Aslam u alaikum,

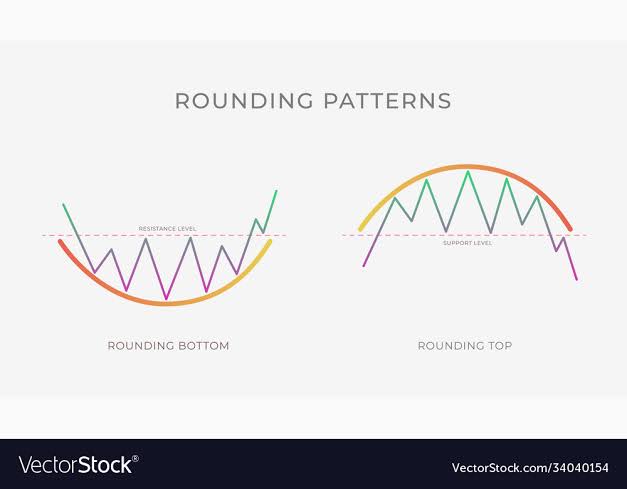

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Forex trading main market ki movement ko samjhny k liy chart pattern ki buht importance ha. In patterns main round bottom aik important pattern hai. Ager ap is pattern ki understanding lay laity hain to ap ki trading decisions making accuracy increase ho jati hai. Aj main ap say round bottom chart pattern ka knowledge share krna chata hoon.

How to identify round bottom pattern:

Dear friends, Jab market downward movement krti howi nechy at hai, aur dobara upward movement start kr daiti hai, is slow movement ki waja say, aik round shape banti hai, is liy, is pattern ko rounding bottom pattern kehty hain.

Yah pattern is waja say banta hai qk jab market downward movement krti hai lakin support level ko break no kr sakti, to round bottom pattern banta hai. Support level per aa kr market movement slow ho jati hai. Is slow movement ki waja say chart pattern round shape me banta hai. Is liy is pattern ko round bottom pattern kehty hain.

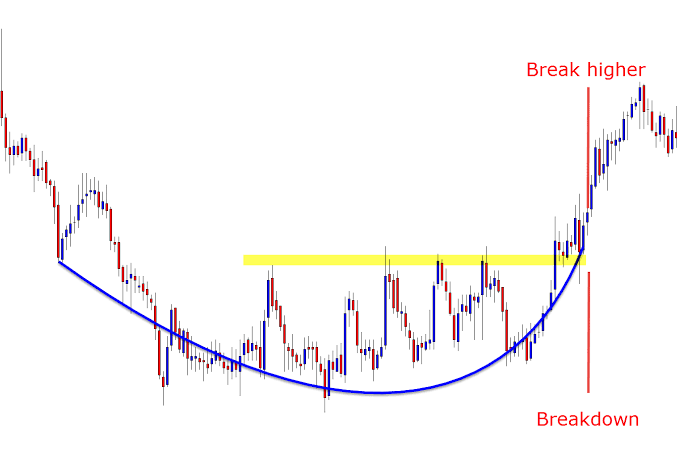

How to trade on round bottom pattern formation:

Dear forex members, round bottom pattern market k aik strong support level k oper banta hai qk market is level ko break ni kr sakti, to yah ap ko, aik buying opportunity provide krta hai.

Money management:

Dear forex members, Forex trading aik risky business hai, is me ap ko kabi bi, aik pattern daikh k trade ni lagani chaiy, Bal k aik aur confirmation zaror lay laini chaiy. Is tarah ap nuksan say bach sakty hain. Risk to reward ratio ko follow karke hi ap long term trading kar sakte hain.

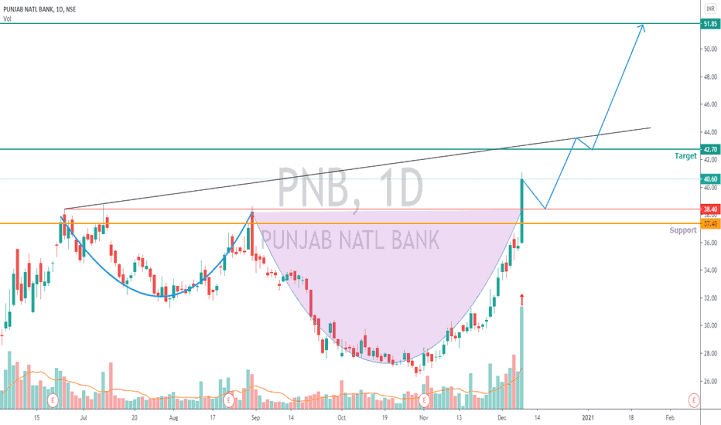

Chart:

Dear forex members, Nechy diy gay chart me ap clearly round bottom chart pattern ko daikh sakty hain. Agr ap is pattern ki clear understanding lay laity hain to ap ko trade krny main buht asani hogi.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Forex trading main market ki movement ko samjhny k liy chart pattern ki buht importance ha. In patterns main round bottom aik important pattern hai. Ager ap is pattern ki understanding lay laity hain to ap ki trading decisions making accuracy increase ho jati hai. Aj main ap say round bottom chart pattern ka knowledge share krna chata hoon.

How to identify round bottom pattern:

Dear friends, Jab market downward movement krti howi nechy at hai, aur dobara upward movement start kr daiti hai, is slow movement ki waja say, aik round shape banti hai, is liy, is pattern ko rounding bottom pattern kehty hain.

Yah pattern is waja say banta hai qk jab market downward movement krti hai lakin support level ko break no kr sakti, to round bottom pattern banta hai. Support level per aa kr market movement slow ho jati hai. Is slow movement ki waja say chart pattern round shape me banta hai. Is liy is pattern ko round bottom pattern kehty hain.

How to trade on round bottom pattern formation:

Dear forex members, round bottom pattern market k aik strong support level k oper banta hai qk market is level ko break ni kr sakti, to yah ap ko, aik buying opportunity provide krta hai.

Money management:

Dear forex members, Forex trading aik risky business hai, is me ap ko kabi bi, aik pattern daikh k trade ni lagani chaiy, Bal k aik aur confirmation zaror lay laini chaiy. Is tarah ap nuksan say bach sakty hain. Risk to reward ratio ko follow karke hi ap long term trading kar sakte hain.

Chart:

Dear forex members, Nechy diy gay chart me ap clearly round bottom chart pattern ko daikh sakty hain. Agr ap is pattern ki clear understanding lay laity hain to ap ko trade krny main buht asani hogi.

:max_bytes(150000):strip_icc():format(webp)/RoundingBottom2-0a1514186d454d4b9e4fba32aed39f24.png)

تبصرہ

Расширенный режим Обычный режим