Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge aur forex sa ak acha gain le raha hon ga.

Importance of Candlestick Patterns in forex trading:

Forex trading man trader currency pairs aur commodities ki price movements ko smajhna k liye price chart ko read kerta ha, q k price chart patterns man changes, momentum aur price k trend man change ko accuracy k sath identify kerta ha. Candlestick Patterns currency pairs aur commodities k price chart man price ki movement ko track kerna k liye use hona wala most important technical tool ha. Trader forex trading man kisi currency pair ya commodity ko buy/sell kerna k liye candlestick patterns per depend kerta ha. Aj man apka k sath important Candlestick Pattern per trading k related apna knowledge share kerta hon.

Inverted Hammer Candlestick Pattern:

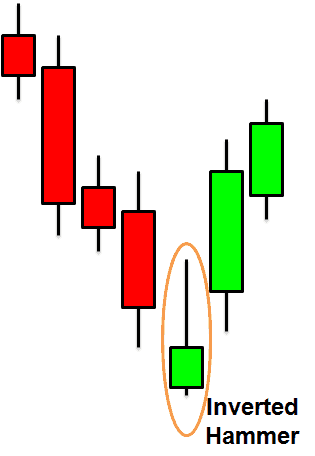

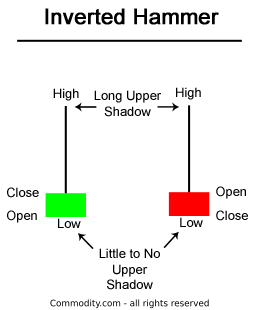

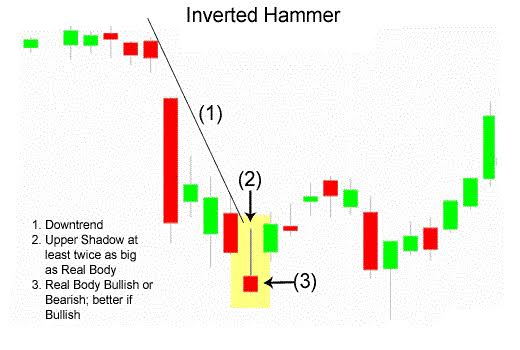

Inverted Hammer Candlestick Pattern ak bearish trend reversal candlestick pattern ha, jo currency pairs aur commodities k price chart man long bearish trend k bottom per support level k qareeb banta ha. Is pattern man first candle small real body ki bearish/bullish candle banti ha jiska upper wick long hota ha aur lower wick smaller ya zero hota ha. Upper wick ki length real body k double k baraber hoti ha. Is candle Inverted Hammer Candlestick kehta han. Is liye is pattern ka name Inverted Hammer Candlestick Pattern kehta han.

Identification of Inverted Hammer Candlestick Pattern in Price Chart:

Inverted Hammer Candlestick Pattern price k bearish trend ko bullish trend man change ker deta ha isliye is pattern ko bullish candlestick pattern b kehta han. Ye pattern two candles per moshtamil hota ha.

1. Is pattern man first candle Day-1 ki Inverted Hammer Candlestick banti ha jo buyers aur sellers k dermiyan indecision ko batati ha.

2. Is pattern man second candle Day-2 ki long real body ki bullish candle banti ha, jo first candle ki real body k sath gapup k sath banti ha.

Trading with Inverted Hammer Candlestick Pattern:

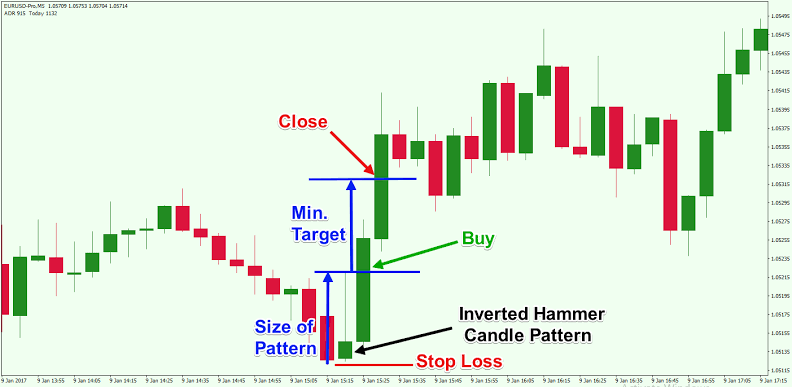

Inverted Hammer Candlestick Pattern per trading kerna k liye zarori ha k trader is pattern k complete hona ka wait kara aur jab ye pattern complete ho jae to new candle k open per trader ko ""Buy ki Trade"" active kerni chaheye.

Stoploss and Take Profit:

Inverted Hammer Candlestick Pattern per trading k doran trader ko Stoploss Inverted Hammer Candlestick ki low sa 6 pips nicha place kerna chaheye aur Take Profit ko next resistance levels per Tp-1, Tp-2 aur Tp-3 ker k place karen.

Inverted Hammer Candlestick Pattern per mazeed confirm trading k liye trader ko Relative Strength Index Indicator ko combination man use kerna chaheye.

..

Dear forex member umeed karta hun aap sab khairiyat se honge aur forex sa ak acha gain le raha hon ga.

Importance of Candlestick Patterns in forex trading:

Forex trading man trader currency pairs aur commodities ki price movements ko smajhna k liye price chart ko read kerta ha, q k price chart patterns man changes, momentum aur price k trend man change ko accuracy k sath identify kerta ha. Candlestick Patterns currency pairs aur commodities k price chart man price ki movement ko track kerna k liye use hona wala most important technical tool ha. Trader forex trading man kisi currency pair ya commodity ko buy/sell kerna k liye candlestick patterns per depend kerta ha. Aj man apka k sath important Candlestick Pattern per trading k related apna knowledge share kerta hon.

Inverted Hammer Candlestick Pattern:

Inverted Hammer Candlestick Pattern ak bearish trend reversal candlestick pattern ha, jo currency pairs aur commodities k price chart man long bearish trend k bottom per support level k qareeb banta ha. Is pattern man first candle small real body ki bearish/bullish candle banti ha jiska upper wick long hota ha aur lower wick smaller ya zero hota ha. Upper wick ki length real body k double k baraber hoti ha. Is candle Inverted Hammer Candlestick kehta han. Is liye is pattern ka name Inverted Hammer Candlestick Pattern kehta han.

Identification of Inverted Hammer Candlestick Pattern in Price Chart:

Inverted Hammer Candlestick Pattern price k bearish trend ko bullish trend man change ker deta ha isliye is pattern ko bullish candlestick pattern b kehta han. Ye pattern two candles per moshtamil hota ha.

1. Is pattern man first candle Day-1 ki Inverted Hammer Candlestick banti ha jo buyers aur sellers k dermiyan indecision ko batati ha.

2. Is pattern man second candle Day-2 ki long real body ki bullish candle banti ha, jo first candle ki real body k sath gapup k sath banti ha.

Trading with Inverted Hammer Candlestick Pattern:

Inverted Hammer Candlestick Pattern per trading kerna k liye zarori ha k trader is pattern k complete hona ka wait kara aur jab ye pattern complete ho jae to new candle k open per trader ko ""Buy ki Trade"" active kerni chaheye.

Stoploss and Take Profit:

Inverted Hammer Candlestick Pattern per trading k doran trader ko Stoploss Inverted Hammer Candlestick ki low sa 6 pips nicha place kerna chaheye aur Take Profit ko next resistance levels per Tp-1, Tp-2 aur Tp-3 ker k place karen.

Inverted Hammer Candlestick Pattern per mazeed confirm trading k liye trader ko Relative Strength Index Indicator ko combination man use kerna chaheye.

..

تبصرہ

Расширенный режим Обычный режим