Forex trading the martingale way

the martingale strategy was most commonly practiced in the gambling halls of las vegas casinos. it is the main reason why casinos now have betting minimums and maximums. the problem with this strategy is that you need a significant supply of money to achieve 100 % profitability. in some cases, your pockets must be infinitely deep. a martingale strategy relies on the theory of mean reversion. without a plentiful supply of money to obtain positive results, you need to endure missed trades that can bankrupt an entire account. it' s also important to note that the amount risked on the trade is far higher than the potential gain. despite these drawbacks, there are ways to improve the martingale strategy that can boost your chances of succeeding .

What is the marketing satretegy

the martingale was introduced by the french mathematician paul pierre levy and became popular in the 18th century. 2 the martingale was originally a type of betting style based on the premise of" doubling down." the american mathematician joseph leo doob continued work on the martingale strategy. however, he sought to disprove the possibility of a 100 % profitable betting strategy. 3

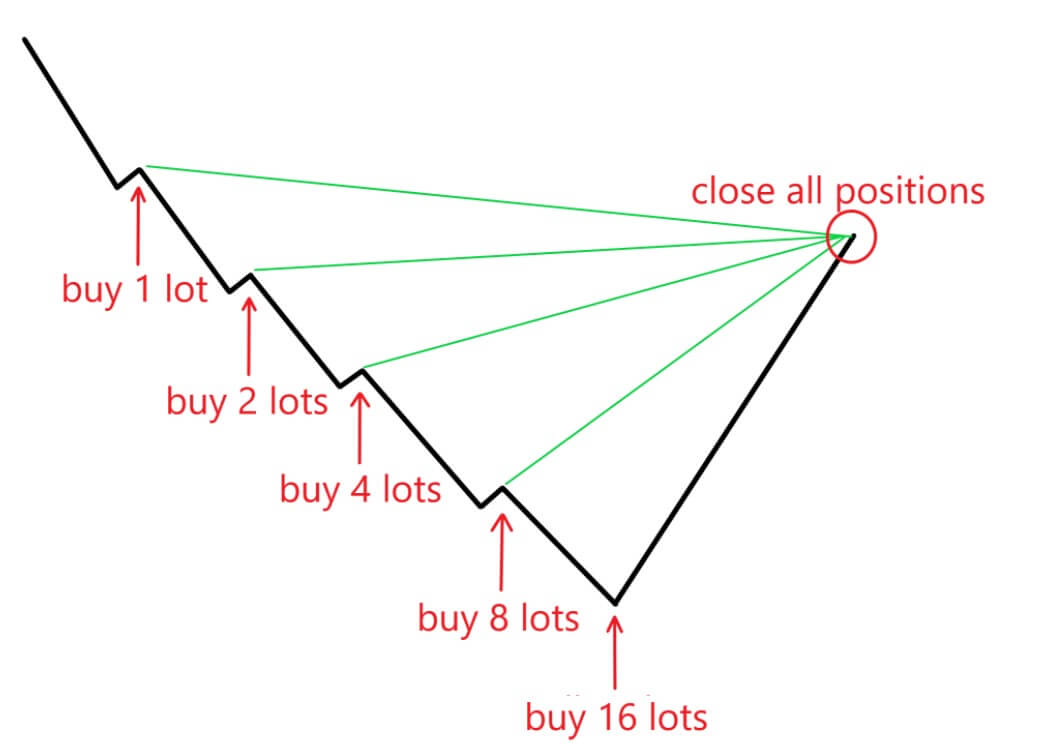

to understand the basics behind the martingale strategy, let' s look at an example. suppose we had a coin and engaged in a betting game of either heads or tails with a starting wager of $ 1. there is an equal probability that the coin will land on heads or tails. each flip is an independent random variable, which means that the previous flip does not impact the next flip. if you doubled your bet every time you lost, you would eventually win and regain all of your losses, plus $ 1. the strategy is based on the premise that only one trade is needed to turn your account around .

the martingale strategy was most commonly practiced in the gambling halls of las vegas casinos. it is the main reason why casinos now have betting minimums and maximums. the problem with this strategy is that you need a significant supply of money to achieve 100 % profitability. in some cases, your pockets must be infinitely deep. a martingale strategy relies on the theory of mean reversion. without a plentiful supply of money to obtain positive results, you need to endure missed trades that can bankrupt an entire account. it' s also important to note that the amount risked on the trade is far higher than the potential gain. despite these drawbacks, there are ways to improve the martingale strategy that can boost your chances of succeeding .

What is the marketing satretegy

the martingale was introduced by the french mathematician paul pierre levy and became popular in the 18th century. 2 the martingale was originally a type of betting style based on the premise of" doubling down." the american mathematician joseph leo doob continued work on the martingale strategy. however, he sought to disprove the possibility of a 100 % profitable betting strategy. 3

to understand the basics behind the martingale strategy, let' s look at an example. suppose we had a coin and engaged in a betting game of either heads or tails with a starting wager of $ 1. there is an equal probability that the coin will land on heads or tails. each flip is an independent random variable, which means that the previous flip does not impact the next flip. if you doubled your bet every time you lost, you would eventually win and regain all of your losses, plus $ 1. the strategy is based on the premise that only one trade is needed to turn your account around .

P

Martingale strategy ka istemal karne ke liye kuch important tips:

Martingale strategy ka istemal karne ke liye kuch important tips:

تبصرہ

Расширенный режим Обычный режим