The Upside Tasuki Gap candlestick pattern

*Asalam o alaikum* members

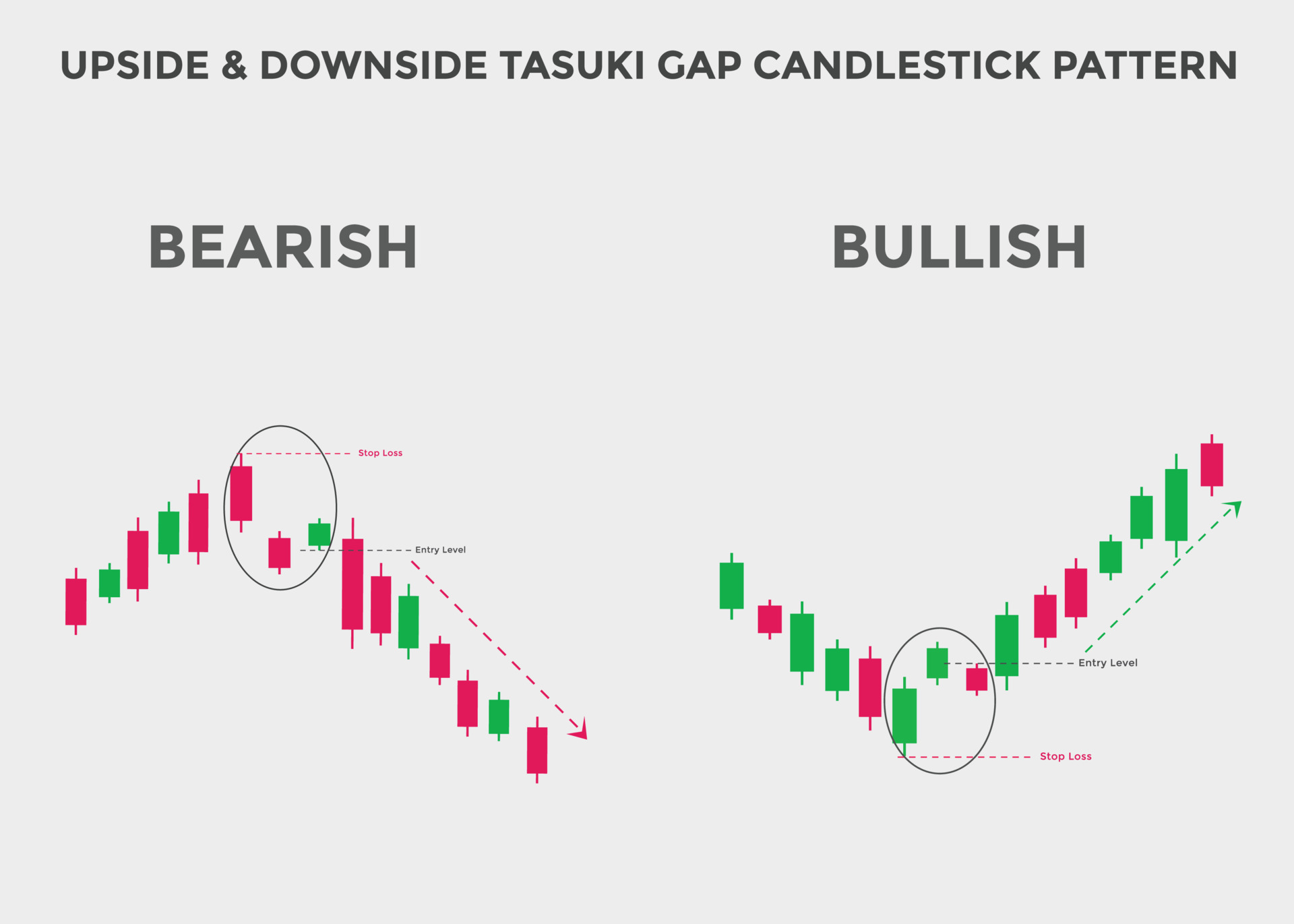

The Upside Tasuki Gap is a three-bar candlestick formation that signals the continuation of the current uptrend. The Upside Tasuki Gap's third candle partially closes the gap between the first two bars. Traders often use other gap patterns in conjunction with the Upside Tasuki gap to confirm bullish price action.

Upside tasuki gap candle stick pattern aik bullish trend reversal candle stick pattern hey jo keh teen bullish candle stick r aik reversal gap par mshtamel hotay hein 2 bullish candle stick kay bad aik gap or aik bearish candle stick par moshtamel hote hein. Aik specific tarteeb tasuki gap candle tick pattern kay upper hesay ko indicate karte hey or forex market mein candle stick pattern ke confirmation karte hain.

Yeh candle stick pattern new trader ko yeh batata hey keh bullish pattern jare rahay ga or buyer forex market kay control mein hein new trader zyada say zyada profit ke khatar long period ke trade par kaim rehtay hein.

Upside Tasuki gap Formation

Pehle candle stick aik important bullish candle stick hote hey jo keh forex market mein buyer ke zabardast raftar or price kay bullish trend ko identify karnay mein madad karte hey or forex market mein price mein bullish ka trend jare rehta hein.

Dosree candle stick pehle candle stick kay opar or gap mein range kay opar r bahar open ho ge or price kay bahar he open ho ge es ke bandesh ke price zyada ho ge or candle stick ka size small ho ga

tasaree candle stick bearish ke ho ge esay pechle candle stick ke limit kay andar open hna chihay or pehle candle stick ke close honay wale price kay opar close hona chahy.

Trading

Yeh aik trend continuation candle stick pattern hota hey jo keh trading mein dosray technical analysis or tools ko bhe shamel kea jata hey yeh forex market mein trend line or moving average kay sungom kay sath shamel kea jata hai.

Keywords

Tasuki candlestick pattern basic tor par stock or index market mein hota hai. Engulfing candle stick pattern or pin bar candle stick pattern forex mein important candle stick pattern hoty hein.

yeh humen es bat ke taraf safaresh kartay hein keh serf aik candle stick par bharosa nahe karen trading strategy bananay kay ley dosray technical tools ko bhe shamel karna chihay live trading karnay kay ley trading strategy ko sahi tarekay say janchen or bad mein es par trading karen.

*Asalam o alaikum* members

The Upside Tasuki Gap is a three-bar candlestick formation that signals the continuation of the current uptrend. The Upside Tasuki Gap's third candle partially closes the gap between the first two bars. Traders often use other gap patterns in conjunction with the Upside Tasuki gap to confirm bullish price action.

Upside tasuki gap candle stick pattern aik bullish trend reversal candle stick pattern hey jo keh teen bullish candle stick r aik reversal gap par mshtamel hotay hein 2 bullish candle stick kay bad aik gap or aik bearish candle stick par moshtamel hote hein. Aik specific tarteeb tasuki gap candle tick pattern kay upper hesay ko indicate karte hey or forex market mein candle stick pattern ke confirmation karte hain.

Yeh candle stick pattern new trader ko yeh batata hey keh bullish pattern jare rahay ga or buyer forex market kay control mein hein new trader zyada say zyada profit ke khatar long period ke trade par kaim rehtay hein.

Upside Tasuki gap Formation

Pehle candle stick aik important bullish candle stick hote hey jo keh forex market mein buyer ke zabardast raftar or price kay bullish trend ko identify karnay mein madad karte hey or forex market mein price mein bullish ka trend jare rehta hein.

Dosree candle stick pehle candle stick kay opar or gap mein range kay opar r bahar open ho ge or price kay bahar he open ho ge es ke bandesh ke price zyada ho ge or candle stick ka size small ho ga

tasaree candle stick bearish ke ho ge esay pechle candle stick ke limit kay andar open hna chihay or pehle candle stick ke close honay wale price kay opar close hona chahy.

Trading

Yeh aik trend continuation candle stick pattern hota hey jo keh trading mein dosray technical analysis or tools ko bhe shamel kea jata hey yeh forex market mein trend line or moving average kay sungom kay sath shamel kea jata hai.

Keywords

Tasuki candlestick pattern basic tor par stock or index market mein hota hai. Engulfing candle stick pattern or pin bar candle stick pattern forex mein important candle stick pattern hoty hein.

yeh humen es bat ke taraf safaresh kartay hein keh serf aik candle stick par bharosa nahe karen trading strategy bananay kay ley dosray technical tools ko bhe shamel karna chihay live trading karnay kay ley trading strategy ko sahi tarekay say janchen or bad mein es par trading karen.

Pehla Candlestick: Pehla candlestick uptrend ya downtrend ke dauran aata hai. Agar market uptrend mein hai to pehla candle bullish (barhne wala) hota hai aur agar downtrend mein hai to bearish (girawat) hota hai. Dusra Candlestick: Dusra candlestick pehle candlestick ke opposite direction mein hota hai, yani agar pehla bullish tha to dusra bearish hota hai aur agar pehla bearish tha to dusra bullish hota hai. Dusra candle pehle candle ke close ke near open hota hai. Teesra Candlestick: Teesra candlestick dusre candle ke close ke near open hoti hai, lekin ismein market direction change hoti hai. Agar pehla candle uptrend mein tha, dusra bearish tha, aur teesra bullish hai, to ye Tasuki bullish pattern hai. Agar pehla candle downtrend mein tha, dusra bullish tha, aur teesra bearish hai, to ye Tasuki bearish pattern hai.Tasuki Candlestick pattern, traders ko current trend ke continuation ya reversal ki possibility ka andaza deta hai. Agar ye pattern sahi tarah se confirm hota hai, to traders uske hisab se apne trading decisions bana sakte hain. Lekin yaad rahe ke market mein koi bhi pattern ya indicator 100% guarantee nahi deta, isliye proper risk management aur trading strategy ka bhi khayal rakhna zaroori hai. Is pattern ko samajhne aur istemal karne ke liye traders ko candlestick charts aur technical analysis ki basic understanding honi chahiye. Tasuki candlestick pattern, dusre technical indicators aur analysis tools ke sath istemal karke trading strategy ko improve karne mein madadgar ho sakta hai.

Pehla Candlestick: Pehla candlestick uptrend ya downtrend ke dauran aata hai. Agar market uptrend mein hai to pehla candle bullish (barhne wala) hota hai aur agar downtrend mein hai to bearish (girawat) hota hai. Dusra Candlestick: Dusra candlestick pehle candlestick ke opposite direction mein hota hai, yani agar pehla bullish tha to dusra bearish hota hai aur agar pehla bearish tha to dusra bullish hota hai. Dusra candle pehle candle ke close ke near open hota hai. Teesra Candlestick: Teesra candlestick dusre candle ke close ke near open hoti hai, lekin ismein market direction change hoti hai. Agar pehla candle uptrend mein tha, dusra bearish tha, aur teesra bullish hai, to ye Tasuki bullish pattern hai. Agar pehla candle downtrend mein tha, dusra bullish tha, aur teesra bearish hai, to ye Tasuki bearish pattern hai.Tasuki Candlestick pattern, traders ko current trend ke continuation ya reversal ki possibility ka andaza deta hai. Agar ye pattern sahi tarah se confirm hota hai, to traders uske hisab se apne trading decisions bana sakte hain. Lekin yaad rahe ke market mein koi bhi pattern ya indicator 100% guarantee nahi deta, isliye proper risk management aur trading strategy ka bhi khayal rakhna zaroori hai. Is pattern ko samajhne aur istemal karne ke liye traders ko candlestick charts aur technical analysis ki basic understanding honi chahiye. Tasuki candlestick pattern, dusre technical indicators aur analysis tools ke sath istemal karke trading strategy ko improve karne mein madadgar ho sakta hai.

تبصرہ

Расширенный режим Обычный режим