INTRODUCTION:A

slam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge aur forex trading me apny knowledge ki base pe acha workout kar k trading me apni income ko increase kar rahy hon gy.. Trading ek risky business ha is me traders ko loss b kafi ziada hota ha is ly humy secure trading krni chahiye..

IMPORTANCE OF CANDLESTICK PATTERN:

Dear members forex trading k doran traders currency pairs r commodities ki price movement ko smjhny k liye price chart ko read krta ha.. q k price chart pattern me changes, momentum r price k trend me change ko accuracy k sth identify krta ha. Candlestick pattern Currency pairs r commodities k price chart me price ki movement ko track krny k liye use hony wla important tool ha . Traders forex trading me kisi b currency pairs ya Commodities ko buy sell krny k liye Candlestick pattern pr depend krta ha.

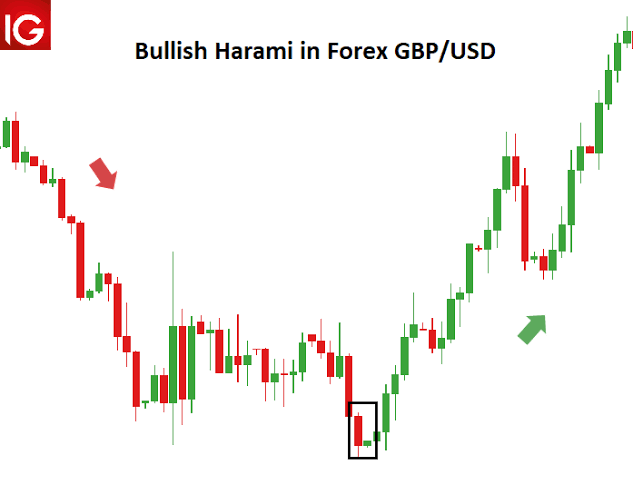

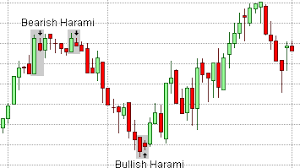

BULLISH HARAMI CROSS CANDLESTICK PATTERN:

Dear members forex trading me bullish harami candlestick pattern ek bearish trend reversal Candlestick pattern ha. Jo Currency pairs r commodities k price chart me long bearish trend k bottom pr Support level k qareeb bnta ha. Is Pattern me second candle doji cross ya doji stat Candlestick bnti ha. "Harami japanese" word ha. Is pattern ki first candle long real body ki bearish candle bnti ha. R second candle ki formation first candle k real me hoti ha. Is liye is pattern ko Bullish harmi Candlestick pattern kehty hn...

IDENTIFICATION OF BULLISH HARAMI CROSS CANDLESTICK PATTERN:

Dear members forex trading me bullish harami cross Candlestick pattern Bearish trend ko bullish trend. Me change krta ha. Is liye i pattern ko bullish candle pattern kehty hn.

Ye pattern three candles se mill kr bnta ha..

1: is pattern me first candle Day_1 ki long real body ki bearish candle bnti ha. Jo buyer ka market pe strong hold show krati ha.

2: is pattern ki second candle Day_2 ki doji star/cross candle bnti ha. Jo market me buyer r seller k drmyan indecision ka btati ha.

3: is pattern ki third candle Day_3 ki long real body ki bullish candle bnti ha Jo market price k bullish trend k start hony ka confirmation deti ha..

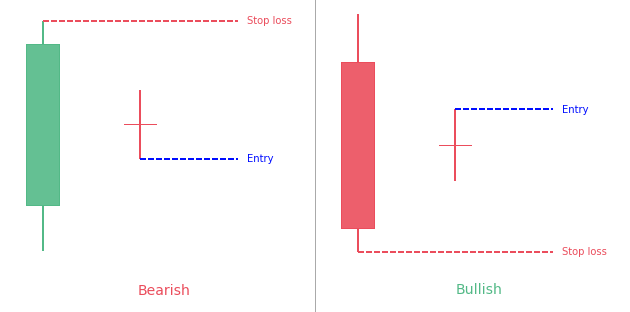

TRADING WITH BULLISH HARAMI CROSS CANDLESTICK PATTERN:

Dear members bullish harami cross Candlestick pattern pr trading krny k liye traders ko is patteen k complte hony ka wait krna chahiye...jab ye pattern complete ho jae to new candle k open pr trader ko "Buy ki Trade" active kr leni chahiye...

STOPLOSS AND TAKE PROFIT:

Dear members forex trading me koi b trader 100% accurate ni ho skta. Is liye traders ko trading k doran market price ki inverse movement ko mind me rkhty huy stoploss r take profit lazmi use krna chahiye...

Bullish harami cross Candlestick pattern pr trading k doran traders ko stoploss pattern ki first candle k low se nichy place krna chahiye. Take profit ko next resistance level pr Tp1, Tp2, Tp3 kr k place kren..

RELETIVE STRENGTH INDEX INDICATOR RSI:

Dear members bullish harami cross Candlestick pattern k sth Reletive Strength Index indicator lzmi use krna chahiye. Patteen k valid hony k liye zaruri ha k RSI pattern k Ki formation k doran Oversold area me hona bht zaruri hota ha . Jb trader trade me entry ly to RSI 30 level ko oper ki trf cross kr rha ho .

slam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge aur forex trading me apny knowledge ki base pe acha workout kar k trading me apni income ko increase kar rahy hon gy.. Trading ek risky business ha is me traders ko loss b kafi ziada hota ha is ly humy secure trading krni chahiye..

IMPORTANCE OF CANDLESTICK PATTERN:

Dear members forex trading k doran traders currency pairs r commodities ki price movement ko smjhny k liye price chart ko read krta ha.. q k price chart pattern me changes, momentum r price k trend me change ko accuracy k sth identify krta ha. Candlestick pattern Currency pairs r commodities k price chart me price ki movement ko track krny k liye use hony wla important tool ha . Traders forex trading me kisi b currency pairs ya Commodities ko buy sell krny k liye Candlestick pattern pr depend krta ha.

BULLISH HARAMI CROSS CANDLESTICK PATTERN:

Dear members forex trading me bullish harami candlestick pattern ek bearish trend reversal Candlestick pattern ha. Jo Currency pairs r commodities k price chart me long bearish trend k bottom pr Support level k qareeb bnta ha. Is Pattern me second candle doji cross ya doji stat Candlestick bnti ha. "Harami japanese" word ha. Is pattern ki first candle long real body ki bearish candle bnti ha. R second candle ki formation first candle k real me hoti ha. Is liye is pattern ko Bullish harmi Candlestick pattern kehty hn...

IDENTIFICATION OF BULLISH HARAMI CROSS CANDLESTICK PATTERN:

Dear members forex trading me bullish harami cross Candlestick pattern Bearish trend ko bullish trend. Me change krta ha. Is liye i pattern ko bullish candle pattern kehty hn.

Ye pattern three candles se mill kr bnta ha..

1: is pattern me first candle Day_1 ki long real body ki bearish candle bnti ha. Jo buyer ka market pe strong hold show krati ha.

2: is pattern ki second candle Day_2 ki doji star/cross candle bnti ha. Jo market me buyer r seller k drmyan indecision ka btati ha.

3: is pattern ki third candle Day_3 ki long real body ki bullish candle bnti ha Jo market price k bullish trend k start hony ka confirmation deti ha..

TRADING WITH BULLISH HARAMI CROSS CANDLESTICK PATTERN:

Dear members bullish harami cross Candlestick pattern pr trading krny k liye traders ko is patteen k complte hony ka wait krna chahiye...jab ye pattern complete ho jae to new candle k open pr trader ko "Buy ki Trade" active kr leni chahiye...

STOPLOSS AND TAKE PROFIT:

Dear members forex trading me koi b trader 100% accurate ni ho skta. Is liye traders ko trading k doran market price ki inverse movement ko mind me rkhty huy stoploss r take profit lazmi use krna chahiye...

Bullish harami cross Candlestick pattern pr trading k doran traders ko stoploss pattern ki first candle k low se nichy place krna chahiye. Take profit ko next resistance level pr Tp1, Tp2, Tp3 kr k place kren..

RELETIVE STRENGTH INDEX INDICATOR RSI:

Dear members bullish harami cross Candlestick pattern k sth Reletive Strength Index indicator lzmi use krna chahiye. Patteen k valid hony k liye zaruri ha k RSI pattern k Ki formation k doran Oversold area me hona bht zaruri hota ha . Jb trader trade me entry ly to RSI 30 level ko oper ki trf cross kr rha ho .

تبصرہ

Расширенный режим Обычный режим