Explanation of Matching Low Candlestick Pattern

*Asalam o alaikum* members

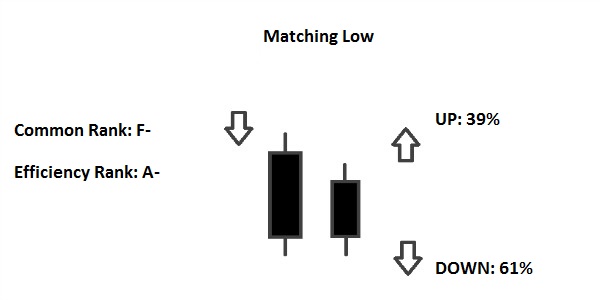

Matching low candlestick pattern aik bullish trend reversal candle stick pattern hota hai jo keh forex market mein aik he close honay wale price kay 2 bearish candle stick par moshtamel hota hey or candle stick k lower parts par koi shadow nahe hota. Ye zyada tar stock or index market mein bany ga. yeh aik new bullish trend kay start ka eshara kart hey matching low candle stick pattern trend kay continuation pattern kay tor par kam karta hey laken zyada tar moamlat mein yeh trend ko tabdel kar kay pattern kay tor par kam karta hai.

What is matching low candlestick pattern?

A matching low is a two-candle bullish reversal pattern that appears on candlestick charts. It occurs after a downtrend and, in theory, signals a potential end to the selling via two long down (black or red) candlesticks with matching closes. It is confirmed by a price move higher following the pattern.

Pehle candlestick aik bare bearish candle stick ho ge jo keh forex market mein seller ke bare raftar ko zahair karte hey es candle stick ka sabka trend bhe bearish ka hona chahye. Dosree candle stick aik ga sath kholay ge laken pechle candle stick ke limit kay andar yeh pechle candle stick ke end price par ja kar close ho jay ge yeh bearish candle stick ho gy. Dono candle stick kay lower hesay par koi shadow nahe banay hain.

Matching Low Trading Strategies

Es candlestick kay pechay nafseyaat yeh hey trader new low trend mein nakam ho rahay hein. Seller nay aik bare level banay hove hey or market ko control kar rahay hein buyer weak hein buyer es kabel bhe nahe htay hein keh price ko stop kar saken es ley price kam hte ja rehe hai. Pehle candle stick kay low hnay kay sath dosree candle stick kholte hey or yeh zahair hota hey kh es close par bhe kuch ho raha hey dosree candle stick dobara pechle candle stick ke close price par close ho rehe hote hey yeh aik new lower level bananay kay ley pechle level ko kam nahe karta hey or break nahe karta hai.

What Does a Matching Low Tell Us About the Market?

Price kay chart par candlestick pattern par trade karna bhut he assan hota hey or yeh bohut zyada importance rakhta hey mesal kay tor par chart lkay upper hesay mein aik reversal pattern banta hey to ap ko trend kay reversal karnay ke pore salehat nahe mellay ge kunkeh yeh price chart kay nechay banta hey

support zone / demand zone

overbought condition matching low candle stick pattern kuch sharait kay sath trend kay continuation pattern kay tor par bhe kam karay ga lahza es say nematnay kay ley ap ko hamesha intazar karna paray ga jab tak tesaree candle stick na ban jay tesaree candle stick aik bare bullish candle stick ban jay ge aik confirmation candlestick hone chahay esay pechle candlestick kay start price kay opar close ho jana chahye.

*Asalam o alaikum* members

Matching low candlestick pattern aik bullish trend reversal candle stick pattern hota hai jo keh forex market mein aik he close honay wale price kay 2 bearish candle stick par moshtamel hota hey or candle stick k lower parts par koi shadow nahe hota. Ye zyada tar stock or index market mein bany ga. yeh aik new bullish trend kay start ka eshara kart hey matching low candle stick pattern trend kay continuation pattern kay tor par kam karta hey laken zyada tar moamlat mein yeh trend ko tabdel kar kay pattern kay tor par kam karta hai.

What is matching low candlestick pattern?

A matching low is a two-candle bullish reversal pattern that appears on candlestick charts. It occurs after a downtrend and, in theory, signals a potential end to the selling via two long down (black or red) candlesticks with matching closes. It is confirmed by a price move higher following the pattern.

Pehle candlestick aik bare bearish candle stick ho ge jo keh forex market mein seller ke bare raftar ko zahair karte hey es candle stick ka sabka trend bhe bearish ka hona chahye. Dosree candle stick aik ga sath kholay ge laken pechle candle stick ke limit kay andar yeh pechle candle stick ke end price par ja kar close ho jay ge yeh bearish candle stick ho gy. Dono candle stick kay lower hesay par koi shadow nahe banay hain.

Matching Low Trading Strategies

Es candlestick kay pechay nafseyaat yeh hey trader new low trend mein nakam ho rahay hein. Seller nay aik bare level banay hove hey or market ko control kar rahay hein buyer weak hein buyer es kabel bhe nahe htay hein keh price ko stop kar saken es ley price kam hte ja rehe hai. Pehle candle stick kay low hnay kay sath dosree candle stick kholte hey or yeh zahair hota hey kh es close par bhe kuch ho raha hey dosree candle stick dobara pechle candle stick ke close price par close ho rehe hote hey yeh aik new lower level bananay kay ley pechle level ko kam nahe karta hey or break nahe karta hai.

What Does a Matching Low Tell Us About the Market?

Price kay chart par candlestick pattern par trade karna bhut he assan hota hey or yeh bohut zyada importance rakhta hey mesal kay tor par chart lkay upper hesay mein aik reversal pattern banta hey to ap ko trend kay reversal karnay ke pore salehat nahe mellay ge kunkeh yeh price chart kay nechay banta hey

support zone / demand zone

overbought condition matching low candle stick pattern kuch sharait kay sath trend kay continuation pattern kay tor par bhe kam karay ga lahza es say nematnay kay ley ap ko hamesha intazar karna paray ga jab tak tesaree candle stick na ban jay tesaree candle stick aik bare bullish candle stick ban jay ge aik confirmation candlestick hone chahay esay pechle candlestick kay start price kay opar close ho jana chahye.

Matching Low pattern ki tashkhees karne ke baad, traders entry aur exit points determine karte hain. Entry point pattern ki pehli candlestick (previous candlestick) ki low price ke neechay rakha jata hai. Yani ke jab current candlestick previous candlestick ki low price se neechay jaaye, tab entry ki jaati hai. Exit point, yaani ke trade ko khatam karne ka point, pattern ki low price ke neechay ya price ka aur neechay hona hota hai. Yani ke jab price pattern ki low price se aur neechay jaaye, tab trade ko close kiya jata hai. Matching Low pattern ki tashkhees karne ke baad, traders apne trading strategies ke mutabiq iska istemal karte hain. Yeh pattern aksar short-term traders aur day traders ke liye useful hota hai, jo quick price reversals par tawajjuh dete hain. Matching Low pattern ki trading strategies mein kuch points ko samajhna zaroori hota hai. Pehle, confirmatory indicators ka istemal karna zaroori hai. Yeh indicators jaise ki trend lines, moving averages, ya oscillators traders ko pattern ki authenticity ko verify karne mein madad karte hain. Dusre, risk management ki zaroorat hoti hai. Stop-loss orders aur take-profit orders ka istemal karte hue, traders apni positions ko protect karte hain aur profit booking karte hain. Isse risk ko manage kiya ja sakta hai. Teesre dusre technical analysis tools ka bhi istemal karna zaroori hai. Support aur resistance levels, chart patterns, aur price indicators traders ko overall market conditions aur price movements ke baare mein aur ache insights dete hain.

Matching Low pattern ki tashkhees karne ke baad, traders entry aur exit points determine karte hain. Entry point pattern ki pehli candlestick (previous candlestick) ki low price ke neechay rakha jata hai. Yani ke jab current candlestick previous candlestick ki low price se neechay jaaye, tab entry ki jaati hai. Exit point, yaani ke trade ko khatam karne ka point, pattern ki low price ke neechay ya price ka aur neechay hona hota hai. Yani ke jab price pattern ki low price se aur neechay jaaye, tab trade ko close kiya jata hai. Matching Low pattern ki tashkhees karne ke baad, traders apne trading strategies ke mutabiq iska istemal karte hain. Yeh pattern aksar short-term traders aur day traders ke liye useful hota hai, jo quick price reversals par tawajjuh dete hain. Matching Low pattern ki trading strategies mein kuch points ko samajhna zaroori hota hai. Pehle, confirmatory indicators ka istemal karna zaroori hai. Yeh indicators jaise ki trend lines, moving averages, ya oscillators traders ko pattern ki authenticity ko verify karne mein madad karte hain. Dusre, risk management ki zaroorat hoti hai. Stop-loss orders aur take-profit orders ka istemal karte hue, traders apni positions ko protect karte hain aur profit booking karte hain. Isse risk ko manage kiya ja sakta hai. Teesre dusre technical analysis tools ka bhi istemal karna zaroori hai. Support aur resistance levels, chart patterns, aur price indicators traders ko overall market conditions aur price movements ke baare mein aur ache insights dete hain.

تبصرہ

Расширенный режим Обычный режим