Inverted hammer

inverted hammer candlestick aik patteren hai jo chart par zahir hota hai jab stock ki qeemat ko oopar ki taraf dhakelnay ke liye khredar ka dabao hota hai. yeh aik reversal candle stuck patteren hai jo neechay ke rujhan ke neechay zahir hota hai aur mumkina taizi ke ulat jane ka ishara deta hai. is candle stuck patteren ko is ka naam haqeeqi zindagi mein aik ultay hathoray se mila hai. inverted hammer neechay ke rujhan ke baad taizi ke ulat jane ka ishara hai. yeh taajiron ko batata hai ke bail ab girty hui qeematon par stock kharidne ke liye tayyar hain. kami ke baad market mein kharidaron ki janib se stock ki qeematon mein izafay ka dabao hai. yeh market mein farokht knndgan se bahar niklny ko kehta hai kyunkay woh taizi se tabdeel ho satke hain aur kharidaron se kehta hai ke woh apni kharidari ki position mein daakhil ho jayen kyunkay taizi ka rujhan shuru honay wala hai. lekin yaad rakhen ke dosray takneeki isharay ke sath is signal ki tasdeeq karen kyunkay yeh baaz auqaat signal gir sakta hai. aap taizi ke rujhan ke aaghaz ki tasdeeq ke liye aglay tijarti din ka bhi intzaar kar satke hain. agar aglay tijarti session mein iftitahi qeemat ulti himr candle stuck ki ikhtitami qeemat se ziyada hai to aap khareed position mein daakhil ho satke hain .

When trading with inverted hammer

jab hum is ultay hathoray candle stuck patteren ka istemaal karte hue stock ka tajzia karna shuru karte hain, to kuch aisay pehlu hain jin ki hamein talaash karni chahiye. zail mein chand pehlu hain jo aap ko ulti himr candle stuck patteren ke sath tijarat karne mein madad karen ge.

1. patteren ki tasdeeq karen : kuch tasdeeqi mayarat hain jin par taajiron ko inverted himr candle stuck ka istemaal karte hue tijarat karte waqt ghhor karna chahiye. tajir ko pehlay is baat ki tasdeeq karni chahiye ke oopri saaye ki lambai asli body se do gina ziyada hai. agar inverted hammers ki tashkeel pichlle din ki candle stuck se neechay ke waqfay ke sath hoti hai, to ulat jane ke imkanaat ziyada mazboot hotay hain. inverted hammer candlestick patteren ki tashkeel ke din trading mein hajam ziyada hona chahiye. ziyada volume is baat ki nishandahi karta hai ke khredar market mein daakhil hue hain aur stock ki qeemat mein izafay par dabao daal rahay hain. agar qeemat ziyada khulti hai to aglay din kharidari ki position mein daakhil hona behtar hai. tijarat mein daakhil honay se pehlay, tajir ko ulta himr ki taraf se diye gaye blush reversl signal ki tasdeeq ke liye mandarja baala miyaar par ghhor karna chahiye.

2. patteren ke peechay nafsiat : pehlay ka rujhan neechay ka rujhan hona chahiye ji to zs ka matlab hai ke qeematein kam ho rahi hon aur baichnay walon ki taraf se qeemat ko giranay ke liye farokht ka dabao hona chahiye. jab yeh mom batii banti hai, to yeh zahir karta hai ke bail dobarah market mein aagaye hain aur qeematon mein izafay ke liye kharidari ka dabao daalna shuru kar diya hai aur reechh qeemat ko neechay laane se qassar hain. agar qeemat aglay trading session mein bhi apni taaqat ko barqarar rakhti hai, to koi bhi khareed position mein daakhil ho sakta hai.

3. mom batii ke deegar namonon ke sath uljan mein nah parrin : tajir aksar ultay hathoray aur shooting star candle stuck patteren ke darmiyan ulajh jatay hain. lekin aik note karna chahiye ke ulta hathora down trained ke baad hota hai jabkay shooting ka aaghaz oopar ke rujhan ke baad hota hai. aap stock age app ka istemaal karkay aglay din trading ke liye stock ko flutter karne ke liye takneeki skinus ka bhi istemaal kar saktay hain, jo ab web version mein bhi dastyab hai .

inverted hammer candlestick aik patteren hai jo chart par zahir hota hai jab stock ki qeemat ko oopar ki taraf dhakelnay ke liye khredar ka dabao hota hai. yeh aik reversal candle stuck patteren hai jo neechay ke rujhan ke neechay zahir hota hai aur mumkina taizi ke ulat jane ka ishara deta hai. is candle stuck patteren ko is ka naam haqeeqi zindagi mein aik ultay hathoray se mila hai. inverted hammer neechay ke rujhan ke baad taizi ke ulat jane ka ishara hai. yeh taajiron ko batata hai ke bail ab girty hui qeematon par stock kharidne ke liye tayyar hain. kami ke baad market mein kharidaron ki janib se stock ki qeematon mein izafay ka dabao hai. yeh market mein farokht knndgan se bahar niklny ko kehta hai kyunkay woh taizi se tabdeel ho satke hain aur kharidaron se kehta hai ke woh apni kharidari ki position mein daakhil ho jayen kyunkay taizi ka rujhan shuru honay wala hai. lekin yaad rakhen ke dosray takneeki isharay ke sath is signal ki tasdeeq karen kyunkay yeh baaz auqaat signal gir sakta hai. aap taizi ke rujhan ke aaghaz ki tasdeeq ke liye aglay tijarti din ka bhi intzaar kar satke hain. agar aglay tijarti session mein iftitahi qeemat ulti himr candle stuck ki ikhtitami qeemat se ziyada hai to aap khareed position mein daakhil ho satke hain .

When trading with inverted hammer

jab hum is ultay hathoray candle stuck patteren ka istemaal karte hue stock ka tajzia karna shuru karte hain, to kuch aisay pehlu hain jin ki hamein talaash karni chahiye. zail mein chand pehlu hain jo aap ko ulti himr candle stuck patteren ke sath tijarat karne mein madad karen ge.

1. patteren ki tasdeeq karen : kuch tasdeeqi mayarat hain jin par taajiron ko inverted himr candle stuck ka istemaal karte hue tijarat karte waqt ghhor karna chahiye. tajir ko pehlay is baat ki tasdeeq karni chahiye ke oopri saaye ki lambai asli body se do gina ziyada hai. agar inverted hammers ki tashkeel pichlle din ki candle stuck se neechay ke waqfay ke sath hoti hai, to ulat jane ke imkanaat ziyada mazboot hotay hain. inverted hammer candlestick patteren ki tashkeel ke din trading mein hajam ziyada hona chahiye. ziyada volume is baat ki nishandahi karta hai ke khredar market mein daakhil hue hain aur stock ki qeemat mein izafay par dabao daal rahay hain. agar qeemat ziyada khulti hai to aglay din kharidari ki position mein daakhil hona behtar hai. tijarat mein daakhil honay se pehlay, tajir ko ulta himr ki taraf se diye gaye blush reversl signal ki tasdeeq ke liye mandarja baala miyaar par ghhor karna chahiye.

2. patteren ke peechay nafsiat : pehlay ka rujhan neechay ka rujhan hona chahiye ji to zs ka matlab hai ke qeematein kam ho rahi hon aur baichnay walon ki taraf se qeemat ko giranay ke liye farokht ka dabao hona chahiye. jab yeh mom batii banti hai, to yeh zahir karta hai ke bail dobarah market mein aagaye hain aur qeematon mein izafay ke liye kharidari ka dabao daalna shuru kar diya hai aur reechh qeemat ko neechay laane se qassar hain. agar qeemat aglay trading session mein bhi apni taaqat ko barqarar rakhti hai, to koi bhi khareed position mein daakhil ho sakta hai.

3. mom batii ke deegar namonon ke sath uljan mein nah parrin : tajir aksar ultay hathoray aur shooting star candle stuck patteren ke darmiyan ulajh jatay hain. lekin aik note karna chahiye ke ulta hathora down trained ke baad hota hai jabkay shooting ka aaghaz oopar ke rujhan ke baad hota hai. aap stock age app ka istemaal karkay aglay din trading ke liye stock ko flutter karne ke liye takneeki skinus ka bhi istemaal kar saktay hain, jo ab web version mein bhi dastyab hai .

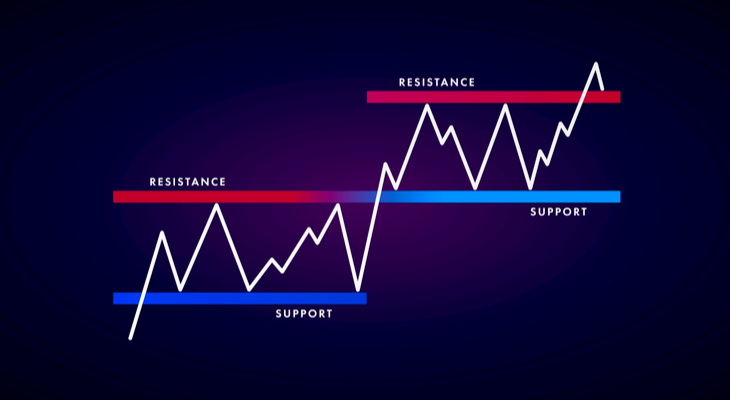

Is pattern ki location ko bhi broader price chart ke andar dekhen. Agar inverted hammer kisi significant support/resistance level ya trendline ke paas form hota hai, to iski relevance aur bhi zyada ho sakti hai.

Is pattern ki location ko bhi broader price chart ke andar dekhen. Agar inverted hammer kisi significant support/resistance level ya trendline ke paas form hota hai, to iski relevance aur bhi zyada ho sakti hai.

تبصرہ

Расширенный режим Обычный режим