**Dow Theory: Ek Nazar**

Dow Theory, stock market ki analysis ke liye aik purani aur maqbool tareeqe ka naam hai. Is theory ko Charles H. Dow ne develop kiya tha, jo Dow Jones & Company ke co-founder aur first editor the. Dow Theory ka maqsad stock market ki trends aur unke potential movements ko samajhna hai. Is theory ki buniyad teen principles par hai:

**1. Market ki Teen Trends**

Dow Theory ke mutabiq, market teen qisam ki trends mein chalti hai:

- **Primary Trend:** Ye long-term trend hoti hai jo ek saal ya usse zyada chal sakti hai. Is trend ko uptrend (bull market) ya downtrend (bear market) ke roop mein dekha ja sakta hai.

- **Secondary Trend:** Ye primary trend ka part hoti hai, lekin ye short-term corrections ya reversals ko represent karti hai. Is trend ki duration kuch hafton se lekar kuch mahino tak hoti hai.

- **Minor Trend:** Ye sabse choti trend hoti hai jo din ya hafton tak chalti hai. Ye minor fluctuations ko show karti hai jo daily trading ya short-term movements ko reflect karti hai.

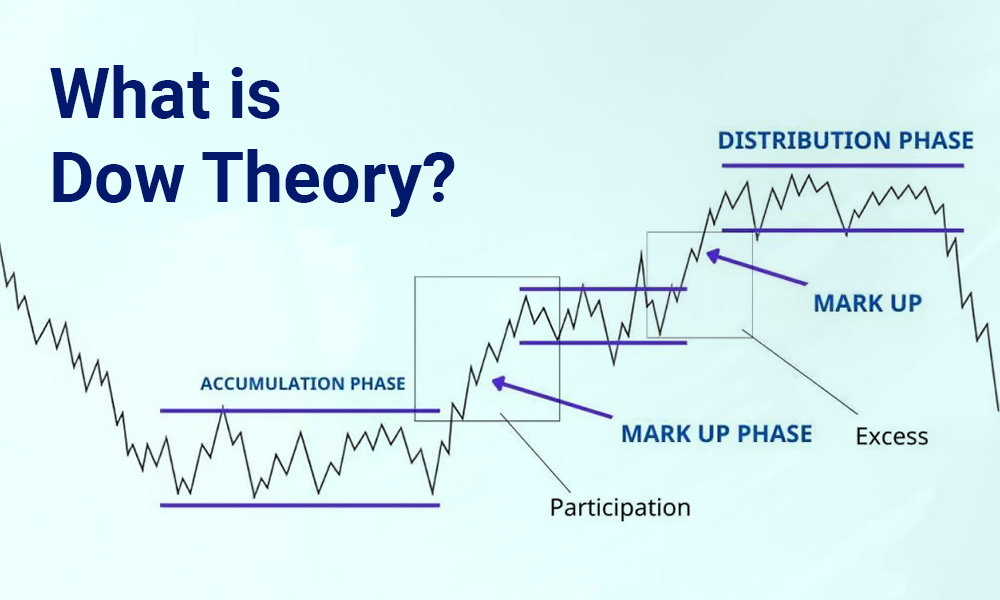

**2. Market ki Three Phases**

Har primary trend ko teen phases mein divide kiya jata hai:

- **Accumulation Phase:** Ye phase tab hota hai jab market ki mood bearish hoti hai lekin savvy investors aur traders stocks ko accumulate karna shuru kar dete hain.

- **Public Participation Phase:** Is phase mein market ka mood bullish hota hai aur majority of investors stocks kharidna shuru kar dete hain. Is period mein prices typically peak karte hain.

- **Distribution Phase:** Is phase mein market ka trend apne peak par hota hai aur institutional investors apne holdings ko distribute karte hain. Prices phir se girna shuru ho sakti hain.

**3. Confirmation ka Principle**

Dow Theory ke mutabiq, market ke movements ko confirm karne ke liye, do alag indices (jaise Dow Jones Industrial Average aur Dow Jones Transportation Average) ko dekhna zaroori hota hai. In dono indices ko same trend ko show karna chahiye taake ek trend ki confirmation ho sake.

Dow Theory ko samajhkar, traders aur investors market ki broader trends aur unke future movements ko behtar tarike se anticipate kar sakte hain. Ye theory stock market analysis ke liye ek strong foundation provide karti hai aur iski principles aaj bhi trading aur investment decisions mein use hoti hain.

Dow Theory, stock market ki analysis ke liye aik purani aur maqbool tareeqe ka naam hai. Is theory ko Charles H. Dow ne develop kiya tha, jo Dow Jones & Company ke co-founder aur first editor the. Dow Theory ka maqsad stock market ki trends aur unke potential movements ko samajhna hai. Is theory ki buniyad teen principles par hai:

**1. Market ki Teen Trends**

Dow Theory ke mutabiq, market teen qisam ki trends mein chalti hai:

- **Primary Trend:** Ye long-term trend hoti hai jo ek saal ya usse zyada chal sakti hai. Is trend ko uptrend (bull market) ya downtrend (bear market) ke roop mein dekha ja sakta hai.

- **Secondary Trend:** Ye primary trend ka part hoti hai, lekin ye short-term corrections ya reversals ko represent karti hai. Is trend ki duration kuch hafton se lekar kuch mahino tak hoti hai.

- **Minor Trend:** Ye sabse choti trend hoti hai jo din ya hafton tak chalti hai. Ye minor fluctuations ko show karti hai jo daily trading ya short-term movements ko reflect karti hai.

**2. Market ki Three Phases**

Har primary trend ko teen phases mein divide kiya jata hai:

- **Accumulation Phase:** Ye phase tab hota hai jab market ki mood bearish hoti hai lekin savvy investors aur traders stocks ko accumulate karna shuru kar dete hain.

- **Public Participation Phase:** Is phase mein market ka mood bullish hota hai aur majority of investors stocks kharidna shuru kar dete hain. Is period mein prices typically peak karte hain.

- **Distribution Phase:** Is phase mein market ka trend apne peak par hota hai aur institutional investors apne holdings ko distribute karte hain. Prices phir se girna shuru ho sakti hain.

**3. Confirmation ka Principle**

Dow Theory ke mutabiq, market ke movements ko confirm karne ke liye, do alag indices (jaise Dow Jones Industrial Average aur Dow Jones Transportation Average) ko dekhna zaroori hota hai. In dono indices ko same trend ko show karna chahiye taake ek trend ki confirmation ho sake.

Dow Theory ko samajhkar, traders aur investors market ki broader trends aur unke future movements ko behtar tarike se anticipate kar sakte hain. Ye theory stock market analysis ke liye ek strong foundation provide karti hai aur iski principles aaj bhi trading aur investment decisions mein use hoti hain.

تبصرہ

Расширенный режим Обычный режим