Re: Explain Bullish Breakway Candlestick:

Understanding Bullish Breakaway Pattern

Five candles make up the bullish breakaway pattern, which, as its name suggests, denotes bullishness. It typically forms during a downward trend. How to spot this pattern is as follows:

A large red bearish candle is on the first candlestick.Another red bearish candle, this time smaller than the previous, is on the second candlestick.A Doji candlestick with a short body and lengthy shadows is the third candlestick. This candle may be red or green.The third candle is just barely higher than the fourth candlestick. Once more, it might be red or green.The last and fifth candlestick is a large green bar that forms a bullish engulfing pattern.

This pattern indicates that the bears have lost the battle and bulls have taken control of prices. However, you must wait for the confirmation candlestick to form in the direction of bullish reversal before initiating a long trade.

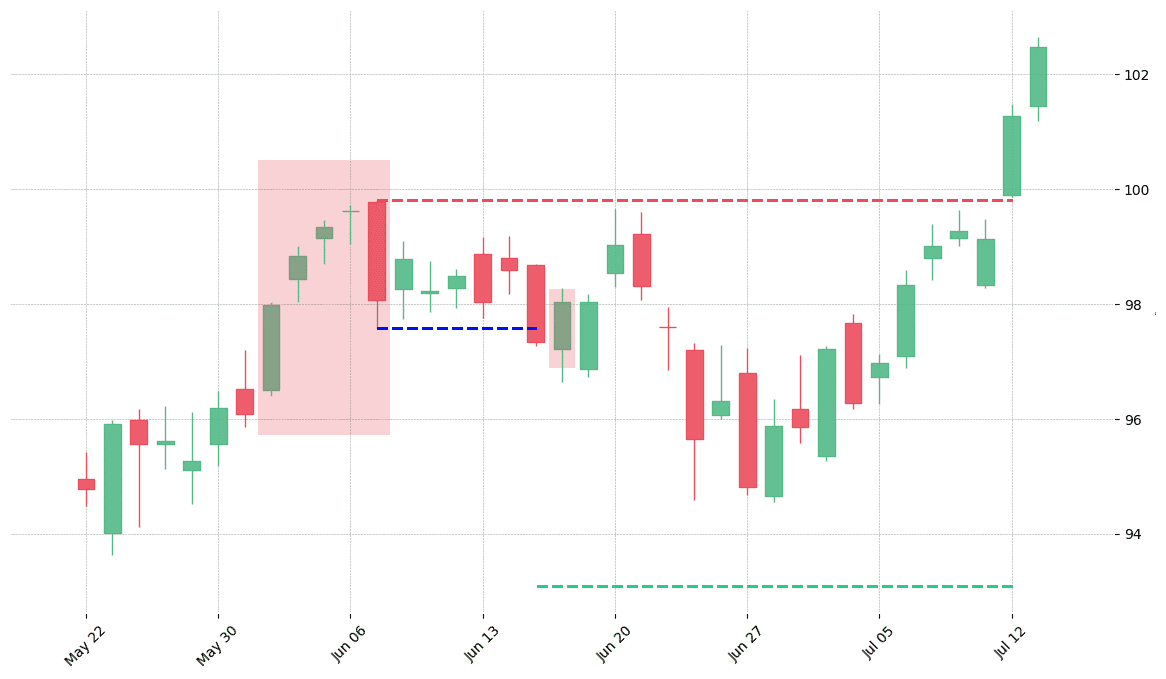

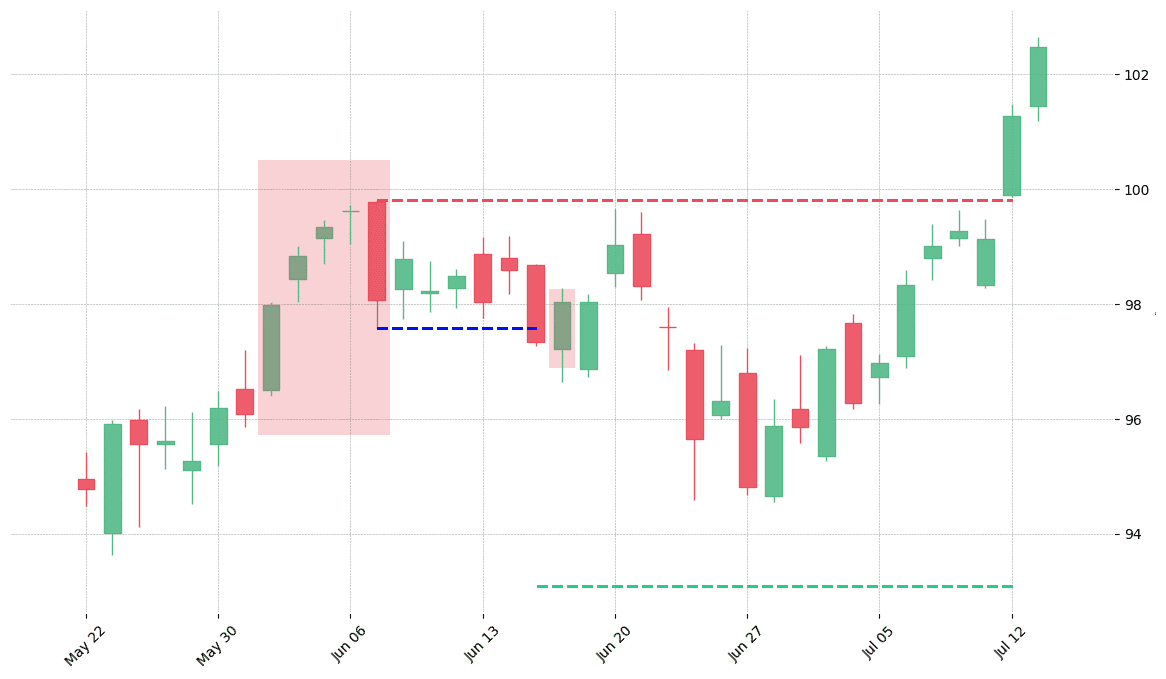

Understanding Bearish Breakaway Pattern

The bearish breakaway pattern, which denotes bearishness, is the reverse of the bullish breakaway pattern. Usually, it forms during an upward trend. The following characteristics can help you identify a bearish breakaway pattern:A large green bullish candle makes up the first candlestick.The second candle, which is a smaller version of the first, is also a green bullish candle.The third candlestick is a Doji candle that lacks a body and casts extended shadows. This candle may be red or green.The third candlestick is a little bit higher than the fourth one. It might be a red or a green candle.A large red candlestick forms the fifth and final candlestick, forming a bearish engulfing pattern.

Understanding Bullish Breakaway Pattern

Five candles make up the bullish breakaway pattern, which, as its name suggests, denotes bullishness. It typically forms during a downward trend. How to spot this pattern is as follows:

A large red bearish candle is on the first candlestick.Another red bearish candle, this time smaller than the previous, is on the second candlestick.A Doji candlestick with a short body and lengthy shadows is the third candlestick. This candle may be red or green.The third candle is just barely higher than the fourth candlestick. Once more, it might be red or green.The last and fifth candlestick is a large green bar that forms a bullish engulfing pattern.

This pattern indicates that the bears have lost the battle and bulls have taken control of prices. However, you must wait for the confirmation candlestick to form in the direction of bullish reversal before initiating a long trade.

Understanding Bearish Breakaway Pattern

The bearish breakaway pattern, which denotes bearishness, is the reverse of the bullish breakaway pattern. Usually, it forms during an upward trend. The following characteristics can help you identify a bearish breakaway pattern:A large green bullish candle makes up the first candlestick.The second candle, which is a smaller version of the first, is also a green bullish candle.The third candlestick is a Doji candle that lacks a body and casts extended shadows. This candle may be red or green.The third candlestick is a little bit higher than the fourth one. It might be a red or a green candle.A large red candlestick forms the fifth and final candlestick, forming a bearish engulfing pattern.

تبصرہ

Расширенный режим Обычный режим