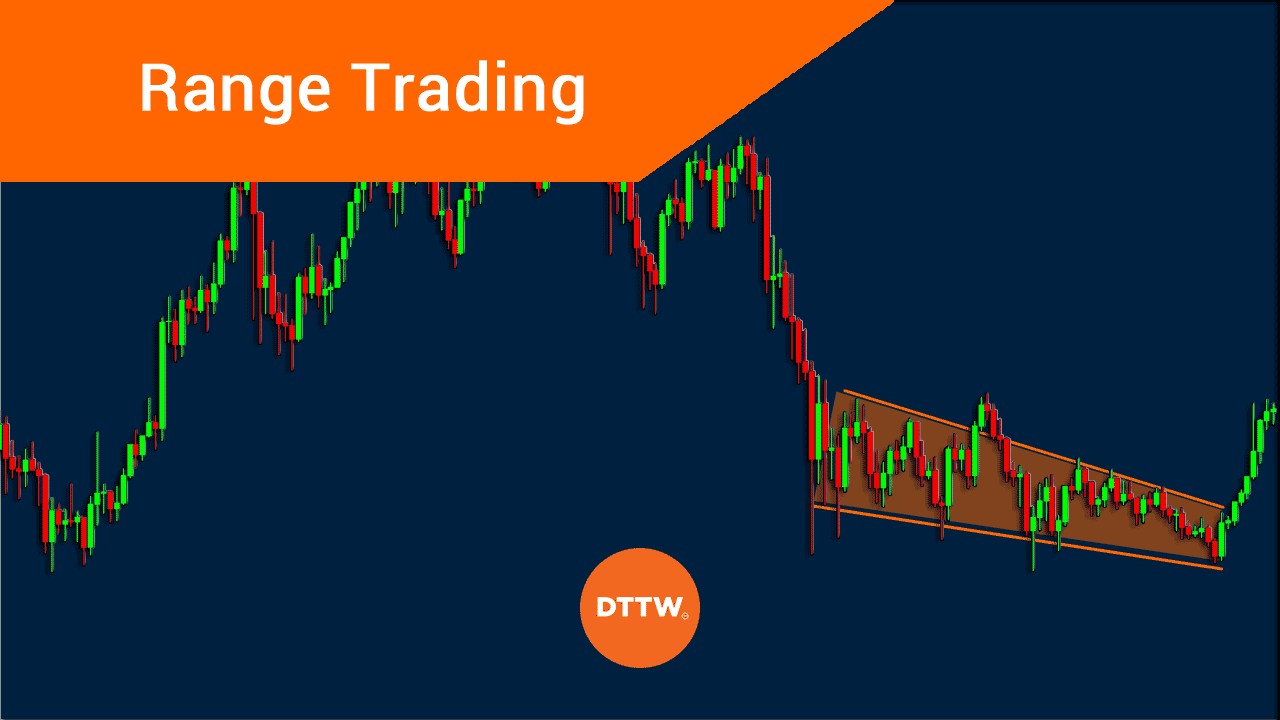

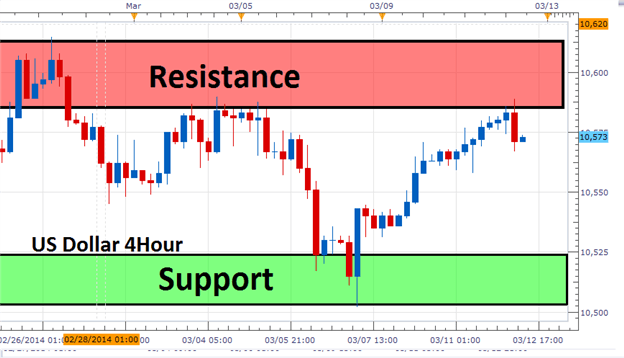

Dear Forex members Range bound strategy ka maqsad market ki last movements ka andaza lagana hota hay. Range ko measure karny kay liye kisi indicator ka ya tool ka auto per use nai kia jata balkeh manually do horizontal lines draw karni hoti hain. Jo market main hony wali last zig zag movements kay tops aur bottoms ko milany kay liye istemal ki jati hain. In lines kay draw karny say hamain support aur resistance level ki nishandahi ho jati hay. Aur jab ham daikhty hain keh market sabqa kuch periods say musalsal isi tarah up down ho rahi hay to ham is movement say acha trading benefit lay sakty hain.

HOW IT WORKS

Friends Jab price in horizontal lines main move karti hui support ko hit ho kar wapas jaye to ham support say kuch pips down stop loss aur upper resistance ko take profit set kar daity hain, aur buy ka order place kar daity hain. Jab hamari trade resistance level tak puhnch kar take profit say hit ho jaye to yahan ab hamain again is movement kay down any ka wait karna hota hay. Jab price resistance say wapas a jaye to resistance say kuch pips up side stop loss jab keh support level tak take profit set karty huye ham sell ka order place kar daity hain. Is tarah ham donon movements main achi trading karty huye earning karty rehty hain.

Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Forex main trend ko behter samjhna aur isky mutabiq trade karna he acha profit day sakta hay. Different candlesticks patterns ka istemal aur indicators ka use isi maqsad kay liye kia jata hay keh trade aur account ko hata-al-wasah safe rakha jaye aur minimum loss bardasht karna pary.

PURPOSE OF RANGE BOND STRATEGY

Dear Forex members Range bound strategy ka maqsad market ki last movements ka andaza lagana hota hay. Range ko measure karny kay liye kisi indicator ka ya tool ka auto per use nai kia jata balkeh manually do horizontal lines draw karni hoti hain. Jo market main hony wali last zig zag movements kay tops aur bottoms ko milany kay liye istemal ki jati hain. In lines kay draw karny say hamain support aur resistance level ki nishandahi ho jati hay. Aur jab ham daikhty hain keh market sabqa kuch periods say musalsal isi tarah up down ho rahi hay to ham is movement say acha trading benefit lay sakty hain.

HOW IT WORKS

Friends Jab price in horizontal lines main move karti hui support ko hit ho kar wapas jaye to ham support say kuch pips down stop loss aur upper resistance ko take profit set kar daity hain, aur buy ka order place kar daity hain. Jab hamari trade resistance level tak puhnch kar take profit say hit ho jaye to yahan ab hamain again is movement kay down any ka wait karna hota hay. Jab price resistance say wapas a jaye to resistance say kuch pips up side stop loss jab keh support level tak take profit set karty huye ham sell ka order place kar daity hain. Is tarah ham donon movements main achi trading karty huye earning karty rehty hain.

تبصرہ

Расширенный режим Обычный режим