Aslam u alaikum,

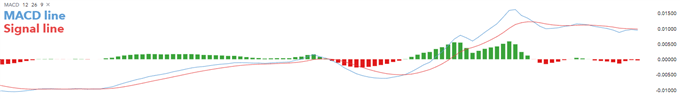

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Moving average convergence divergence aik technical tool hey jes ke mdad say market mein serf exponential moving average ko indentify karnay mein madad dayta hey hey MACD aik nele ling or signal line red line kay sath indicate kea geya hey or aik histogram sabz dekhata hey MACD line or signal line kay darmean mein wakay hey

MACD lines jo keh 2 taiz lines kay darmean difference ko indicate karte hey jo keh exponential level moving average hote hey jo keh 12 or 26 hota hey jab keh signal lines aam tor par average line period hote hey

MACD lines 0 lines kay andar or es kay ass pass dagmate hein yeh MACD ko aik oscillator ke khsoseaat ko indicate karte hein jo ke beltarteeb 0 line kay opar or nechay over sold or over bought kay signal daytay hein

Moving Average Convergence Divergence ke pemaish;

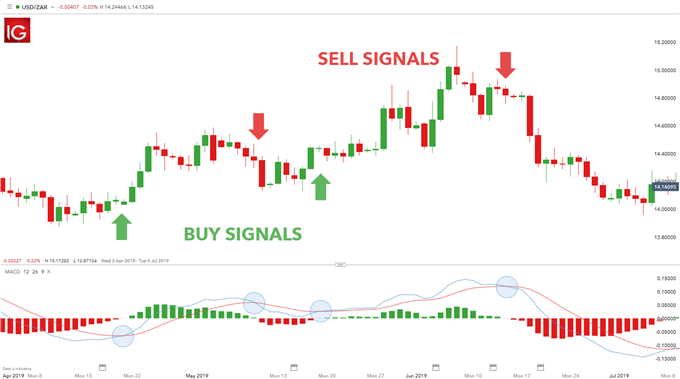

Moving Average aik convergence divergence indicator hey jo keh reference point ko estamal kar kay trend ke strength ka idea dayta hey jab keh moving average convergence divergence 0 line say opar cross karte hey or yeh up trend ka signal dayte hey

jab MACD line 0 line kay nechay say cross karte hey to yeh mechay ke taraf signal dayta hey

es kay elawa MACD kay signal buy ya sell kay rder daytay hein jo os wakt dey jatay hein jab 2 MACD lines apas mein guzar jate hein

Jab MACD lines signal lines kay par say guzarte hein to buy kay signal kay tor par estaml karte hein

Jab MACD lines signal lines kay nechay say guzarte hey to yeh sell signal kay tor estamal karte hein

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Moving average convergence divergence aik technical tool hey jes ke mdad say market mein serf exponential moving average ko indentify karnay mein madad dayta hey hey MACD aik nele ling or signal line red line kay sath indicate kea geya hey or aik histogram sabz dekhata hey MACD line or signal line kay darmean mein wakay hey

MACD lines jo keh 2 taiz lines kay darmean difference ko indicate karte hey jo keh exponential level moving average hote hey jo keh 12 or 26 hota hey jab keh signal lines aam tor par average line period hote hey

MACD lines 0 lines kay andar or es kay ass pass dagmate hein yeh MACD ko aik oscillator ke khsoseaat ko indicate karte hein jo ke beltarteeb 0 line kay opar or nechay over sold or over bought kay signal daytay hein

Moving Average Convergence Divergence ke pemaish;

Moving Average aik convergence divergence indicator hey jo keh reference point ko estamal kar kay trend ke strength ka idea dayta hey jab keh moving average convergence divergence 0 line say opar cross karte hey or yeh up trend ka signal dayte hey

jab MACD line 0 line kay nechay say cross karte hey to yeh mechay ke taraf signal dayta hey

es kay elawa MACD kay signal buy ya sell kay rder daytay hein jo os wakt dey jatay hein jab 2 MACD lines apas mein guzar jate hein

Jab MACD lines signal lines kay par say guzarte hein to buy kay signal kay tor par estaml karte hein

Jab MACD lines signal lines kay nechay say guzarte hey to yeh sell signal kay tor estamal karte hein

تبصرہ

Расширенный режим Обычный режим