Aslam u alaikum,

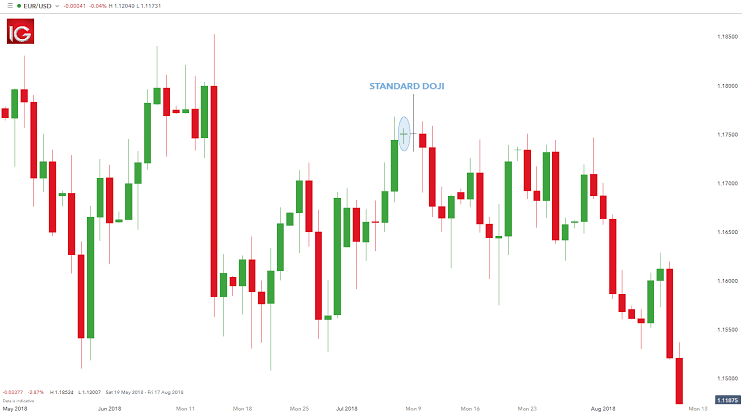

Dear forex member umeed karta hun aap sab khairiyat se honge dear members forex market mai doji candlestick pattern se indication aor direction mai change ho raha ho to aus time ye pata chal jata hai to aus waja se market mai jab ye candlestick pattern banta hai to aus mai reversal ki indication hoti hai. Aisy candlestick pattern ko dekh k hum ais market mai trade laga sakty hain kun k ye patterns reverasal ka signal dy rahy hoty hai aor aisy patterns ko find karna bahot asan hota hai. Aisi candle ko asani k sath wick dekh k hum find kar sakty hain.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members forex market mai doji candlestick pattern se indication aor direction mai change ho raha ho to aus time ye pata chal jata hai to aus waja se market mai jab ye candlestick pattern banta hai to aus mai reversal ki indication hoti hai. Aisy candlestick pattern ko dekh k hum ais market mai trade laga sakty hain kun k ye patterns reverasal ka signal dy rahy hoty hai aor aisy patterns ko find karna bahot asan hota hai. Aisi candle ko asani k sath wick dekh k hum find kar sakty hain.

Ais ki differnet types hai jin ko hum dekh k ais market mai trade kar sakty hain.

Doji Candlesticks Pattern Types:

1: Standard Doji/ Neutral Doji

2: Long Legged Doji

3: Dragonfly Doji

4: Gravestone Doji

5: 4-Price Doji

Doji Candlesticks Patterns Formed:

Dear brother jab ais market mai kisi bhi time frame mai new candle start hoti hai aor closing bhi ausi price k nazdeek karti hai magar ais candle ki wicks bahot lambi hoti hai magar body nahi hoti hai to ye aik doji candle banti hai. Jab ye doji candle kisi resistance ya support par banti hai to aus par humy ye signal milta hai k market ne ais level se reversal leni hai. Hum ais market mai doji candle ko dekh k confirmation k baad trade laga sakty hain.

1: Standard Doji/ Neutral Doji:

Dear brother Standard Doji jab banti hai to ais mai wicks dono taraf aik jaisi hoti hai aor aisi doji candle mai body nai hoti hai jab ye candle kisi resistance ya support par banti hai to waha se reversal k hisab se hum apni trade laga sakty hain. Aisi trade ka stop loss candle se thora sa oper hota hai aor take profit next resistance ya support par hota hai aisi candles resistance aor support level par valid hoti hai.

2: Long Legged Doji:

Dear brother market mai long legged doji tab banti hai market mai moment kafi zayda hota hai aor aisi candle mai wick bahot lambi hoti hai aisi candle mai body bahot choti hoti hai magar wick bahot zayda bari hoti hai. Long legged doji pattern jab kisi resistance ya support par banti hai to to ais ki wick ko dekh k pata chal jata hai k market mai next moment bhi zayda volatile ho sakti hai ais mai jaisy hi confirmation milti hai humy ais market mai trade open kar deni chaye, pattern k hisab se trade lagany k baad humy ais market mai stop loss resistance ya support level se thora dor rakhna hota hai kun k ye candle jab banti hai to next candle ais k high point tak aa sakti hai aisi candle par trade se kafi zayda faida ho jata hai.

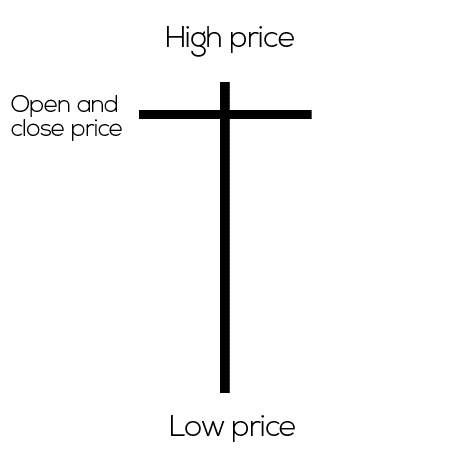

3: Dragonfly Doji:

Dear brother ye pattern sirf support level par banta hai ais pattern ki sab se achi baat ye hai k hum ais pattern ko asani k sath her time frame mai find kar sakty hain, ais pattern ki shape ''T'' hoti hai mean ais candle k necny side par wick hoti hai magar upper side par wick nai hoti hai, jab ye pattern banta hai to ais k baad market upside par moment karti hai humy ais market mai trade lagany k liay ais candle k baad next candle ko bullish close hony ka wait krna hota hai jaisy hi next candle bullish close ho hum market mai trade laga sakty hain. Ais pattern k hisab se trade ka stop loss support level se thora nechy hota hai aor take profit next resistance level par hota hai jaha par hum apna target set kar sakty hain.

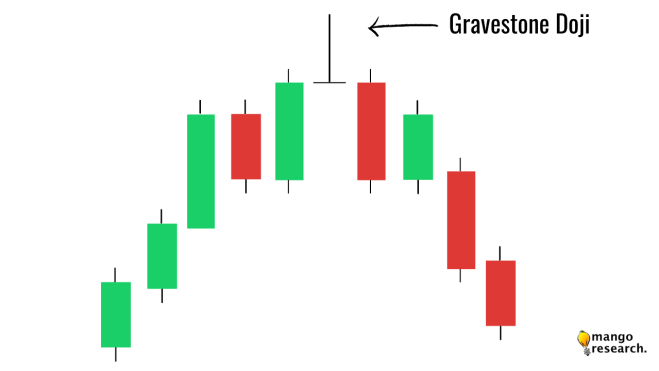

4: GraveStone Doji:

Dear Gravestone doji opposite hoti hai Dragonfly Doji ki ais mai candle jab banti hai to ye resistance level par banti hai aor ais mai sirf upside par wick hoti hai aisi candle k down side par market wick nai banati hai. Jab market ye pattern banti hai to aus k baad humy sell ki trade lagani hoti hai kun k ye candle resistance level par banti hai aor aus k baad market down side par aati hai humy ais market mai confirmation k baad trade lagani hoti hai ye candle jab banti hai to aus k baad market ki next candle down close honi chaye tab ye candle valid hoti hai aor hum ais par trade laga sakty hain. Trade ka stop loss resistance level se thora oper rakha jata hai aor take profit support level par rakha jata hai.

5: 4-Price Doji:

Dear brother ye candle jab market mai banti hai to ais mai candle ki wicks nai hoti hai simple aik line hoti hai jis mai candle ki opening aor closing ais k sth high aor low sab aik hi point par hota hai aisi candle tab hi market mai banti hai jab market open hoti hai aor aik hi jagha par ruki rehti hai ais patterns ko dekh k pata chal jata hai k market mai buyyers aor seller ka presure nai hai humy ais market mai trade se avoid karna chaye jab ais candle k baad next candle ki body lambi ho to aus k baad hum ais market mai trade laga sakty hain. Ais candle ki shape ''-'' Line jaisi hoti hai aor ais mai market bilkul hi nai banati hai aisi candle ko hum dekh k trade lagany k liay kisi resistance ya support level ko sath dekhna hota hai. Ais candle mai humri trade ka stop loss resistance aor support level k hisab se hota hai.

Doji Candlesticks Pattern Types:

1: Standard Doji/ Neutral Doji

2: Long Legged Doji

3: Dragonfly Doji

4: Gravestone Doji

5: 4-Price Doji

Doji Candlesticks Patterns Formed:

Dear brother jab ais market mai kisi bhi time frame mai new candle start hoti hai aor closing bhi ausi price k nazdeek karti hai magar ais candle ki wicks bahot lambi hoti hai magar body nahi hoti hai to ye aik doji candle banti hai. Jab ye doji candle kisi resistance ya support par banti hai to aus par humy ye signal milta hai k market ne ais level se reversal leni hai. Hum ais market mai doji candle ko dekh k confirmation k baad trade laga sakty hain.

1: Standard Doji/ Neutral Doji:

Dear brother Standard Doji jab banti hai to ais mai wicks dono taraf aik jaisi hoti hai aor aisi doji candle mai body nai hoti hai jab ye candle kisi resistance ya support par banti hai to waha se reversal k hisab se hum apni trade laga sakty hain. Aisi trade ka stop loss candle se thora sa oper hota hai aor take profit next resistance ya support par hota hai aisi candles resistance aor support level par valid hoti hai.

2: Long Legged Doji:

Dear brother market mai long legged doji tab banti hai market mai moment kafi zayda hota hai aor aisi candle mai wick bahot lambi hoti hai aisi candle mai body bahot choti hoti hai magar wick bahot zayda bari hoti hai. Long legged doji pattern jab kisi resistance ya support par banti hai to to ais ki wick ko dekh k pata chal jata hai k market mai next moment bhi zayda volatile ho sakti hai ais mai jaisy hi confirmation milti hai humy ais market mai trade open kar deni chaye, pattern k hisab se trade lagany k baad humy ais market mai stop loss resistance ya support level se thora dor rakhna hota hai kun k ye candle jab banti hai to next candle ais k high point tak aa sakti hai aisi candle par trade se kafi zayda faida ho jata hai.

3: Dragonfly Doji:

Dear brother ye pattern sirf support level par banta hai ais pattern ki sab se achi baat ye hai k hum ais pattern ko asani k sath her time frame mai find kar sakty hain, ais pattern ki shape ''T'' hoti hai mean ais candle k necny side par wick hoti hai magar upper side par wick nai hoti hai, jab ye pattern banta hai to ais k baad market upside par moment karti hai humy ais market mai trade lagany k liay ais candle k baad next candle ko bullish close hony ka wait krna hota hai jaisy hi next candle bullish close ho hum market mai trade laga sakty hain. Ais pattern k hisab se trade ka stop loss support level se thora nechy hota hai aor take profit next resistance level par hota hai jaha par hum apna target set kar sakty hain.

4: GraveStone Doji:

Dear Gravestone doji opposite hoti hai Dragonfly Doji ki ais mai candle jab banti hai to ye resistance level par banti hai aor ais mai sirf upside par wick hoti hai aisi candle k down side par market wick nai banati hai. Jab market ye pattern banti hai to aus k baad humy sell ki trade lagani hoti hai kun k ye candle resistance level par banti hai aor aus k baad market down side par aati hai humy ais market mai confirmation k baad trade lagani hoti hai ye candle jab banti hai to aus k baad market ki next candle down close honi chaye tab ye candle valid hoti hai aor hum ais par trade laga sakty hain. Trade ka stop loss resistance level se thora oper rakha jata hai aor take profit support level par rakha jata hai.

5: 4-Price Doji:

Dear brother ye candle jab market mai banti hai to ais mai candle ki wicks nai hoti hai simple aik line hoti hai jis mai candle ki opening aor closing ais k sth high aor low sab aik hi point par hota hai aisi candle tab hi market mai banti hai jab market open hoti hai aor aik hi jagha par ruki rehti hai ais patterns ko dekh k pata chal jata hai k market mai buyyers aor seller ka presure nai hai humy ais market mai trade se avoid karna chaye jab ais candle k baad next candle ki body lambi ho to aus k baad hum ais market mai trade laga sakty hain. Ais candle ki shape ''-'' Line jaisi hoti hai aor ais mai market bilkul hi nai banati hai aisi candle ko hum dekh k trade lagany k liay kisi resistance ya support level ko sath dekhna hota hai. Ais candle mai humri trade ka stop loss resistance aor support level k hisab se hota hai.

تبصرہ

Расширенный режим Обычный режим