Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members forex me 3 actual wedges hoti hen Jin sy so forex me kisi bhi trend ki next move ki asani sy sy predict kr skty hen is leya apko chye Kay AP is me kam karn to wedges and patterns ko Samny rakhty huay traidng kren wedges ki types Jo darj zail hen:

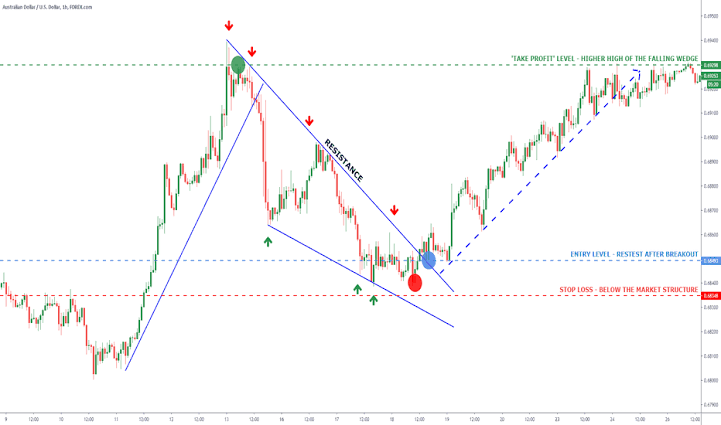

Falling wadge

Falling wedge market ki down movement ky wakt formation Hoti hai agar aap market k down trend main ek chenel draw karen our market us channel main move kar k down ja rahi ho to aap is main Supports and resistance ka sahara le ka Good earning kar sakte hai is main hame try karna chahiye k ham long term par sell trade open karen ya phir short term main channel ki top and bottom line par buy and sell trade kar k earning karen

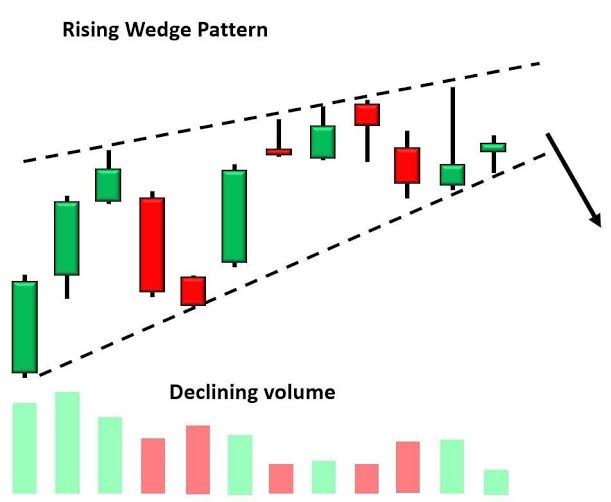

Rising wedge

Rising wedge pattern market main Up trend k wakt banti ha our is main market Slow move karte huye Up trend banati hai our ek channel main safar karti ha rising wedge main hame buy par twaja deni chahiye lekin ham chennel ki Top par sell our botton par buy entery b kar sakte hai lekin agar market chennel ko cross karti ha to ye long side par kisi b tarf ja sakti hai is liye channel k bahr apna Stop loss selecy tkaren

Trading strategy in falling wedge.

Falling wedge ma b trade karny k lae same methods ko use kiya ja sakta hai but es ma sell ki trade ko open karna chahe. Jo trader rising wedge ma sell ki or falling wedge ma buy ki trade ko open kar ley ga usk lae profit hasil karna mushkil ho jata hai. So trader ko pattern zarur help karty hain or trader ko en patterns ki help zarur leni chahe. Es ma he trader ka benefit posheda hai. Jo trader pattern ko ignore karty hain wo in short profit ko ignore kar dety hain Ye pattern is tarah banta hay keh jab bearish trend main hota hay to lower highs and lower lows banaty huye itna squeeze hoty jaty hain keh ye triangle bilkal khatam ho jati hay aur yehi say trend reversal start hoti hay. Is tarah trader is pattern main bullish reversal main trading karta hay. Aur jaisy he triangle cone ban jati hay to yahan say stop loss use karty huye effective buy ki trade ki ja sakti hay.

Trading strategy in rising wedge.

Rising wedge pattern ma market ka up trend hota hai so trade ko es ma buy ki trade open karni chahe. Rising wedge ma price channels ko hit karti hoe agy move karti hai to ham es ma 2 tarha sy trade kar sakty hain ik to ham small lot sy long term buy ki trade open kar sakty hain jo zayada trader karty hain. But asa b kar sakty hain k bottom of channel ko jb price hit kary to hamy buy ki tradr open karni chahe or jb price channel k top par ponch jae to hamy sell ki trade open karni chahe Rising wedge pattern bearish reversal trend pattern hay. Jab up trend higher high and higher low banata hay to ager higher high and higher lows ko line say milaya jaye to aik point per ye donon lines mil kar aik cone banati hayn. Jahan per ye lines mil jati hain wahi say bearish reversal trend start hota hay. Aur is pattern ki takmeel per sell main trading order place karny say achi earning mutawaqy ho sakti hay.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members forex me 3 actual wedges hoti hen Jin sy so forex me kisi bhi trend ki next move ki asani sy sy predict kr skty hen is leya apko chye Kay AP is me kam karn to wedges and patterns ko Samny rakhty huay traidng kren wedges ki types Jo darj zail hen:

- Ascending (Rising) wedge/triangle

- Descending (Falling) wedge/triangle

- Symmetrical (Symmetric shape) wedge/triangle

Falling wadge

Falling wedge market ki down movement ky wakt formation Hoti hai agar aap market k down trend main ek chenel draw karen our market us channel main move kar k down ja rahi ho to aap is main Supports and resistance ka sahara le ka Good earning kar sakte hai is main hame try karna chahiye k ham long term par sell trade open karen ya phir short term main channel ki top and bottom line par buy and sell trade kar k earning karen

Rising wedge

Rising wedge pattern market main Up trend k wakt banti ha our is main market Slow move karte huye Up trend banati hai our ek channel main safar karti ha rising wedge main hame buy par twaja deni chahiye lekin ham chennel ki Top par sell our botton par buy entery b kar sakte hai lekin agar market chennel ko cross karti ha to ye long side par kisi b tarf ja sakti hai is liye channel k bahr apna Stop loss selecy tkaren

Trading strategy in falling wedge.

Falling wedge ma b trade karny k lae same methods ko use kiya ja sakta hai but es ma sell ki trade ko open karna chahe. Jo trader rising wedge ma sell ki or falling wedge ma buy ki trade ko open kar ley ga usk lae profit hasil karna mushkil ho jata hai. So trader ko pattern zarur help karty hain or trader ko en patterns ki help zarur leni chahe. Es ma he trader ka benefit posheda hai. Jo trader pattern ko ignore karty hain wo in short profit ko ignore kar dety hain Ye pattern is tarah banta hay keh jab bearish trend main hota hay to lower highs and lower lows banaty huye itna squeeze hoty jaty hain keh ye triangle bilkal khatam ho jati hay aur yehi say trend reversal start hoti hay. Is tarah trader is pattern main bullish reversal main trading karta hay. Aur jaisy he triangle cone ban jati hay to yahan say stop loss use karty huye effective buy ki trade ki ja sakti hay.

Trading strategy in rising wedge.

Rising wedge pattern ma market ka up trend hota hai so trade ko es ma buy ki trade open karni chahe. Rising wedge ma price channels ko hit karti hoe agy move karti hai to ham es ma 2 tarha sy trade kar sakty hain ik to ham small lot sy long term buy ki trade open kar sakty hain jo zayada trader karty hain. But asa b kar sakty hain k bottom of channel ko jb price hit kary to hamy buy ki tradr open karni chahe or jb price channel k top par ponch jae to hamy sell ki trade open karni chahe Rising wedge pattern bearish reversal trend pattern hay. Jab up trend higher high and higher low banata hay to ager higher high and higher lows ko line say milaya jaye to aik point per ye donon lines mil kar aik cone banati hayn. Jahan per ye lines mil jati hain wahi say bearish reversal trend start hota hay. Aur is pattern ki takmeel per sell main trading order place karny say achi earning mutawaqy ho sakti hay.

تبصرہ

Расширенный режим Обычный режим