"how to use bearish spinning top candlestick pattern"

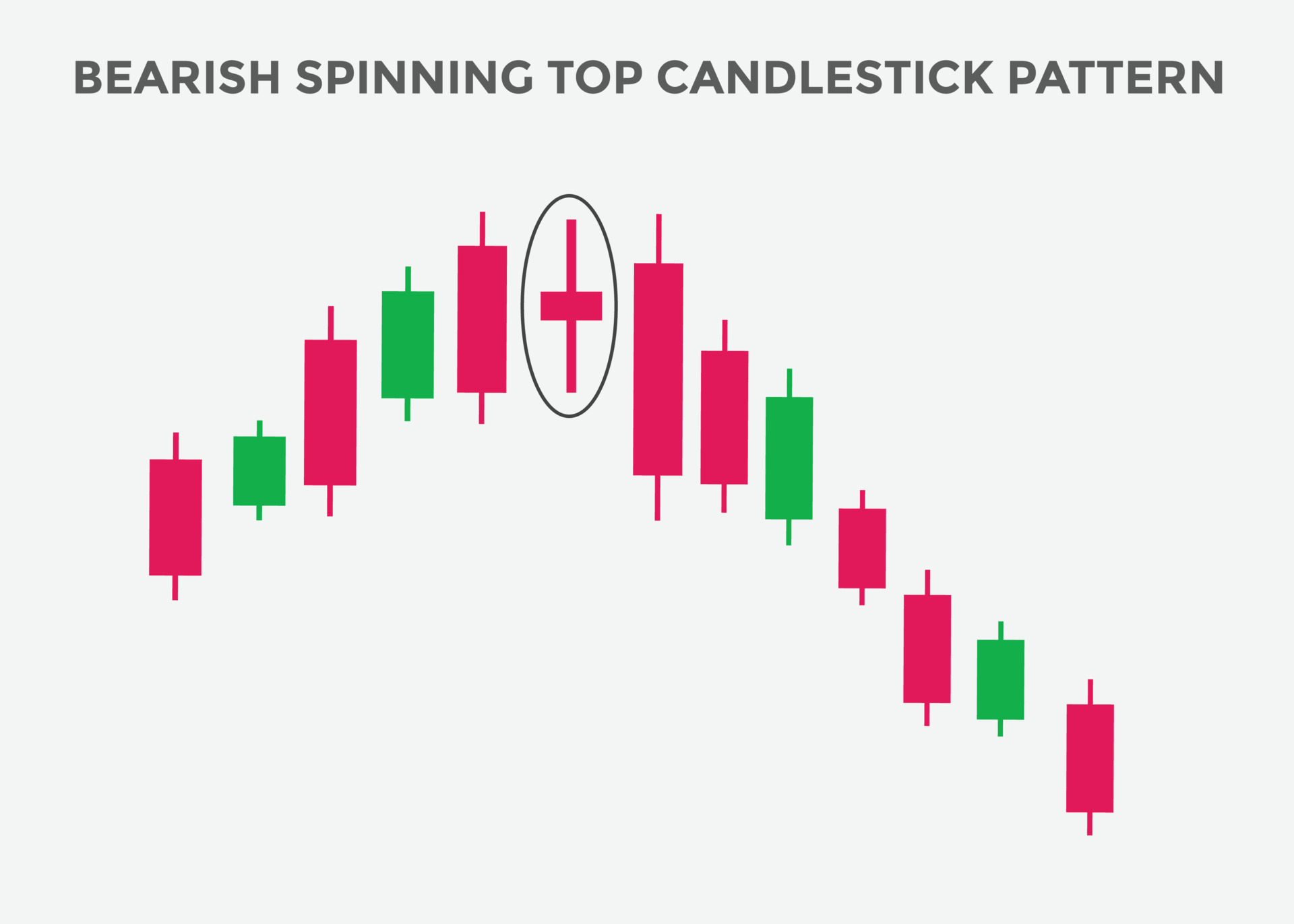

Bearish Spinning Top candlestick pattern ek technical analysis tool hai jo traders ko market sentiment ke changes ke bare mein suchit karta hai, khaas kar ke bearish reversal ke context mein. Yeh pattern ek single candlestick se pehchana ja sakta hai, jismein chhoti si body aur upper aur lower wicks hote hain.

1. Identification of Bearish Spinning Top:

2. Confirmation of Market Conditions:

3. Look for Confirmation Signals:

4. Placement of Stop Loss and Take Profit Levels:

5. Risk Management:

6. Stay Informed:

Bearish Spinning Top pattern ke istemal se pehle, traders ko hamesha yeh yaad rakhna chahiye ke kisi bhi single indicator ya pattern par pura bharosa na karein. Hamesha comprehensive analysis, market conditions, aur risk management ko mad-e-nazar rakhein taki sahi trading decisions liye ja sakein.

Bearish Spinning Top candlestick pattern ek technical analysis tool hai jo traders ko market sentiment ke changes ke bare mein suchit karta hai, khaas kar ke bearish reversal ke context mein. Yeh pattern ek single candlestick se pehchana ja sakta hai, jismein chhoti si body aur upper aur lower wicks hote hain.

1. Identification of Bearish Spinning Top:

- Pehli cheez jo trader ko karni chahiye, woh hai bearish spinning top ko pehchan'na. Yeh candlestick ek choti si body ke saath aata hai jismein upper aur lower wicks hote hain. Body ke rang se yeh pata chalta hai ke sellers control mein hain.

2. Confirmation of Market Conditions:

- Bearish Spinning Top pattern ko dekhte waqt, zaroori hai ke trader market ke overall conditions ko bhi mad-e-nazar rakhe. Agar yeh pattern uptrend ke baad aata hai, toh yeh bearish reversal signal ho sakta hai. Lekin, market context ko confirm karne ke liye doosre technical indicators ya patterns ka istemal bhi zaroori hai.

3. Look for Confirmation Signals:

- Trading decisions ko confirm karne ke liye, traders ko doosre technical indicators ka istemal karna chahiye. For example, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), aur doosre momentum indicators. Yeh confirm karta hai ke market mein actual weakness hai.

4. Placement of Stop Loss and Take Profit Levels:

- Agar trader Bearish Spinning Top pattern ko confirm karta hai, toh usay apne trade ke liye stop loss aur take profit levels set karna chahiye. Stop loss aur take profit levels trade ko manage karne mein madad karte hain aur risk ko control mein rakhte hain.

5. Risk Management:

- Har trading strategy mein risk management ka ek crucial hissa hota hai. Bearish Spinning Top pattern ke istemal mein bhi, trader ko apne risk ko control karne ke liye ek sahih risk management plan banakar us par amal karna chahiye.

6. Stay Informed:

- Market conditions hamesha mein tabdeel hoti rehti hain, isliye trader ko market ke latest updates par bane rehna chahiye. Isse woh apni strategy ko adjust kar sakein, agar zarurat ho.

Bearish Spinning Top pattern ke istemal se pehle, traders ko hamesha yeh yaad rakhna chahiye ke kisi bhi single indicator ya pattern par pura bharosa na karein. Hamesha comprehensive analysis, market conditions, aur risk management ko mad-e-nazar rakhein taki sahi trading decisions liye ja sakein.

تبصرہ

Расширенный режим Обычный режим