Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge aur apki trading achi jaa rahi ho ge.

Dear forex member umeed karta hun aap sab khairiyat se honge aur apki trading achi jaa rahi ho ge.

Agr ap meri posts read karty hain to apko yad ho ga hm head & shoulder pattern phly cover kar chuky hain aur aj ki post main hum inverted Head & shoulder pattern ko discuss karen gy.

What is Inverted Head & Shoulder pattern?

Dear members ye aik bullish reversal pattern ha.

ye bearish trend k end main bnta ha jb market kafi nechy jaa chuki hoti ha oversold ho chuki hoti ha or ksi strong support area py rukti ha or thora opr ja k aik high bnati ha or wahan se nechy ati ha sedha or apna previous low break kr k nechy ja k aik naya low bnati ha or phr es jgha se opr jati ha or usi jgha rukti hai jahan phly high bna chuki hoti ha merket es resistance area se phr nechy ati ha or jo 1st low bnaya tha market ny us k equal nechy aa k low bnati ha or wapis apni redistance ki trf jati ha.

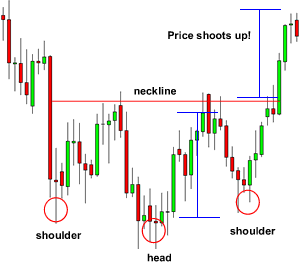

inverted head and shoulder k 4 parts hain jo k nechy bayan kye gaye hain.

Necklin: Nechy jany k bad wapis jahan aa k market 3 bar rukti ha , or phr nechy ja k new lows bnati ha, es resitance line ko jahan market rukti ha, neckline kaha jata ha jesa k ap picture main dkh skty hain nechy.

Head: apni neckline se tkrany k bad market nechy ja k 3 lows bnati ha jin main se 2 low equal hoty hain jb k aik darmyan wala low un se thora nechy hota ha esko head khty hain.

left & right shoulder:

head jo k sb se nechy wala kow hota ha uski dono sided py equal length k low hoty hain jo k right & left shoulder khlaty hain jesa k ap picture main dkh skty hain nechy.

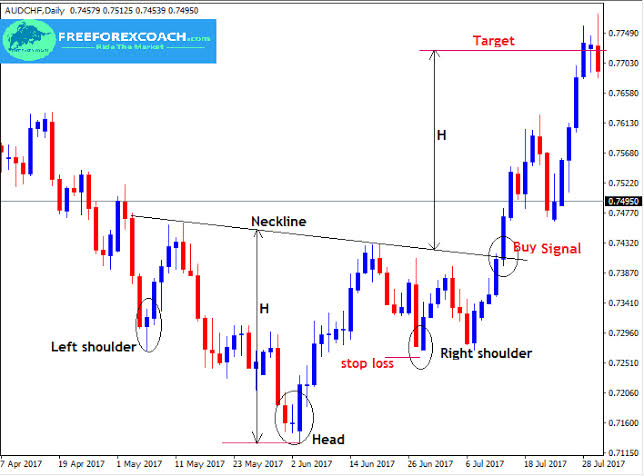

Breakout of Neckline:

Dear members pattern jb complete ho jata ha to es k bad neckline k breAkout ka wait kia jata ha. Breakout tb hota ha jb market neckline ko cross kr jy or us k bahor km se km aik ghnty ki candle close kry.

breakout ki confirmation k bad hi es main trace lo jati ha buy ki.

Stoploss: es main hmara stop loss neckline se nechy hota ha.

Profit Target: Es main profit target head se neckline ki height k equal ka hota ha.

What is Inverted Head & Shoulder pattern?

Dear members ye aik bullish reversal pattern ha.

ye bearish trend k end main bnta ha jb market kafi nechy jaa chuki hoti ha oversold ho chuki hoti ha or ksi strong support area py rukti ha or thora opr ja k aik high bnati ha or wahan se nechy ati ha sedha or apna previous low break kr k nechy ja k aik naya low bnati ha or phr es jgha se opr jati ha or usi jgha rukti hai jahan phly high bna chuki hoti ha merket es resistance area se phr nechy ati ha or jo 1st low bnaya tha market ny us k equal nechy aa k low bnati ha or wapis apni redistance ki trf jati ha.

inverted head and shoulder k 4 parts hain jo k nechy bayan kye gaye hain.

Necklin: Nechy jany k bad wapis jahan aa k market 3 bar rukti ha , or phr nechy ja k new lows bnati ha, es resitance line ko jahan market rukti ha, neckline kaha jata ha jesa k ap picture main dkh skty hain nechy.

Head: apni neckline se tkrany k bad market nechy ja k 3 lows bnati ha jin main se 2 low equal hoty hain jb k aik darmyan wala low un se thora nechy hota ha esko head khty hain.

left & right shoulder:

head jo k sb se nechy wala kow hota ha uski dono sided py equal length k low hoty hain jo k right & left shoulder khlaty hain jesa k ap picture main dkh skty hain nechy.

Breakout of Neckline:

Dear members pattern jb complete ho jata ha to es k bad neckline k breAkout ka wait kia jata ha. Breakout tb hota ha jb market neckline ko cross kr jy or us k bahor km se km aik ghnty ki candle close kry.

breakout ki confirmation k bad hi es main trace lo jati ha buy ki.

Stoploss: es main hmara stop loss neckline se nechy hota ha.

Profit Target: Es main profit target head se neckline ki height k equal ka hota ha.

:max_bytes(150000):strip_icc():gifv():format(webp)/inverse-head-and-shoulders-4194370-02-FINAL-d4e30d85371349d3b13b21ec4cfd3842.png)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Inverse_Head_And_Shoulders_Definition_Feb_2020-01-97f223a0a4224c2f8d303e84f4725a39.jpg)

تبصرہ

Расширенный режим Обычный режим