Market ky technical analysis kerny ky liay different types ky technical indicators available hain jin ki madad sy ham market ka current aur overall trend find ker ky trade open aur continue ker sakty haiin agar market per koi fundamental effect na ho raha ho tou market hamesha technical movement kerti rehti hai ky hamain trade open aur continue kerny ky liay market ky technical analysis kerna perty hain jis ky liay ham trading tools ky sath sath different technical indicators use kerty hain jin main moving average ky sath sath relative strength index maximum traders use kerty hain jo market ky chart main by default set hoty hain lekin in ky elawa bhi bahot sary technical indicators hain lekin ham yahan per MACD technical indicator ko discuss kerny ja rehy hain

MACD technical indicator !

MACD stand for moving average convergence and divergence yeh aik technical indicator hai jo market ki movement ki strength ky sath sath market ki convergence aur divergence ko show kerta hai jis ko follow kerty huey ham market main trade enter kerty hain same indicator main market ki bullish aur bearish power bhi show ho rehi hoti hai ky agar market upward movement ker rehi hai tou same indicator main market centre line sy upward hoti hai aur jesy jesy market ka uptrend apni strength ko decrease kerta hai tou same indicator main bhi strength decrease hona shoru ho jati hai aur market ki position centre line ky qareeb aa jati hai aur jesy hi same line upper side sy cross ho ker lower side per shift ho jati hai tou same time per market ky bullish trend main retracement hoti hai jis ki strength bhi hamain same indicator main show ho jati hai

Forex trading with MACD indicator !

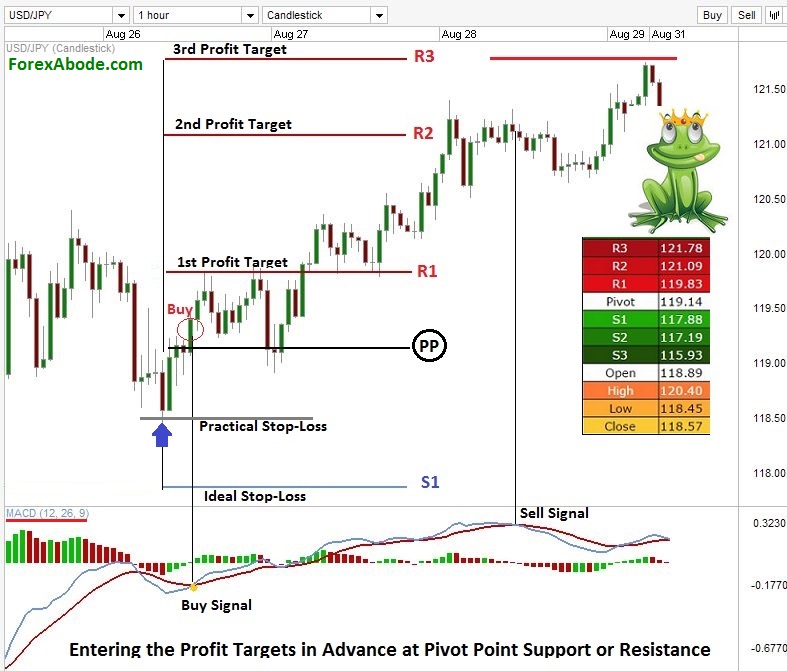

Jab ham forex market main trading ky liay MACD indicator ko use ker rehy hoty hain tou hamain is bat ko mind main rakhna chahiay ky jesy hi market centre line ko cross ker rehi ho tou hamain bhi same direction main trade open ker leni chahiay aur same open trade ko ham tab tak continue ker sakty hain jab tak same side per market ki movement ki strength decrease nehi hoti aur jab same strength decrease hoty hoty market centre line ky qareeb ponch jati hai tou ham same open trade ko close ker dety hain aur agar phir sy centre line cross kery tou ham new direction ky mutabiq trade open ker ky continue ker sakty hain jo MACD main strength decrease hony tak continue rakh sakty hain

Secure Trading MACD !

Jab ham MACD indicator ko use kerty huey trade open ker lety hain ky market jab centre line ko cross ker ky downward ya upward movement ki strength ko change kerti hai aur ham trade open ker lety hain tou aesi trade ko bhi hamain secure kerny ky liay her surat stop loss set kerna chahiay ky kabhi kabhi strength bahot jald decrease ho ker market ki position change ho jati hai tou aesy time per profit ki bajaey hamain loss hona shoru ho jata hai hamain bary loss sy bachny ky liay her surat stop loss set ker ky trade continue kerni chahiay

MACD technical indicator !

MACD stand for moving average convergence and divergence yeh aik technical indicator hai jo market ki movement ki strength ky sath sath market ki convergence aur divergence ko show kerta hai jis ko follow kerty huey ham market main trade enter kerty hain same indicator main market ki bullish aur bearish power bhi show ho rehi hoti hai ky agar market upward movement ker rehi hai tou same indicator main market centre line sy upward hoti hai aur jesy jesy market ka uptrend apni strength ko decrease kerta hai tou same indicator main bhi strength decrease hona shoru ho jati hai aur market ki position centre line ky qareeb aa jati hai aur jesy hi same line upper side sy cross ho ker lower side per shift ho jati hai tou same time per market ky bullish trend main retracement hoti hai jis ki strength bhi hamain same indicator main show ho jati hai

Forex trading with MACD indicator !

Jab ham forex market main trading ky liay MACD indicator ko use ker rehy hoty hain tou hamain is bat ko mind main rakhna chahiay ky jesy hi market centre line ko cross ker rehi ho tou hamain bhi same direction main trade open ker leni chahiay aur same open trade ko ham tab tak continue ker sakty hain jab tak same side per market ki movement ki strength decrease nehi hoti aur jab same strength decrease hoty hoty market centre line ky qareeb ponch jati hai tou ham same open trade ko close ker dety hain aur agar phir sy centre line cross kery tou ham new direction ky mutabiq trade open ker ky continue ker sakty hain jo MACD main strength decrease hony tak continue rakh sakty hain

Secure Trading MACD !

Jab ham MACD indicator ko use kerty huey trade open ker lety hain ky market jab centre line ko cross ker ky downward ya upward movement ki strength ko change kerti hai aur ham trade open ker lety hain tou aesi trade ko bhi hamain secure kerny ky liay her surat stop loss set kerna chahiay ky kabhi kabhi strength bahot jald decrease ho ker market ki position change ho jati hai tou aesy time per profit ki bajaey hamain loss hona shoru ho jata hai hamain bary loss sy bachny ky liay her surat stop loss set ker ky trade continue kerni chahiay

تبصرہ

Расширенный режим Обычный режим