Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge aur forex market sa daily basis per acha gain hasil ker raha hon ga. Dear trader forex market ak bari market ha jis man price ki movement bhot zayada hoti ha ager trader lalach ki waja sa stoploss ka use nahe kerta ya stoploss ko mind man rukhta howa lotsize ki selection nahe kerta to is sa trader ko bjot loss hota ha. Is liye traders her trade k sath Stoploss aur Take Profit ka use karen. Aj man apka sath bhot important Chart Pattern k bara man apna knowledge share kerta hon.

Importance of Chart Pattern:

Dear Friends Market price chart price ki actual movement ko bhot accuracy k sath identify kerta ha. Chart pattern ak bhot important technical tool ha jo trader price chart man Trade Entry aur Trade Exit ko accuracy k sath identify kerna man help kerta hai.

Tripple Top Chart Pattern:

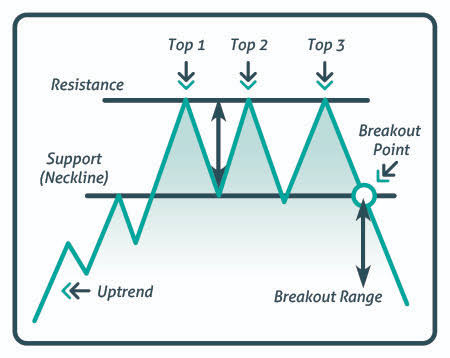

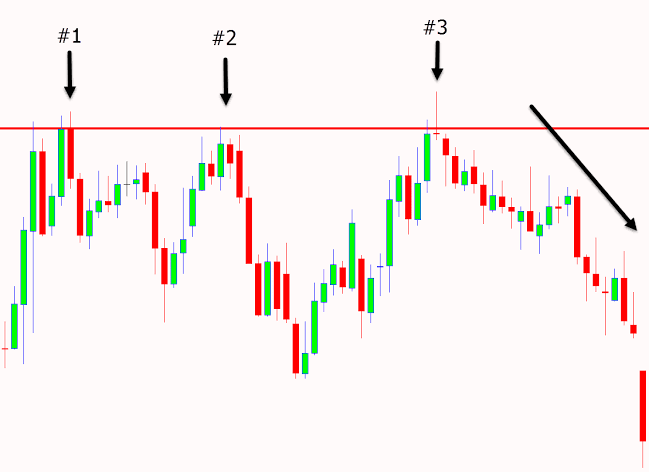

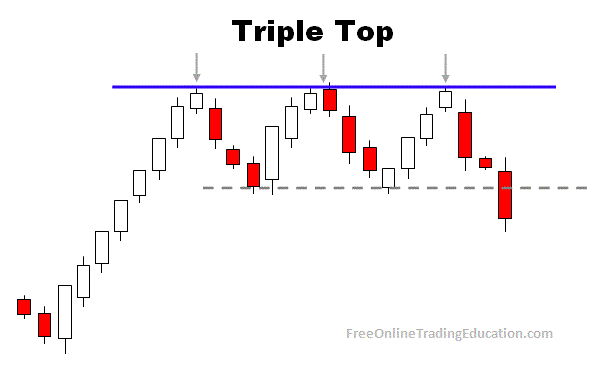

Dear Friends Tripple Top Chart Pattern man market price three same hight ki peaks banati ha aur uska bad market price long down fall man jati ha. Is pattern man buyer three time market price ko oper le jana ki koshish kerta han lakin hold nahe ker pata aur sellers price nicha le atta ha. Buyers k three attempts kerna k bad sellers completely market ko apni direction man move kerwata ha. Ye pattern hamasha long bullish trend k bad banna to zayada effective hota hai.

Identification of Triple Top Chart Pattern:

Dear Friends Triple Top Chart Pattern man buyers long bullish trend k bad weak ho chuka hota han aur wo market price three times oper le jata han lakin weak hona ki waja sa hold nahe ker pata aur jab third time sellers price ko nicha le ker atta han to price long fall kerti han. Is pattern man teeno tops same level sa start hota han. Ager teeno tops k start ko ak trend line sa jora jae to is line ko ""Neckline"" kahen ga. Jo is pattern per Trading kerna k liye bhot important hai.

Trading with Tripple Top Chart Pattern:

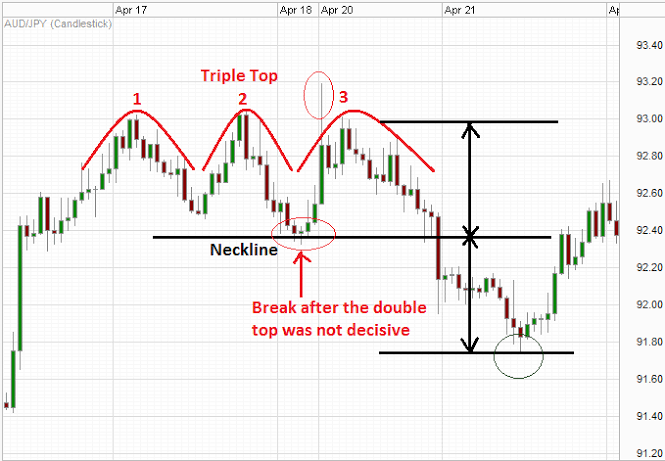

Dear Friends Tripple Top Chart Pattern per trading knliye trader ""Neckline"" k Breakout ka wait kerta ha. Jab price neckline sa nicha candle ka close deti han to is sa breakout ki confirmation ho jati ha lakin is per trader ko trade active nahe kerni chaheye q k breakout per trade ki confirmation nahe hoti ha. Is liye trader jab price neckline ko re-test kerna ka liye ae to retest kerna k bad trader ko ""Sell ki Trade"" active kerni chaheye. Stoploss ko is pattern ki last top sa 6 pips oper place karen aur Take Profit ko Top aur neckline k dermiyan distance k baraber nicha place karen.

Dear Friends Tripple Top Chart Pattern ki mazeed confimation k liye iska sath technical indicator ka use kia ja sakta ha. Is pattern k sath ager trader Relatve Strength Index Indicator ko use ker raha ha to is pattern ki third peak banna k doran jab price oper ja rahe ho to RSI line nicha ki taraf move ho rahe ho. Ye is pattern per trade ki confirmation hai.

Dear forex member umeed karta hun aap sab khairiyat se honge aur forex market sa daily basis per acha gain hasil ker raha hon ga. Dear trader forex market ak bari market ha jis man price ki movement bhot zayada hoti ha ager trader lalach ki waja sa stoploss ka use nahe kerta ya stoploss ko mind man rukhta howa lotsize ki selection nahe kerta to is sa trader ko bjot loss hota ha. Is liye traders her trade k sath Stoploss aur Take Profit ka use karen. Aj man apka sath bhot important Chart Pattern k bara man apna knowledge share kerta hon.

Importance of Chart Pattern:

Dear Friends Market price chart price ki actual movement ko bhot accuracy k sath identify kerta ha. Chart pattern ak bhot important technical tool ha jo trader price chart man Trade Entry aur Trade Exit ko accuracy k sath identify kerna man help kerta hai.

Tripple Top Chart Pattern:

Dear Friends Tripple Top Chart Pattern man market price three same hight ki peaks banati ha aur uska bad market price long down fall man jati ha. Is pattern man buyer three time market price ko oper le jana ki koshish kerta han lakin hold nahe ker pata aur sellers price nicha le atta ha. Buyers k three attempts kerna k bad sellers completely market ko apni direction man move kerwata ha. Ye pattern hamasha long bullish trend k bad banna to zayada effective hota hai.

Identification of Triple Top Chart Pattern:

Dear Friends Triple Top Chart Pattern man buyers long bullish trend k bad weak ho chuka hota han aur wo market price three times oper le jata han lakin weak hona ki waja sa hold nahe ker pata aur jab third time sellers price ko nicha le ker atta han to price long fall kerti han. Is pattern man teeno tops same level sa start hota han. Ager teeno tops k start ko ak trend line sa jora jae to is line ko ""Neckline"" kahen ga. Jo is pattern per Trading kerna k liye bhot important hai.

Trading with Tripple Top Chart Pattern:

Dear Friends Tripple Top Chart Pattern per trading knliye trader ""Neckline"" k Breakout ka wait kerta ha. Jab price neckline sa nicha candle ka close deti han to is sa breakout ki confirmation ho jati ha lakin is per trader ko trade active nahe kerni chaheye q k breakout per trade ki confirmation nahe hoti ha. Is liye trader jab price neckline ko re-test kerna ka liye ae to retest kerna k bad trader ko ""Sell ki Trade"" active kerni chaheye. Stoploss ko is pattern ki last top sa 6 pips oper place karen aur Take Profit ko Top aur neckline k dermiyan distance k baraber nicha place karen.

Dear Friends Tripple Top Chart Pattern ki mazeed confimation k liye iska sath technical indicator ka use kia ja sakta ha. Is pattern k sath ager trader Relatve Strength Index Indicator ko use ker raha ha to is pattern ki third peak banna k doran jab price oper ja rahe ho to RSI line nicha ki taraf move ho rahe ho. Ye is pattern per trade ki confirmation hai.

تبصرہ

Расширенный режим Обычный режим