My dear friends forex exchange men kafi ziada prhe hain or unko understand bhi kia hai jo ok buying and selling major kafi hadh tk use ho rahy hain to humy kafi faida bhi pouncha rahy hain so ye bhi un foremost sy ek pattern hai is tarha agr him isko apprehend kr len or isko examine kren dialy base py to hum bht jld kamyab ho skhte hain so primary apke sath is okay critical topic percentage krti hon. Ham jitni mehnat ke sath Kisi petrol ko analyse karte Hain To Hamen utna hi maarpeet Mein Paida hota Hai aur Hamen acchi trade mil jaati hai isliye Kisi bhi pattern ko acche tarike se analyse karna hamare liye bahut hi profitable hota Hai.

Homing pigeon candlestick pattern:

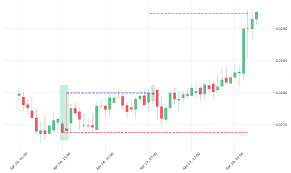

ye ek reversal pattern hai or ye humy bullish formation ki tarah nazar ata hai . Or kafi zaida fashion is ko harami pattern okay sath connected krte hain . Iski vital bt ye hain okay ye sample 2 candlestick sy mil ok bna hai is primary all both candlestick blck hoti hain . Jab tak hmare pas is k bare most important information ni hoga hm isko kbhi perform ni kr skhte. Homing pigeon pattern jo dekhne do bearish candles par mushtamil aik bullish fashion reversal pattern hai, jiss okay fees okay backside location ya bearish trend me bante dekha gaya hai. Sample fees k bottom me banne ki waja se "decending hawk candlestick pattern" ka contrary ya inverse hota hai, q k wo prices k pinnacle par banta hai. Pattern me shamil dono candles black hoti hai, jis me 1st candle aik bari real frame wali hoti hai, jab k second candle aik small real frame wali hoti hai. Pattern ki khas baat ye hai k is me 2d candle 1st candle okay real body ok bulkul mid (center) me banti hai, jis tarah se harami pattern hota hai.

Identification of homing Pigeon Candlestick Pattern:

Is pattern ki identification Ham to candles ki madad se karte hain aur ham bahut hi acche tarike se kar sakte hain.

homing pigeon candlestick pattern do bearish candles par mushtamil hota hai, jo k layout me bullish harami pattern ki tarah hello hotti hai, aur ye donno sample fashion reversal k leye estemal hotte fowl. Homing pigeon candlestick pattern fundamental candles ki formation darjazzel tarah se honni chaheye:

1. Homing pigeon pattern expenses okay bottom ya bearish trend me banne ki waja se aik bullish fashion reversal sample ka kaam karta hai.

2. Agar ye same pattern market k qeematon k darmeyan me banta hai to ye bearish trend continuation sample ka kaam karega.

3. Pattern do (2) black candles par mushtamil hota hai.

4. Pattern ki 1st candle aik bari black actual frame wali bari candle hoti hai.

5. Sample ki waja second candle small black actual frame wali hoti hai.

6. Pattern ki second small black candle 1st black candle ok bulkul midpoint (middle) me banti hai.

Clarification of homing pigeon pattern:

Jitni acchi tarike se Ham Kisi pattern ki clerification karte hain hamari trading utani hi iji ho jaati Hai kyunki clarification se hi Hamen pata chalta Hai Ki humne market Mein ka entry leni hai. homing pigeon candlestick pattern backside ko bullish fashion me badalne ka kaam karta hai. Ye sample do candles par mushtamil hotta hai, jis me youngster patterns "bullish harami", "bearish engulfing" aur "descending hawk pattern" ki hososeyyat hotti hai. Is pattern me pehlee candle dosri candle ko apne adar engulf kartti hai, jab okay sample equal to identical bullish harami jaisa hello hai, lekin dosri candle okay shade ka farraq hotta hai. Ye sample decending hawk sample ka contrary aur sample me shamil dono candles bearish hotti hai. Homing pigeon candlestick sample ki pehlee candle ek bearish long real body wali sturdy candle bantti hai, jis se marketplace me sellers ya endure power ki mazzbotti ka pata chaltta hai. Lekin dosre din ki candle aik to bantti bhi small size most important hai aur dosra ye candle pehlee candle okay actual body important ban jatti hai. Yani candle ki open aur close dono prices pehlee candle k centre me hotti hai. Ye candle bearish trend ki kamzzori okay sath sath bullish trend k reversal ka bhi sign detti hai.

Trading with homing Pigeon Candlestick Pattern:

Agar Ham is pattern ke liye technical analysis karte Hain To yah hamare liye bahut hi best hote hain kyunki Hamen jarur yah dekhna chahie ki yah pattern ka banta hai aur kaise banta hai to tab hi ham profit able trading kar sakte hain.

pattern pe buying and selling se pehle affirmation sign ka hona zarori hai, is waja se traders ko third candle ka intezar karna chaheye. Market me buy ki entry ok leye 3rd candle "white" hogi, jab ok sell ki access ok leye third candle "black" hogi. Purchase sign pe forestall loss 1st black candle k lowest aspect pe hoga, jab ok promote ki access ok lye 1st black candle okay maximum fee pe hoga. Homing pigeon pattern expenses okay backside essential banne ki waja se ye sample decending hawk candlestick sample ka opposite hota hai, jo k fees ok top me bearish trend reversal pattern ka kaam karta hai.

Homing pigeon candlestick pattern:

ye ek reversal pattern hai or ye humy bullish formation ki tarah nazar ata hai . Or kafi zaida fashion is ko harami pattern okay sath connected krte hain . Iski vital bt ye hain okay ye sample 2 candlestick sy mil ok bna hai is primary all both candlestick blck hoti hain . Jab tak hmare pas is k bare most important information ni hoga hm isko kbhi perform ni kr skhte. Homing pigeon pattern jo dekhne do bearish candles par mushtamil aik bullish fashion reversal pattern hai, jiss okay fees okay backside location ya bearish trend me bante dekha gaya hai. Sample fees k bottom me banne ki waja se "decending hawk candlestick pattern" ka contrary ya inverse hota hai, q k wo prices k pinnacle par banta hai. Pattern me shamil dono candles black hoti hai, jis me 1st candle aik bari real frame wali hoti hai, jab k second candle aik small real frame wali hoti hai. Pattern ki khas baat ye hai k is me 2d candle 1st candle okay real body ok bulkul mid (center) me banti hai, jis tarah se harami pattern hota hai.

Identification of homing Pigeon Candlestick Pattern:

Is pattern ki identification Ham to candles ki madad se karte hain aur ham bahut hi acche tarike se kar sakte hain.

homing pigeon candlestick pattern do bearish candles par mushtamil hota hai, jo k layout me bullish harami pattern ki tarah hello hotti hai, aur ye donno sample fashion reversal k leye estemal hotte fowl. Homing pigeon candlestick pattern fundamental candles ki formation darjazzel tarah se honni chaheye:

1. Homing pigeon pattern expenses okay bottom ya bearish trend me banne ki waja se aik bullish fashion reversal sample ka kaam karta hai.

2. Agar ye same pattern market k qeematon k darmeyan me banta hai to ye bearish trend continuation sample ka kaam karega.

3. Pattern do (2) black candles par mushtamil hota hai.

4. Pattern ki 1st candle aik bari black actual frame wali bari candle hoti hai.

5. Sample ki waja second candle small black actual frame wali hoti hai.

6. Pattern ki second small black candle 1st black candle ok bulkul midpoint (middle) me banti hai.

Clarification of homing pigeon pattern:

Jitni acchi tarike se Ham Kisi pattern ki clerification karte hain hamari trading utani hi iji ho jaati Hai kyunki clarification se hi Hamen pata chalta Hai Ki humne market Mein ka entry leni hai. homing pigeon candlestick pattern backside ko bullish fashion me badalne ka kaam karta hai. Ye sample do candles par mushtamil hotta hai, jis me youngster patterns "bullish harami", "bearish engulfing" aur "descending hawk pattern" ki hososeyyat hotti hai. Is pattern me pehlee candle dosri candle ko apne adar engulf kartti hai, jab okay sample equal to identical bullish harami jaisa hello hai, lekin dosri candle okay shade ka farraq hotta hai. Ye sample decending hawk sample ka contrary aur sample me shamil dono candles bearish hotti hai. Homing pigeon candlestick sample ki pehlee candle ek bearish long real body wali sturdy candle bantti hai, jis se marketplace me sellers ya endure power ki mazzbotti ka pata chaltta hai. Lekin dosre din ki candle aik to bantti bhi small size most important hai aur dosra ye candle pehlee candle okay actual body important ban jatti hai. Yani candle ki open aur close dono prices pehlee candle k centre me hotti hai. Ye candle bearish trend ki kamzzori okay sath sath bullish trend k reversal ka bhi sign detti hai.

Trading with homing Pigeon Candlestick Pattern:

Agar Ham is pattern ke liye technical analysis karte Hain To yah hamare liye bahut hi best hote hain kyunki Hamen jarur yah dekhna chahie ki yah pattern ka banta hai aur kaise banta hai to tab hi ham profit able trading kar sakte hain.

pattern pe buying and selling se pehle affirmation sign ka hona zarori hai, is waja se traders ko third candle ka intezar karna chaheye. Market me buy ki entry ok leye 3rd candle "white" hogi, jab ok sell ki access ok leye third candle "black" hogi. Purchase sign pe forestall loss 1st black candle k lowest aspect pe hoga, jab ok promote ki access ok lye 1st black candle okay maximum fee pe hoga. Homing pigeon pattern expenses okay backside essential banne ki waja se ye sample decending hawk candlestick sample ka opposite hota hai, jo k fees ok top me bearish trend reversal pattern ka kaam karta hai.

تبصرہ

Расширенный режим Обычный режим