Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members aj ham bat krein ga double bottom chart pattern ka bare ma ,dosto double bottom ko W top bhi kahta hain kuk iski pehchan chart ma angrezi word w ki tarah hoti ha ,double bottom chart pattern chart pattern mandi ka trend ma ana wala bullish reversal chart pattern ha matlab ka bazar ma jo mandi ka trend chal tha ha wo shuru hona wala ha or ab uptrend ki shuruwat hona wali ha .

Formation of Double bottom Chart pattern :

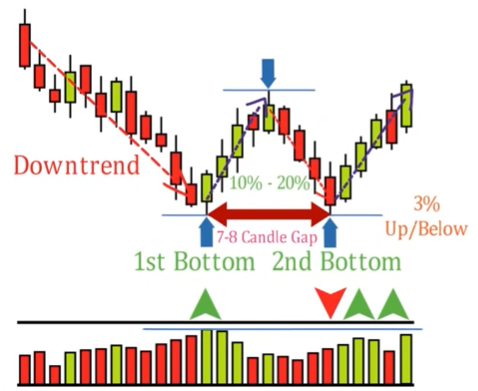

Dosto chart ma ham dekhta hain bazar ma lamba mandi ka trend chal raha ha or double bottom ka bana ma ya zaruri ha pichla trend downtrend ho ,jab chart ma pahla bottom bana to yaha zaruri ha to ya pichla trend ka highest high ho pichla tredn yani ka highest high ho ,iska bad market highest high bana ka thora upar ata ha ya uptrend 10% sa 20 % hosakti ha is pahla top ma volume dusra top ka mukabla ziada hota ha ,pahla bottom bana ka bad jab market utrend ma jati ha tab voulme normal hojata ha iska kuch dair bad ya girawat kuch wakt tak gir jati ha or range bound ma chalti h ,ab kuch dair ka bad price wapis sa necha ki taraf jata ha or thik usi level par ya uska as pas dusra level banata ha ,ya dusra top pahla top ka mukabla 3% ka upar necha hosakta ha ,is dusra top ma volume pahla top ka mukabla kam hota ha lakin jab price 2nd top bna kar necha girna lagta ha to yha uptrend bohat tez hota ha or volume bhi tez hona lagta ha dosto 2 top ka bech ma kam sa kam 7-8 candle ka gap to hona hi chaye agr is sa kamhoga to ya valid douuble botttom nahi kahlaye ga ,dosto chart pattern ka sath time frame ka itna hona zaruri nahi ha kuk ya har tim frame ma banta ha or acha sa kam karta hain .Agr ap double bottom ko intraday chart ma dekh raha hain to double bottom ka bech ma kam sa kam 7-8 candle ka gap hona chayei ,or agr ap short term ma dekh rha hha to kam sa kam 3-4 week ka gap ,or medium term ma 4-5 month ka gap or log term ma 1-2 year ka gap ya is sa zyada hosakta ha .

Buying With Double bottom :

Dosto agar ap chart ma double bottom ka formation dekh raha hain to apko isma buying karna k lie dono top ka bech ma jo resistance ha uska high ko touch karta hue horizontal lien khenchna hogi ,is horizontal line ko doublebottom chart pattern ka sath neckline kahta hain ab apko isma buying karna ka lie yaha dekhna ha jab price dusra bottom banana ka bad candle neckline ka upar closing da dato uska bad wali candle ma hamein buy karna ha ,buy ki trade lana ka foran badn ji candle na neckline ka upar closing di ha uska high ka necha ka stoploss lagana ha ,isi bech trade lana sa pahla apko ek bat ka dihan rakhna bohat zaruri ha trade lana sa stoploss lagana tak apko risk reward ration ka rule 2% ko apply karn ha .Profit book karna ka lie apko ya dekhna ha jaha sa price pahla bar downtrend ma gaye usa ham name deta hain point A or jaha par pahla bottom banta ha usa ham name deta hain point B ab point a or b ka jo difference ha wo hamara target ha.Dusra bottom banana ka bad jab price upar jata ha tab point A or B ka jo difference ha wo upar ki taraf hamara target hoga .

Dear forex member umeed karta hun aap sab khairiyat se honge dear members aj ham bat krein ga double bottom chart pattern ka bare ma ,dosto double bottom ko W top bhi kahta hain kuk iski pehchan chart ma angrezi word w ki tarah hoti ha ,double bottom chart pattern chart pattern mandi ka trend ma ana wala bullish reversal chart pattern ha matlab ka bazar ma jo mandi ka trend chal tha ha wo shuru hona wala ha or ab uptrend ki shuruwat hona wali ha .

Formation of Double bottom Chart pattern :

Dosto chart ma ham dekhta hain bazar ma lamba mandi ka trend chal raha ha or double bottom ka bana ma ya zaruri ha pichla trend downtrend ho ,jab chart ma pahla bottom bana to yaha zaruri ha to ya pichla trend ka highest high ho pichla tredn yani ka highest high ho ,iska bad market highest high bana ka thora upar ata ha ya uptrend 10% sa 20 % hosakti ha is pahla top ma volume dusra top ka mukabla ziada hota ha ,pahla bottom bana ka bad jab market utrend ma jati ha tab voulme normal hojata ha iska kuch dair bad ya girawat kuch wakt tak gir jati ha or range bound ma chalti h ,ab kuch dair ka bad price wapis sa necha ki taraf jata ha or thik usi level par ya uska as pas dusra level banata ha ,ya dusra top pahla top ka mukabla 3% ka upar necha hosakta ha ,is dusra top ma volume pahla top ka mukabla kam hota ha lakin jab price 2nd top bna kar necha girna lagta ha to yha uptrend bohat tez hota ha or volume bhi tez hona lagta ha dosto 2 top ka bech ma kam sa kam 7-8 candle ka gap to hona hi chaye agr is sa kamhoga to ya valid douuble botttom nahi kahlaye ga ,dosto chart pattern ka sath time frame ka itna hona zaruri nahi ha kuk ya har tim frame ma banta ha or acha sa kam karta hain .Agr ap double bottom ko intraday chart ma dekh raha hain to double bottom ka bech ma kam sa kam 7-8 candle ka gap hona chayei ,or agr ap short term ma dekh rha hha to kam sa kam 3-4 week ka gap ,or medium term ma 4-5 month ka gap or log term ma 1-2 year ka gap ya is sa zyada hosakta ha .

Buying With Double bottom :

Dosto agar ap chart ma double bottom ka formation dekh raha hain to apko isma buying karna k lie dono top ka bech ma jo resistance ha uska high ko touch karta hue horizontal lien khenchna hogi ,is horizontal line ko doublebottom chart pattern ka sath neckline kahta hain ab apko isma buying karna ka lie yaha dekhna ha jab price dusra bottom banana ka bad candle neckline ka upar closing da dato uska bad wali candle ma hamein buy karna ha ,buy ki trade lana ka foran badn ji candle na neckline ka upar closing di ha uska high ka necha ka stoploss lagana ha ,isi bech trade lana sa pahla apko ek bat ka dihan rakhna bohat zaruri ha trade lana sa stoploss lagana tak apko risk reward ration ka rule 2% ko apply karn ha .Profit book karna ka lie apko ya dekhna ha jaha sa price pahla bar downtrend ma gaye usa ham name deta hain point A or jaha par pahla bottom banta ha usa ham name deta hain point B ab point a or b ka jo difference ha wo hamara target ha.Dusra bottom banana ka bad jab price upar jata ha tab point A or B ka jo difference ha wo upar ki taraf hamara target hoga .

:max_bytes(150000):strip_icc():format(webp)/DoubleBottomDefinition2-2158982e470f4a3faea9b7ba7aac6294.png)

تبصرہ

Расширенный режим Обычный режим