Assalamu Alaikum! dear member Main ummid Karti hun, aap sab khairiyat se Honge aur Apna Achcha kam kar rahe Honge. Jab aap ismein kam karte hain to aapko daily ka target complete karna hota hai aur hard work ke sath kam karna hota hai. agar aap ismein hard work Nahin Karenge to aap kabhi bhi successful trading nahin kar sakte, isliye aapko market Mein different important analysis per completely study Karni chahie aur Market ko acchi tarike se focus karna chahie jitne acchi analysis ke sath aap is market Mein trading Karenge aapko itna hi Achcha result milega. main aaj aapse bahut hi important information share karungi, jo aapki trading ko profit table banaa sakti hai to Mera topic hai inverted hammer candlestick pattern kya hai Ham is per Kaise trading ko profitable banaa sakte hain.

Inverted hammer Candlesitck pattern !

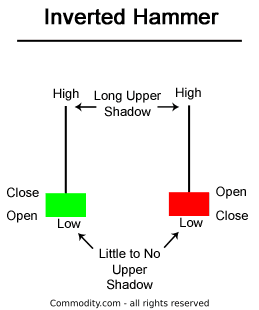

Inverted hammer candlestick Ek long upper Tel ke sath short body ki ek single candle take pattern Hai Jiska open or close price Ek dusre ke kareeb Hona chahie yah candle Dekhne Mein do ji candles Ki Tarah Lagti Hai but do ji candlestick se different Hoti Hai Kyunki do ji candles take Mein body Banti hi nahin hai aur ismein short body Hoti Hai inverted hammer ki ek long Appa Tel lower price ki is baat ka Ishara Karti Hai Ki Ab Yahan Se price reject ho gai hai is vajah se vah dusri reversal Se Mat Mein Apne trend ki ko continue Karti Hai ismein trend ki sim mat change hoti hai balki jo candles take hammer banti hai uske Tel ki sem side per trend start hota hai inverted hammer inverted hammer candlestick pattern bullish aur Veeresh donon Tarah Ki candles mein ho sakti hai lekin market aur price ke Jyada lower area Mein hone ki vajah se yah Bullish trend reversal ky liye Jyada famous candle hai.

Formation !

Invited hammer candlestick price ke bottom mein jyada supply aur kam demand ke result mein vajud mein Aati Hai yah candle ek strong reversal ke liye Jaani jaati hai jo ki down word side mein kisi bhi color ki real body mein ho sakti hai candles ki formation darja Zail tara se ho sakti hain.

Inverted hammer candlestick Agar price ke bottom Mein Banti Hai Tujhe bullish ya Veeresh donon Mein Se Jis color mein bhi Ban Jaaye ya bullish candle ki tasawar ki Jaati Hai Kyunki yah point trend reversal ki position ho sakti hai candles ke liye price ki position zaroori hai color Nahin Hai.

Explanation !

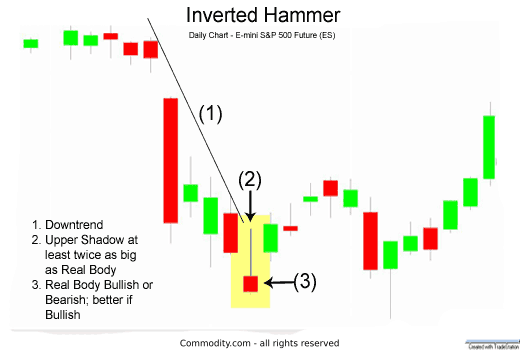

Inverted hammer candlestick price chart per mostly bottom your top price per Najar aati hai aur Aksar Kisi position price reversal Ho Jaati Hai yah candle Ek Safai ki condition Mein Najar Aati Hai Jab Bhi Kisi strong news ki vajah se price Teji ke sath down world fall karne ke bad Wapas Apne Upar open price ke kareeb ja kar clos Hoti Hai To yah candle Ek long upper Shadow ke sath Hoti Hai Jiske lower side per Ek Saman real body Hoti Hai candle ke lower side per Sambhal Vik Banane se candle ki performers per Koi Asar Nahin padta hai lekin Jyada Lamba Shadow Banane se candles ki Yad natural Ho Jaati Hain real body ka color Kisi Khas pattern Ka Hona Jaruri Nahin Hai Lekin is Candle ki lower price Mein Hona Jyada important hai Dekhne Mein yah candle bottom price per banne wali Dragonfly doji candle ki Hi ulat Lagti Hai.

Trading !

Inverted hammer candles price ke bottom mein jyada Veeresh pressure padane per banti hai jisse ek Saman real body hi candle ke upper side per Ek Lamba Saya hota hai jo ki candles ke real body se takriban doguna ya usse Bhi Jyada banta hai yah candle ek strong bullish single signal generate Karti Hai Jis per confirmation ke bad bye ki entry ki Ja sakti hai confirmation candles kabalesh real body Mein Hona jaruri hai Jab Ke standard banne se yah candle invalid Ho Jaati Hai CCI RSI indicator aur oscillator per value Karni chahie yah confirmation Aur Bhi Jyada mostahik hai kam hoti hai.

Inverted hammer Candlesitck pattern !

Inverted hammer candlestick Ek long upper Tel ke sath short body ki ek single candle take pattern Hai Jiska open or close price Ek dusre ke kareeb Hona chahie yah candle Dekhne Mein do ji candles Ki Tarah Lagti Hai but do ji candlestick se different Hoti Hai Kyunki do ji candles take Mein body Banti hi nahin hai aur ismein short body Hoti Hai inverted hammer ki ek long Appa Tel lower price ki is baat ka Ishara Karti Hai Ki Ab Yahan Se price reject ho gai hai is vajah se vah dusri reversal Se Mat Mein Apne trend ki ko continue Karti Hai ismein trend ki sim mat change hoti hai balki jo candles take hammer banti hai uske Tel ki sem side per trend start hota hai inverted hammer inverted hammer candlestick pattern bullish aur Veeresh donon Tarah Ki candles mein ho sakti hai lekin market aur price ke Jyada lower area Mein hone ki vajah se yah Bullish trend reversal ky liye Jyada famous candle hai.

Formation !

Invited hammer candlestick price ke bottom mein jyada supply aur kam demand ke result mein vajud mein Aati Hai yah candle ek strong reversal ke liye Jaani jaati hai jo ki down word side mein kisi bhi color ki real body mein ho sakti hai candles ki formation darja Zail tara se ho sakti hain.

Inverted hammer candlestick Agar price ke bottom Mein Banti Hai Tujhe bullish ya Veeresh donon Mein Se Jis color mein bhi Ban Jaaye ya bullish candle ki tasawar ki Jaati Hai Kyunki yah point trend reversal ki position ho sakti hai candles ke liye price ki position zaroori hai color Nahin Hai.

Explanation !

Inverted hammer candlestick price chart per mostly bottom your top price per Najar aati hai aur Aksar Kisi position price reversal Ho Jaati Hai yah candle Ek Safai ki condition Mein Najar Aati Hai Jab Bhi Kisi strong news ki vajah se price Teji ke sath down world fall karne ke bad Wapas Apne Upar open price ke kareeb ja kar clos Hoti Hai To yah candle Ek long upper Shadow ke sath Hoti Hai Jiske lower side per Ek Saman real body Hoti Hai candle ke lower side per Sambhal Vik Banane se candle ki performers per Koi Asar Nahin padta hai lekin Jyada Lamba Shadow Banane se candles ki Yad natural Ho Jaati Hain real body ka color Kisi Khas pattern Ka Hona Jaruri Nahin Hai Lekin is Candle ki lower price Mein Hona Jyada important hai Dekhne Mein yah candle bottom price per banne wali Dragonfly doji candle ki Hi ulat Lagti Hai.

Trading !

Inverted hammer candles price ke bottom mein jyada Veeresh pressure padane per banti hai jisse ek Saman real body hi candle ke upper side per Ek Lamba Saya hota hai jo ki candles ke real body se takriban doguna ya usse Bhi Jyada banta hai yah candle ek strong bullish single signal generate Karti Hai Jis per confirmation ke bad bye ki entry ki Ja sakti hai confirmation candles kabalesh real body Mein Hona jaruri hai Jab Ke standard banne se yah candle invalid Ho Jaati Hai CCI RSI indicator aur oscillator per value Karni chahie yah confirmation Aur Bhi Jyada mostahik hai kam hoti hai.

تبصرہ

Расширенный режим Обычный режим